KLCI waves

KLCI waves 21 - correction wave B on the run

hotstock1975

Publish date: Sat, 22 Aug 2020, 06:32 PM

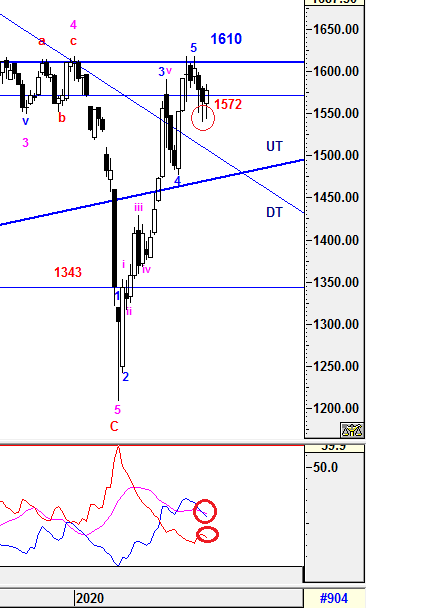

Weekly Time Frame

As expected, KLCI was able to rebound and close above 1572 after forming three longer candle tails which indicated bottom fishing attempted when market went to dip. However, caution is still required when KLCI trading in between range of 1572-1610.

On other hand, the higher degree of correction will be elaborated further in daily time frame.

-DMI (red line) is curving down indicates bearish momentum is decreasing. +DMI (blue line) is still heading down with greater margin and still below ADX (pink link) indicates the pace of bull strenght is still decreasing. ADX (pink line) is curving down which implying the volatility of the current bull trend is still uncertain in shorter term. Therefore, the summations of the 3 signals above is implying uncertainty still remains and knee jerk reaction is unavoidable as expected.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Immediate Resistance - 1590

Immediate Support - 1572

Support - 1540

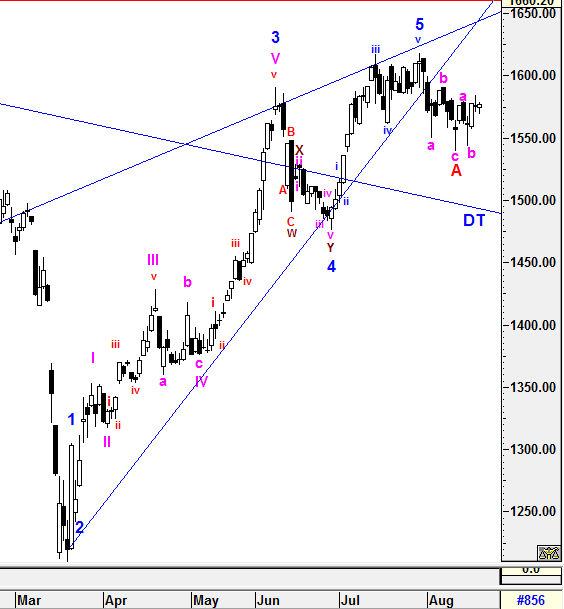

Daily Time Frame

To recap, wave A had been formed with 3 sub minutte waves "abc" eventhough wave A ended at 1539.61 which was 9 points away from its minimum criteria at 1530 (Fibo 61.8%). Due to magnitude of the momentum, there are acceptable threshole allowances to fit or qualify the criteria.

Currently, wave B is being constructed with a possible target of 1569 - 1588 (38.2-61.8%) and could be formed by another 3 sub minutte waves "abc" before a start of wave C. However, there was a high of 1584.36 which might already fit the minimum criteria of wave B (4 points away) and might conclude that a Zig Zag Formation construction is highly possible for the entire correction waves. If 1588 is breached and moving higher, a flat correction would be emerged with wave B could be ended in between 1588-1618 (61.8-100%).

The type of the entire correction formation will be monitored and reveal when wave C emerged as wave C has the most properties of wave forms which may lead to complexity formations.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Immediate resistance - 1584, 1590

Immediate support - 1572

Support - 1540

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments