GENTING - Will RM4.50 Support Hold?

DividendGuy67

Publish date: Sat, 03 Aug 2024, 11:10 AM

A couple of weeks ago, I sold off my GENTING holdings at RM4.80+. The reason was technical, not fundamental. Technically, I felt it was not ready yet to break a few resistance, and the stock was still in consolidation mode. So, I sold off. Fortunately, I was able to buy back at RM4.50 on Friday. The next question is will RM4.50 support hold?

Let's review GENTING's fundamentals again, starting with its past 10 years performance. As investors, we believe its long term past is an important indicator to its long term future performance, especially for larger companies,, as Corporate DNA is not easy to change. We are not in the business of changing or hoping companies to change its DNA, but rather looking to find a right investment fit, and then have its Board and Management works for us as shareholders.

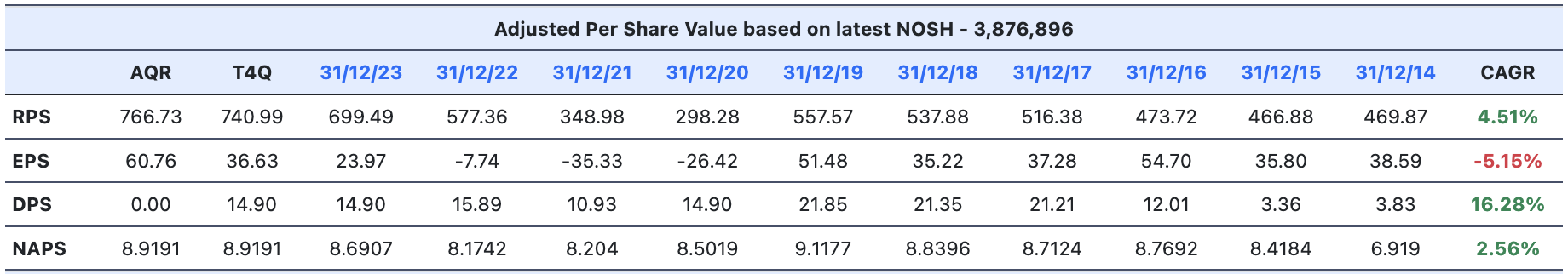

Past 10Y Fundamentals

There's obviously pros and cons with GENTING:

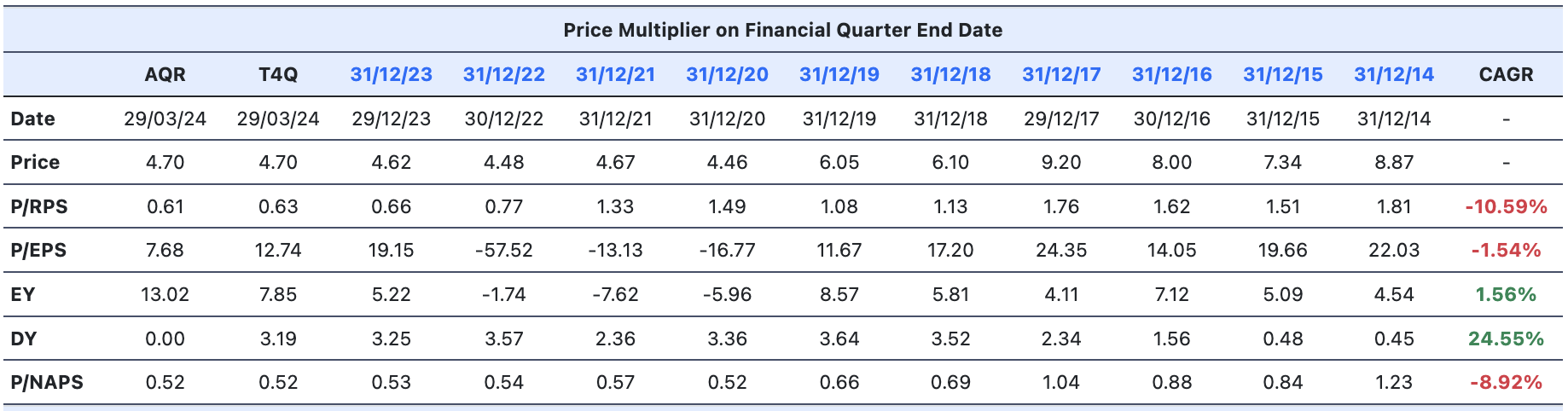

1. The pros - some cheap metrics observed such as P/RPS (~ 0.6-0.65), P/BV (~0.5 to 0.55), with EPS turning positive from COVID low negative EPS. Revenues making record levels.

