Q3 EPS: HENGYUAN 130 cents, PETRONM 30 cents

FutureEyes

Publish date: Sat, 11 Nov 2017, 09:03 PM

Exactly 3 months ago, I had written an article to predict Hengyuan’s Q2 EPS, refer below:

http://klse.i3investor.com/blogs/Insight1/129795.jsp

The actual reported earning was somewhat close, though the basis used to predict did not exactly tally with some information mentioned in HY Q2 financial report. Thus, I had made an amendment to my current derivation on Q3 EPS accordingly. The change is purely on the inventory valuation where according to my judgement they are hedging about 50% of its value. This way, my estimation would be way more conservative too as I am basically reducing the gains by half for Q3.

I am writing this article again to continuously educate i3 member to have an idea of how the refinery business works, so that they can appreciate HY's full potential valuation, while not getting spooked (deterred) by its short-term volatility by simply patiently seeing the inventory effects on longer-term (6 months). This way perhaps we could have avoided the dip on price we saw after Q2 results on 28 August where 11 Million shares changed hand from poorly informed investors to the intelligent ones.

This article on its EPS prediction is something the writer does for fun and as such do not place in all your eggs on these baskets (or remove, or transfer your eggs) simply because the article suggests so – always use your own judgements.

Now let the fun part of numbers begin..

For any refinery, there are two independent factors that contribute to its quarterly earnings, one is the Refining Margin (1) and the other is the Inventory gain/loss (2) due to crude oil price changes between the reporting period.

Earnings factor (1): the refining margin

This is called the profit due to CCS Margin.

(A) CCS Profit = Refining Throughput, T (Barrels/day) x No. of days in operation (Days) x Refining CCS Margin (USD/Brl) x Exchange rate (RM/USD)

Using a realistic estimate of the expected Q3 average refining margin of 10USD/brl, HRC CCS profit is as per below:

= 112k bpd x 90 days x 10 USD/brl x 4.2 RM/USD

= 423 M

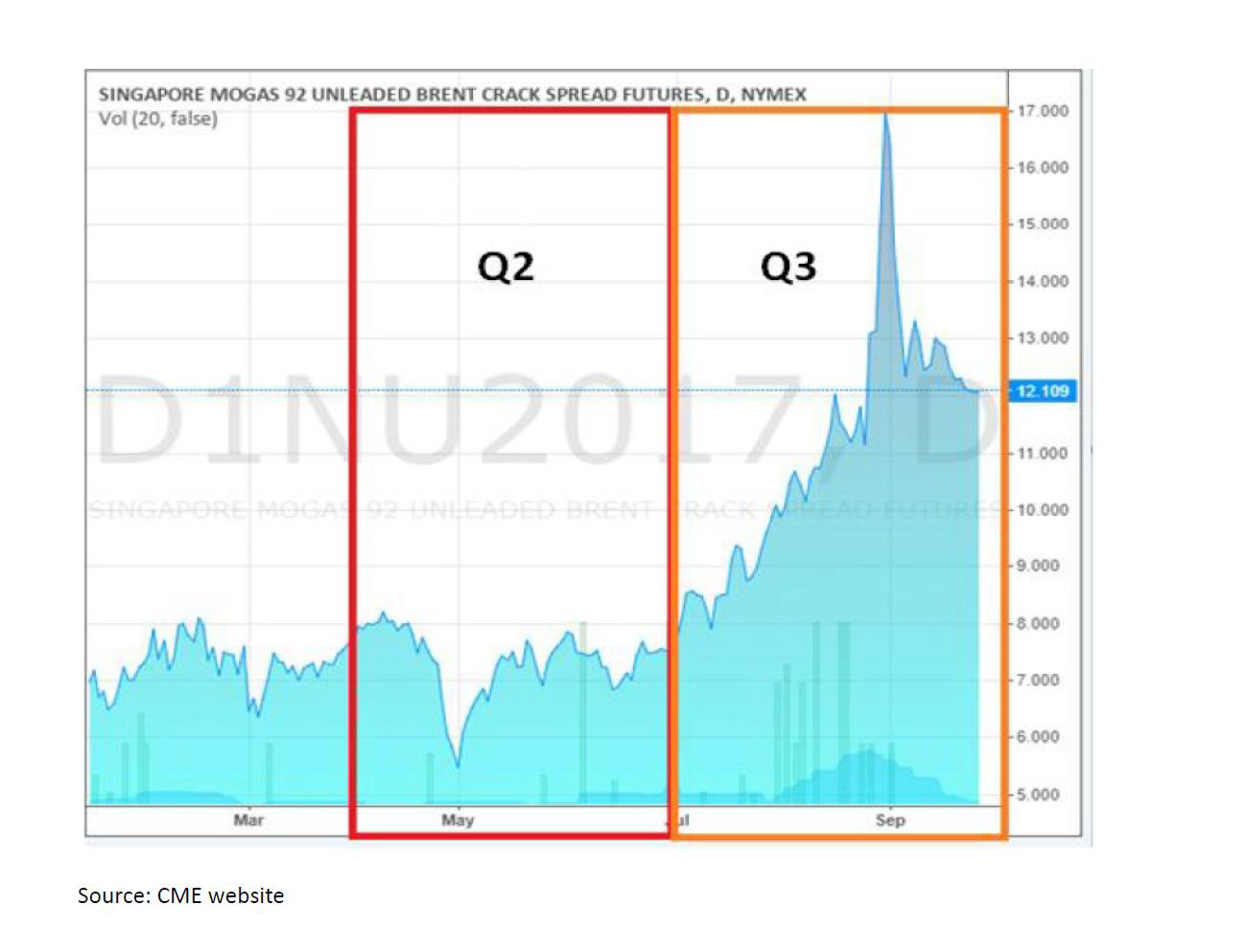

One can refer to the below chart on the 10USD/brl justifcation:

Note that, I am unable to show the crack spread for Gasoil (Diesel) which combined with Gasoline (Petrol) yields more than 95% of HY refined products, however the 10USD/brl average I am using is rather conservative considering some of the peak in crack spread caused by Hurricane Harvey and consistently higher than 11USD/brl crack spread on certain months during this qtr for Diesel.

Earnings factor (2): Inventory gain / loss,

This is simply the valuation of their Inventory (consisting of both product and feed crude) as per the market valuation at end of the reporting period.

The oil price used by the company during the reporting period is quite dependent on the date they chose as a reference, we may only use the Brent closing price on the last week of the month as an approximate indicator.

As such taking a conservative approach, I estimate that Brent price of ~ 56 USD/brl to represent ending value for Sept17 and 47 USD/brl to represent starting value as of end June17. The difference is 9 USD/brl.

Due to 50% hedging on its inventory assumption, we only consider 50% of the inventory affected by the Brent price change. Thus, 4700 barrels inventory (used originally as per my article 3 months ago) is now reduced by half to 2350 barrels.

(B) The inventory Gain = Ending Value of inventory (Sept 17) – Starting Value of Inventory (Jun 17)

Starting Value of Inventory (June17) = Inventory (barrels) x Starting Price of Brent (USD/barrel)

= 2350k barrels x USD 47/brl

= 110M

Ending Value of Inventory (Sept17) = Inventory (barrels) x Ending Price of Brent (USD/barrel)

= 2350k barrels x USD 56/brl

= 131M

Thus, the inventory gain is

= 131M – 110M

= 21M USD

= 88M RM

The Total Effect, Is the FIFO profit which will be the reported Gross profit is simply the addition of the CCS Profit with Inventory gain/loss.

Refineries divide the FIFO profit by the barrels processed to obtain FIFO refining margins.

Thus, the FIFO Profit (GROSS PROFIT):

= CCS Profit + Stock gain/loss

= 423M + 88 M

= 511 M

Taking Hengyuan's Sales & Admin overhead costs, Other expenses and Finance costs which comes to approximately 120M, the Net profit would be:

= 511M – 120M

= 391 M (this results with a staggering EPS of 130 cents for Q3 2017 for HENGYUAN assuming no tax as per previous qtr).

