BRIGHT - do you trust the Net Cash in this company?

DividendGuy67

Publish date: Sun, 28 Jul 2024, 07:30 PM

Background

Another question posed to me is would you swap PPHB for BRIGHT? I blogged about PPHB before here, so, let me share my thoughts on BRIGHT.

Introduction to BRIGHT

On paper, BRIGHT is extremely under-valued. At 21.5 sen, it's Net Cash is larger than the entire Market Value. Value investors love this type of situation and would be buying already. However, Mr Market rarely get things wrong over a long period, so, the question is - why? In particular, if Mr Market doesn't trust, should you trust the Net Cash in this company?

Long Term Charts

With 3 decades of investing and trading experience, I have learnt to trust price charts, especially long term charts and what does the chart say?

This monthly chart is interesting because the triangle over 28 year period is quite clear (and unusual). Another way of looking at this is that Mr Market is uncertain about this stock for decades. It seems to be heading towards a critical decision sometime in 2026-2027. Why is that?

Past 10Y Fundamentals

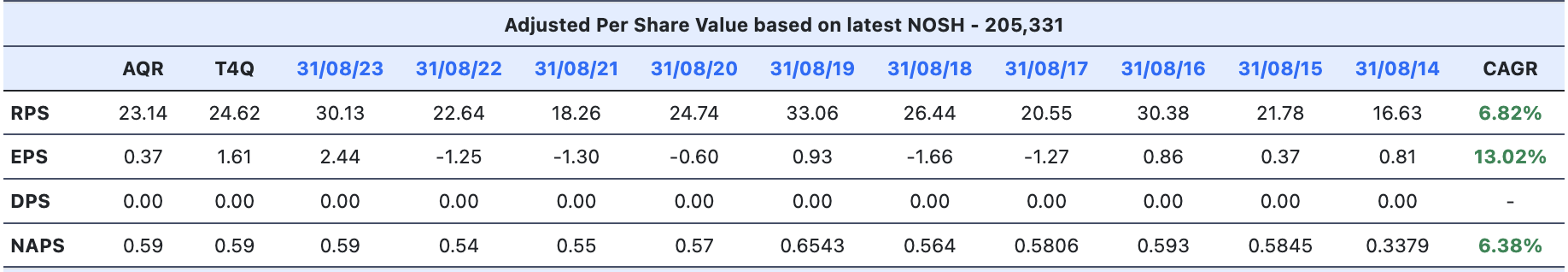

Using FYE14 as starting point, doesn't seem shabby. However, some question marks:

- Using FYE15 as starting point, NAPS didn't grow from 2015-2023? Why?

- Over past 10 years, EPS is negative 50% of the time (5 times). Why?

- This is a massively large Net Cash company but why is DPS still nil after all these years?

- Net Cash is large at last QR - 54m / 205m NOSH = 26 sen. Why still trading at only 21.5 sen?

