LIONIND – The massive 900,000 ton Hot Briquetted Iron (HBI) Plant 100% EXPORT at PE = 1

FutureEyes

Publish date: Sat, 04 Aug 2018, 12:09 PM

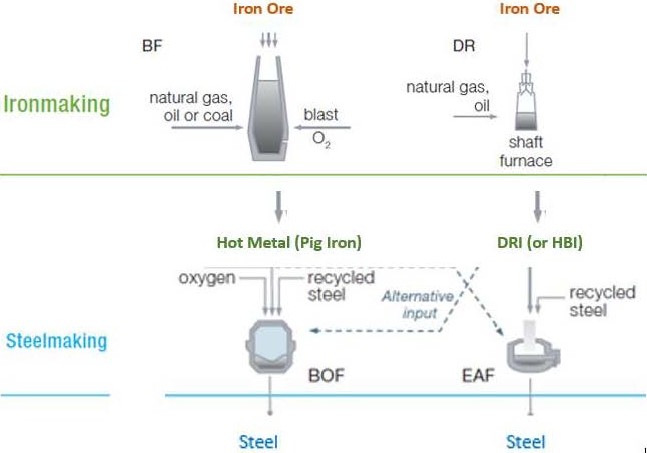

To appreciate this article, it is important for readers to understand the difference between Iron making and Steel making.

"Part 1" is the only hardest part, once you understood this all others will be like kacang putih! ![]()

You will then be a Steel Guru for life.

PART 1: The simple Iron Making process and how the spike in Scrap Iron price against Iron Ore makes HBI producer the ultimate winner?

For a layman to understand one can view their difference in terms of Carbon content. From Iron Ore (having the highest carbon content), Iron Making plants works to produce intermediate products Iron having lesser Carbon content suitable for further processing to make Steel.

IRON ORE (very high carbon content) --> IRON (high carbon content) --> STEEL (very low carbon content)

Schematic Diagram for Ironmaking and Steelmaking below:

You need to memorize the above,![]() this is the only hardest thing in this article!

this is the only hardest thing in this article!

Once you have done that, you can proceed to the below sections.![]()

1.1: THE IRON MAKING

Referring to the above schematic diagram Iron making plants can be divided into 2 types:

1. Blast Furnace (BF) , shown at top left above

2. Direct Reduced Iron (DR), shown at top right above

BF plant uses Iron Ore, Coal and Natural Gas to produce Iron referred as Hot Metal and in transportable form is called Pig Iron, whereas

