KLCI waves

KLCI waves 34 - Nice Impulsive Sub Minuette Extension Waves Towards Higher Level

hotstock1975

Publish date: Sat, 21 Nov 2020, 11:32 PM

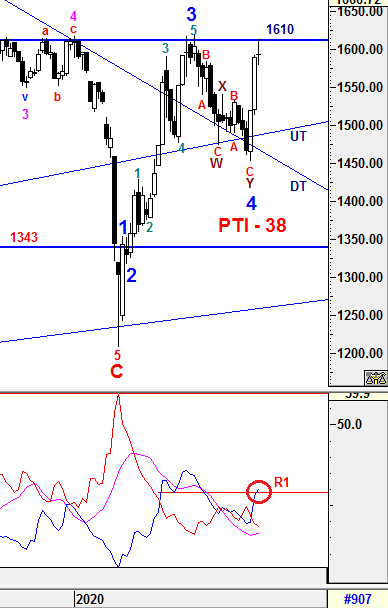

Weekly Time Frame

KLCI has re-tested and yet to close above 1610 which has been the critical strong resistance of all time. Besides that, there was a Doji candle formed which indicated consolidation phase may continue next week.

To recap, the Higher Degree of Wave 5 is being constructed to archieve higher level. The current weekly PTI reading is still remain at 38 which indicating that the prior Higher Degree of Complex Correciton waves WXY was healthy which could succeed Wave 5 at higher level. Therefore, the tendency to breach above 1610 level is high in coming weeks. Subsequent minor waves would be elaborated further in daily time frame.

1) -DMI (red line) continue heading down with lower margin indicates bearish momentum is still decreasing.

2) +DMI (blue line) continue heading up with a breakout above R1 indicates bull strenght is still strong.

3) ADX (pink line) continue heading up with greater margin implying the volatility of the current trend is improving.

Therefore, the summations of the 3 signals above is implying uncertainty is reduced with narrow margin but caution is still required for any unexpected knee jerk reaction. From current situaton, +DMI has continued staying above -DMI and initiate a breakout above R1 indicates bull strenght is still in favor with improved volatility. However, a continuous increased in ADX reading is still required in order to validate a prominent trend to be developed.

Prevailing trend could be emerged if Weekly levels listed below was broken:

Resistance - 1639,1650,1682

Immediate resistance - 1610,1621-1623

Immediate Support - 1577, 1564, 1556,1530

Support - 1490 (UT line), 1467 (DT line)

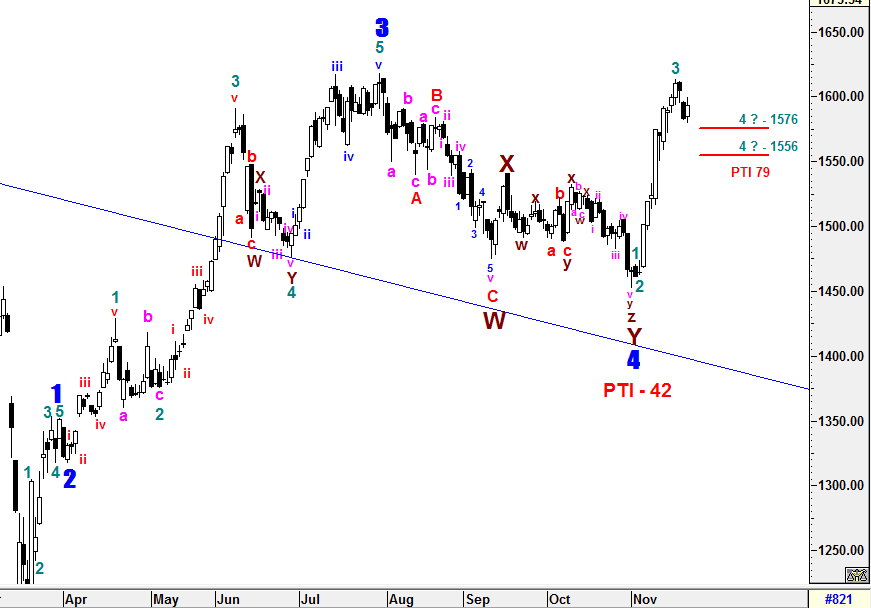

Daily Time Frame

To recap, the entire Higher Degree of Wave counts has been revised where the current implusive up waves constructing could be in Wave 5 instead. The revision took place when the degree of momentum for these implusive waves were too strong which had triggered the quantification of waves count requirements.

To recap, the entire 5 sub minuette waves with extensions were still being constructed to complete Wave 5. Currently, 3rd sub minuette waves extension has been completed at 1613.34 and 4th sub minuette correction wave is being constructed which may end at 2 possible levels in between 1556 and 1576 with good minuette wave's PTI reading of 79. These indicates the post correction's momentum would be implusive again to succeed 5th sub minuette waves at higher level in short run.

To re-iterate, the daily Higher Degree Wave's PTI reading is still remain at 42 indicating the prior Higher Degree of Complex Correciton waves WXY was healthy which could succeed Wave 5 at 3 possible targets level at 1639, 1685 or 1706 if the penetration of the high of Wave 3 (1618.01) could be realized convincingly.

The entire wave structures will still be monitored closely if the low of Wave Y at 1452.13 is breached as more complexity wave formations could be emerged such as multiple WXY correction waves may take place before Higher Degree of 5 Waves Bull Run.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if Daily levels listed below was broken:

Resistance - 1639,1650,1682

Immediate resistance - 1610,1621-1623

Immediate Support - 1577, 1560, 1554

Support - 1530, 1490

==========================================================================

Patient is required for Implusive Waves of the SUPER CYCLE Bull Run.

==========================================================================

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments