|

| |

Overview

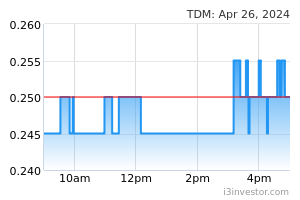

Financial HighlightHeadlinesBusiness Background TDM Bhd is an investment holding company, which is engaged in the cultivation of oil palms and provision of healthcare services. It operates in the following segments: Plantation, Healthcare, and Others. The Plantation segment which generates majority revenue produces and trades oil palms and fruits. The Healthcare segment offers consultancy and medical care services. The Others segment consists of dormant firms. The firm is organized geographically across two principal operating segments: Malaysia and Indonesia. Geographically Malaysia accounts for the majority revenue of the firm.

Francisco García Paramés A check with the group’s Annual Report 2018 shows that the affected area makes up about 7% of TDM's total 12,645ha of planted oil plam land in Kalimantan. The group has another 31,346ha in Terengganu, which bring its total planted oil palm land to 43,991ha. ______________________________________________ You are too armature , even if they lose the lawsuit, just wind down the entire Indonesian operation ... Maximum loss 7% of TDM asset, what it has to do with your market cap... Such a newbie comment ... no sense of business 03/03/2024 4:51 PM Albukhary Do more homework ya... Some of you maybe first come to know about this counter, and you google a bit and found some bad news, then you automatic ignore this counter. But we are different, we are monitoring TDM since Year 2008, we have earn few hundred thousand from TDM, also loss few hundred thousand on it also... we monitor TDM is like monitor a kid, we donno this kid grow up will be a good man or bad man, but we monitor him, we see how he made mistake, and how he corrected the mistake... we see this kid is telling lies or truth, we see how he working with which party, we read every single news, every single announcement, every single corporate movement, and we analyze it through various of source. In stock market, some investor can outperform other investor, put aside luck, the key factor will knowledge and experience. Everybody know how to read news, but not many know how to analyze the news, because to analyze a news, you need to have a lot of industry knowledge, legal knowledge, case study, experience, understanding human behavior. 03/03/2024 9:54 PM Albukhary TDM is back on track, heading to its Wawasan 2030. Below is quote by TDM's chairman before :- "Under the group's transformation model, TDM hopes to attain a market capitalisation of RM2bil, RM100mil in annual dividend and RM1bil in revenue". 06/03/2024 3:53 PM lck1300 https://www.malaymail.com/news/money/2024/03/18/epf-commits-rm250m-to-catalysing-malaysian-mid-to-growth-stage-companies/124084 The investments will focus on six strategic themes, which include healthcare focusing on aged care and the silver economy; agriculture and food science looking at improving the food production ecosystem; financial services inclusivity; sustainability focusing on energy transition; education aiming at provision of quality education; and social infrastructure as well as future themes that would fit into the EPF’s strategic mandate,” it said. 19/03/2024 12:48 PM BursaKakis Based on TDM's market cap of RM430.89 million and KMI Healthcare's valuation of about RM365 million, this would mean the market has ascribed only RM65.89 million for the plantation segment. At an EV/Ebitda of eight times, the plantation business is almost free - The Edge Weekly 25/3/2024 25/03/2024 9:03 AM ITreeinvestor PT RKA was officially served with the decision of the Supreme Court that the Court rejected the appeal and upheld the decision of Pengadilan Tinggi Pontianak as follows: i) PT RKA is to pay a compensation of IDR188,977,440,000 (approximately RM56,677,646) for the environmental loss to the National Account of Indonesia as per the claim by the Respondent; and ii) PT RKA is to rehabilitate the environment on the affected area due to the fire incident of 2,560 ha and to reactivate the affected ecology system with the cost of IDR731,036,640,000 (approximately RM219,250,698). 