KLCI waves

KLCI waves 27 - Longer correction for Wave 2 but will end soon

hotstock1975

Publish date: Sun, 04 Oct 2020, 03:56 AM

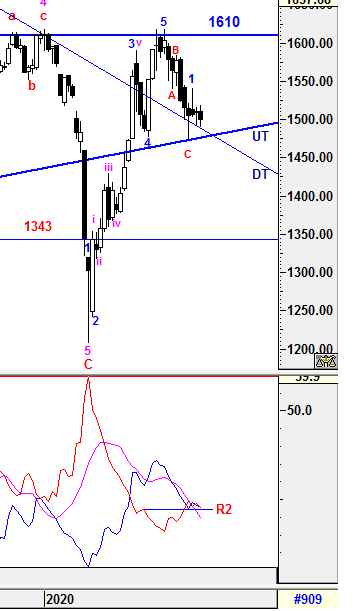

Weekly Time Frame

It seems the level of 1515 is still the level to watch for confirmation of major trend reversal to the upside even KLCI has been unable to close above these level for the past few weeks. To reiterate, DT and UT line are still playing an important role as critical supports as consolidation phase had emerged above these two levels. Therefore, caution is still remained unless KLCI able to close above 1515 in this coming Friday.

On other hand, the Higher Degree of Wave counts will be elaborated further in daily time frame.

1) -DMI (red line) reversed down with greater margin indicates bearish momentum is decreasing but it require penetrating below support at point R2 for signalling bear trend weakening.

2) +DMI (blue line) reversed down indicates bull strenght is still weak.

3) ADX (pink line) is still heading down with narrow margin which implying the volatility of the current trend is still low with uncertainty.

Therefore, the summations of the 3 signals above is implying uncertainty still remains and knee jerk reaction is unavoidable. From current situaton, +DMI and -DMI had moving down together with narrow margin indicate a prominent trend has not been developed yet. Even -DMI still above +DMI, bearish momentum is decreasing. Besides that, ADX is still indicating weakness in volitality of the current momentum unless ADX start to curve up.

Prevailing trend could be emerged if levels listed below was broken:

Major Resistance - 1610

Immediate Resistance - 1510, 1515, 1525, 1545

Immediate Support - revised to 1486 (DT line)

Support - 1477 (UT line)

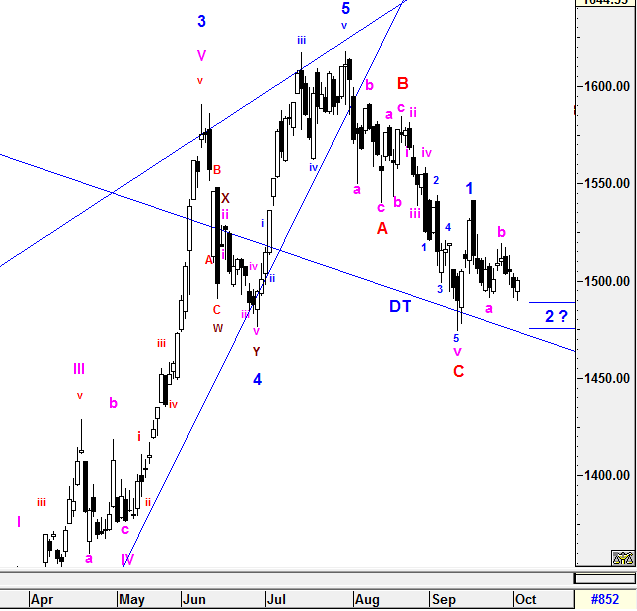

Daily Time Frame

To recap from prior session, Wave 2 would have completed at 1491.17 which qualified the minimum criteria of FIBO 76.4% retracement (1490). However, 1491.17 had been breached with narrow margin to a low of 1489.66 due to some knee jerk reaction. Therefore, Wave 2 have to be revisit and revised where Wave 2 could form longer correction phase.

From the current observation, Wave 2 could be formed with minuttes waves of Zig-Zag Formation (5-3-5). The prior complex waves [abc(w)-(x)-i-ii-iii-iv-v (y)] would be catergozied as wave a (5 minutte waves) which ended at 1491.17 and wave b ended at 1519.05. For wave c, these 5 minutte waves consist of minor complex waves which could be ended in between 1488 (61.8%) and 1474.23(100%). To reiterate, the completion of wave c would be inconjunction with Wave 2. However, the current closing was 1489.66 which was 1 point away from qualifying FIBO 61.8% minimum criteria. As mentioned, there is threshole that minor deficiency could be accepted to qualify the criteria based on the magnitude of momentum. In this case, Wave 2 can be validated if KLCI manage to breach and close above the end of wave b (1519.05) convincingly. If it does, Wave 3 would have started but again it require confirmation of validatity if KLCI manage to close above Wave 1 at 1541.14 convincingly. If Wave 3 is validated, the possible Wave 3 target would be 1558 or 1600.

On the other hand, the prior Higher Degree of Correction Waves will be revised If the prior low of wave C (1474.23) is breached. Therefore, the entire wave structure will still be monitored closely as complexity wave formations could be emerged such as WXY correction waves may take place before Higher Degree of 5 Waves Bull Run.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if levels listed below was broken:

Resistance - 1610

Immediate resistance - 1510, 1515, 1531

Immediate Support - 1495, revised to 1486 (DT line)

Support - revised to 1477 (UT line)

=======================================================

Sometimes complex waves are required to initiate SUPER CYCLE Bull Run.

=======================================================

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

1 person likes this. Showing 2 of 2 comments

Glove and related lead but other will drop in blue chip term.Seing below 1400 in the making.Just far too long to make a rebound if next week can't substain 1500 again

2020-10-04 16:49

hotstock1975

PureBull. Thanks for your sharing. No doubt gloves stock has played a vital role on KLCI index movements during these pandemic period. As aware, the entire basket of the index still need to be monitored as rotation play still ongoing on how different blue chip to sustain the growth of the index gradually. Whether KLCI is already at the second 5 bull waves or still under impending larger consolidation before the impulsive bull waves, I am still preferring waves analysis approach to track the movement rather than fundamental analysis as TA signal will lead FA approximately 6 to 9 months ahead. No matter how sophisticated the waves being formed, all has been priced in. Therefore, magnitude of movement measurement comes in to quantify the validity of wave forms during the structuring process stage by stage. From my first few session during March, KLCI had formed double top on 2014 and 2018 and did a huge correction since then. I am still believing these entire double top correction is over and we are in the midst of Super Bull Cycle to overwrite the double top formation in long run. Ofcos, we may encounter unexpected hiccups along the way up. From my observation, KLCI has lead over SnP500 in term of waves count as SnP 500 had just completed Wave 1 after ABC correction done. Shall KLCI will lead SnP500 ongoing forward or both will synchronize soon before making up Wave 3? For Gloves stocks wave form especially those index link one, no doubt they are the most mirroring KLCI waves now. However, I will still let the waves do the talking.

Due to time constrain, I guess I won't be able to open a private forum to share my analysis at the moment. However, I will still keep sharing my analysis here and keep learning.

As my sifu always said never stop learning to sail with Mr Market.

Wave Believer

2020-10-04 16:15