Guess which share increased 48.89% in 2022? (No, it's not a goreng stock)

CynicalCyan

Publish date: Sat, 03 Sep 2022, 07:47 PM

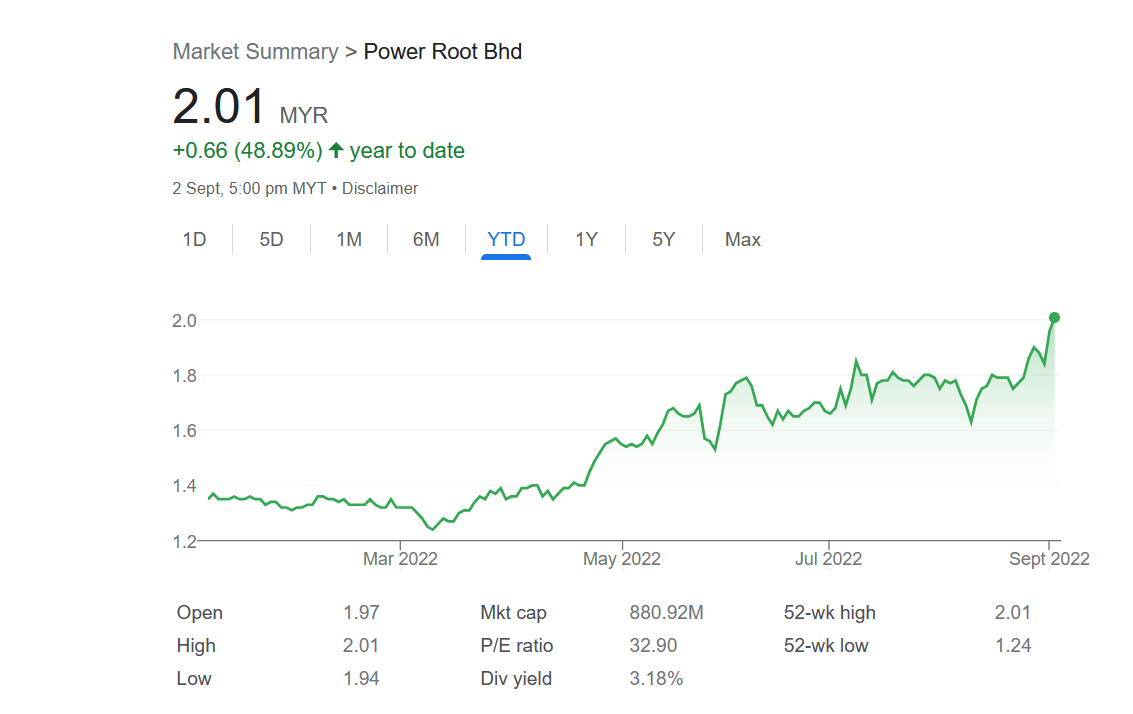

PWROOT has emerged as one of the biggest gainers of 2022, where other stocks have either gone down or hardly moved in share price. A picture paints a thousand words. 48.89% gain as of 02/09/2022!

Several lessons can be learnt from PWROOT stock:

1. When a company's earnings is low, its valuation usually is low.

In Jan 2022, Mr. Market saw PWROOT suffered its worst financial performance in FY 2021 & pressed PWROOT's share price down to RM1.30-RM1.40+ levels. Many investors won't have confidence in PWROOT after seeing its lackluster performance.

That is the time where investors who trust in the company benefit from buying at lower prices. Only investors who had faith in PWROOT to recover, would have bought PWROOT in Jan 2022, when earnings were dropping for few quarters in a row & share price moving sideways.

2. Companies that have strong track record continues its fine performance.

A brief glance at the consumer sector of alcohol, consumer goods, motor vehicles, etc. (even airline & tourism!) one would notice that generally the consumer sector has seen a recovery. PWROOT is a reasonably strong F&B brand that has presence in Malaysia and the Middle East. It has been in net cash position for some time.

Would inflation dampen this recovery? To a certain extend, yes. However, companies that are in the consumer sector that have shown years of being profitable, with no problems dishing out dividends after churning out good cashflow, such as PWROOT, would eventually do well after navigating through a challenging period.