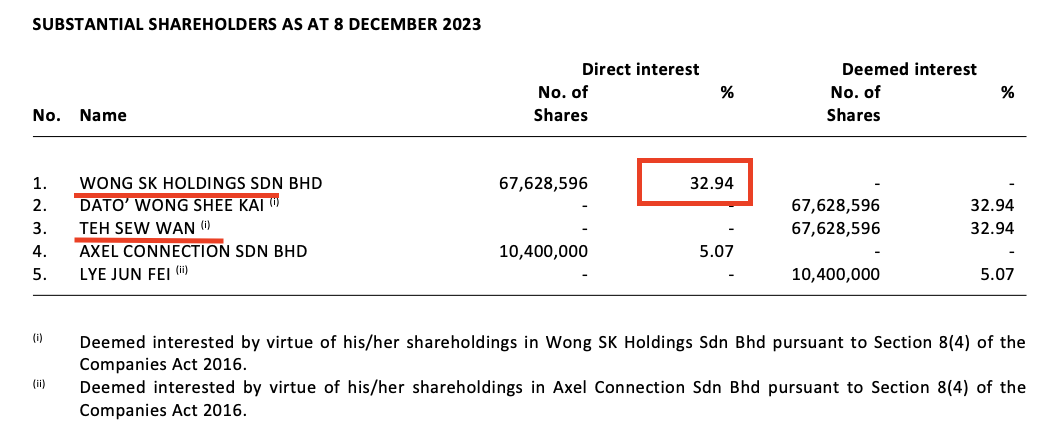

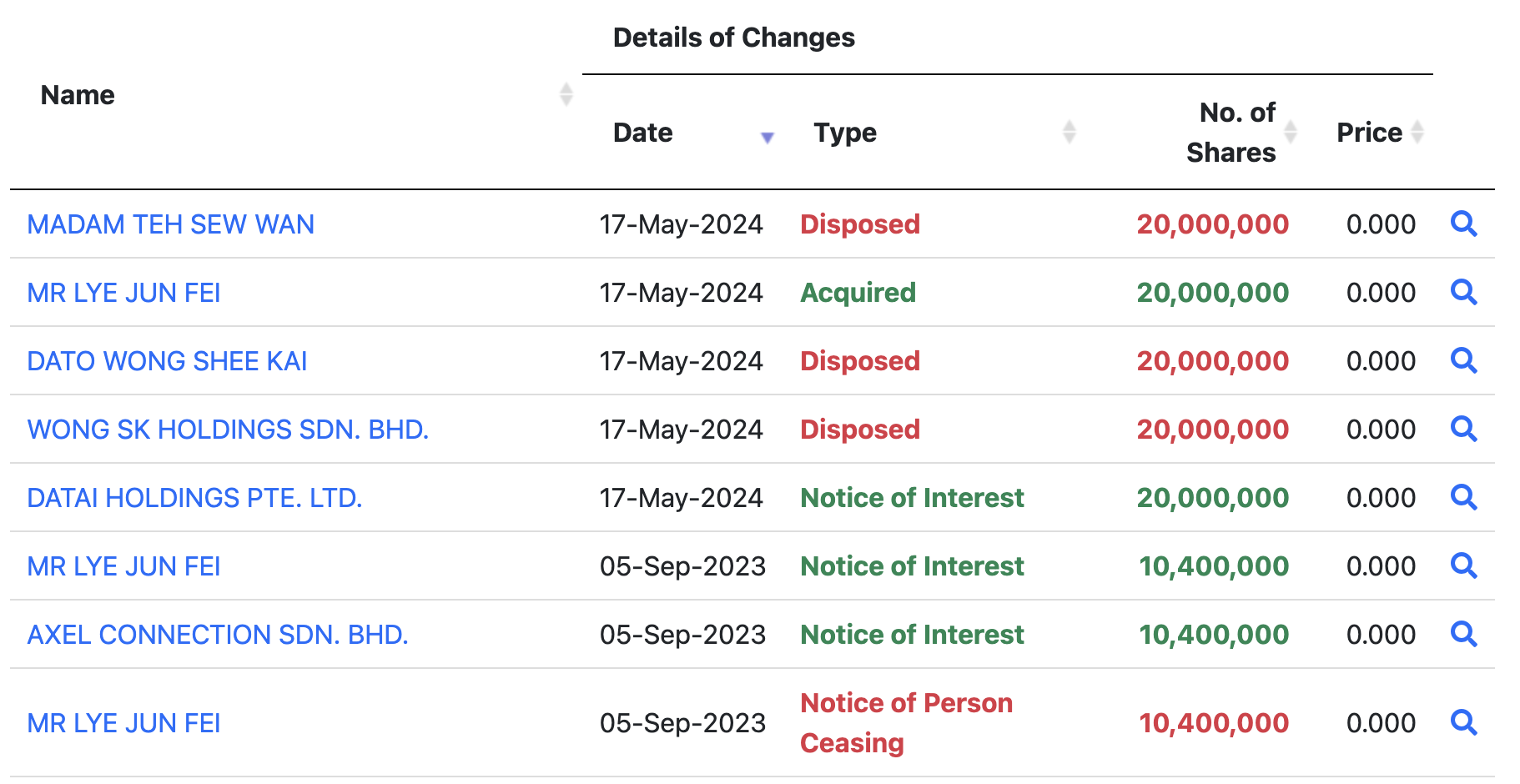

Shareholding

Question first on Syed Ali

- Why did Syed Ali disposed everything in 2014?

- Why resigned as Chairman in 2017?

- Why BRIGHT still didn't replaced the Chairman after 7 years - up to today (FYE2023), the Annual Reports still show Deputy Chairman with the Chairman position vacant. When it takes longer than 6 months or 1 year to replace Chairman, serious question marks rise such as - are they so picky that the Chairman must be someone who does someone else's bidding? Why is the Deputy still a Deputy after 7 years?