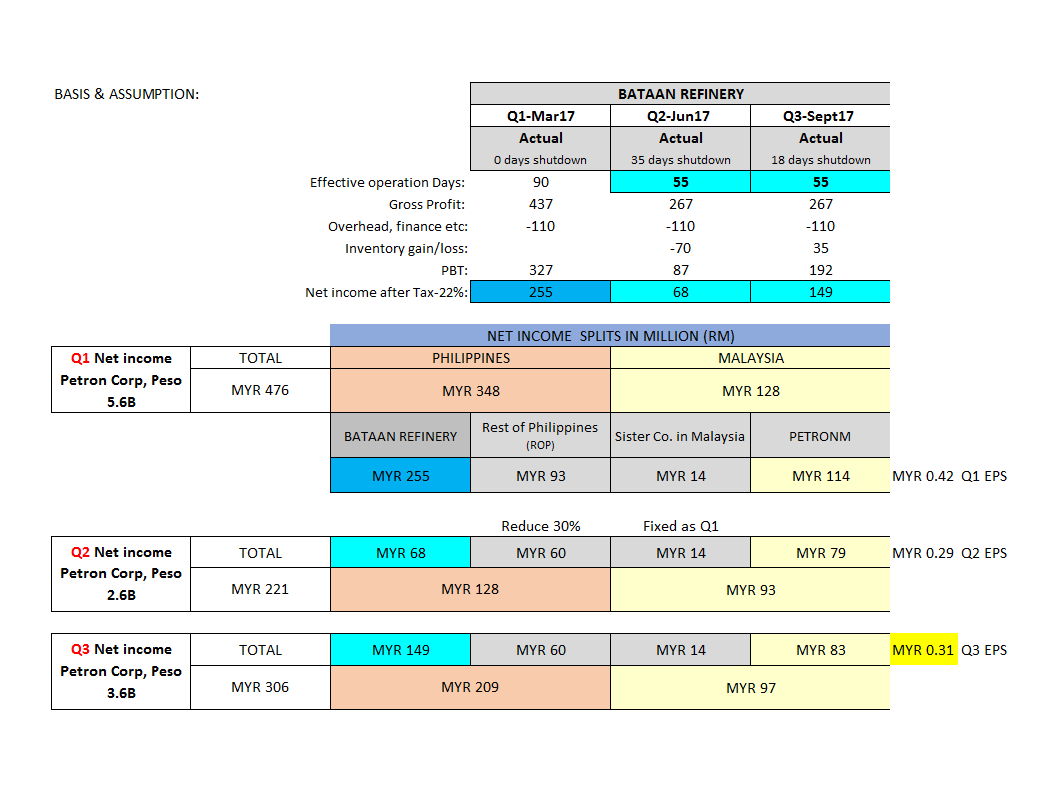

Unlike HY, for PETRONM, i am unable to find a good derivation method for my prediction. I had based on the exclusion method presented on the Table below (which is self-explanatory using some basis on Bataan refinery shutdown conservatively).

The table basically expresses the fact that in all-likelihood PetronM is unlikely to deliver a spectacular EPS inline with Hengyuan (say exceeding 50 cents) as some may be expecting (market expectations). However, its current price of ~ RM 13 is still cheap for a recurring quarterly EPS of 30 cents. This is probably due to interruption on PetronM supplies (outsourcing) caused by the shutdown of Bataan refinery which had carried over to Q3.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Hard Datas

Created by FutureEyes | Aug 10, 2018

Created by FutureEyes | Aug 04, 2018

Discussions

SEE U TALK PEOPLE GREAT CHINAMAN GRANDFATHER FOR WHAT LEH ??

ASK ALREADY CAN MAH...NO NEED TO INSULT PEOPLE 9 GENERATION LOH..!!

Posted by cheoky > Nov 12, 2017 12:30 PM | Report Abuse

u work for the shangdong chinaman? so geng. hedging also captured....

2017-11-12 13:29

unbelievable EPS or thoroughness?

Thought he gave an indicative work based on closing and starting crude price...plus indicative refining margin..kikiki

Posted by cheoky > Nov 12, 2017 01:25 PM | Report Abuse

haiz i tak taruh lo. i impress with author estimation to the extend unbelievable thoroughness. full stop. you cont your accumulation on hrc. good luck

2017-11-12 13:31

If EPS really 130 sen publish early like Pet Dag. Can out this week no need delay.

2017-11-12 13:46

VERY WRONG SHORT TERM THINKING MAH....!!

RESULT ANNOUNCEMENT BASED ON DIRECTOR AVAILABILITY MAH....AFTER BOARD MTG THEN ANNOUNCE LOH....!!

SO THEY ALREADY PRE BOOKED THE MTG DATES LOH...!!

U MEAN LIKE PUDU MKT VEGE AHFAH MEH, IF VEGE PRICE VERY GOOD, QUICKLY OPEN STALL EARLY AT 4.00AM INSTEAD OF 5.30 AM MEH !!

Posted by ks55_ > Nov 12, 2017 01:47 PM | Report Abuse

If Q3 QR good why dare not out early like Pet Dag?

2017-11-12 13:57

I actually scare when future eye is not a naysayer anymore.... Can ur valuation be more conservative? Say 13 sen only will help a lot to balance a bit. I dun want so fast stage 4.

Also, u discounted possible shutdowns, unplanned inefficiencies, awesome hrc forex skill (see q²).

2017-11-12 14:05

Alex, its more of a game of how close he can get to the bulls eye ma...its not about conservative EPS to justify evaluation...i guess

how if the inventory gain is for the whole stock of 1.2B?

how if they operate at a higher throughput?

how if they manage to hedge the crack spread at higher value than 10?

2017-11-12 14:09

Haha... See... Forecast too high... 130sen one quarter how to belief~ now ppl say u cheat d

Better be conservative... And let hrc result speaks for itself.

Alex tp 30 sen beat qoq yoy

2017-11-12 14:11

haha probability sifu...u know la...later all so optimistic RM1.30 eps, and come out 30sen? how? gap down kau kau...aiyoyo....

2017-11-12 16:41

If people become optimistic with its actually EPS also...do you think it can get to a level where they are optimistic on its PRICE?

if it quickly hit paperplane sexy babe target..next week...then we can say market became optimistic lor..kikiki

2017-11-12 16:45

lol....if want hit paper bro tp, need to limit up tmr. Cannot lar, must be realistic....

1 day up 10 sen ok? if rollar coaster my heart also cannot take =D

2017-11-12 16:49

sometimes I don't understand those people who keep bashing this stock. If you don't really like, you should stay at the stock you invest.

I mean the problem of these people is negativity, the community will only prosper if we spread positive energy ma

2017-11-12 16:57

This KS55 really.

Stay away if you already sell ur share at RM8 last week.

HRC plans to reduce borrowings till nil, before setting up a dividend policy. Just patient ?

2017-11-12 17:04

Who push up HRC why cannot declare to Bursa? ASB sold must declare why those buying must hide?

2017-11-12 17:06

si stockraider i respect you but you too emotion in hrc. you should disconnect from hrc for like 2 days. that should be ok for your wealth and wellbeing. let me correct myself regarding author article view. I admire author thought thoroughness in covering all aspect of refinery's parameters just as per q2 estimation. i keep asking hedging previously. this author also provided. u disconnect pls. two days will do.

2017-11-12 17:46

futureeye, i am awaiting your write up for HRC for so long.

Finally it is out. It is matching my assumption.

Good work!

2017-11-12 23:17

Just a thought experiment. Not saying your assumptions are wrong but an experiment. The assumption of 130 cents EPS rest on 10 variables, which 7 out of 10 are macro factors. To build in the uncertainty of reality, assume all variables are off by 5%. So what is suppose to 'benefit' will adjust downward by 5% and likewise revise upward 5% for any cost.

So:

A) 106k bpd x 85 days x 9.5 USD/brl x 4 RM/USD = 342 mil

B) 47.6% hedging x 4700K = 2237k x USD 49/brl = 109 mil (Starting)

2237k barrels x USD 53/brl = 119 mil (Ending)

Gain = 10 mil x 4 RM/USD = 40 mil

342 mil + 40 mil = 382 mil - 126 mil (SGA) = 256 mil or 0.85 cents

So a mere 5% swing on all the variables is enough to swing EPS by 35%

2017-11-13 07:20

5% swing is a lot for all variable.. >.<

Nvm..

