DIFFERENCE between PETRONM and HENGYUAN

FutureEyes

Publish date: Thu, 22 Feb 2018, 07:20 PM

I WOULD LIKE TO PRESENT THIS ARTICLE AGAIN IN i3 to ensure investors understand the difference between PetronM and Hengyuan (apologies for reposting and taking space of i3 blogs again).

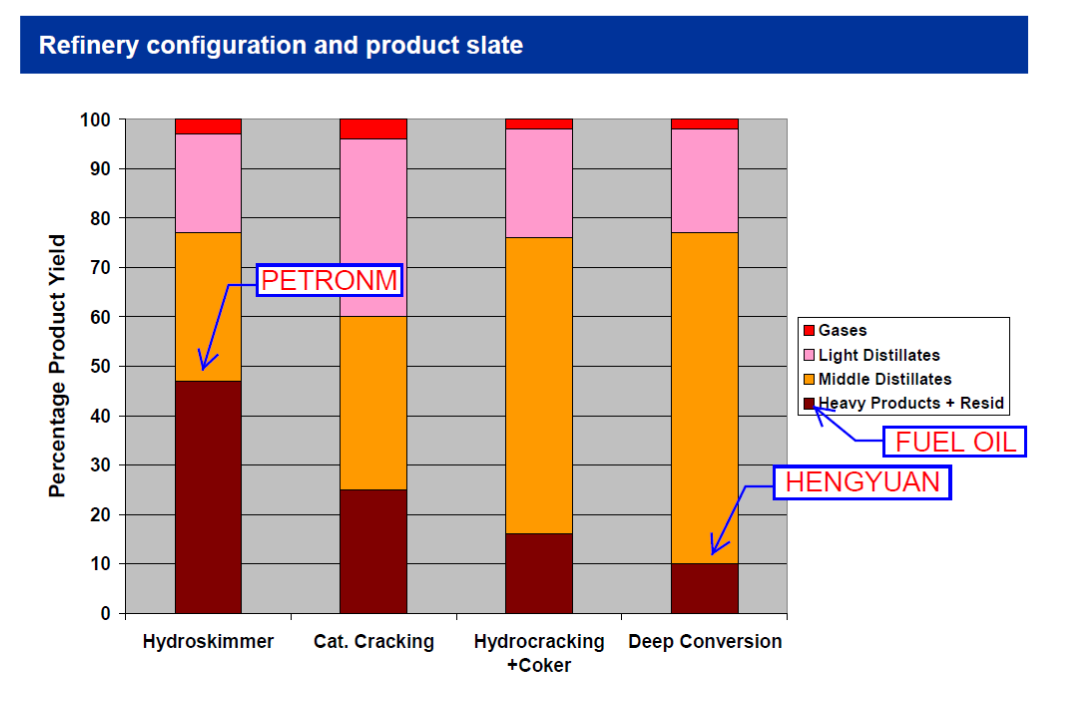

By now, many of i3 members are probably aware that Petron Malaysia is a Simple Refinery unlike Hengyuan a Complex refinery equipped with a Catalytic Cracker to convert Fuel Oil to a much more valuable product Diesel.