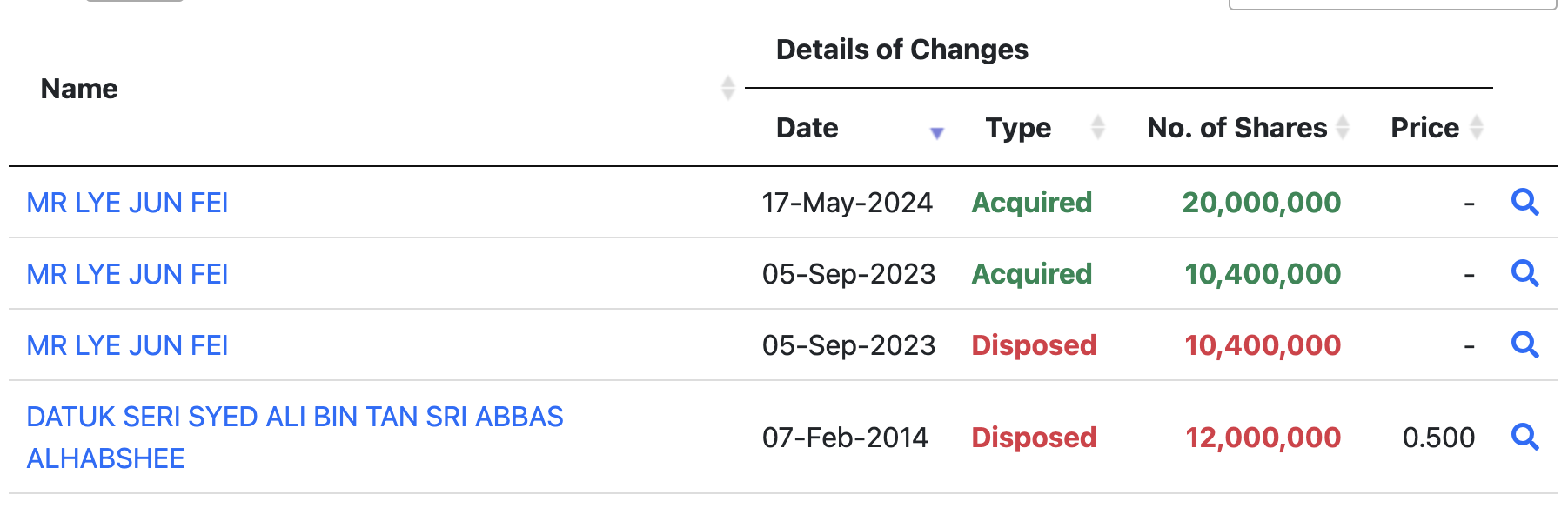

Questions on Lye Jun Fei - why did he dispose all his direct holdings in 2023, and convert to indirect? Why did he buy on 17 May 2024 indirectly?