Even at 85 cent, this share is worth RM15, easy lo.. so undervalue.

2017-11-13 08:56

Given the unpredictable nature of macro factors, you want to be roughly right not precisely wrong. And it is common even for analyst to miss actual EPS by 10-30% +/-

Again this underlie a huge misassumption. EPS of a quarter has little to do with value, hence it rarely changes the fundamental valuation of a company. If share price does change, it has more has to do with market sentiment that true fundamental, disagree as you like. It is not that hard to test this hypothesis. That is why I can never fathom why someone would enjoy estimating EPS, throw in a multiple, 10x just to make it convenient, and assume the market will agree with him. And worse, when the actual EPS came out and confirmed his prediction and the share price followed, he started to think he is skilful. I think this misconception of fundamental is worse than the estimation of EPS, which itself is a futile exercise to begin with.

2017-11-13 09:15

If i were to follow Graham's advice, he said not to emphasize so much for the future, but to buy for what it is today. His thesis is that the future is uncertain and earning forecast is often a miss. HRC provides attractive price entry (if you want Graham's 22.5 law), with improving fundamental like crude oil price and favorable crack spread, and guaranteed sales, and sustainability post euro4m.

2017-11-13 09:56

NOT TRUE LOH...SHARE PRICE IS DRIVEN BY BOTH SENTIMENT AND FUNDAMENTAL LOH....IF BOTH TANGO...IN WHICH HENGYUAN WILL...CAN BE VERY VERY POWERFUL LOH...!!

osted by Ricky Yeo > Nov 13, 2017 09:15 AM | Report Abuse

Given the unpredictable nature of macro factors, you want to be roughly right not precisely wrong. And it is common even for analyst to miss actual EPS by 10-30% +/-

Again this underlie a huge misassumption. EPS of a quarter has little to do with value, hence it rarely changes the fundamental valuation of a company. If share price does change, it has more has to do with market sentiment that true fundamental, disagree as you like. It is not that hard to test this hypothesis. That is why I can never fathom why someone would enjoy estimating EPS, throw in a multiple, 10x just to make it convenient, and assume the market will agree with him. And worse, when the actual EPS came out and confirmed his prediction and the share price followed, he started to think he is skilful. I think this misconception of fundamental is worse than the estimation of EPS, which itself is a futile exercise to begin with.

2017-11-13 12:45

The true margin on refining maybe much lower than the simple crack spread would suggest.

2017-11-13 17:39

I thought warren buffet advice to be roughly right & no need precise loh....!!

Question pose if 3iii has been proven so wrong many time...do u think his comment got credibility;

Posted by stockraider > Nov 13, 2017 05:38 PM | Report Abuse X

Just be wary of dishonest 3iii loh...!!

He has cheated simplesoul monies loh...!!

He call people to sell hengyuan when Rm 3.60...now Rm 10.60 a staggering losses loh...!!

2017-11-13 17:44

Nobody care about CIT.....so much fun enjoying the rally. It seems that grace period has been ended and going to reflect in this QR announcement. HY was probably enjoying balance of unabsorbed tax losses RM 1.1 billion in year 2014. Anyway, PER is not that high after taken into account CIT. lol

JayC Why no tax?

11/11/2017 22:53

2017-11-13 19:19

Ricky Yeo Given the unpredictable nature of macro factors, you want to be roughly right not precisely wrong. And it is common even for analyst to miss actual EPS by 10-30% +/-

Again this underlie a huge misassumption. EPS of a quarter has little to do with value, hence it rarely changes the fundamental valuation of a company. If share price does change, it has more has to do with market sentiment that true fundamental, disagree as you like. It is not that hard to test this hypothesis. That is why I can never fathom why someone would enjoy estimating EPS, throw in a multiple, 10x just to make it convenient, and assume the market will agree with him. And worse, when the actual EPS came out and confirmed his prediction and the share price followed, he started to think he is skilful. I think this misconception of fundamental is worse than the estimation of EPS, which itself is a futile exercise to begin with.