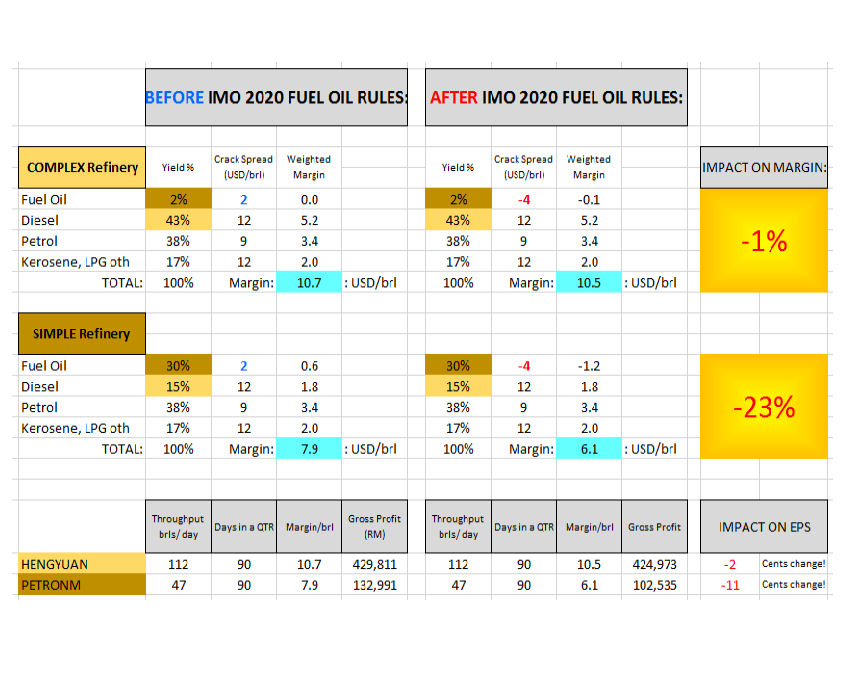

Their typical product yield are as presented on below table where Simple Refiners produce approximately 30% Fuel Oil and almost all of them are converted to Diesel by Hengyuan.

The Table summarizes the implication of Fuel Oil Crack spread at negative 4USD/brl, i.e selling below Crude Oil price for both Complex refinery like Hengyuan and Simple Refinery like PetronM as recently reported.

In Q4 2017, Fuel Oil margins became low (-4 USD/brl) from a positive value of 2 USD/brl and Diesel Margins were much better in Q4 2017 than Q3 2017 at above 12 USD/brl.

Refer the recent news on Fuel Oil crack spread implications mainly in Europe who still use Simple Refining technology:

We can easily see the Gross Margin of PetronM drops significantly versus Hengyuan which had barely changed.

PetronM is a Simple Refiner and Hengyuan a Deep Converter.

PetronM does not have the ability to convert Fuel Oil extracted from the Crude Oil to Diesel unlike what Complex Refinery does with a Catalytic Cracker - refer their plant specifications below:

http://abarrelfull.wikidot.com/esso-port-dickson-refinery

http://abarrelfull.wikidot.com/shell-port-dickson-refinery

Catalytic Crackers are absolutely necessary to convert Fuel Oil to Diesel. Refer typical yields of Simple Refiner and Complex refiner via charts below – Page 6

https://www.energyinst.org/_uploads/documents/session-4-refining-notes-2012.pdf

From Page 6 of the article and knowing Hengyuan only produces 2% Fuel, Hengyuan refinery falls under Deep Conversion and since PetronM does not even have a Catalytic Cracker it falls under Hydroskimmer category.

Since recent dip in crack spread has more to do with Fuel Oil affecting Simple Refiners, it is precisely the reason for PetronM gross margin reduction.

Refer the recent news on Fuel Oil crack spread implications mainly in Europe who still use Simple Refining technology:

Thus, the volatilty in Earnings is in fact higher in PetronM as it is the Fuel Oil Margins which is highly vulnerable now, not the Diesel which in fact stands to benefit from Q4 2017 Diesel Crack Spread observation and the IMO 2020 implementation in future.

Further to that, please note that WTI crude was significantly cheaper than Brent in Q4 2017 (averaging 6USD/brl) and that it can be effectively utilized by Complex refinery like Hengyuan. Many Chinese refineries including Malaysian had started sourcing this Crude Oil from U.S in replace of Brent due to the following reasons:

COLUMN-U.S. crude oil exports to Asia soar, complicating OPEC's efforts: Russell

https://www.reuters.com/article/column-russell-crude-asia-idAFL3N1NJ17M

"Imports from Malaysia are up 500 percent, those from Britain by 95 percent and from the Republic of Congo by 459 percent."

COLUMN-Forties pipeline outage is a gift to U.S. oil exporters, others: Russell

https://www.reuters.com/article/column-russell-crude-asia/column-forties-pipeline-outage-is-a-gift-to-u-s-oil-exporters-others-russell-idUSL3N1OC1YP

This widened the premium of front-month Brent over WTI CL-LCO1=R to $6.74 a barrel, up from $4.76 as recently as Nov. 24. The spread is closing in on the $7.07 touched in September when Hurricane Harvey knocked out U.S. Gulf Coast refineries, temporarily cutting crude demand.

The blowout of the Brent-WTI spread in September saw a flood of U.S. crude head toward Asia, with vessel-tracking data showing that top global crude buyer China imported a record 293,000 bpd in November.

Please refer the price difference between Brent and WTI for Q4 2017 as per below:

https://ycharts.com/indicators/brent_wti_spread

If Hengyuan's smart management did capture this precious opportunity in Q4 2017, the overall gross refining margin would easily increase by 40% compared to Q3 2017!!

That would have mind boggling implication on its Q4 2017 EPS of HENGYUAN.

Way above any analysts would be able to predict! Refer below article:

Thai energy giant PTT FY profit up 43 percent at $4.3 bln, beats analyst estimates:

https://af.reuters.com/article/africaTech/idAFL4N1Q61BP

With the above, i am extremely optimistic on Hengyuan future of refining. It will definitely continue to deliver performance above current expectation at current price level.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Hard Datas

Created by FutureEyes | Aug 10, 2018

Created by FutureEyes | Aug 04, 2018

Discussions

you better read my comment carefully!!!!

Posted by deMusangking > Feb 22, 2018 10:13 PM | Report Abuse

to u bicycle is better than a motor car?

ur analogy is really 'out of the road'; ur analysis is simplistic at best! just show ur lack of analytical prowess to discuss!!

kekekekekekke

Posted by Halite > Feb 22, 2018 10:07 PM | Report Abuse X

who doesn't know motorcycle can run faster than bicycle ?

but

how about other things that will help you to arrive at a right decision of which transportation to use?

why motorcycle is better than bicycle ?

why bicycle with the combination of other alternatives can be better than motorcycle ?

2018-02-22 22:17

Totaly agree,with halite.. speculator quickily come out to give this kind of comparison to minimise,the,sell down of hrc tomorow due,to the efect of petronm

2018-02-22 22:20

just mark GEneral Raider words....tomorrow Petron going up...not down loh.....!!

Posted by trulyinvest > Feb 22, 2018 10:20 PM | Report Abuse

Totaly agree,with halite.. speculator quickily come out to give this kind of comparison to minimise,the,sell down of hrc tomorow due,to the efect of petronm

2018-02-22 22:21

is this your definition of long term and short term

has Nestle anything to do with Hengyuan ?

based on what logic you compare hengyuan with Nestle , Just PE of Ahmah and ah Chong .

why not Ahmad with Ali

ah chong with Ah seng ?

Posted by stockraider > Feb 22, 2018 10:15 PM | Report Abuse

Below is a proper analysis of short term & longterm loh;

Short term

NESTLE PE 42x v Hengyuan PE 4x loh....!!

Longterm;

Nestle PE 25x v Hengyuan pe 12x loh....!!

agree, this is a fair comment for short term , not for long term

no one will stop you promoting hengyuan

but,if you are sharing misleading information or making not appropriate comparison , the the story is different

Posted by stockraider > Feb 22, 2018 10:05 PM | Report Abuse

Promotion bcos hengyuan is undervalue loh....!!

Hengyuan PE 4x, Petdag PE 8x, Petdag PE 16x, China Petroleum PE 11.7x, Phillip PE 22x, Petron Pe 8x, Nestle PE 42x.

HENGYUAN is a world champion stock eps Rm 3.40 exceed NESTLE Rm 2.75 mah...!!

2018-02-22 22:22

Agree.

we want both Petronm and Hengyuan going up tomorrow

Posted by stockraider > Feb 22, 2018 10:21 PM | Report Abuse

just mark GEneral Raider words....tomorrow Petron going up...not down loh.....!!

2018-02-22 22:24

If u think this article is misleading please provide ur own analysis and fact to support ur words and not just talk cock over here. Lol

2018-02-22 22:24

are you forcing me to agree with you

Posted by deMusangking > Feb 22, 2018 10:21 PM | Report Abuse

Halite, consistency is the key word only if profits are high!!! what for having consistency with low profits!!! maybe u dont study statistics!!!

from ur analysis, i can deduce u dont have the analtyical mind to make comparison!

