Your One-Stop Shop to Understand the FundMyHome P2P Housing Scheme - New post

NeoZach

Publish date: Mon, 05 Nov 2018, 01:43 PM

The concept of Peer-to-Peer Housing Scheme was announced by the Finance Minister during the Budget 2019 tabling few days ago, quickly followed by the news that the FundMyHome.com (owned by EdgeProp Sdn Bhd) is up and running. It was meant to tackle the housing affordability issue for the first-time homeowners in our country.

Let’s take a look at what FundMyHome is and how does it impact you and me.

How FundMyHome Works?

- Basically, the notion is that Homebuyers only need to fork out 20% of purchase price (either through savings or loan from a bank), while Investors put up the subsequent 80% of the capital needed to finance the deal, in exchange for the opportunity to profit from the capital appreciation of the property.

- After 5 years, the Homebuyers will either have to (i) SELL THE HOUSE or (ii) REFINANCE if they choose to stay.

- Refinance can come in 2 ways: (i) Get a loan from a bank OR (ii) refinance on FundMyHome again (from an entirely new set of investors). No matter how, there is a confirmed exit for the investors after 5 years.

How’s the Profit Distributed After 5 Years?

*The actual scheme is much more complex than the explanation above. To keep things simple, I have omitted the role Developers play in financing the deal.

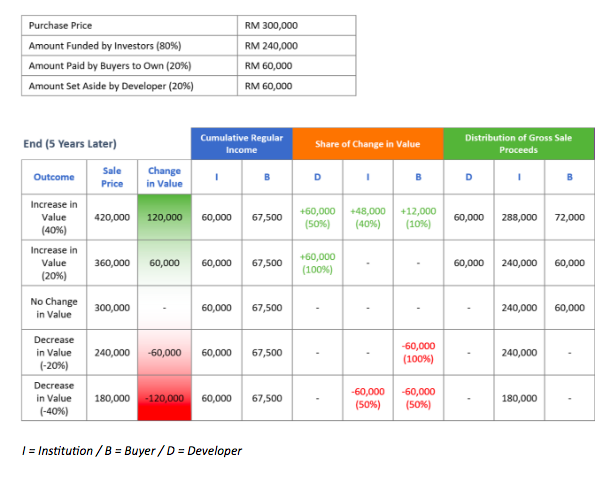

To understand how the profit distribution works, please take a look at the chart below.

Chart from FundMyHome.com FAQ page

From the chart, the mainpoints are as follow:

- Assume that after 5 years, the house increases in value. The rights to receive the profit goes in the following order: Developer (limited to the amount of money they put in), Investors, Homeowners. After Developer takes the share, the rest of the profit is split accordingly between the investor (80%) and the homeowner (20%).

- Assume that after 5 years, the house decreases in value. The burden of loss will go in this order: Homeowner, Investors. The losses will come from the 20% capital by Homeowner, which acts as a cushion for the investors. After that, Investors will start to see losses on their capital.

*I am not sure why the Developer has to chip in 20% as well. Their capital doesn’t help the deal in any way, don’t understand why Developer has the right to take the profit first. Maybe it is to entice Developer to list their project on FundMyHome.com? But that would require Developer to park 20% of the revenue here, which is bad for their cashflow. Why should they do that? Don’t understand. I have contacted the customer service of FundMyHome.com for further clarification. Will update again.

-------

Perspectives of Different Players

Let’s take a look at the deal from different players’ perspectives

1. Homebuyer

Upside:

- I can buy a house right away, even if I am not qualified to get a conventional housing loan from banks.

- During the 5 year period, I do not have to pay any rent/interest at all.

- I can still benefit from the appreciation of the house, albeit very limited.

Downside:

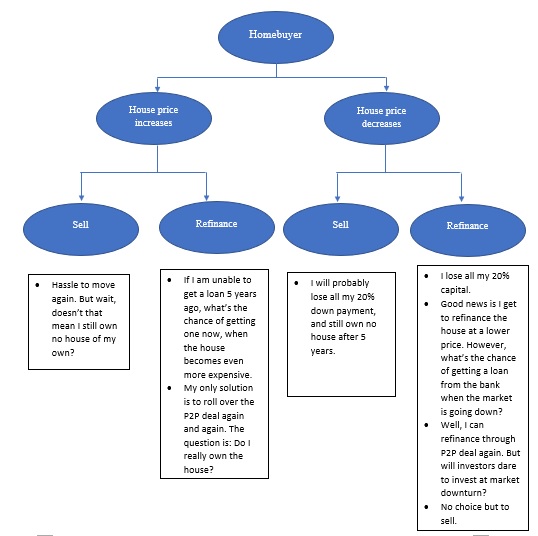

In conclusion, according to how the deal is set up, I personally think that Homebuyers is the party that take the biggest risk out of all. Not only do they receive profit last, they bear the losses first.