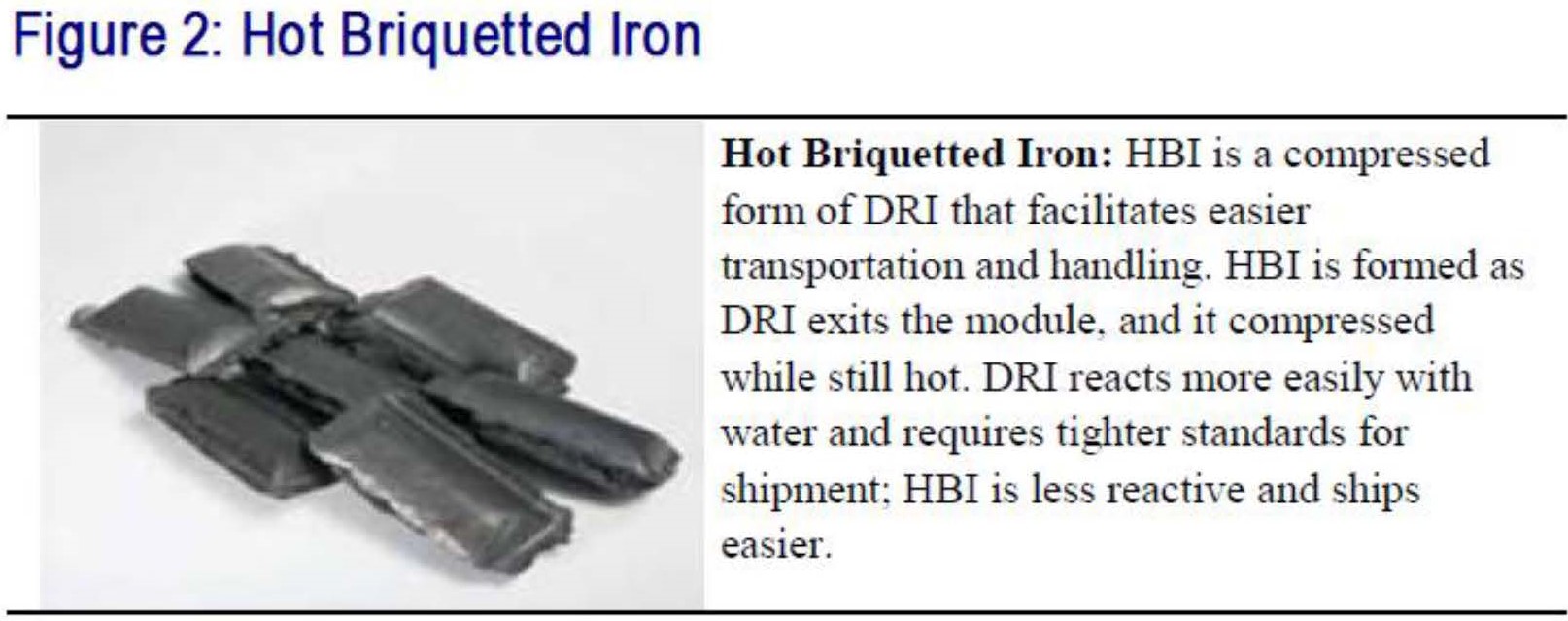

DR plant uses only Iron Ore and Natural Gas to produce DRI, and in a compacted premium form for Export shipment it is called as Hot Briquetted Iron (HBI).

The major difference in their process is that BF actually melts the Iron Ore using Coal in the process of removing its Carbon while DRI as the name itself says, it ‘reduces the carbon content’ without melting ‘directly’ using energy from Natural Gas only without Coal usage.

Images of BF products Pig Iron:

Images of DR products HBI:

The only Malaysian manufacturer who makes Iron via BF route is ANNJOO and via DRI route is LIONIND. The rest of the manufacturers do not even make Iron but Steel with their raw material being Scrap Iron mixed with certain fraction of these DRI and Pig Irons.

1.2 : THE STEEL MAKING:

Referring to the schematic diagram, briefly for Steel making all the reader needs to know now is that:

1. For BOF method, their raw material is Hot Metal (Pig Iron in liquid molten form)

2. For EAF method, their raw material is Scrap Iron (recycled steel) and substitutes such as Pig Iron and Direct Reduced Iron referred as HBI if imported via sea shipment

These 3 materials - referred as Irons, compete among each other as raw material in Electric Arc Furnace (EAF) Steel making plants.

EAF is the current trend in Steel Making process in China to reduce pollution emissions for Environmental reason as it only uses Electricity to melt them.

The Basic oxygen furnace (BOF) method does not have ability to melt Iron. This process (BOF) must be combined with Blast Furnace Iron Making to receive the Pig Iron in hot molten form referred as Hot Metal as its raw material.

Since Blast Furnace (BF) uses Iron Ore & Coal combustions as raw material, it causes significant pollution, as such this method is discouraged and were the targets of steel capacity reduction in China. The same applies to Natural Gas combustion to produce DRI/HBI.

These factors had contributed to selective demand for Scrap Iron instead of Iron Ore (which is the raw material for Blast Furnace) and had caused significant spike in Scrap Iron price and reduced demand for Iron Ore and Coke.

Note: we had already witness Huaan’s recent results due to this.