2018-02-22 22:26

Petronm result is not fantastic.. it lacks,d wow factor... so no positive surprise to chase high.. no makor sell down is consider lucky.. div anounced is,oredi discounted as previous year oso anounced dividen.. extra 3 sen dividen for a rm12 stock is not tat atractive.. unless the extra 30 or 50 sen dividen

2018-02-22 22:26

In Malaysia , the 3 largest petrol retailing business are Shell Petrol Retailing , Petronas Dagangan and Petron . Why compare Petron with Hengyuan instead of Petron with PetDag ? Petron 's 3 year eps from 2015 to 2017 were 82 sen, 90sen and 150 sen which are superbed . Petronas Dagangan eps for 2015 was 79.5 sen , 95 sen and 127 sen ( 3 qtrs ) .

Petronm share price is half of Petronas Dagangan although the eps were quite close .

2018-02-22 22:27

did you read the reasons I had given earlier

do not make me think that you blind or purposely refuse to understand any reason I had already given to say the article is misleading !

Posted by Whey Whey > Feb 22, 2018 10:24 PM | Report Abuse

If u think this article is misleading please provide ur own analysis and fact to support ur words and not just talk cock over here. Lol

2018-02-22 22:28

What kind of reason is that that without figure or fact support etc? U only complaining without any fact to support ur words.

2018-02-22 22:30

Petronm is still undervalued, there is still a growth in 2017.

I agreed Hengyuan is better than Petronm based on facts and figures especially EPS and PER.

How many stock in KLSE has a PER < 5, net profit > 1 billion RM and EPS > 3.50.

Please quote one and compare.

2018-02-22 22:30

General raider would love to compare Petron with Petdag but ....petdag no refinery loh....!!

2018-02-22 22:30

any wow factor for petdag now selling at RM25.5 ?

Posted by trulyinvest > Feb 22, 2018 10:26 PM | Report Abuse

Petronm result is not fantastic.. it lacks,d wow factor... so no positive surprise to chase high.. no makor sell down is consider lucky.. div anounced is,oredi discounted as previous year oso anounced dividen.. extra 3 sen dividen for a rm12 stock is not tat atractive.. unless the extra 30 or 50 sen dividen

2018-02-22 22:32

Cannot compare petron with petdag... one is petronas one is filipino.. no reason to explain tat.. tis is malaysia

2018-02-22 22:33

No,wow factor for petdag oso.. no need to argue,tat bcos petdag is,owned by petronas.. tis is,malaysia

2018-02-22 22:34

I feel this question sounds very pandai

I think WB also can give you a satisfactory answer

Posted by deMusangking > Feb 22, 2018 10:31 PM | Report Abuse

u STRESS that Hengyuan is doing refinery alone , nothing else. but petronm has refinery , petrol stations, petrochemical and land asset

yes, i believe u... but y is that EPS for Hengyuan is better ?

2018-02-22 22:35

I ask u to provide the fact and figures and u can't even give one. What u doing here is just keep arguing with everyone like tin kosong.

2018-02-22 22:36

Same,thing like lctitan with pchem.. y pchem can,fetch a higher pe than lctitan? Same thing.. no need to explain.. pchem is owned by petronas.. tis us malaysia

2018-02-22 22:38

Posted by Halite > Feb 22, 2018 10:38 PM | Report Abuse X

you are right

but petdag is selling at RM 25

and Petronm has both refinery and retailing but selling at RM12

do you see something shining here ?

Posted by stockraider > Feb 22, 2018 10:30 PM | Report Abuse

General raider would love to compare Petron with Petdag but ....petdag no refinery loh....!!

2018-02-22 22:39

FutureEyes did a good job to predict the earning very accurately for both Hengyuan and Petronm.

It is not fair to attack him.

I have my fullest respect on him.

2018-02-22 22:41

please read in Contonese

CHOY-NIE-DOU-GONG

Please read in Mandarin

睬你都傻

Posted by Whey Whey > Feb 22, 2018 10:36 PM | Report Abuse

I ask u to provide the fact and figures and u can't even give one. What u doing here is just keep arguing with everyone like tin kosong.