If you look at the chart above, you would probably notice that under the 5-year sell or refinance limitation, homebuyers never actually own the house. If you cannot get a loan from the banks, and have to refinance the house through P2P over and over again (you only own 20% of the house), you are just in the illusion that you own the house, but in fact you are in the never-ending rat-race. To add salt to the injury, you are still responsible for the insurance, maintenance fee, agent fee etc for the house. This looks more like Homebuyers subsidizing Investors to own their investment than Investors helping the Homebuyers to own their house.

To be fair, if the Homebuyer makes the deal in his/her 20s, the income will rise faster than housing price, then maybe they are able to refinance the house through the bank at a later date to truly own the house. And don’t forget, Homebuyer gets to stay in the house for free during the 5 years. This 5-year rent-free benefit is irrefutable, though you might never reach the ultimate goal of owning a house. I just want to point out the good and bad of the deal. There is a probability that you’ll reap the benefits short-term, but pay the price long-term. So make your decision wisely.

2. Investors

Upside:

- I get to participate in the potential capital appreciation of the real estate without having to own the house, pay the insurance, maintenance etc.

- I don’t have to spend time managing the investment. The homebuyers and FundMyHome.com will manage the property.

Downside:

- I will only profit from this deal if the house appreciates by more than 20%.

- If the house prices change is between +20% and -20%, I get nothing in return after 5 years. That’s a lot of opportunity cost. If I just put money in FD, I will get around 20% after 5 years.

- If the house price drops by more than 20%, I start to incur losses.

In conclusion, just looking at the reward dynamics, I personally think it is not a good investment. From 1990-2017, Malaysia housing price increase by 6.5% annually on average. Compound that and you get 37% over 5 years. 20% belongs to Developers, and you only get 17%, a CAGR of 3.2% (Lower than some Fixed Deposit).

One interesting to note, the website states that investors will get a guaranteed annual yield of 5%. I suspect that this money will come from the 20% capital set aside by the developer (4 annual payments of 5% each, then exit on the 5th year). This means that developers actually give a discount of 20% upfront that they would re-coup over time. Nevertheless, if this is true, then 3.2% + 5% = 8.2%. That is still a decent return.

3. Developers

Upside:

- I have problems to sell my houses, because banks just don’t want to approve loans. If I list my projects on FundMyHome.com, I get to sell my properties quick.

Downside:

- Limited downside. If there is one, it might be that I have to park 20% of the revenue in a trust fund that I will recoup after 5 years. Since I won’t be able to sell the property anyway, parking 20% of my revenue is still so much better than not getting the revenue in the first place.

4. EdgeProp (FundMyHome.com)

Upside:

- I get to pick what developers to list on my website. This will increase my bargaining power with fellow developers, further strengthening the company’s competitive advantage in the property, finance, tech and media sector.

- I create value by selling houses which were initially very hard to sell. By creating value, I can make some money for sure!

Downside:

- Not much downside. If fail, might tarnish EdgeProp brand if people label the company as fraud. But hey, the platform has a different name, creating some shielding effect for the EdgeProp brand.

5. The Malaysian Economy

Would this P2P solves the affordability issue? Personally, I think yes, but only to an extent. The issue is just the symptoms of a larger problem with our policy and economy, which I will discuss at another day if I have the chance. But to solve this issue, one of 2 things has to happen: House prices drops, or Malaysian income increase.

The way FundMyHome.com set up the deal kind of fulfil the first criteria: dropping the house price. Remember that in the previous section, I mentioned that Developers are required to set aside 20% of price, which I suspected is used to sweeten the deal for Investors so everything can happen. Developers put aside 20%, only to recoup the same amount after 5 years. Take into account the Malaysia’s average inflation rate of 3% a year (you can think of this as time value of money), that represents a >15% discount for houses.

Overall, I think the downside of this scheme is that if Homebuyers Income Growth cannot outpace the Housing Price Increase, Homebuyers will fall into the illusion that they have owned a house, while in fact they are still in the rat race.