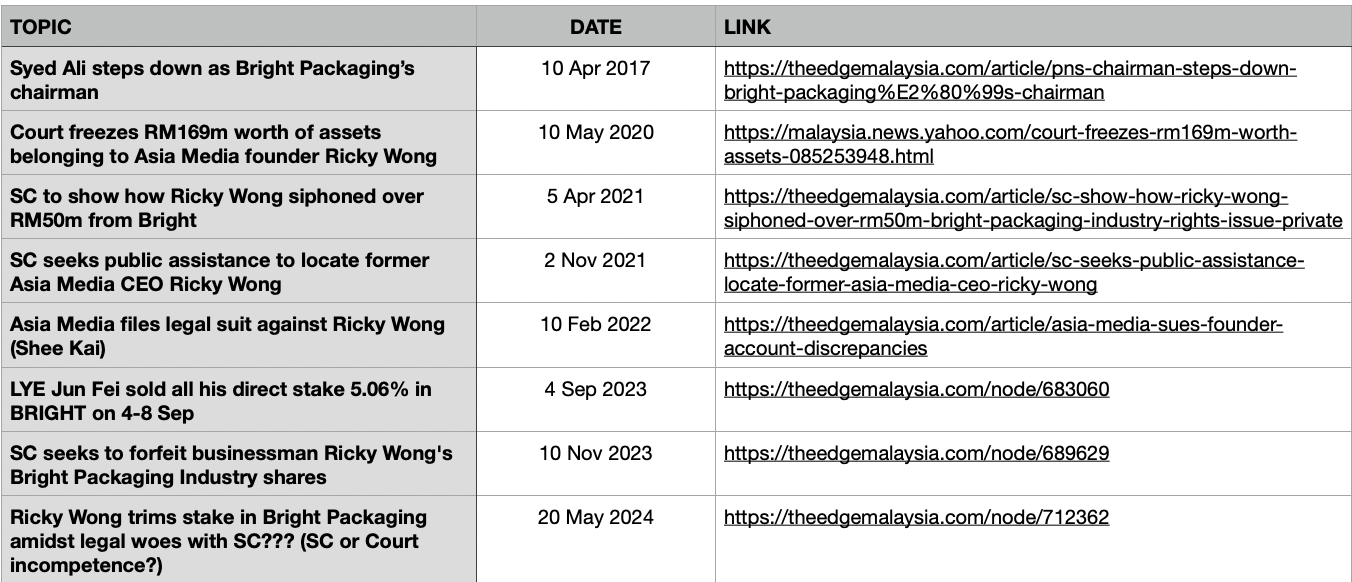

Controversies surrounding Ricky Wong (Wong Shee Kai)

Ricky Wong is the son of Teh Sew Wan, they both own Wong SK Holdings.

A series of google searches shows the following

It's quite clear that somebody has been dictating things, especially what happens to the Net Cash.

- Ricky Wong (a young guy many years ago) has been in fugitive since 2021, with court cases against him. Why run? (already failed the Integrity criteria).

- He, his mother, Wong SK have been alleged to contravened Capital Markets and Services Act 2007, by using various devices to defraud BRIGHT and/or operating BRIGHT as a fraud of the company.

- Google and read the stories - very interesting how they allegedly defraud over RM56 million. There's seldom one cockroach in the kitchen. Which leads to the question - is the Net Cash in BRIGHT really safe given the long term history?