2018-02-22 22:44

this is the proof that you are very interested

Posted by deMusangking > Feb 22, 2018 10:42 PM | Report Abuse

Halite , iif u cant furnish ur argument with facts and fiqures as trulyinvest has said, i think no body will be interested in ur arguments!!! a longkang cleaner can also do that!

2018-02-22 22:45

Posted by Halite > Feb 22, 2018 09:51 PM | Report Abuse X

very misleading article

why ?

1. the is a comparison of a complex refinery and a simple refinery, not Petronm and Hengyuan

2. you should compare hengyuan with another company which business model is the same, that is refinery alone

3. Hengyuan is doing refinery alone , nothing else. but petronm has refinery , petrol stations, petrochemical and land asset

4. only emphasize on the efficiency of complex refinery over the simple refinery ,how about volatility of crude oil and other risks factors that affect the profit margin are not touched at all. so it is very unfair and biased.

conclusion:

very irresponsible and misleading article

2018-02-22 22:46

you know better, i am not zhuge_liang

Posted by deMusangking > Feb 22, 2018 10:47 PM | Report Abuse

Halite,would u say Zhuge_Liang's view is biased since he likes the article?

2018-02-22 22:49

Haha cannot win an argument so don't dare to even answer me anymore. Seriously just a idiot ROFL

2018-02-22 22:50

Posted by Halite > Feb 22, 2018 10:51 PM | Report Abuse X

the auntie stay next door of me also had predicted the 4 ekor first prize correctly last week

do you want to follow her to buy more

Posted by Zhuge_Liang > Feb 22, 2018 10:41 PM | Report Abuse

FutureEyes did a good job to predict the earning very accurately for both Hengyuan and Petronm.

It is not fair to attack him.

I have my fullest respect on him.

2018-02-22 22:52

Please la halite aka aseng aka xuewen and many more ur other clone id name. Just because u sold ur Hengyuan already so now attacking HY now? Hahaha

2018-02-22 22:52

I wish I can reply all the comment you post

but some comments are so pandai , I need time to think to give a good reply

SABAR (patient)

2018-02-22 22:56

INFORMATIVE ABOUT A COMPLEX REFINERY COMPARE WITH A SIMPLE REFINERY .

PLEASE CORRET THE TITLE

IT IS VERY MISLEADING

2018-02-22 23:07

You should call him XUEWEN now hahaha

deMusangking

1299 posts

Posted by deMusangking > Feb 22, 2018 11:08 PM | Report Abuse

Halite, remember many moons ago, i said u never use ur head but use only ur mouth to talk? and u always said u have to refer to ur sifu!!???? so i need to be sabar!!! and i understand y i have to saber!

hahahahahaha

2018-02-22 23:10

let's stop sharing misleading information.

I am not new to Hengyuan and Petronm

when I was talking about Hengyuan and Petronm with my good friends Stockraider and Probability , many of you including future eye still no where to be found

2018-02-22 23:11

other than personal attacks, there are still many ways we can communicate better.

2018-02-22 23:14

if do not feel what you are saying is despicable, then i do not think there are people who can help you to talk better

2018-02-22 23:16

yes, good night

finally you do it right

if not I scare both of us can't sleep well tonight

2018-02-22 23:26

haha, thanks Whey Whey, this joker xuewen is talking rubbish again, better watch out this joker, he always talk big but prove nothing.

Whey Whey Please la halite aka aseng aka xuewen and many more ur other clone id name. Just because u sold ur Hengyuan already so now attacking HY now? Hahaha

22/02/2018 22:52

2018-02-22 23:40

This xuewen can one day talked very positive & the next day talked very bad on the same counter, quite a heavy mentally ill.

2018-02-22 23:47

Halite is right, Hengyuan is a god damn cyclical but Petronm is sustainable long-term growth stock.

2018-02-23 00:26

Which company in bursa can pay you 25 cents dividend at the selling price of RM12, consistently better and better every year

If this can't make the FM slivating, then what else can be more appealing to them.

Do not miss the most important point, shares trading is a supply demand game. You and me can't move the market. EPS also can't move the market. But the big fund can. I believe the 25 cents dividend declared by petronm will make many big funds slivating.