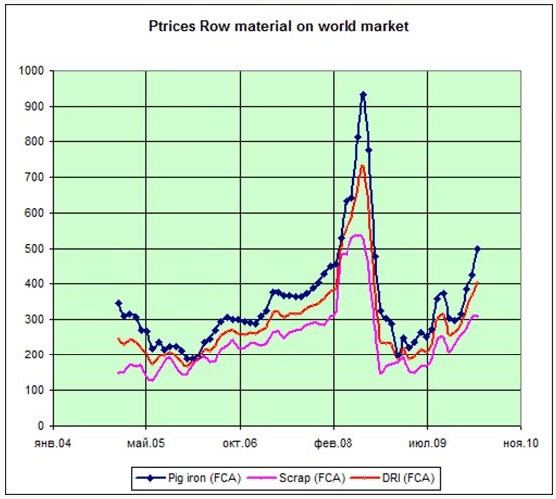

The same factor above had caused the regional price of Scrap Iron competitors, Pig Iron and DRI to shoot up significantly.

PART 2: The turnaround in Lion’s HBI plant in 2017 and what will happen in 2018 considering raw material-Iron ore price is declining and product HBI price sky-rocketing with Scrap Iron?

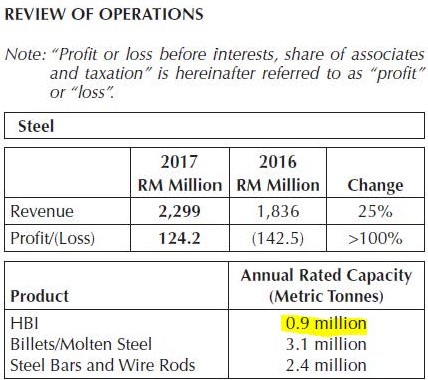

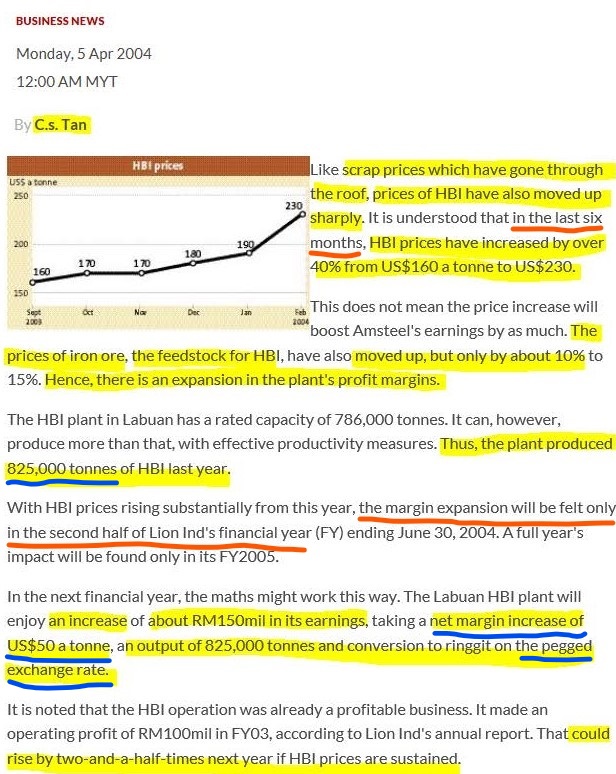

The Labuan HBI plant has a rated capacity of 900,000 tons HBI per annum. During the time before China’s dumping of export steel, the plant used to operate at 92% of its capacity at 825,000 tons per annum (refer table in annual reports and TheStar news in 2004 provided below):

https://www.thestar.com.my/business/business-news/2004/04/05/lion-groups-hbi-plant-on-a-roll/

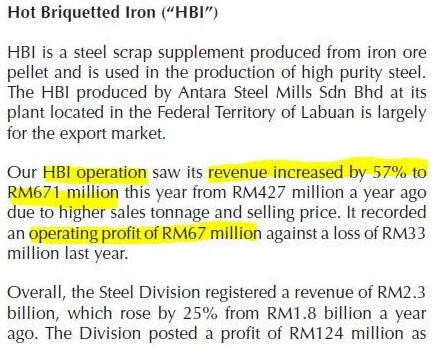

Extract from 2017 AR, page 40:

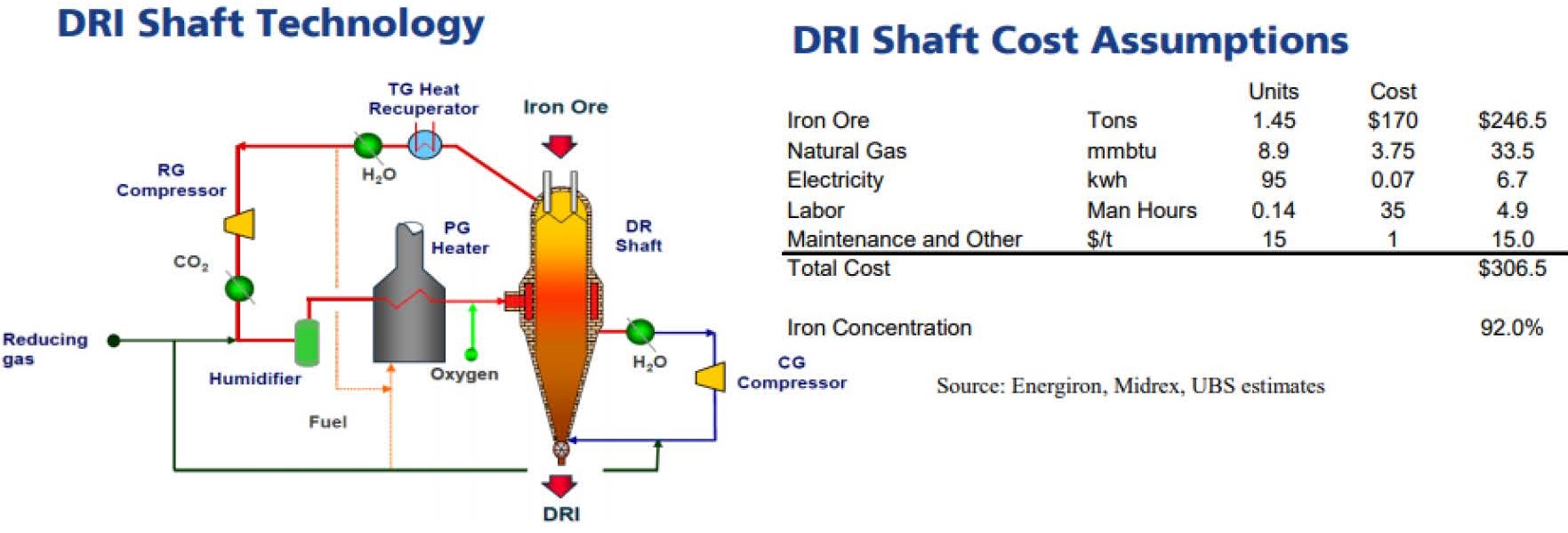

The technology employed is Midrex as shown by the links below. We can see what is the Cost of production of DRI the un-compacted form of HBI as per below link and snapshot from Page 5:

The amount of Iron Ore, Natural Gas and Electricity required per ton production of HBI is fixed for any process.