In my humble opinion, this solution will help remedy the affordability issue to an extent, but will not be enough to solve the problem to its roots. And if applied at large scale, this solution might give rise to some new systemic risk as well. Only time will tell whether this would cause anything like the 2008 crisis.

Anyway, we should all applaud the brave Malaysians who work hard to solve the problem through innovation. Thank you to the government for being open-minded and willing to try out new solutions. Innovation doesn’t always succeed, but without innovation, we will never succeed as a nation.

----------

Feel free to share this article or share your opinions about P2P housing scheme, but only construstive discussion please. I will keep on updating once I get new information. FundMyHome is just one of the many yet-to-come P2P platforms. Let's see what is coming next.

Discussions

FYI, if all approved, will launch by Q1 2019.

SC to review structure, guidelines for property crowdfunding framework

http://www.thesundaily.my/news/2018/11/05/sc-review-structure-guidelines-property-crowdfunding-framework

I think a lot of ppl hv mistaken it to be another gomen rumah kos rendah. It’s not. The private company involved is The Edge Property Sdn Bhd.

2018-11-06 21:15

I understand, at least initially, the 80% portion will be funded by banks/ institutions. Will this cause systematic risk like in Lehman case?

The answer is No....as there is no gearing, this is not a derivative, the first 20% loss in taken up by the buyers. It is a very safe form of investment for investors. No downside but can participate in the upside.

For the buyer...he can stay there without installments/ rentals.....and can participate in the upside. Whatever money he contribute becomes equity in this house.

2018-11-06 21:44

1). I suspect the initial 20% can be in the form of housing loan as well. As long as Bank and the Institution can sort out ownership agreement, approval of housing loan is likely. Term of the loan however, should not be more than 5 years.

2). The deal is good for a house buyer only under the following conditions :

2a). The house buyer is currently renting. By moving to this, he is essentially on a rent-to-own scheme.

2b). The house buyer is not looking for capital appreciation, but a genuine house owner who would like to own the house after 5 years.

3). For a genuine house owner, you will not care if the price went down.

4). If the price went up at the end of 5 years, going for a bank loan would be easier with 20% paid. Some may argue that at the end of 5 years, if price goes up, house buyer would need to fork out an even bigger amount. Then again owning 20% is better than owning none.

5). If the price went up beyond affordability, sell the 20% stake and move to a cheaper house. The home owner get 5 years free stay and all the money back. How nice.!

The plan is very innovative.

What I feel pathetic about is that our MOF and PM run out of ideas and need to stole the thunder of a Business man. Maybe Tong Kooi Ong should be appointed as Minister of Finance instead.

2018-11-06 21:55

Chonghai,

This is not Gomen project. Private project. Just that now Gomen need not build 1m affordable homes. Private developers will now help out to make the number.

2018-11-06 22:02

2018-11-06 22:07

qqq3

P2P financing not new in Msia. All other existing ones also regulated by SC.

https://www.sc.com.my/digital/list_rmo/

Any idea if they are doing well?

2018-11-06 22:15

chonghai....the businessman is very happy got Budget speech endorsement....

The PH government is very innovative to have a scheme to solve the country problem with excessive unsold units and buyers cannot get loans.

This scheme will help the country to recover.

2018-11-06 22:25

BuahCiku > Nov 6, 2018 10:23 PM | Report Abuse

Aiyo...why why why...beginning it look gook

====================

not true...end of 5 years, buyers will get first option to convert to normal mortgage loan....the 20% contribution becomes his down payment.

2018-11-06 22:28

Just happened in China!

https://money.cnn.com/2018/08/08/news/economy/china-p2p-lending/index.html

2018-11-06 22:57

qqq3 One party will suffer badly under the FundmyHome scheme.

Landlords!!!

2018-11-06 23:12

Too many assumptions what if this and that...talk until so long...only I know if buyer not even dare to commit to buy with 20% loan for his own stay if he qualifies...no point of talking what happen 5 yrs later. I know one day for sure he/she will end up either renting other ppl home for life or sleep on d street.

If d attitude is right, get a roof top 1st then stable down, start doing proper financial planning for the next 5 yrs to come. Otherwise, u will be poor for next of your life.

2018-11-06 23:15

ciku

there is no cure for stupidity, but LGE and PH got cure for the deserving and the hard working......

