KLCI waves

KLCI waves 38 - Wave 5 Is Not Out of Wood Yet !!!

hotstock1975

Publish date: Sun, 20 Dec 2020, 06:42 PM

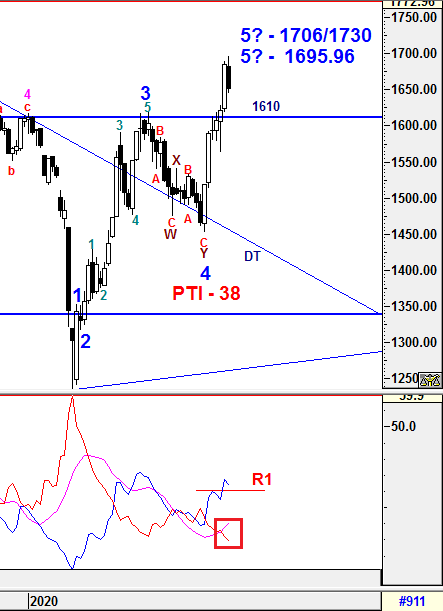

Weekly Time Frame

As expected, KLCI had entered into consolidaiton phase after making a high of 1695.96. To recap, It is a good new start for the Bull to test higher level in order to overwrite the double top formation which formed years ago. Healthy correction is good for longer run. However, caution is required along the way up for any knee jerk reaction possible and consolidation might continue in short run before the Bull recharged.

To recap, the Higher Degree of Wave 5 is still being constructed to archieve higher level. The current weekly PTI reading is still remain at 38 which indicating that the prior Higher Degree of Complex Correciton waves WXY was healthy which could succeed Wave 5 at higher level. No doubt that Wave 5 is confimred to be realized at higher level since KLCI was trading higher than 1618.01 (Wave 3). Subsequent minor waves would be elaborated further in daily time frame.

1) -DMI (red line) continued heading down with lower margin indicates bearish momentum is still decreasing.

2) +DMI (blue line) curved down with lower margin indicates bull strenght is decreasing but still in favor with slower pace. Consoliation took place after the breakout at R2 emerged indicates continuous bull strength could emerge soon.

3) ADX (pink line) continue heading up with consistent margin implying that the volatility of the current trend is increasing consistently.

Therefore, the summations of the 3 signals above is still implying uncertainty is reduced with heathly margin but caution is still required for any unexpected knee jerk reaction. From current situaton, +DMI above -DMI spread is still wide indicates bull strenght is still in favor with consistent volatility. Since -DMI and ADX have realized an criss-crossed setup last week, upside momentum is still in favor. However, a continuous increased in ADX reading is still required in order to validate a prominent trend to be developed.

Prevailing trend could be emerged if Weekly levels listed below was broken:

Resistance - 1720

Immediate Resistance - 1700

Immediate Support - 1650, 1639, 1621-1623, 1610

Support - 1577, 1564, 1556,1530, 1490, 1461 (DT line)

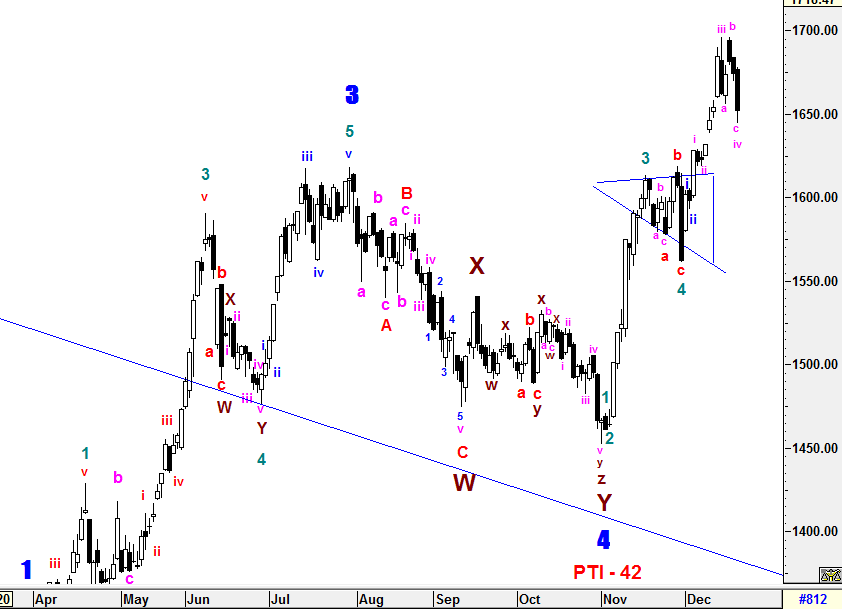

Daily Time Frame

To recap, KLCI had penetraded the projected target zone to hit the 2nd projected target of 1685 and it had met the minimum criteria of Wave 5 which could be realized from now. If the momentum is continued to be strong, i would not rule out that it would hit the next possible target at 1706 or even around 1730 (Expanding Triangle formation target). However, the uptrust momentum has been halted and resisted twice at the high of around 1695 which formed on 02/07/2019. Therefore,1695.96 could be the point of Wave 5 being realized.

To re-iterate, the daily Higher Degree Wave's PTI reading is still remain at 42 indicating the prior Higher Degree of Complex Correciton waves WXY was healthy which could succeed Wave 5. After reviewed the entire 5th minuette waves counts carefully, there was another sub extension of 3rd sub minuette of 5th sub minuette of 5th minuette waves being formed as labelled. The current correction waves have been formed as a-b-c which might realized iv sub extension of 3rd sub minuette of 5th sub minuette of 5th minuette waves from now at 1644.83. However, i won't rule these minuette correction waves could end down further at around 1631 (near lower gap support) to realized iv sub extension of 3rd sub minuette of 5th sub minuette of 5th minuette waves. Therefore, the prior projected target of Wave 5 (1706/1730) are still not out of wood yet.

The entire wave structures will still be monitored closely if the low of Wave Y at 1452.13 is breached as more complexity wave formations could be emerged such as multiple WXY correction waves may take place before Higher Degree of 5 Waves Bull Run.

All waves' count and projected target are generated based on past/current price level and it may be subjected to vary if degree of momentum movement change.

Prevailing trend could be emerged if Daily levels listed below was broken:

Resistance - 1720

Immediate resistance - 1662, 1679, 1685, 1700

Immediate Support - 1650, 1639-1631, 1610, 1597, 1577, 1560, 1554

Support - 1530, 1490

==================================================================================

Patient is required for the Implusive Waves of the SUPER CYCLE Bull Run.

==================================================================================

Let's Mr Market pave the waves.

Trade safely

Wave Believer

More articles on KLCI waves

KLCI waves 94 - WILL THE DOWNWARD PRESSURE TO BE IMPULSIVE TOWARDS WAVE E?

Created by hotstock1975 | Jan 24, 2022

KLCI waves 93 - EXTENSION UPWARD ENDED AND IT'S TIME TO THE DOWNSIDE?

Created by hotstock1975 | Jan 17, 2022

KLCI waves 89 - KLCI WILL EXTEND AND HIT LOWER TARGETS GRADUALLY

Created by hotstock1975 | Dec 20, 2021

Discussions

Be the first to like this. Showing 0 of 0 comments