What Petron Corp results means for PETRONM Q2, 21 cents?

FutureEyes

Publish date: Mon, 14 Aug 2017, 02:19 PM

What Petron Corp results for Q2 2017 announce on 8th Aug could mean for PetronM?

There are two ways of predicting results, either by looking into (1) the causes such as crack spread, throughput, sales volume, timing of purchase, assumptions on closing Brent price, utilization losses, etc, the variables are endless, OR

just by (2) directly seeing the effects, the results itself by deduction via exclusions.

Some PetronM forum members know how accurately did Sumato88 predicted EPS of PetronM for Q1 purely using the second method:

Refer link below:

https://klse.i3investor.com/blogs/sumato88/122720.jsp

My approach here is via the second method:

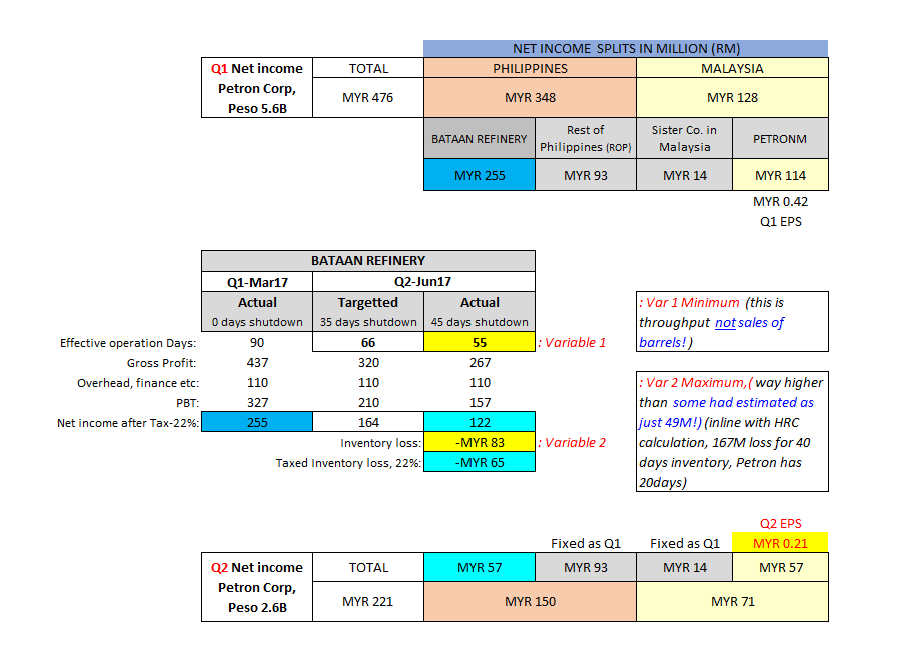

To summarize Sumato88 findings, I had made the first quarter earnings split as per below where Petron Malaysia Sister co. is expected to be generating a Net income of RM 14M/qtr:

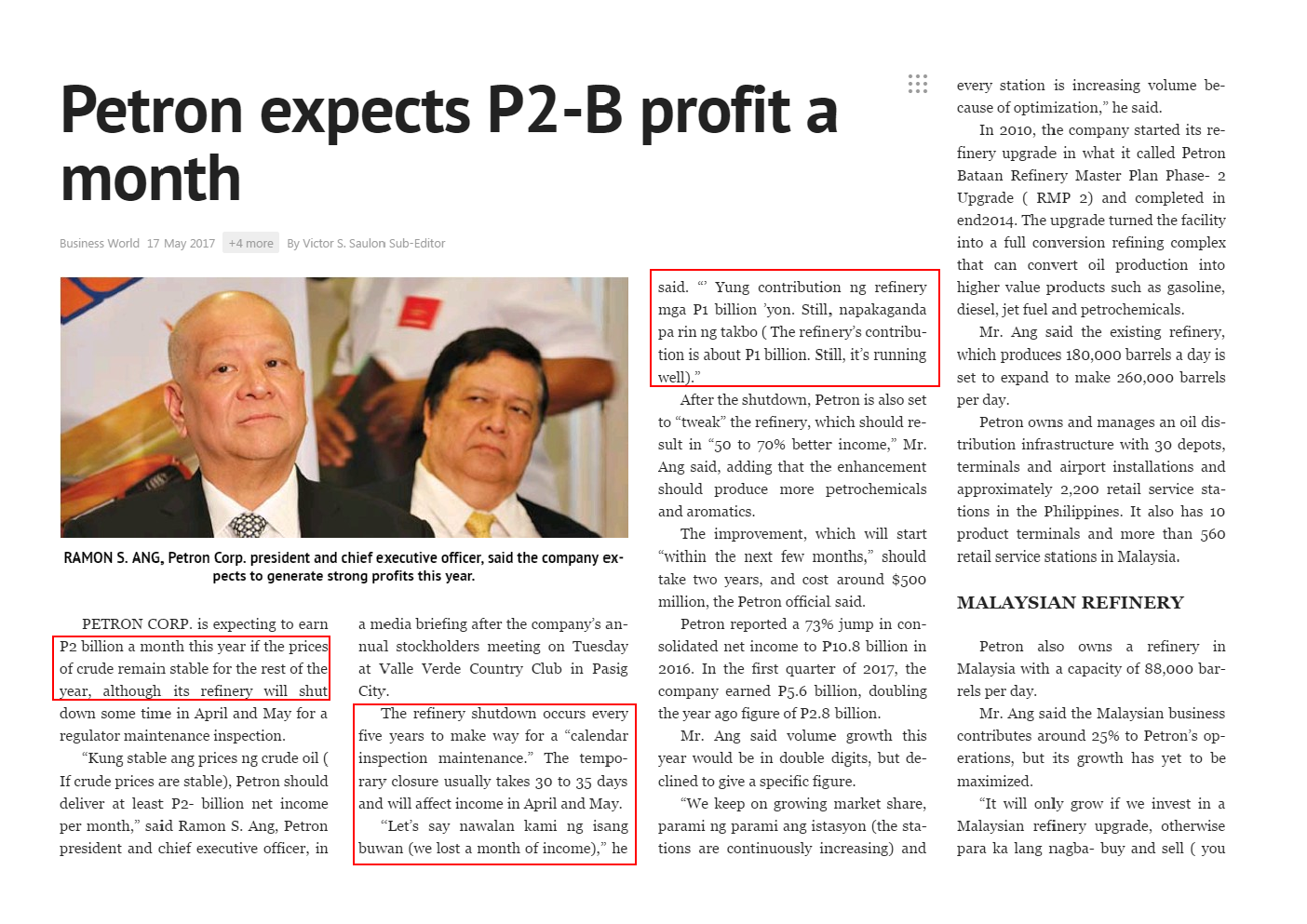

No one including myself knew exactly the split between Bataan refinery and the Rest of Philippines (ROP) operations contributions. However, this changed when I saw the news article below:

https://www.pressreader.com/philippines/business-world/20170517/281569470656950

“Let’s say nawalan kami ng isang buwan (we lost a month of income),” he said. “’Yungcontribution ng refinery mga P1 billion ’yon. Still, napakaganda pa rin ng takbo (The refinery’s contribution is about P1 billion. Still, it’s running well).”

CEO Mr. Ang had even given the forecasted drop in net income of 1 Billion Peso for the estimated shutdown period of 30 – 35 days. This immediately gave me a hint on what is the expected Net income of the refinery per quarter.

1B peso / month x 3 months/qtr x 0.085 RM/peso = RM 255M / qtr (Bataan Refinery).

Since we have 255M as the generated Net income from Bataan Refinery, the Rest of the contributions from Philippines (ROP) must be RM 93M for Q1.

With the Net Income available, the PBT is worked back with their tax rate of 22% and subsequently the Gross Profit by adding a reasonable sum of Overhead, Finance and other expenses of 110M closely matching HRC. Note that the calculated Gross Profit of 437M for 90 days operations exactly matches the rated capacity of 180k bpd at ~80% utilization at refining margin of ~8 USD/brl just like it was for HRC.

Now with Foundation of basis laid out above, to predict what would be PetronM Net Income for Q2, all we need to see how much is the reduction in the Net income of Bataan Refinery in Q2 due to:

(1) shutdown of 45 days, i.e the effective Operation in days (variable 1), and

(2) Inventory losses just like I had estimated for HRC earlier (variable 2)

It would be reasonable to assume that Rest of Philippines operation (ROP) and PetronM sister company in Malaysia’s net income is fairly unchanged from Q1 to Q2.

Once we have estimated Net income for Bataan Refinery for Q2, we just need to deduct the total Petron Corp earnings for Q2 of 221M (reported on 8Th August) by the Rest of the Philippines Operations (ROP), Petron Malaysia Sister company in Malaysia, and the estimated Net income from Bataan refinery to derive PetronM earnings for Q2.

The lower the derived Net Income for Bataan Refinery for Q2, the higher the EPS for PetronM for Q2. As such, all considerations are made to minimize the forecasted Bataan refinery earnings for Q2 by reducing the effective operation days (Var 1 minimized) and maximizing the Inventory losses (Var 2 maximized).

Variable 1 (Effective Operating days), Minimum derivation:

Petron Corp had reported 45 days shutdown for Bataan refinery on their Q2 report.

In my opinion, in line with other bloggers thoughts and forumers comments, the effective Operating days are calculated as per below assuming at least 30% of the throughput are taking place during shutdown:

Targeted shutdown of 35 days:

= 55 days full operation + 30% x 35 days shutdown (effective)

= 66 days effective operation per qtr

Actual shutdown of 45 days:

= 45 days full operation + 30% x 45 days shutdown (effective)

= 59 days effective operation per qtr

If one compares the expected 255M Net income with the 164M derived with 35 days shutdown i.e 66 days effective operation on table above, it exactly matches Mr. Ang prediction of 1B peso loss on Net Income.

For the actual effective operation, I had used 55 days as a practical minimum value possible to allow PetronM to have higher forecasted earnings for Q2.

Important note: Note that, by right the earnings of Bataan refinery should never be linked to its reduction in throughput, as what counts is the barrels sold and not the barrels processed. They could have easily sourced it from their own inventories and other refineries.

The Sales volume of barrels reported for Q2 against Q1 for Petron Corp has barely changed suggesting the max shutdown impact on their Bataan refinery Sales volume in barrels is only 25 days = (45 days shutdown – 20 days inventory) even by assuming the outsourced refined products sold had zero contribution to its profits.

Meaning instead of 55 days effective operation used, we should have used 65 days instead!

Variable 2 (Inventory losses), Maximum derivation:

As shown for the Inventory loss calculation for Hengyuan of 40 days which came to 167M, Using 20 days inventory volume for Bataan refinery of similar size and considering the estimated Crude price drop between the reporting period similar to HRC, the losses would be half of HRC (167M), at 83 Million.

The lesser the inventory loss we assume here the lesser the PetronM's EPS for Q2. Thus, it was my intention to show the maximum possible inventory loss for Bataan Refinery.

Based on these above inputs the EPS derived for PETRONM in Q2 seems to be at the level 21 cents.

(Unlike my article on HRC earlier, the uncertainty on the EPS estimation of PetronM is higher simply because even small variation on the net income of Bataan refinery can have significant effects on PetronM numbers. Readers are advised to create their own excel sheet similar to the table above, and feel free to use any figures they think reasonable on the variables as per their own understanding and comfort. The errors could only be on the variables nothing else. This is only to give a feel on the expected earnings of PetronM. I had tried my level best to minimize variables 1 and maximize variable 2 in order to derive the maximum earnings for PetronM above. i3 member inputs are welcomed to further enhance the prediction)

Now, one may ask what happened to cause the earnings of PetronM to drop so much from previous qtr?