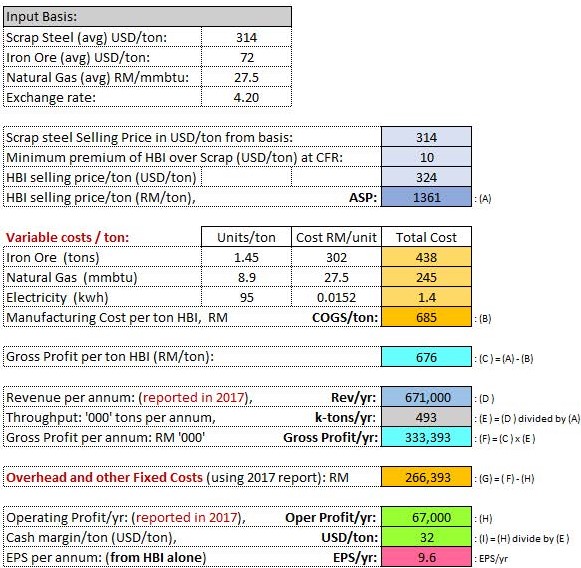

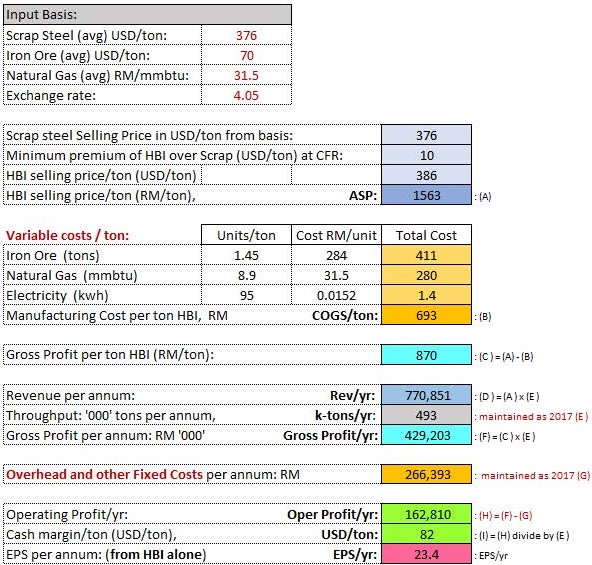

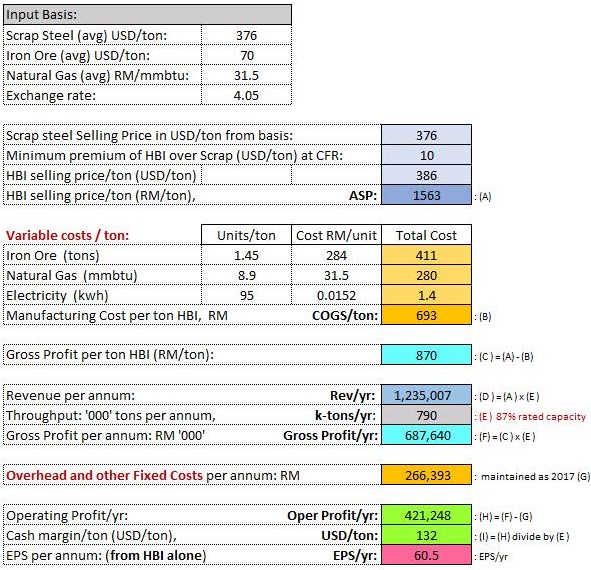

As such, using the above same Midrex technology employed by Antara Labuan plant, we can derive the following Costs of Production (refer Table 1 below) and Gross Margin per ton based on the Reported Revenue and Operating Profit of 671M and 67M respectively in 2017.

From Miti publications linke below, we could obtain the following:

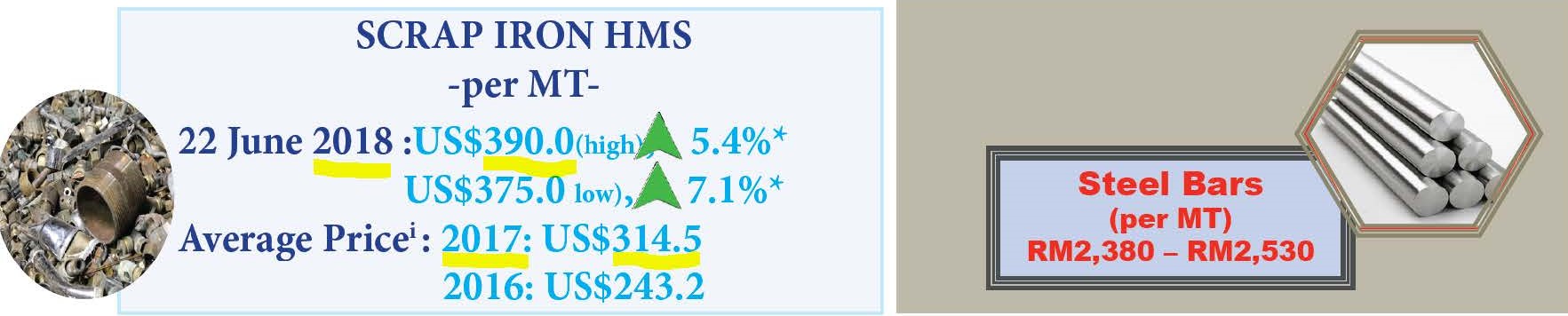

Average Scrap Iron price in 2017 : 314 USD/ton

Average Scrap Iron price in 2018 : 376 USD/ton todate ( a rise of 62 USD/ton!)

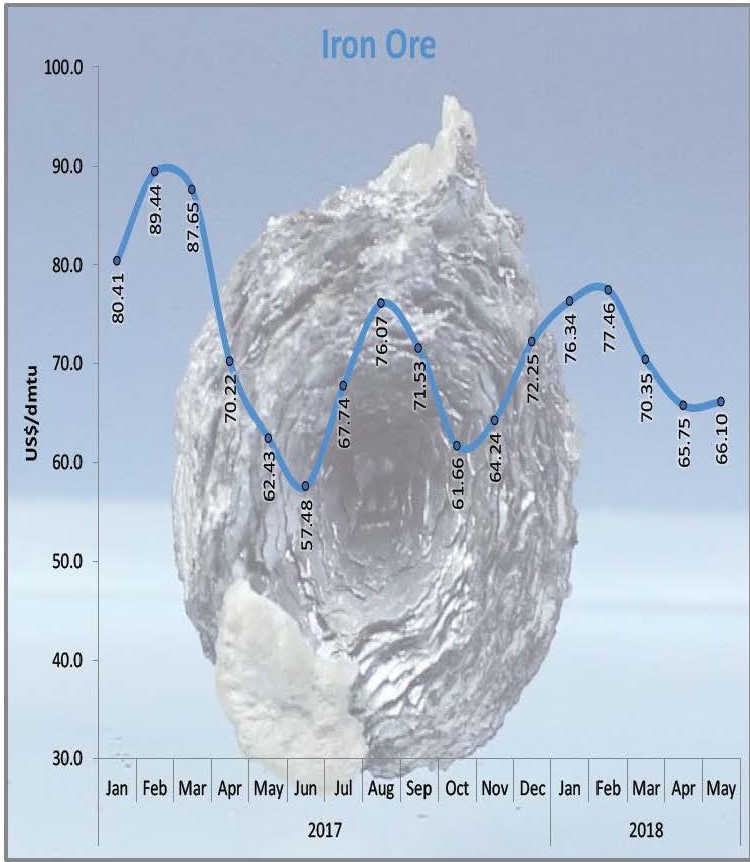

Average Iron Ore price in 2017 : 72 USD/ton

Average Iron Ore price in 2018 : 70 USD/ton todate ( a decline of 2 USD/ton)

