|

| |

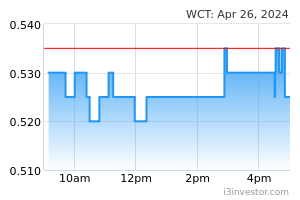

OverviewFinancial Highlight

Headlines

Business Background WCT Bhd is an investment holding company, which is primarily involved in engineering and construction, property development, and property investment and management activity. Geographically, the group has its presence in the region of Malaysia, Qatar, UAE, Bahrain, India and Vietnam. It derives most of the revenue through construction segment which includes engineering works specializing in earthworks, highway construction, and related infrastructure works.

stockpick2me @abc12343. Whether the company will pay dividend this year or not, we also don't know 24/08/2024 10:20 AM Ahmad Shauqi WCT Holdings Berhad recently secured a RM214 million contract from Kwasa Land Sdn Bhd. The project involves infrastructure work and the construction of a vehicular underpass at the Kwasa Damansara Township in Selangor. The scope of the contract includes site clearance, earthworks, road and bridge structures, and river improvement, among other tasks. The project is expected to be completed within 30 months from August 2024( The Malaysian Reserve , New Straits Times ). 26/08/2024 11:35 AM Johnchew123 Insider know something , QR report leaking , strong report net profit should announed by today 26/08/2024 11:50 AM abc12343 https://thesun.my/business-news/wct-group-achieves-higher-net-profit-of-rm31-million-in-q2fy2024-BL12915141 27/08/2024 5:56 PM Abba84 Its private placement, price at .991of 80 million shares has killed investors,hope.!! 02/09/2024 5:04 PM LY Hoh Continue dropped, may be drop until rate cut then it will bounce back? As cut rate property shares may got some benefits.... 09/09/2024 5:26 PM abc12343 https://www.thestar.com.my/business/business-news/2024/09/18/wct-holdings-identifies-properties-to-be-included-in-proposed-paradigm-reit 18/09/2024 8:41 PM star899 Has anyone tried to figure out the true value of this WCT gem ? Would you be really surprised ? Let you all get a deeper insight in this gem ! 19/09/2024 11:07 AM chon99 https://theedgemalaysia.com/node/727229 Very informative updated report on WCT as at 19-09-2024 12.42pm 19/09/2024 1:55 PM newbie9893 Construction & property sector will be the next theme to play...buy now to be rewarded soon 15/10/2024 3:24 PM Apple2353 Middle East is the other side of the world lah. no impact here. who cares about Middle East. 16/10/2024 4:16 PM | |