A plausible explanation is that it incurred a huge inventory loss for PetronM Port Dickson refinery itself as it is expected for HRC and a higher cost of refined products purchased externally (outsourced) due to Bataan refinery shutdown.

More articles on Hard Datas

Created by FutureEyes | Aug 10, 2018

Created by FutureEyes | Aug 04, 2018

Discussions

U think Rm 0.21 and not rm 0.35 meh ??

Raider senior analyst told raider should be good with EPS rm 0.35 woh......!!

This senior analyst very panlai mah...!!

2017-08-14 14:35

if result is better, are you going to compensate ppl?

Give your hp, home address, office address etc here.

2017-08-14 14:35

paper,

don ask people to compensate mah....!!

They just forecast only mah....!!

just an opinion only loh....!!

2017-08-14 14:37

Posted by calvintaneng > Aug 14, 2017 02:36 PM | Report Abuse

3iii is correct!

Smart Raider already made 300%. All smart holders dumped to foolish sorchai Jonn Lu.

RAIDER COMMENT ;

NOT TRUE LOH....RAIDER BELIEVE IN LONG TERM MAH...!!

2017-08-14 14:39

market (including yourself and myself) may not really care on its worth as much as it does on the qtrly EPS

2017-08-14 15:09

Where is the retailer portion of the calculation when it only mention about the operating days of refineries and inventory losses? Is that taken into factor? Thank you

2017-08-14 15:53

Who is FutureEyes? He is a nobody to me and why should I trust his analysis? Haha. I think i3 should come up with a system to allow readers to rate the quality of article that a member uploads here. The only person that I know of that is trustable in this forum is paperplane, jay and sosfinance to me. The others are half pail of water if you get what I mean.

2017-08-14 17:18

Our FutureEyes came out with two bearish articles after both refiner stocks corrected substantially. Agenda motivated?

2017-08-14 17:19

Low class writeup hehehe, no where to compare the quality with david's estimation.

It's simply rubbish, no value at all..........lol

2017-08-14 18:19

Another quick way of seeing the impact on Bataan Refinery Earnings is this way:

1 Billion peso loss = 85M for shut down of 30 days as per Ang.

45 days shutdown impact via proportional estimate:

= (45/30) x (85 M)

= 127.5 M reduction in Bataan Refinery profit

Thus 90 days (1 QTR), is equivalent 255M Bataan refinery profit generation.

By putting the above figures on Q1 Earnings split , ROP is derived to be 93M.

For 2nd qtr Bataan refinery profit without inventory losses becomes = 127.5M

Taking the max possible inventory losses of 83M (after tax of 65M), the minimum possible Bataan refinery profit for Q2 becomes:

= 127.5 – 65

= 62.5M

Thus PetronM net Profit for Q2 max :

= Total Profit of Petron Corp – Bataan Refinery profit – ROP profit – PetronM sister co profit

= 221M – 62.5m – 93M – 14M

= 51.5M (EPS of 17 cents only)

The above derived EPS of 21 cents is higher because I had intentionally reduced the effective operation to 55 days instead of 59 days expected.

2017-08-14 18:55

FutureEyes's writing is damn boring and lack of good thnking skills.

Written by hopeless people.

2017-08-14 19:26

I am hoping for someone to challenge my derivations above.

Optimism is good, but not to the point of becoming blind.

some even want to close their eyes intentionally.

2017-08-14 21:04

I believe futureeyes is somebody's clone account. guess who? somebody tipped me.

2017-08-14 21:34

Hi Sohai. FYI, Petron latest quarter EPS 33 cents. Are you using bangla calculator?

2017-08-24 17:19

This is why i3 should come out with a mechanism to filter out kindergarten grade low quality articles like what is written by FutureEyes

2017-08-24 17:20

FutureEyes

Market will take time to digest this information.

The earlier one can go through and understand, the better.

2017-08-14 14:31