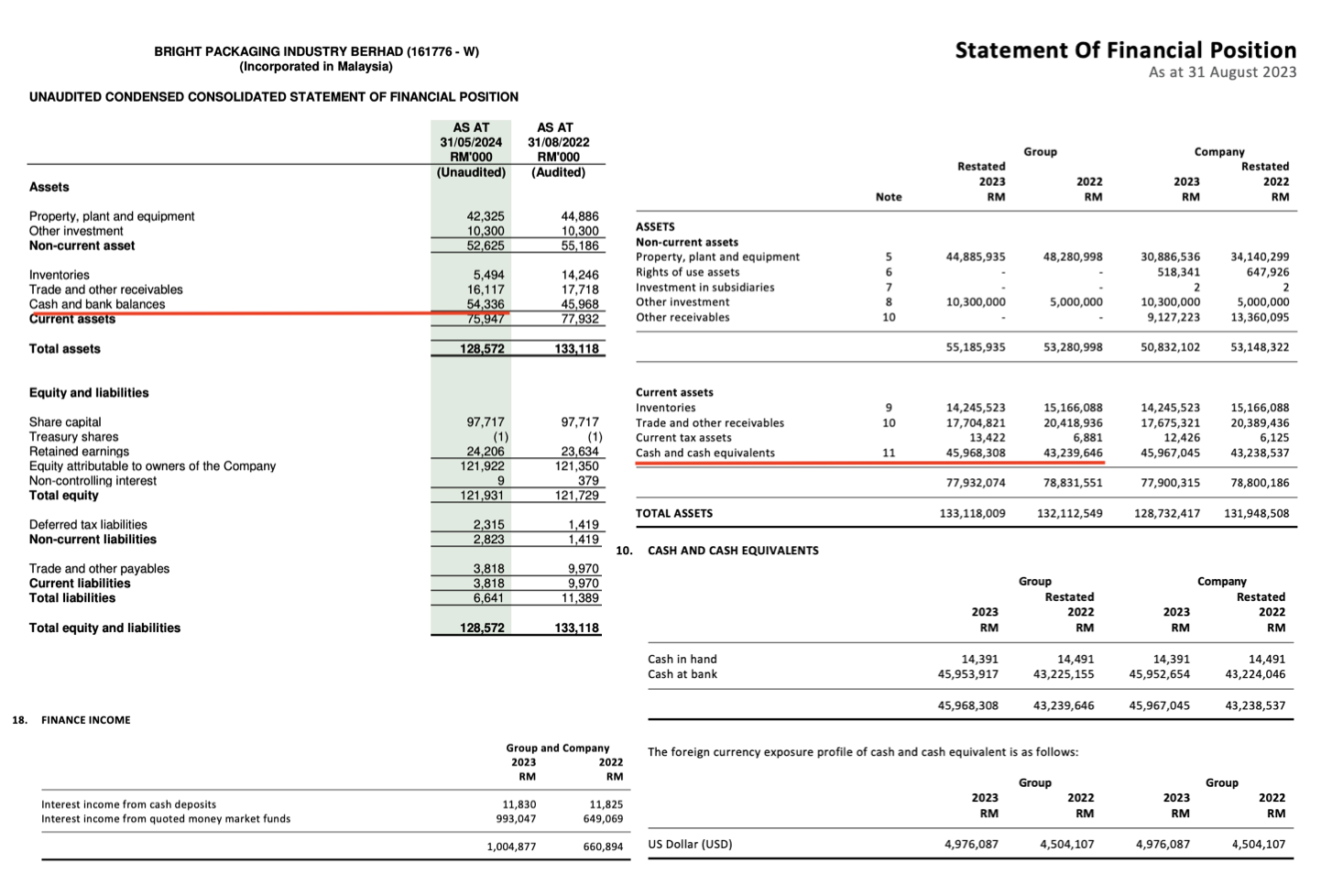

What is the Company doing with its Cash Holdings?

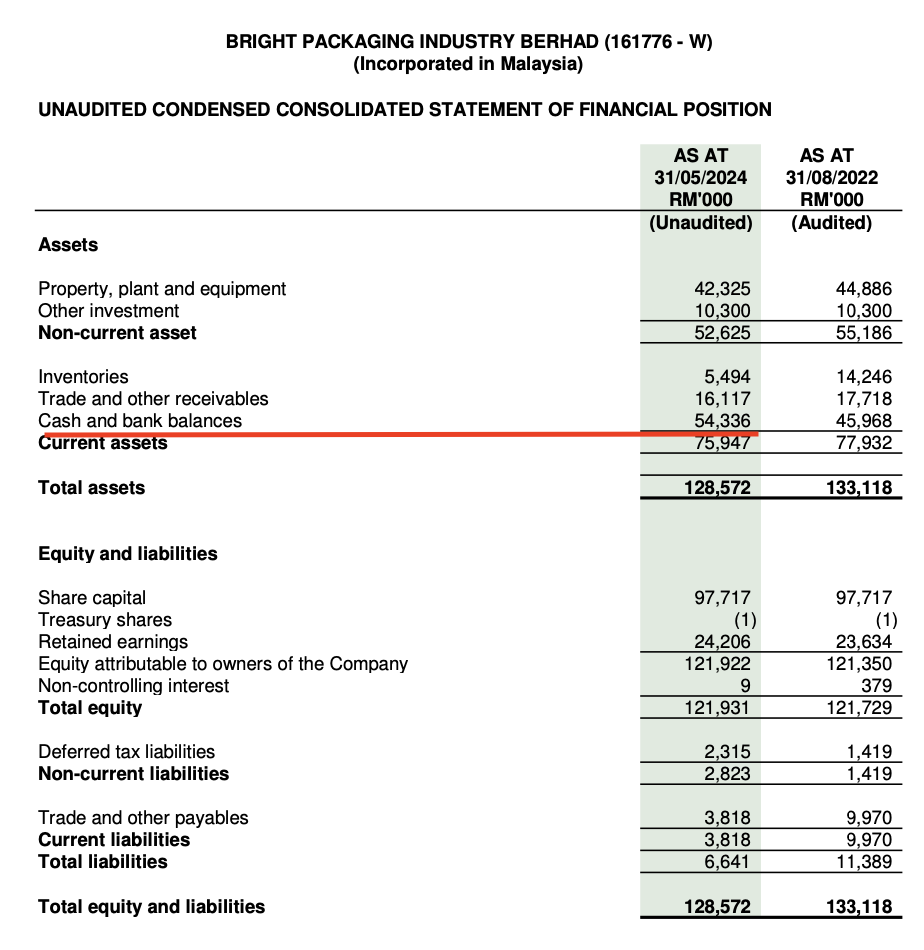

This image has a lot of information. Key highlights:

- Cash grew slowly (by 2 million) over 12 months in FYE2023, but accelerated over 9 months (by over 8 million) in 2024. Will minority shareholder get a share with nil dividends?