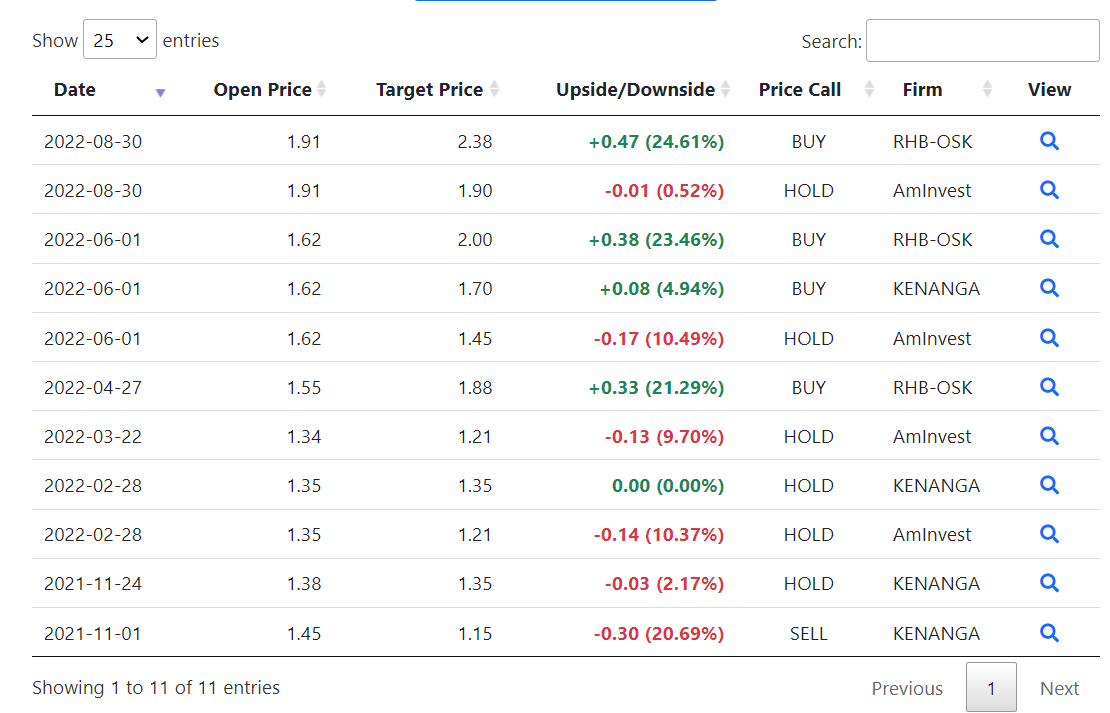

3. The upgrade by analysts

Analysts' upgrade of PWROOT from a "SELL" or "HOLD" to a "BUY" has some influence over Mr. Market's determination of PWROOT's share price. Upward revision of PWROOT's target price boosted Mr. Market's sentiment over PWROOT.

Conclusion:

Thomas Phelps said it best.

“To make money in stocks, you must have vision to see them, the courage to buy them and the patience to hold them. Patience is the rarest of the three.”

Investors who had these 3 virtues enjoyed the share price surge of PWROOT along with stable dividend payout.

Technical chart wise, refer to RHB IB's https://klse.i3investor.com/web/blog/detail/rhbinvest/2022-09-02-story-h1628876361-Trading_Stocks_Power_Root & AmInvest's https://klse.i3investor.com/web/blog/detail/AmInvestResearch/2022-09-02-story-h1628876359-Stocks_on_Radar_Power_Root

Can PWROOT sustain its powerful momentum?

I think it depends on these:

Can its future performance beat Mr. Market's expectations like its recent quarters? Can PWROOT offer more growth and stability compared to other stocks on the KLSE? Are funds getting more interested in PWROOT? Will PWROOT gain attention from retail investors?

Disclaimer: This article is not tailored financial advice, but mere general stock sharing / observations. Please do further due diligence. The author disclaims all liabilities from readers. The author does not own shares of PWROOT.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Ultimate Stock Tips

Created by CynicalCyan | Nov 18, 2023

Created by CynicalCyan | Jul 08, 2023

Created by CynicalCyan | Jun 24, 2023

Created by CynicalCyan | Jun 18, 2023