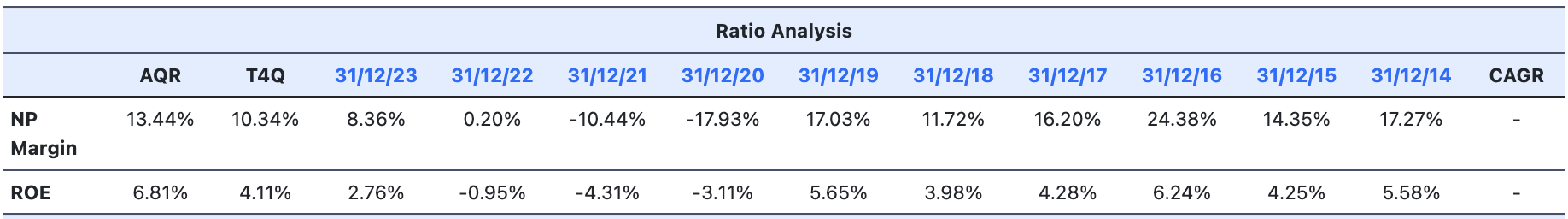

2. Some potentials - ROE naturally turned positive with FYE23 reporting 2.76%, and T4Q higher and AQR even higher suggesting improving recent earnings trend, and investors are hoping the earnings momentum continues.

3. DY ~ 3.3%. (15 sen / 4.5). Close to FD rates.

4. Despite record revenue, it's not peak earnings nor peak ROE yet i.e. its financial profile has changed from say 2016. Likely due to some damages incurred during COVID pandemic which has hurt GENTING tremendously. However, recovery seems to be happening the past years since COVID. The longer term question mark is will GENTING regain its past glory and there's a lot of naysayers re online gaming's threat taking slices away from GENTING.

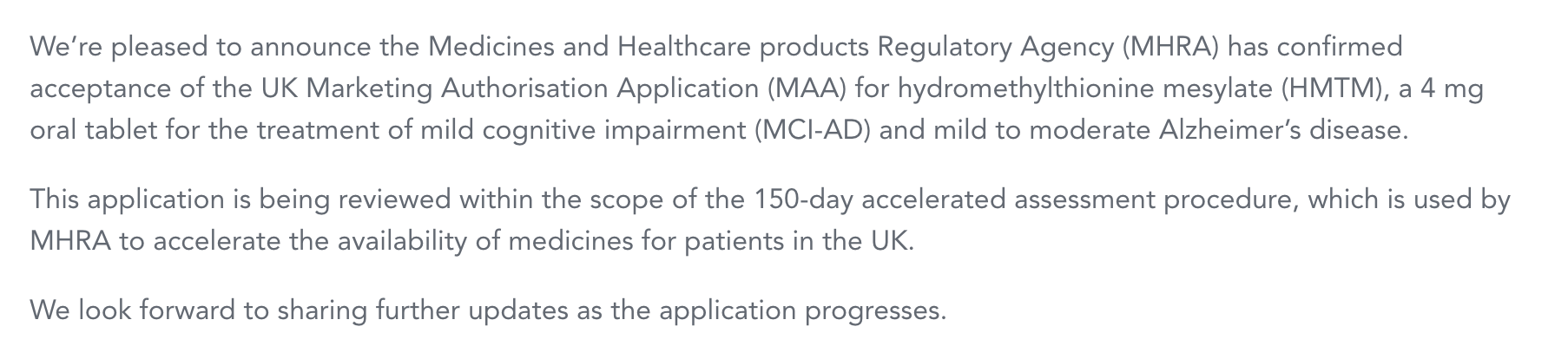

5. The recent interest and excitement surround TauRx - the forum has discussions on this topic (see here), quick google shows articles like this and more. Future prospects is indeed important consideration too - the question mark is "how much". Here's what TauRx says on their website on 29 July, and many are looking at/before Dec 2024 for the outcome of the MAA. (It could be before, due to the theoretical "insider" possibilities, and market looking months ahead). The acceleration assessment is what makes certain market players optimistic and excited.