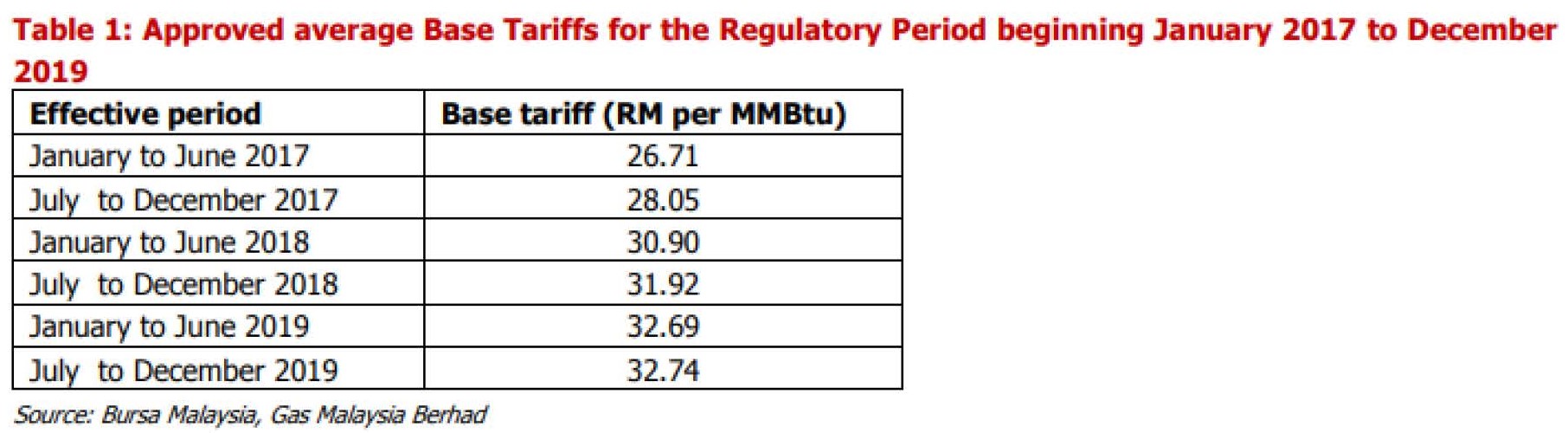

Natural Gas was RM 27.5/mmbtu and expected to rise to RM 31.5/mmbtu average in 2018.

The above figures were used as inputs on the below Table 1 to derive all other parameters which are self explanatory.

Table 1: Actual 2017 performance of HBI plant, Labuan:

Note that we can derive the throughput achieved in 2017 (refer (E) on Table 1, if we know the Average Selling Price of HBI which we can estimate to be at a premium against Scrap Iron average price during the year.

From the below link and chart, we know HBI is a premium form of raw material for the Electric Arc Furnace (EAF) steel making plants to produce much higher quality steel. HBI always sells at a higher price than Scrap Iron ~ 10 USD/ton:

Refer chart below extracted from this link: http://www.urm-company.com/production/dri

I

With that we can approximate the Average Selling Price (ASP) of HBI in 2017 as derived on Table above as RM 1361/ton.

The throughput is simply the reported Revenue of 671M divided by the ASP above, giving = 493 tons for 2017

The COGS using the reported raw material price was, RM 685/ton with Iron Ore average cost of 72 USD/ton.

Refer snapshots on MITI publications below showing the Input Basis on above Table 1:

http://www.miti.gov.my/index.php/pages/view/3060?mid=73

Using the same throughput derived above for 2017, let us see the implication on Gross Profit in 2018 with current Scrap Iron price and rise in Natural Gas and Exchange rate as per below:

In 2018 Scrap Iron had moved to an average of 376 USD/ton with Iron Ore averaging at 70 USD/ton. Natural Gas cost used were based on scheduled hike implemented by government above at average of RM31.5/mmbtu.

2018 1st Scenario Table: Maintained Throughput at 493 tons/yr

We would be easily achieving an EPS of 24 cents from this HBI alone!

Meaning you can assume all other plants in west Malaysia ceased operation, and yet it would be trading at PE = 3 with the Labuan Export product.

Now what happens if the throughput is risen to just 87% rated capacity at 790,000 tons/annum instead of their usual 92% at 825,000 ton/annum as reported during 2004 maintaining all other parameters the same:

2018 2nd Scenario Table: Raised throughput to 790 tons/yr

That is 60 cents from this HBI alone. All they need to do is raise their throughput to 87% utilization!

Or hope for Malaysian ringgit to depreciate further![]()

PART 3: Strong supporting facts for the possibility of above 60 cents EPS derivation in Part 2 , 2nd scenario.

