MYCRON STEEL - potential hints?

FutureEyes

Publish date: Sun, 21 May 2017, 03:17 AM

.

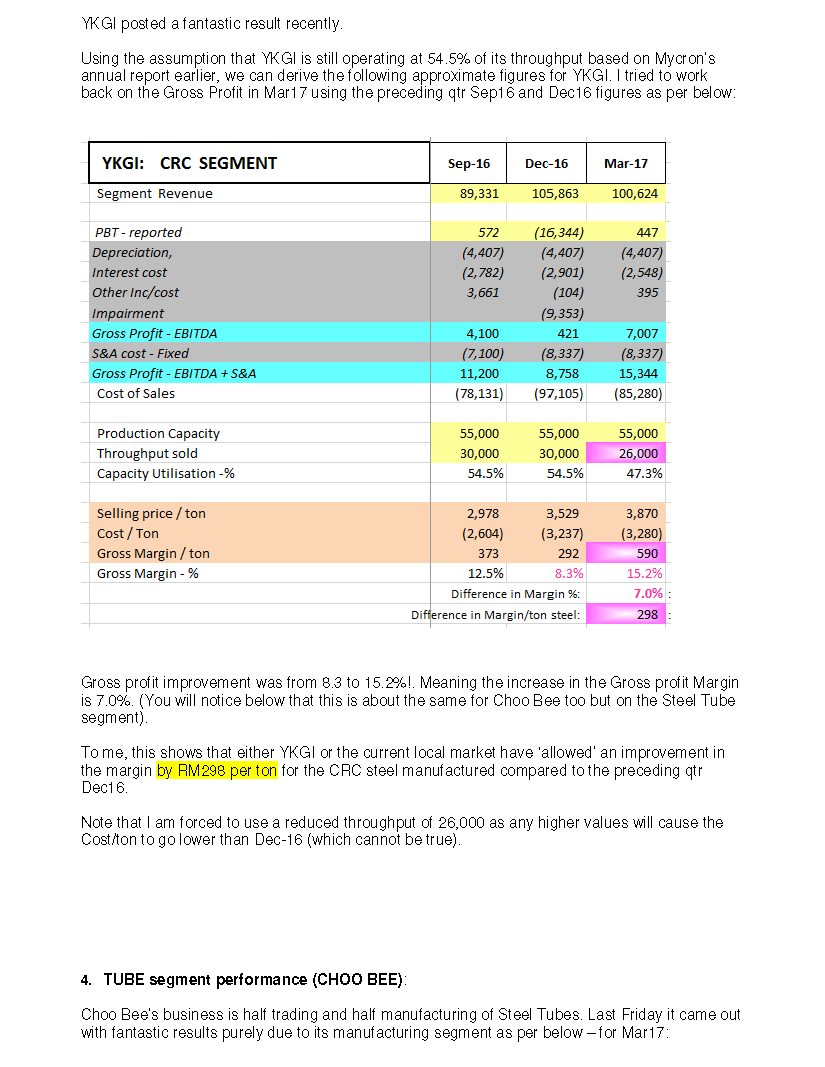

Throughput of Choo Bee is ~ 50% of its capacity = 14,000 ton / qtr, meaning improvement on Margin is about RM400 per ton throughput. Note that I was forced to use a reduced throughput sold as higher figures will cause the Selling price compared to preceding qtr Dec16 not in line with news below:

http://www.klsescreener.com/v2/news/view/223985

“This, said UOB Kay Hian, was mainly on account of the 30% improvement in its manufacturing division's average selling price, which was up by 30.4% to RM3,000 per tonne in 1Q17 from RM2,300 in 4Q16.”

"Choo Bee expects its manufacturing division's growth to moderate in 2017 to a high single digit," the stockbroking firm said.