- The average cash balance during FYE2023 is around 44 million, but Finance Income is only 1 million. This suggests the company is only earning a paltry 2.3% per annum interest - even my own FD is 50% higher than this. The company clearly is not managing its Finances well. A red flag. What is the mindset of the CFO?

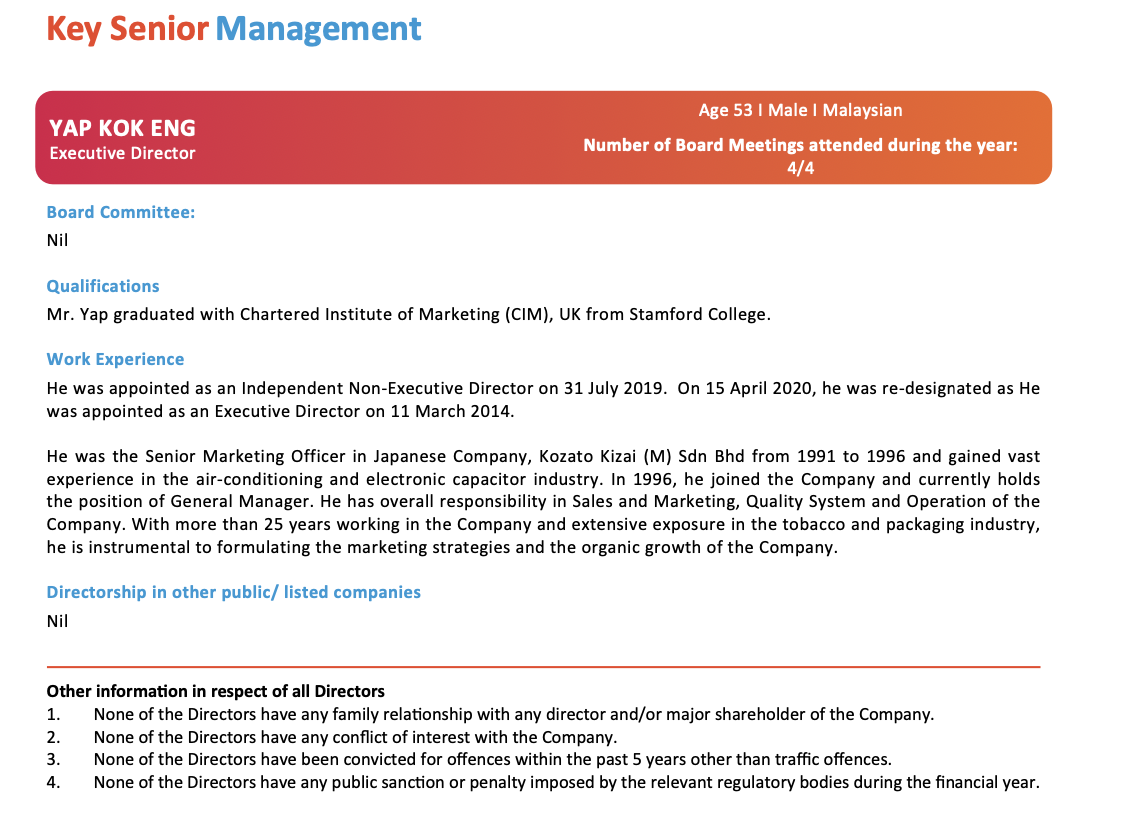

Who is the CFO? Who are the Management Team?

It strikes me a bit strange that in 2023 Annual Report, there is only 1 person in the Management Team disclosed in the Annual Report. Same with 2016 Annual Report too. I don't know about you, but to me, this is serious red flag. CFO is typically the 2nd most important person in the company after the CEO, and only having the CEO all the time is not transparent, like everything else about the company.

