|

| |

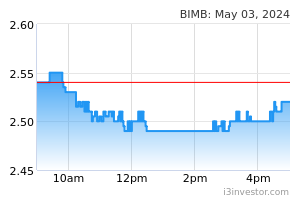

OverviewFinancial Highlight

Headlines

Business Background Bimb Holdings is a Malaysia-based Islamic holding company that is principally engaged in providing financial products and services. The company is involved in Islamic business activities mainly through its investment in Shariah-compliant business entities. The company holds a 100% stake in Bank Islam Malaysia Berhad, which is the first Shariah-based bank in Malaysia and Southeast Asia. The company has a major stake in Syarikat Takaful Malaysia Berhad, which is an Islamic insurance provider. The company also has interests in venture capital, unit trusts, stock broking, offshore banking, and others.

DividendGuy67 Looking closer, I was very lucky to have entered into BIMB near the bottom. - My first entry was 9/5/23 at 2.03. - I then keep buying more as price went down until it hit near the bottom of 1.75 - I didn't get the absolute low of 1.7, but it was good enough to be able to buy at 1.75. - That brought my average cost down to 1.87. - Then, we receive dividends. I took some small profits and my net cost after dividends and a small amount of realized means my average cost price is now 1.70. This is for my 5th largest holdings out of 48 stocks. At 2.44 close today, my unrealized gains is now close to 43%. And here I was, when I entered at an average cost of 1.87, I was only happy to target a long term Dividend Yield of 7.2%. Now it turns out, instead of gaining 7% (since I held less than a year), I have earned something like 43% gains. What a bonus. Thank-you Mr Market. 16/02/2024 11:44 PM DividendGuy67 It is amazing when you track its NTA growth over the past 10 years - this small growing stock has consistently grown its NTA by 14% per annum CAGR over past 10 years. It's NTA is 3.29. It's trading at 2.44, below Book Value, for a bank that grows its equity at the rate of 14% per annum over past 10 years ... it was so overlooked by the market. It's Dividend Payout ratio is only 38% ... not stretching at all. This stock grows its Net Worth and grows its earnings and is having a conservative dividend payout ratio. And when I entered at an average cost of 1.87, it was yielding 7.2% dividend yield. What a bargain then. It pays to own overlooked stocks when everyone was afraid and nobody wants to own it when it was crashing back in May 2022. I know this bank's value and with a price action like this, there's no rush to take profits on its way up. I may trim it so that it doesn't become too big a proportion but otherwise, the strategy is still to sit tight on your winners and sit tight on your losers, so that your winners become a larger proportion of your portfolio and your losers naturally become a smaller proportion of your portfolio so that your portfolio can keep making new all time highs regularly especially when you own a portfolio of sound, good fundamental stocks and businesses ... 16/02/2024 11:53 PM TheContrarian I think you got the year wrong, it was crashing in May 2023 rather than 2022. 17/02/2024 4:18 AM Yippy68 Do you guys think MBSB got good future as soon as it turn to another Islamic Bank and listed in BURSA. My cost is less than 60 cents after receiving 8.5 sen dividend I hold big quantity especially last year after my big sweep in Bplant. Likely @Contrarian can contribute your good knowledge in Banking stock. 27/02/2024 2:08 AM Yippy68 I made some profit after i bought Affin at 2,20 and sold at 2,65 around 30K, Thank @Contrarian for all you good sharing. 27/02/2024 2:21 AM TheContrarian @Yippy68, EPS is more relevant than high DPS because high DPS isn't sustainable if EPS drops. MBSB doesn't appear to have the all round strength of other banks. Just rebranding itself as an Islamic bank doesn't transform it overnight to rival Bank Islam which is long established. 27/02/2024 2:24 AM TheContrarian @Yippy68, I feel you are too heavily concentrated in MBSB. Your recent venturing into Affin has brought you financial rewards. Affin share price ran ahead because it is more superior to MBSB. Similarly, Bank Islam share price has also recently run ahead. 