2018-02-23 01:05

PRICE action on opening bell after QR holds the trump card.

Very few money manager knows how to read QR accurately, only the hot foreign funds do.

WHY? Because they have the capacity to read the future into the next 1 to 2 QR down the road for the BIZ.

Many at times, the good CFO could be well advised to hide some profits for next QR, if they have plan for the growth stock to continue flying up n up. This is usually done after looking into the bearing pts of its financial mountain i.e. stock chart. It's silly to waste the financial nuclear bomb for nothing in return!

Tomorrow at OPEN we shall all know:

GAP UP n stays, it must

GAP down, chia.lat

23/02/2018 04:22

In the last 20 years, the fact of the :

DIFFERENCE is:

HENGYUAN was always double in price to PETRONM.

The only time it didn't, was some1 murndered it financially n then sold at 1.80 at fire-sale n quickly fly by nite !

2018-02-23 04:46

PureBULL . > Feb 23, 2018 03:44 PM | Report Abuse X

Dear kennyyap1962,

U asked the toughest Q.

Allow me to attempt to provide a good A.

PE Ratio for PLC is pretty similar to a good biz with products n services that have PRICING POWER. I hope U can follow me at that pic.

i. Good cos with products n services in high demand can raise prices n yet consumers continue to buy n support them yr after yr. That's Pricing Power.

ii. In the case of PLC, great FA growth stocks with high PE r in reality, having a magical Pricing Power that is even greater than in product pricing.

Bnl, CFO or CEO who came from top Ivy League Biz Schools must be super expert in this wonderful n most simple topic to the fastest way of wealth creation.

Ex. That simply explained why AMZN can command a PER of 324X today n still counting, making the owner the fastest richest man on earth.

https://finance.google.com/finance?q=amzn&ei=SL2PWommKpGaeraZoaAH

All growth stocks r cyclical. To win BIG, we want to position ourselves financially at the right time in its growing yr/s.

A good ex is how TOPGLOV is capable of raising PE 15 to now > 35 over the yrs.

The owner was my close neighbour at TGCR.

This Tan Sri is nice n easy to deal with n yet extremely humble n very very sharp n a super smart man.

He is expert in IR i.e. small money must go out then billions will come in n stay.

1st thing 1st is abt how to charm the investing community to always BUY the stock.

This Tan Sri n wife will be at the entrance welcoming all fund managers, analysts n some high-networth individuals to his Fund Manager n Analysts Conference. He did it so well in classy Hilton Hotel KL like he's getting married at least 4 times a yr every yr.

He will provide earnings guidance with transparency n visibility.

Most importantly, while all r enjoying the food, he's seen gg tables to tables talking to all till the very end.

HENGYUAN has lots of BIG potential n I sincerely hope the mgmt team is proactive to embark on this journey, 1 step at a time!

Then only we can talk abt high PE starting from 10, ok.

GOOD LUCK to all HENGYUAN stock holders..

2018-02-23 16:03

hahaha, 1 thing is same between hengyuan and petronm, if hengyuan cant exceed eps 120 this coming quarter, prepare for another deep dive like petronm

2018-02-23 16:50

What's mind blogging is despite the known fact that no one can consistently predict quarterly EPS, this doesn't prevent investors from continuing to predict them. Overconfidence in the domain of investing is hard to get rid of.

2018-02-28 09:35

stockraider

Below is a proper analysis of short term & longterm loh;

Short term

NESTLE PE 42x v Hengyuan PE 4x loh....!!

Longterm;

Nestle PE 25x v Hengyuan pe 12x loh....!!

agree, this is a fair comment for short term , not for long term

no one will stop you promoting hengyuan

but,if you are sharing misleading information or making not appropriate comparison , the the story is different

Posted by stockraider > Feb 22, 2018 10:05 PM | Report Abuse

Promotion bcos hengyuan is undervalue loh....!!

Hengyuan PE 4x, Petdag PE 8x, Petdag PE 16x, China Petroleum PE 11.7x, Phillip PE 22x, Petron Pe 8x, Nestle PE 42x.

HENGYUAN is a world champion stock eps Rm 3.40 exceed NESTLE Rm 2.75 mah...!!

2018-02-22 22:15