25/03/2024 10:10 AM Albukhary TDM is back on track, heading to its Wawasan 2030. Below is quote by TDM's chairman before :- "Under the group's transformation model, TDM hopes to attain a market capitalisation of RM2bil, RM100mil in annual dividend and RM1bil in revenue". 26/03/2024 3:27 PM Albukhary As long as the market maintain its stability (no big bad news or political change), I strongly believe that TDM will marching across 30sen and heading to 35sen. Reason being:- 1) TDM have been undervalue for many years 2) The Indonesia bad news have been passed, whatever losses have been recognised, and the Indonesia subsidiary have been sold (I believe the disposal can be completed within this year, so all the legal issue will be no longer related to TDM) 3) Its healthcare business is really doing good, and it will be doing even better in 2024. I believe the Healthcare business can generate minimum EBITA of RM50mil per year. 4) CPO price will be continue at above RM3700 level, so TDM plantation unit will not facing losses anymore, and it could be generate RM30-40mil per annum. In overall, I estimate RM70mil PAT for Year 2024 (approximately RM15-20mil per quarter), and EPS will be minimum 4 sen per quarter. Based on minimum 10 times PE, TDM should be at least worth 40sen. This 40sen Target Price sure can be achieve if TDM continuous posted PAT above RM15mil++ for Q1 and Q2 2024. 01/04/2024 12:48 AM Albukhary KUALA TERENGGANU: Plantation and healthcare group TDM Bhd has invested RM29.1mil in two new hospitals this year. Executive director Najman Kamaruddin said the healthcare sector contributes about 50% to the group’s overall profits and the two new hospitals are expected to increase the profits considerably. “An investment of RM14.1mil is allocated for the construction of the 100-bed KMI Chukai Medical Centre in Kemaman, while Razif Hospital, in Klang, Selangor, involves an investment of RM15mil for the takeover process. “Both of these hospitals will be managed by TDM’s subsidiary Kumpulan Medic Iman Sdn Bhd,” he said at a press conference. 02/04/2024 2:13 PM Albukhary TDM Bhd embarks on its five-year plan to become one of the top 100 companies listed on Bursa Malaysia, it intends to invest up to RM1 billion to expand its plantation and healthcare businesses. 02/04/2024 2:15 PM Albukhary When a counter hit 52week high, then 3 year high. then 5 year high.. It will shoot all the way to the sky, because there is no resistant anymore. All the shareholder are making money, there is no one still holding the share with paper loss. 04/04/2024 12:43 PM Albukhary Not sure there will be any privatisation or not... If yes, please offer fair price based on the company actual value. Any price below 50sen will not be accepted. 04/04/2024 12:45 PM majuJayaInsyaAllah fly high TDM. the future is bright with steady palm oil price and expansion of healthcare biz. 04/04/2024 1:20 PM x_abe81 Whats TDM share target price yeah considering the expansion /transformation plan? 04/04/2024 2:11 PM Albukhary Without any expansion plan, and assume market economy sentiment is not good, TDM should worth 40sen. Without any expansion plan, and assume market economy sentiment is good, TDM should worth 50sen. With the expansion plan, or sub listing of its medical unit, and assume market economy sentiment is good, TDM should worth 70sen. 04/04/2024 2:28 PM Albukhary TDM could be the leader (Dragon Head) for this round of Plantation Counter. 04/04/2024 11:20 PM Albukhary https://klse.i3investor.com/web/blog/detail/ceomorningbrief/2024-04-05-story-h-184636677-Sudden_Spike_in_Buying_Interest_Lifts_TDM_to_Three_year_High_in_Active_ 05/04/2024 12:01 PM Albukhary https://www.bursamalaysia.com/market_information/announcements/company_announcement/announcement_details?ann_id=3436793 05/04/2024 6:04 PM Albukhary Smart move... TDM announce self clarification before Bursa issue UMA Query. So this can avoid UMA query.. Let TDM rest for few days, then continue to shoot up to next level. Perhaps 70sen? Haha... 05/04/2024 6:05 PM KingKKK TDM is undervalued at 7.3x FY24 PE. Compare this to Healthcare