High Dividend Stocks (2) Kumpulan Fima Berhad (Kfima)

Siew Jian Bin

Publish date: Mon, 16 Dec 2019, 07:00 PM

Kfima 是一家净现金的公司,每股有超过90仙的现金,以现在RM1.62 的股价,公司一半的股价是现钱。

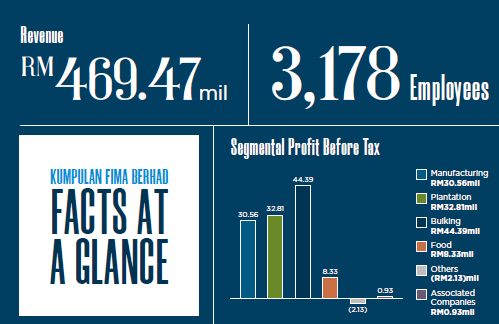

Kfima is a net cash company with more than 90 cents of cash per share. At the current stock price of RM1.62, half of the company's stock price is cash.

Kfima的优点是拥有强劲的现金,而且派息稳定,过去五年多派超过8.5仙。公司业务也多元化,有制造部门,农业部门,液体储存部门还有食物部门。不说可能你不知道,我们用的钞票也是这家公司制造的。

The advantage of Kfima is that it has strong cash and stable dividends, and has paid more than 8.5 cents in each of the past five years. The company's business is also diversified, with manufacturing, agricultural, liquid storage, and food departments. Not to mention you may not know, the banknotes we use are also made by this company.

过去几年,公司因为制造业的业绩下滑和棕油价的低迷导致每股净利下滑。以现在RM1.60 – RM1.65 的股价,PE大概在10-11之间。很多人现在看好棕油价,导致很多棕油股大起,如果你没有在棕油价掉下来之前卖了你的股票,可能你将会住进“总统套房”。Kfima的股价还没有起,所以让我们有一个很好的入场机会。

我个人是一个比较保守的投资者,我喜欢有股息的公司。一家有股息的公司,让我们很清楚的知道公司的账务是没有问题的,而且也看得出管理层非常重视小投资者。虽然有很多的投资者不相信这一套,但是我始终相信一家好公司,在成长的同时也要派息。

这家公司适合那些喜欢稳定股息的人。虽然它不是一家成长股,可是它多元化的业务和持续的发展农业以及食物业,让我投资得安心,睡得安稳!

这家公司如果股价要起,必须要持续发展它的业务。希望管理层能够努力做好这一点,善用公司的钱来发展未来的业务吧!

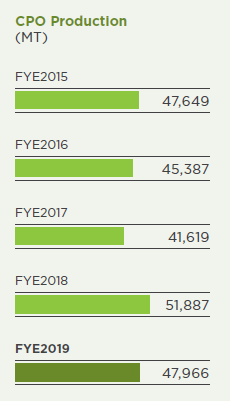

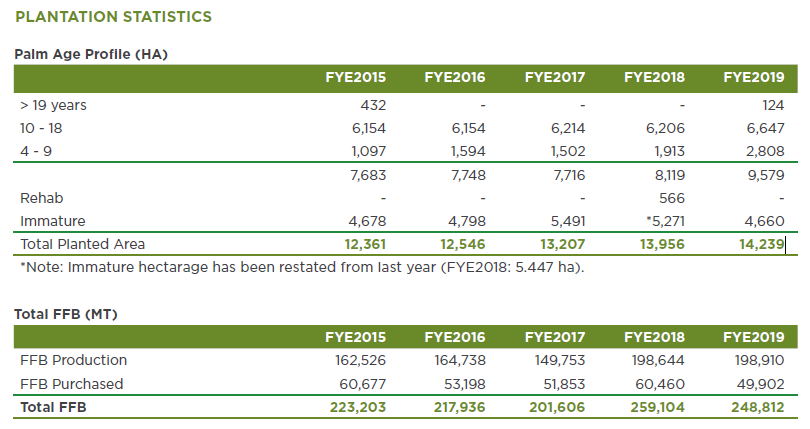

In the past few years, the company's net profit per share has fallen due to the decline in manufacturing performance and the downturn in palm oil prices. With the current stock price of RM1.60 – RM1.65, PE is between 10-11. Many people are optimistic about the price of palm oil, which has caused a lot of palm oil stocks to rise. If you did not sell your stock before the price of palm oil fell, you may live in the "Presidential Suite". Kfima's stock price is not up yet, so it gives a good opportunity for us to enter.

I am a relatively conservative investor, and I like companies with dividends. For a company with dividends, let us know clearly that the company's accounting is not a problem, and we can also see that management treats the small investors well. Although many investors don't believe this, I always believe that a good company must pay dividends as it grows.

This company is for those who like stable dividends. Although it is not a growth stock, its diversified business and continuous development of agriculture and food industry allow me to invest in peace of mind and sleep peacefully!

If the company's stock price is to rise, it must continue to grow its business. I hope the management can work hard to do this and make good use of the company's money to develop future business!

By

SHARE PANDA

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Our Investment Journey

Created by Siew Jian Bin | Nov 29, 2020

Created by Siew Jian Bin | May 10, 2020

Discussions

Fabien "The Efficient Capital Allocater"

This company is prime candidate for privatization. Net cash is more than 50% market cap. Current valuation is at 0.6x of book value.

Used to be darling of Bursa, but performance was greatly affected by loss of business to Datasonic in previous years.

2019-12-16 21:46

Fabien "The Efficient Capital Allocater"

Can treat it as fixed deposits while waiting for potential catalysts to unlock this gem.

You get 9 sen dividend every year. Dividends are well supported by its cash generation ability.

2019-12-16 21:48

Am just look at its fundamental point of view. In term of share price, really hard to predict. So far, hard to see it up although with good dividend and stable business.

2019-12-17 07:50

supersaiyan3

看起來不錯喎!

2019-12-16 20:08