13/11/2017 09:15

Dont forget last round. Everyone predict heavenly result, show red.

This time, probability for good result is higher. Later, higher maintenance cost, give you see red. All die again.

2017-11-13 21:03

Oil refineries produce value-added petroleum products from crude oil. Profitability is thus determined by several different variables:

- Feedstock costs (primarily crude oil)

- Fuel costs and other operational costs for the refinery itself

- Costs of complying with emissions regulations (particularly NOx)

- Market prices for the products produced.

2017-11-13 21:08

A useful but simplified measure of refinery profitability is the “crack spread.” The crack spread is the difference in the sales price of the refined product (gasoline and fuel oil distillates) and the price of crude oil.

2017-11-13 21:10

The crack spread is the easiest measure people have to measure future profit. But it is the least precise.

Before someone say you only need to be roughly right and not precisely wrong.

Remember this, you have no out. The only way hengyuan will go up, if it beats last quarter and last year by a fantastic amount. If it show even flat earning. Sure drop.

Business wise, hengyuan i still ok, but not that cheap anymore.

2017-11-13 21:12

The crack spread tends to be sensitive to the slate of products produced from the refinery. Gasoline and distillate fuel oil (heating oil) are two typically high-valued products, and refineries are generally engineered to maximize production of gasoline and fuel oil.

The crack spread is also sensitive to the selection of the oil price used. There are systematic differences in the prices of heavy crude oils versus fairly light crude oil. Due to these differences, the crack spread calculation (while illustrative) may not be sensible for a particular refinery.

2017-11-13 21:13

The true margin on refining maybe much lower than the simple crack spread would suggest.

Thus, we soon realise the promoters got their estimated profits of Hengyuan so wrong in Q2.

Is analysisng Hengyuan within their circle of competence?

More hypes and hot airs, than real substance are the many posts on the various price levels that Hengyuan may reach! ;-)

2017-11-13 21:15

VERY STUPID COMMENT MAH....!!

LAST YR CRACK MARGIN USD 5.5 BPD

GROSS MARGIN LAST YR = 9.7%

UPTO JUNE 2017 6 MTHS

CRACK MARGIN USD 6.5 BPD

GROSS MARGIN 30-6-2017 = 11.7%

RELATED MAH....THE HIGHER THE CRACK MARGIN SPREAD THE HIGHER THE GROSS MARGIN OF HENGYUAN LOH...!!

WHAT TYPE OF RUBBISH THIS 3iii TALKING LEH ??

Posted by 3iii > Nov 13, 2017 09:15 PM | Report Abuse

The true margin on refining maybe much lower than the simple crack spread would suggest.

Thus, we soon realise the promoters got their estimated profits of Hengyuan so wrong in Q2.

Is analysisng Hengyuan within their circle of competence?

More hypes and hot airs, than real substance are the many posts on the various price levels that Hengyuan may reach! ;-)

2017-11-13 22:28

Posted by probability > Nov 16, 2017 01:56 PM | Report Abuse X

Study the data presented here carefully, you will never find a generous man sharing & spoon feeding such information in i3.

You will notice that Q3 average Gross refining margin 30 to 40% higher than Q1 (for Brent (Cracking) and Dubai (Cracking) - which is of slightly higher complexity than Simple refiners like Petron who does Hydroskimming).

This will result with Net refining Margin exploding by more than 50% relative to Q1 (minimum)!

Posted by probability > Nov 15, 2017 10:00 PM | Report Abuse X

https://www.iea.org/media/omrreports/MHM.xls

Refer: 50/50 HLS/LLS (Cracking)

Jul-17: 10.48

Aug-17: 13.37

Sep-17: 14.38

2017-11-16 14:04

Q3 has 2 days extra compared to Q1, that means about 3% higher throughput in theory.

2017-11-18 20:18

cheoky

haiz i tak taruh lo. i impress with author estimation to the extend unbelievable thoroughness. full stop. you cont your accumulation on hrc. good luck

2017-11-12 13:25