Note that Mycron’s Steel Tube products are of a different class suitable for International API petrochemicals standards. Refer Mycron and Choo Bee tube catalogs here:

http://www.melewar-mig.com/pdf/product-catalog-2014-web.pdf

http://www.choobee.com.my/html/pipetube.htm

Thus, it makes more sense for them to potentially explore foreign market as reported here even more than Choo Bee’s potential:

http://www.theedgemarkets.com/article/mycron-actively-considering-us-uk-export-markets

“In the previous days when Megasteel was still around, we had to buy all our raw materials from Megasteel. It was very expensive, making us uncompetitive when it comes to exporting.

“Since they have stopped operations, we can now begin to consider exporting pipes as we can purchase HRC at competitive prices and hence sell at competitive prices,” he said following Mycron and Melewar Industrial Group Bhd’s annual general meeting yesterday. Melewar is the holding company of Mycron. He said the company is also looking to export CRC”

http://www.klsescreener.com/v2/news/view/81555

“According to Tan, Megasteel will normally charge RM400 to RM500 premium per tonne for HRC over international prices. Raw materials are Choo Bee’s biggest cost, which accounts for about 85% of the group’s operating expenses.

As of now, the group has started to source 80% of its raw materals from other Asian countries since Megasteel, the country’s sole HRC maker, has stopped production. This may in turn help Choo Bee resume its export business to the US and Australia after the third quarter this year, according to Tan.”

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Hard Datas

Created by FutureEyes | Aug 10, 2018

Created by FutureEyes | Aug 04, 2018

Discussions

Additional capacity, room for growth:

15,000 ton/qtr X RM700/ton = 10.5 Million additional gross profit potential!

2017-05-21 13:38

I see that this analysis is purely based on Mean reversion with very realistic gross margins. Who knows what is the true margin potential of CRC makers?

Guess they have not had a chance to show their true colors.

2017-05-21 13:57

YKGI cannot survive if their gross margin does not improve further.

I think this itself shows the margin has only one direction...up.

2017-05-21 14:07

I cannot move the price like Icon after the posting on Lion Industries, but who knows I may at least hit the EPS 6.7 like Icon predicted for Lion.

2017-05-21 14:32

Looking at its Tube segment performance, i think its highly possible.

This is what we call as Margin of Safety.

2017-05-21 15:07

FutureEyes, you could have used throughput of 19,500 (for Dec16) and 15,500 (for Mar17) for Choo Bee tube segment. This way, the selling prices would be exactly like reported UOB Kay Hian.

The gross margins would be 500 and 850 for Dec16 and Mar17 respectively. But, in any case their difference is still considerable = RM350 instead of RM417!

Thus, Mycron's tube segment can definitely improve as per your assumption of RM100/ton.

2017-05-21 19:15

The figures for Mycron are very accurate. I wanted Choo Bee's gross margin for Dec16 to be somewhat closer to Mycron's tube segment and thus used 18,000.

But you are right I could have used the figures you had mentioned.

2017-05-21 19:40

So many steel stock to buy, which one the best?

Annjoo, Ssteel, lion?

Mycron, choobee?

Prestar? Ays? Leonfb?

2017-05-21 21:07

I like this article very much

Nobody can tell whether the author's prediction can come true

But the way he analyse and interprete the data adds a lot of value to the understanding of the stocks

I always like analysis that based on figures rather than just propaganda, empty slogan and shoving things down people throat (Calvin)

Excellent work

2017-05-22 06:53

totally agreed - Calvin is a pasar malam salesman..

Posted by Icon8888 > May 22, 2017 06:53 AM | Report Abuse

I like this article very much

Nobody can tell whether the author's prediction can come true

But the way he analyse and interprete the data adds a lot of value to the understanding of the stocks

I always like analysis that based on figures rather than just propaganda, empty slogan and shoving things down people throat (Calvin)

Excellent work

2017-05-22 19:01

all others depends on the future trend of selling price and the time lag effects on the cost of raw material / inventory...the margin direction is uncertain.

for Mycron, the gross margin has to expand - there is only one clear direction.

2017-05-24 19:34

probability

lots of information here...guess Mycron's Tube sales still have 50% room to grow!

2017-05-21 13:31