2018-11-06 23:22

Calvintanend Research highlights

1) 5% profit for Institution or Bank for 5 years mean 25% profit. The is a positive assumption that property prices will rise for the next 5 years

2) LGE latest budget is expansionary. That means that PH Govt will stimulate the economy for growth

3) As such Bank Interest rate has to be status quo or even go lower by Govt mandate?

4) In this case inflation will be the norm for the next 5 years

5) As such keeping to cash as a form of investment is a no no.

As I see it

THE BN Govt favours high ticket project to siphon money. So construction company benefitted then

THE PH Govt is pushing for car(3rd national car) and affordable properties.

So BN is Govt centric

But PH is People centric

Thumbs up!!!

Hip hip hooray!!!

Malay bolih!!!

2018-11-06 23:45

With the new focus on cars and houses by new PH GOVT

ALL BETTER GO INVEST IN REAL ASSET LIKE HOUSES

YAHOOOOOO!!!!

2018-11-06 23:48

Yes, Calvintaneng, u got it so right!

Come la, ride ur bike( bike lane toll free soon) to Msia come invest in Msian properties n cars! Plenty of ready stocks! Sure huat! That’s PH promise to u! ;)

2018-11-07 00:00

Seem like borrow money to those cant get bank loan..

Bank no dare give loan .. but u dare..

U sure gonna rich than bank soon

2018-11-07 00:46

ciku, no cure for stupidity...but PH got innovative cure for the smart and hardworking........5 years no instalment.....means people got spending power...and good for economy.

2018-11-07 01:04

Good morning from Singapore

I think to call FundMyHome in Malaysia a ponzi scheme is not correct.

THIS is an innovation to fund a capital formation idea.

A house is an appreciating asset over a longer term as opposed to owning a car which depreciates once it left the showroom

Example is the 2 storey houses in Lorong Maarof in Bangsar Park my neighbour bought in year 1970 for only rm20, 000. Today prices have gone up to a high of RM1. 8 millions to rm2 millions

Now in Singapore Lower Delta Road a hdb flat 3 room was S$9,000. Today it is $S300, 000

In those days Singapore Govt priced those HDB flats at few thousand Sing dollars. Today Hdb priced them from S$200,000 up. Your don't call Hdb a ponzi scheme as real inflation has propelled prices upward over time.

Of course there are upcycle and down cycle. But over a very long time properties do appreciate in value due to scarcity of land and material in relation to world population growth.

TAKE JALAN MAAROF HOUSE THAT HAVE GONE UP FROM RM20, 000 TO RM2 MILLIONS FOR EXAMPLE AS IT GREW IN VALUE FROM 1970 TILL NOW FOR 48 YEARS. IT WENT THROUGH THE 1985-87 RECESSION WHEN TIN AND RUBBER PRICES COLLAPSED. THE 1997 ASIAN FINANCIAL CRISIS AND THE 2007 SUBPRIME CRISIS.

THROUGH 3 GREAT CRISIS PRICES EMERGED STRONGER AND STRONGER

SINCE PH GOVT TAKES THE INITIATIVE TO

1. HELP DEVELOPERS CLEAR RM22 BILLIONS STOCK AS BANKS ARE NOT LENDING

2. HELP B40 TO BUY ASSETS WHICH ARE CAPITAL FORMING

NOTE: BUYING ASSETS ARE CAPITAL FORMING RATHER THAN CONSUMING LIKE CARS

3. GIVE OPPORTUNITY FOR INVESTING BANKS AND INSTITUTIONS TO MAKE FAIR RETURNS OF 5% YEARLY AND 25% IN 5 YEARS

4. AND AT THE END OF 5TH YEAR WHEN PROPERTIES ARE SOLD FOR A PROFIT THE PH GOVT ALSO STAND TO GAIN BY RPGT OF 5% - 10%

SO ALL STAND TO GAIN

1. THE BUYER. ONLY 20% PURCHASE PRICE TO PAY WITH LOAN IF POSSIBLE. NO NEED TO PAY THE EXTRA 80%. HE COULD STAY OR RENT IT OUT

2. THE INVESTING BANK OR INSTITUTION WHICH WILL REAP A RETURN

3. PH GOVT WILL GET MORE REVENUE FROM TAXES AFTER 5 YEARS

SO THIS HITS 3 BIRDS WITH ONE STONE

THE SINGAPORE GOVT PRIDES ITSELF AS A BUSINESS GOVT. IT ENSURES THAT HDB PRICES ARE MAINTAINED AT ELEVATED LEVEL

SO IS THE PH GOVT GOING ALONG THAT TRAJECTORY?