Naturally, approval to market TauRx new HMTM drug in the UK is exciting, given the prevalence of Alzheimer's in Western countries, the stronger UK currency, higher healthcare costs/revenues, etc. Great questions like "doesn't drugs not work for everyone?", "doesn't the drug lose efficacy over time?", etc. abounds on the Internet, but the point is it is new and exciting and potentially open up new doors for higher revenues. Great "financial" questions like "how much / how long before TauRx can recoup costs and turn into profitability for GENTING?" should be made clearer, but general impressions are the costs are already sunk i.e accounted for in operating expenses (is it really true?).

I am not an expert on TauRx, and so, will leave the answers to these detailed fundamental questions and discussions to the forum.

Price Charts

To me, I don't think GENTING is sun-setting yet even though it is spending a lot of time in consolidation.

Monthly Chart

Peak price near 2011 and has declined over the past 13 years. This has hurt long term investors for a long time. A silver lining is that the Covid low is higher than 2001 lows and we can see a gradually climbing uptrend support channel below.

Weekly Chart

Since recovering from Covid low, price has spent the past 3 years in horizontal consolidation. The past 2 weeks declined. Last week's candle is longer, with higher red volume suggesting majority odds of lower prices to come, unless there is a stronger bullish force such as markets turning around next week. Hence the title question - will RM4.50 horizontal support hold.

Daily Chart

Last Friday's candle is rather long, with significantly higher volume.

Will RM4.50 support hold?

TA typically says majority odds the strong downward momentum should continue, until you actually see the bottom printed.

- Right now, bottom is not yet printed.

Sharp eyes will note the Opening Gap of RM4.43 is yet to be filled,.

- Previous low in April of RM4.44 didn't quite fill it.

- But some technicians thinks 1 sen difference is "close enough" to be considered filled.

Bears might think - no reason why it couldn't come down to 4.15, near the bottom of that uptrend channel. In truth anything is possible in markets.

Concluding Thoughts

TauRx developments are potentially exciting.

GENTING has been disappointing to many GENTING investors since 2011 peak. The recovery since Covid pandemic low looks small. GENTING has further spent 3 years in horizontal consolidation.

Interest amongst investors have peaked since falling to RM4.50. So, I have bought back what I sold at RM4.80+, just in case.

There is valid reason to consider adding a bit more if price do close the RM4.43 gap, or if price comes further down to the bottom of the uptrend channel near RM4.15. The odds for the latter may be less likely, but nothing is impossible.

In short, if you believe GENTING is fundamentally cheap (P/E, P/BV, P/RPS etc), its TauRx news promising by/before end of 2024 (a potential fundamental catalyst), and chart wise looks promising too, then, you may want to layer in your entries at lower prices. I have taken a position at RM4.50, and we'll see how GENTING performs next year.

Always control your position size in case you are wrong, because anything is always possible in markets. Like any other stocks, GENTING is not immune to crashes.

Disclaimer: As usual, you are fully responsible for your own trading and investing decision.

PS. If you like this article, give it a thumbs up and it may encourage me to share more in the future.

PS2. As I have collected the self-created 30+ sen "dividend" (sold 4.80+, buy back 4.50) this year, I am less likely to repeat as we get closer to the end of the year. If the good news disappoint, then, I am more likely to repeat next year but let's see the charts then.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on https://dividendguy67.blogspot.com

Created by DividendGuy67 | Feb 02, 2025

Created by DividendGuy67 | Jan 25, 2025

Created by DividendGuy67 | Jan 24, 2025

DividendGuy67

During this dip, I added to my GENTING holdings at 4.20.

I had a brief chance to add at around 4.1x or so, but I hesitated and when I decided, it was already 4.24 so, I just queued at 4.20 and went ahead with my daily work routines. After workday, checked and noticed it was hit!

Good luck!

2024-08-08 00:26