27/02/2024 2:34 AM newbie5354_ TheContrarian banking sifu? Which bank(or bank like) counters yet to move? Insas can move like Affin or BIMB? 27/02/2024 7:12 AM TheContrarian I already sold 97% of my Insas last month when it moved from below 90 sen to above RM1.30. Only bank I like now is BIMB. 27/02/2024 10:23 AM 5354_ Like Affin should be foreign funds. Posted by TheContrarian > 6 hours ago | Report Abuse Lately EPF has turned sellers, so who is buying aggressively? 28/02/2024 9:26 PM 5354_ Maybe those posted earlier have sold. Posted by TheContrarian > 3 hours ago | Report Abuse I am rather surprised the forum here is very quiet. 28/02/2024 9:29 PM 5354_ After QR EPF U-turn buy back? 16.81 sen total BIMB dividend DY 6.70%(RM 2.51) is better than EPF 2022 & 2023 dividend? 29/02/2024 9:31 AM Mabel Haha no worries... This counter no need to monitor so much...so steady mah... Dividend investing is like planting a tree... The earlier you start, the bigger your tree is going to grow. And before you know it, you will be resting in the shade of your own financial forest, enjoying the fruits of your labor, year after year... Why? Because dividends... GROW. And that's how some Dividend Machines reached their milestones in dividends. For the past 10 years... DBS (Bank) increased their dividends by 158% Wilmar (Plantation) increased their dividends by 112% So if you think $5,000 in annual dividends today is too little... Your $5,000 'passive' income just became: $12,900 if you invested in DBS $10,600 if you invested in Wilmar All you did is buying the right dividend stocks... ...And wait Get paid in year 1... ...And wait Get paid more in year 2... ...And wait Get paid even more in year 3... https://www.youtube.com/watch?v=-0kcet4aPpQ 02/03/2024 12:11 AM DividendGuy67 Fuiyoh ... biggest gain in my portfolio today. Feeling blessed and thankful ... 05/03/2024 10:41 PM DividendGuy67 Managed to trim a little bit, but still my Top 15% holdings by market value. Dividend yield on cost is 8.3%. Can hold for a long time if not look at markets and just collect dividends. Of course, sitting on winners and do nothing is often the right strategy unless it is a bear market or clearly sideways market. 05/03/2024 10:49 PM TheContrarian 1 week ago rlch RM 2.6 if follow Affin can reach? @rlch , already reached 2.60 and is now higher than Affin. Thank you for your recommendation. 06/03/2024 10:34 PM Mabel BIMB Share Price 7 Day 1 Year 2.57 1.6% 16.3% Upcoming dividend of RM0.042 per share Eligible shareholders must have bought the stock before 15 March 2024. Payment date: 05 April 2024. Payout ratio is a comfortable 68% but the company is paying out more than the cash it is generating. Trailing yield: 6.5%. Within top quartile of Malaysian dividend payers (4.7%). Higher than average of industry peers (5.3%). 09/03/2024 2:31 PM 5354_ DY 6.6% who sell? I buy more because 1% more than EPF just declared dividend. 11/03/2024 9:45 AM 5354_ 024-03-04 EMPLOYEES PROVIDENT FUND BOARD (a substantial shareholder) acquired 1,483,900 shares on 28-Feb-2024. 11/03/2024 11:18 AM KJTAN7 Build my portfolio on May 2023. My target is accumulate more share on this stock 12/03/2024 4:18 PM speakup https://themalaysianreserve.com/2024/03/16/pm-anwar-political-stability-transparent-policies-attract-foreign-investors/ Shame on u PMX! When PN was in power last time , u tried to topple PN through defection. Now u tell PN not to topple u for the sake of foreign investors 17/03/2024 4:49 PM Mabel BIMB Full year 2023 earnings: EPS and revenues exceed analyst expectations Full year 2023 results: EPS: RM0.25 (up from RM0.23 in FY 2022). Revenue: RM2.28b (up 5.6% from FY 2022). Net income: RM553.1m (up 13% from FY 2022). Profit margin: 24% (up from 23% in FY 2022). The increase in margin was driven by higher revenue. Cost-to-income ratio: 60.9% (up from 59.8% in FY 2022). Non-performing loans: 0.94% (down from 1.27% in FY 2022). Revenue exceeded analyst estimates by 5.2%. Earnings per share (EPS) also surpassed analyst estimates by 5.2%. Revenue is forecast to grow 6.9% p.a. on average during the next 3 years, compared to a 7.1% growth forecast for the Banks industry in Malaysia. Meow 20/04/2024 10:55 AM | |