AND THINK

WHEN YOU SAY MALAYSIAN HOUSES ARE Expensive you must realise that in comparing purchasing power in Singapore, Hong Kong, China and even Japan the wage to asset ratio is still quite affordable

One house in Singapore is ten times the value of Malaysia. One house in Hong Kong is 30 times the price of Malaysia

Wages in Singapore is only 3 times more while in Hong Kong only 4 to 5 times more

If B40 realise the cheapness of Malaysian Assets in contrast to those in Spore, Hong Kong, China or Japan they will invest more into Properties

A Nation can grow wealthy by Capital formation.. Not by consumption

2018-11-07 09:05

in regulated markets, a little bit of luck, lots of guts can make a lot of money and no one will cheat you of your winnings.

in ponzi schemes, they are out to cheat u.....and the police will catch u....

2018-11-07 09:36

SO ALL STAND TO GAIN ?

1. THE BUYER. ONLY 20% PURCHASE PRICE TO PAY WITH LOAN IF POSSIBLE. NO NEED TO PAY THE EXTRA 80%. HE COULD STAY OR RENT IT OUT

You are asking them to borrow from Ah Long?

If they can, they already buying with traditional housing loan right now with so much discount and freebies.

Because they could not get housing loan from bank, you are asking them to get loan from Ah Long now, and in 5 years' time, borrow more money to buy 'appreciated house price' from bank?

This was exactly how subprime loan in US came about.

Pay with bank loan $200k house, 5 years later remortgage with $250k, pocket the difference $50k. Another 5 years later, remortgage with $300k, again pocket $50k.

Then FED raise interest rate, house price came down to $200k.

No money to pay mortgage.

No buyer in the market.

What to do?

Wait for foreclosure lah.

That was the reason you saw so many homeless Americans because they had been chased out by the banks.

2018-11-07 10:36

ks....man are very creative...rationalisation, rationalising stuffs like u do.....go ahead and rationalise all u like.

me? I like it when Malaysia is innovative...I like it when the government puts its reputation on the line with good intentions and with innovative ideas. I like it when the government is serious in tackling the twin problems of unsold stock and of buyers cannot get borrowings.

5 years is a long time....5 years, the properly market should have recovered by then....the buyers can get mortgage loans by then. 5 years, more people can get married and have a home, free of worries over installments.....

cup half full, half empty? all I know is people like this ks, can never get any thing done.

I like positive people, I like innovative people, I like problem solvers, I like people solving problems of the poorer segments........

2018-11-07 11:08

In this instances, CIMB and Maybank have agreed to be the main investors to get this going......good job, PH.....

2018-11-07 11:10

CIMB and Maybank mortgage loans are mostly 4%, this thing gives them 5% and a chance to get capital appreciation when the property improves.

2018-11-07 11:19

Posted by qqq3 > Nov 7, 2018 11:19 AM | Report Abuse

CIMB and Maybank mortgage loans are mostly 4%, this thing gives them 5% and a chance to get capital appreciation when the property improves.

Still living in cave?

That was long ago.

How come fake accountant don't know?

2018-11-07 11:21

I think in 5 years, Malaysian economy will be strong, property market recovered, salaries of owners increased and this is golden opportunity for house buyers and investors.

2018-11-07 11:23

ks...I know for a long long time already....people like your mentality can never get any thing done.........

2018-11-07 11:24

You can't even send your children for overseas education.

You don't even have 100k to trade in KLSE.

What are you trying to tell me??????

2018-11-07 11:26

Ask kcchongnz, he will give you good lesson why OPM will not help you getting rich.

He will tell you at your age, you already failed miserably getting good retirement for 'rotten years' to come.........

2018-11-07 11:29

Alternatively, you can ask sslee how you can buy a BM for your wife by P2P Funding luxury car......

2018-11-07 11:31

ks....I have no problem and very confident....cannot say the same for u, kc chong and that ss guy...they don't have what it takes to make money from stock market......

2018-11-07 11:37

look at so called value investors, kc chong , ss guy and yourself....

this is time for genuine value investors to get excited......but those fake value investors are no where to be found...all probably got buried by the market already......

2018-11-07 11:41

If somebody can fake his qualification, surely he can fake everything under the sun.

Check if you are still keeping your underwear?