Poor Governance

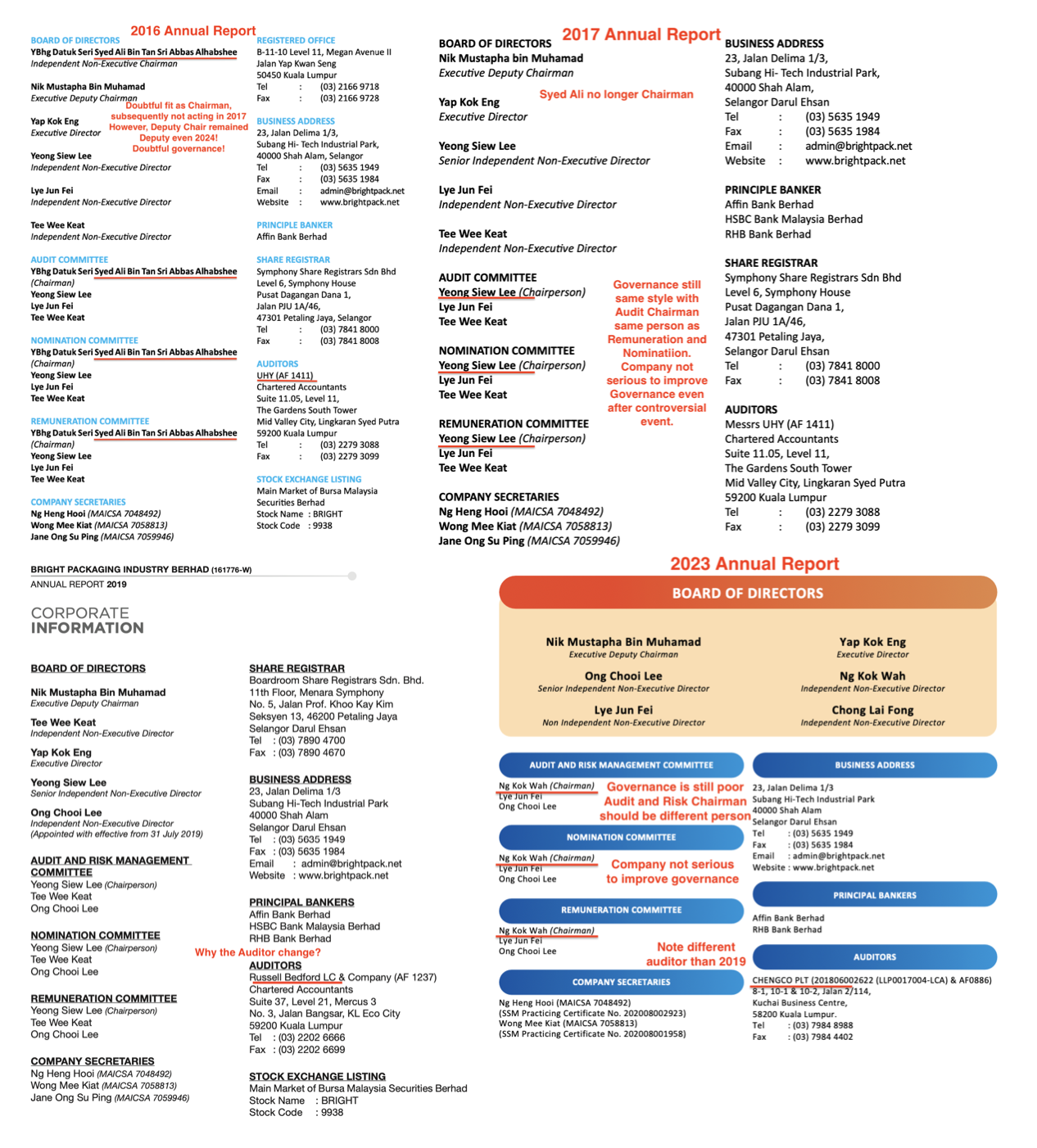

One of Buffett's critical criteria is "trust" and "integrity". Due to the controversies, I don't normally compare Board compositions across various annual reports, but here, I show a snapshot of 4 different Annual Reports just to highlight the very serious question marks on governance:

- Why is the Deputy Chairman still a Deputy after 7 years? (Question marks are raised when the old Chair is removed and replaced instantly, let alone 6-12 months gap, let alone 7 year gap. Serious question mark).

- Why is the Audit (later Audit and Risk) Committee Chair the same person as the Remuneration and Nomination Chair?

- Why is the Auditor different so many times?

How would Buffett view this company?

Buffett has this clever saying about what qualities to look out for, when hiring people to work for you. If you are the shareowner then, the Board Members and the Management works for you and you like to see these qualities in your Board members and management.