PE: IHH: 17x KPJ: 28x And plantation stocks PE: TSH: 15x TH Plantation: 20x Kretam: 13x KimLoong: 14x I assume TDM can generate 4.4 sen EPS in 2024. In Q4 2023, TDM EPS for continuing operation is 1.1 sen. 07/04/2024 10:14 AM KingKKK TDM intrinsic value is 60sen. This is calculated by multiplying 13.6x PE with FY24 EPS of 4.4 sen. 13.6x PE is at 40% discount against average healthcare stocks PE in Malaysia. It is also at 20% discount against plantation stocks average PE of 17x. Lower PE due to lower marker cap. Overtime TDM PE should be higher than this as its earnings become more concentrated to healthcare. In FY2023, healthcare earnings (PBT) is RM31m vs plantation RM14m. Healthcare contributed 69% of 2023 earnings. This is much higher than 2022 healthcare contribution of 22%. 07/04/2024 10:42 AM KingKKK TDM: Can TDM Become A Healthcare Powerhouse? Unveiling A Hidden Gem (KingKKK) https://klse.i3investor.com/web/blog/detail/bestStocks/2024-04-11-story-h-183891627-TDM_Can_TDM_Become_A_Healthcare_Powerhouse_Unveiling_A_Hidden_Gem_KingK 11/04/2024 4:32 AM Michael Kwok Stock to caution Sell call tdm 29 cents. Usually in this time of situation will go below 25 cents,stay for a while. 11/4/24 6.23pm 11/04/2024 6:20 PM Albukhary I am not good at Technical Analysis, so I am not sure whether it will go down to 25sen. But I am a fundamental guy.. I see value in TDM, and its value compare to its share price now, TDM is a very good buy. As a fundamental guy, I notice that for the past 3 months, more n more hidden gem with good fundamental have been buy up, and their share price never come down after go up. With less and lesser good fundamental stock with low share price, I believe TDM will be in the radar for many investor, and its share price should be continue to go up. 11/04/2024 10:42 PM AlphaInvestor The stock is trading at Moving Average 20 support of 28 sen. This is a good entry level. Historically, share price rebounded every time it drop to Moving Average 20 on the following date: i) 16-Feb-2024 ii) 27-Feb-2024 iii) 21-March-2024 iv) 3-April-2024 15/04/2024 3:16 PM Albukhary Yup, it drop because of market fear of war. If no war, by right TDM has cross 32sen today 15/04/2024 3:19 PM AlphaInvestor Actually TDM indirectly benefit from war. As crude oil price goes up, CPO price will follow because it can be converted into biodiesel Healthcare business not affected since Middle East is too far away. 15/04/2024 3:42 PM Albukhary Banyak sakit... My TDM portfolio unrealised gain drop a lot this two days. Luckily I can hold... but feel sorry for many punter that playing contra. 16/04/2024 11:55 AM Dehcomic01 TDM – a wrong plantation bet I originally viewed TDM as a plantation Group with a healthcare arm. About 17 years ago, the healthcare segment only accounted for about 16% of the Group revenue. The Group plantation operations then was mainly in Malaysia and this accounted for a large part of the Group’s revenue. The Group decided to expand it plantations segment by venturing to Indonesia. It took several years to get this going such that the maiden revenue from the Indonesian plantation was only in 2013. By then the Group had “..earmarked that the growth of the plantation operations will be in Kalimantan.” But things began to go wrong with the lndonesian operation soon after. The losses and impairments got so bad that the Group announced its plans to sell the Indonesian assets in 2019. By 2023 it was still trying to complete the sale of its Indonesian assets. If not for the healthcare segment, which had grown to account for 56 % of the Group’s revenue in 2023, TDM would be in a worse shape. Moral of the story? Beware of companies announcing expanding into foreign countries as the Malaysian experience may not always be transferable. Given the poor plantation segment performance, the market took a dim view of the company despite a growing healthcare segment. I guess the market is still waiting for TDM to prove that it can recover from the Indonesian lesson. https://www.youtube.com/watch?v=Ytqj_er30X4 25/04/2024 11:22 AM | | ||||||||||||||||||||||||||||||||||||