2018-11-07 14:18

d by BuahCiku > Nov 7, 2018 01:44 PM | Report Abuse

Aiyo...why why why...qqq3 always against the majority.

===========

I did not design to be against majority...just that the against gang are wrong.........Tong , the guy is good and got future.....he is the guy who exposed 1 MDB and the guy to design this very innovative plan....great future he got......

2018-11-07 15:24

every time some thing innovative sure got idiots against....

but this thing will succeed and the critic will eat crow.

2018-11-07 15:26

P2P fundmyhome lends money to those house buyer who can't get bank loan...

But in the first place, Bank doesn't dare to give loan to those not qualified but u, investor dare to give loan in P2P housing scheme...

U are sure, going to be richer than bank very soon. Hahahahaha

2018-11-07 16:10

pussycats > Nov 7, 2018 04:10 PM | Report Abuse

U are sure, going to be richer than bank very soon. Hahahahaha

================

banks are supposed to be more conservative than I am.....

2018-11-07 21:04

Bn is Govt centric

PH Govt is citizen centric

Bn goes for high infra projects while pH Govt focus on affordable housing

THE risk of Bn is national while the risk to pH is spread out among many individuals

Tun Dr M has proposed rm62 billions for education to help uplift skill and talent for Malaysians

Don't tell me while China, Korea, Japan and Singapore continue to prosper and grow for the next 5 years Malaysians still trail behind?

Better wake up Malaysia!!!

2018-11-07 21:51

this is oxygen for estate agents too....

to me...any innovative idea to help economy is oxygen....

2018-11-07 23:09

FundMyHome could lead to subprime crisis without care, property advisory firm warns

Author: savemalaysia | Publish date: Thu, 8 Nov 2018, 12:23 PM

KUALA LUMPUR, Nov 8 ― The government’s introduction of crowdfunding platforms like FundMyHome as an alternative home financing solution to banks is laudable, property consultancy Knight Frank Malaysia said today.

However, it advised the authorities to be vigilant in checking the profiles of first time home buyers and fund managers to ensure the mortgage crisis that hit the US over too-easy lending does not happen in Malaysia.

"The availability of Property Crowdfunding platforms will make property more accessible for first-time homebuyers who may not easily qualify for bank loans.

“However, there is concern that this may fuel overly lenient lending policies, potentially leading to future subprime situation, a lesson drawn from the United States where homebuyers with inadequate financial capacities were able to secure mortgages,” Knight Frank Malaysia managing director Sarkunan Subramaniam said in a statement.

He urged the Securities Commission especially to be watchful of such crowdfunding platform managers who may be tempted to build up their portfolios too quickly by lending to first-time home buyers with compromised financial credibility as they may not be able to repay their loans later.

Such a scenario could disrupt the property crowdfunding platforms, he added.

“Subsequently, the funds’ portfolios shall be reviewed regularly to ensure that the investors’ investments are secured,” Sarkunan advised.

The crowdfunding platform initiative was announced by Finance Minister Lim Guan Eng during Budget 2019 last Friday and aims to help Malaysians who have been struggling to buy their first property through peer-to-peer money lending.

Prime Minister Tun Dr Mahathir Mohamad launched the first such platform called FundMyHome last Sunday.

2018-11-08 14:00

The upside for the buyer is limited because the buyer only starts sharing the gain with investors at 20:80 when property appreciates beyond 20% based on the sales distribution proceed structure. Based on the current property market trend it seems to be too far fetched. On another hand, the buyer will absorb all losses up to 20% before the investors in the event of depreciation in property value. It also poses high liquidity risk to the buyer. Here's my two cents: https://worldbizweek.com/fundmyhome-property-crowdfunding/

2018-11-16 12:45

good explanation

https://www.thestar.com.my/business/business-news/2018/11/16/crowdfund...

what went wrong is not the product....but misunderstandings and expectations.

history shows a lot of good products can be killed by misunderstandings and wrong expectations.

general public not very smart one........critics not very smart one.

the main point is that this is not a speculative scheme.

2018-11-16 13:23

ho....the buyer can always refinance his house at cost and convert to normal mortgage if the market is weak even after 5 years.....no different if he had taken normal mortgage except now this guy gets free use for 5 years.......

2018-11-16 14:34

qqq3

one caveat....in the early stages , only unsold units from not so hot projects will be listed. Projects selling like hot cakes and second hand homes are not listed....until some one finds a way to make it more lucrative to investors and developers without the 20% retention sum ......

2018-11-06 19:34