You look for three qualities: integrity, intelligence, and energy. And if you don't have the first, the other two will kill you. You think about it; it's true. If you hire somebody without [integrity], you really want them to be dumb and lazy.

In short, I don't trust the CEO, the Board nor the controlling Shareholders.

I feel, Buffett would not touch this company with a 10 foot pole, and so do I.

What about Speculative Trading?

If you are not going to be an investor, would you consider speculative trading?

Let's take a look at the Daily candles - it is widely stated that TA traders don't care about the fundamentals of the stocks they trade because they trade on supply and demand, and what do we see?

The first thing that strikes me is the low daily volume. Only 200K recently. At 20 sen, that's only RM40k traded. Serious traders should avoid this stock.

What about the small retailers?

On supply and demand basis, there seems to be 2 interpretations - since 2018, horizontal sideways (16 sen to 24 sen), shown on the blue line. By this box, BRIGHT at 21.5 sen is not cheap yet. Or the Green Channel over shorter period (less convincing). By this metric, BRIGHT could be monitored to approach Accumulation zone.

However, the main risks is not the charts, but whether you can trust the charts. In general, TA doesn't work much in Bursa because of the smaller volume. It works better in much deeper, much more liquid markets where the market psychology shows itself better when volumes are much larger.

Why does Mr Market not value the Net Cash?

On the surface, it looks crazy, that Mr Market would discount the value of cash in the company so persistently.

Is Mr Market so pessimistic?

Are BRIGHT's problems temporary?

I think Mr Market is probably behaving like Buffett - it is too hard to tell if he can trust the CEO, the Board nor Controlling Shareholders and so, Mr Market is discounting the cash because of numerous warning signs. If you don't have trustworthy CEO, Board nor Controlling shareholders, then, you cannot trust its published books especially when its auditors frequently changes, and clear signs someone is controlling for their own benefit and it won't be the minority shareholders.

Summary and Conclusion

BRIGHT clearly have a lot of Net Cash in the Company at the last QR, but the core question is - can you trust the Net Cash to be shared with other Shareholders?

There are many warning signs. Some are really super easy to change, but why hasn't this been done? Some of these warning signs are:

- Shareholder DPS is still nil, despite the long history of Net Cash and substantial Net Cash relative to Market cap.

- Controlling Shareholders allegedly siphoned monies illegally from BRIGHT.

- Controlling Shareholder is a fugitive.

- Chairman of the Board position still vacant after 7 years and not replaced i.e. are Management, Board, controlling Shareholders really that lame and cannot nominate a Chair person amongst them? Or is it because the regulator keeps declining nominations by Nomination committee that has conflict of interest?

- Board culture still complies, still okay to have the Audit (or Audit and Risk) Chair to be the same person as the Chair of Remuneration and Nomination, ignoring conflict of interest.

- Frequent change of external auditors. Another red flag.

- Still no shareholder dividend. Someone doesn't want to the profits to be shared, with possibly another agenda.

- Only the CEO is featured in the Annual Report - another lame CEO?

Chart shows something may eventually happen in 2026-2027. Your speculations are just as good as mine what will happen by then.

- If you think the outcome will be positive 2-3 years from now, then, besides the usual risk management of avoiding, the usual caveats apply i.e.

- Diversify, diversify, diversify.

- Keep this a small % of holdings so that if things turn negative, you are not hurt too much.

- No need to chase - let price come to you at lower prices, near accumulation zones indicated. Let Universe decide whether to fill you or not.

- Be prepared to lose it all.

- The other possibility is negative outcome.

- Many possibilities - maybe Ricky Wong is found to not be guilty and depending on your views, what might be worse is a crook who is let loose to do more damage in the future.

- Or maybe minorities keep seeing flat cash and wonder where the rest went and why still no dividends, because there's rarely one cockroach in the kitchen.

If you are a large trader, the lack of volume already shuts you out - I would pass and give this a miss.

If you are a small retail trader, I would adopt a shorter timeframe than investors - I would not wait until 2026-7. Instead, I would wait at accumulation zones and immediately after fill, queue to sell higher by a few sen below resistance and look for small gains for most of it and maybe hold on to tiny amounts in case it runs higher, but depends on price action. Bear in mind, small volume, small spread = small gain i.e. better to hone your trading skills elsewhere where volume and price action is much larger.

Disclaimer: As usual, you are solely responsible for your own trading and investment decision.

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Jul 27, 2024