3.1 Historical performance of HBI plant:

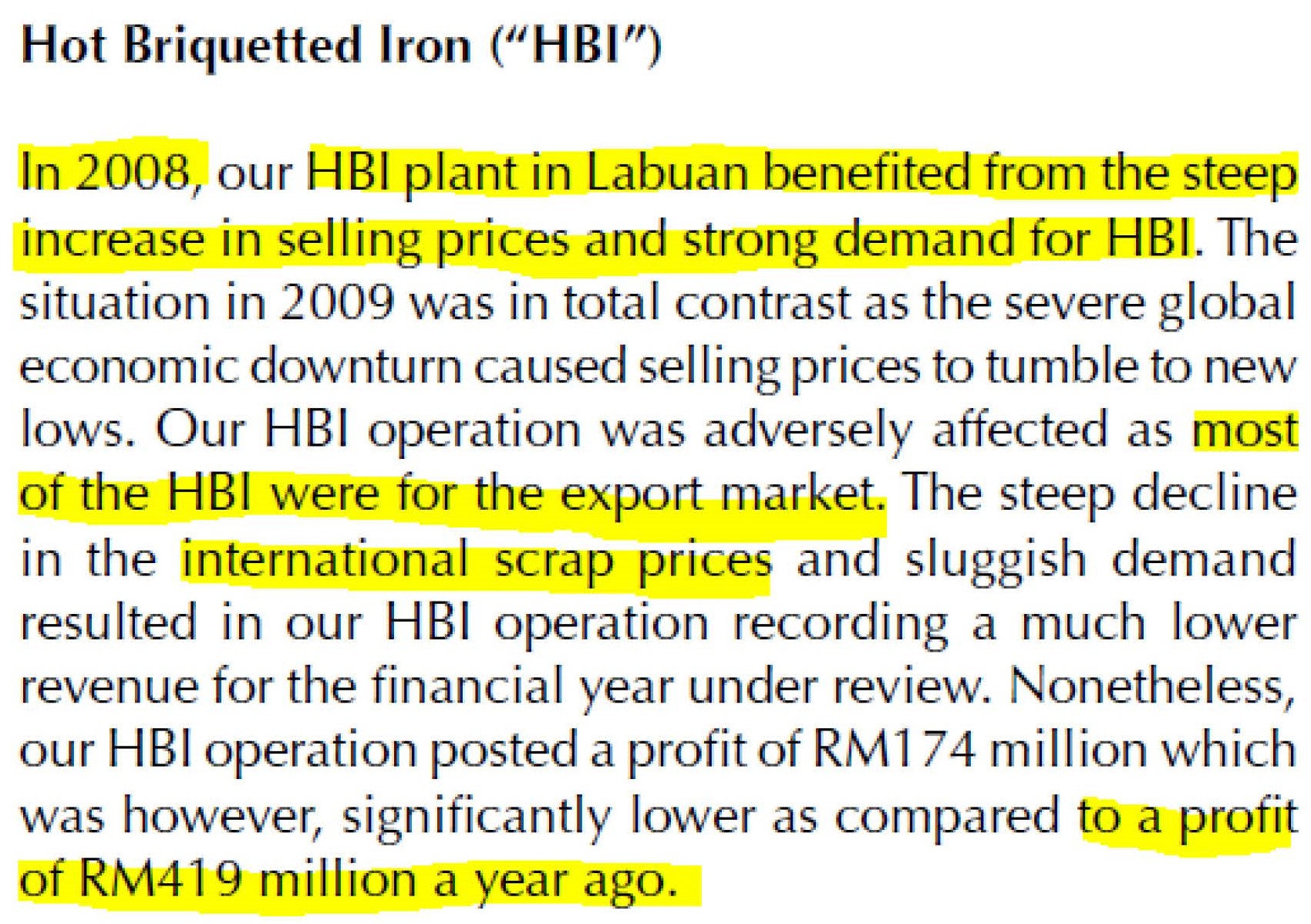

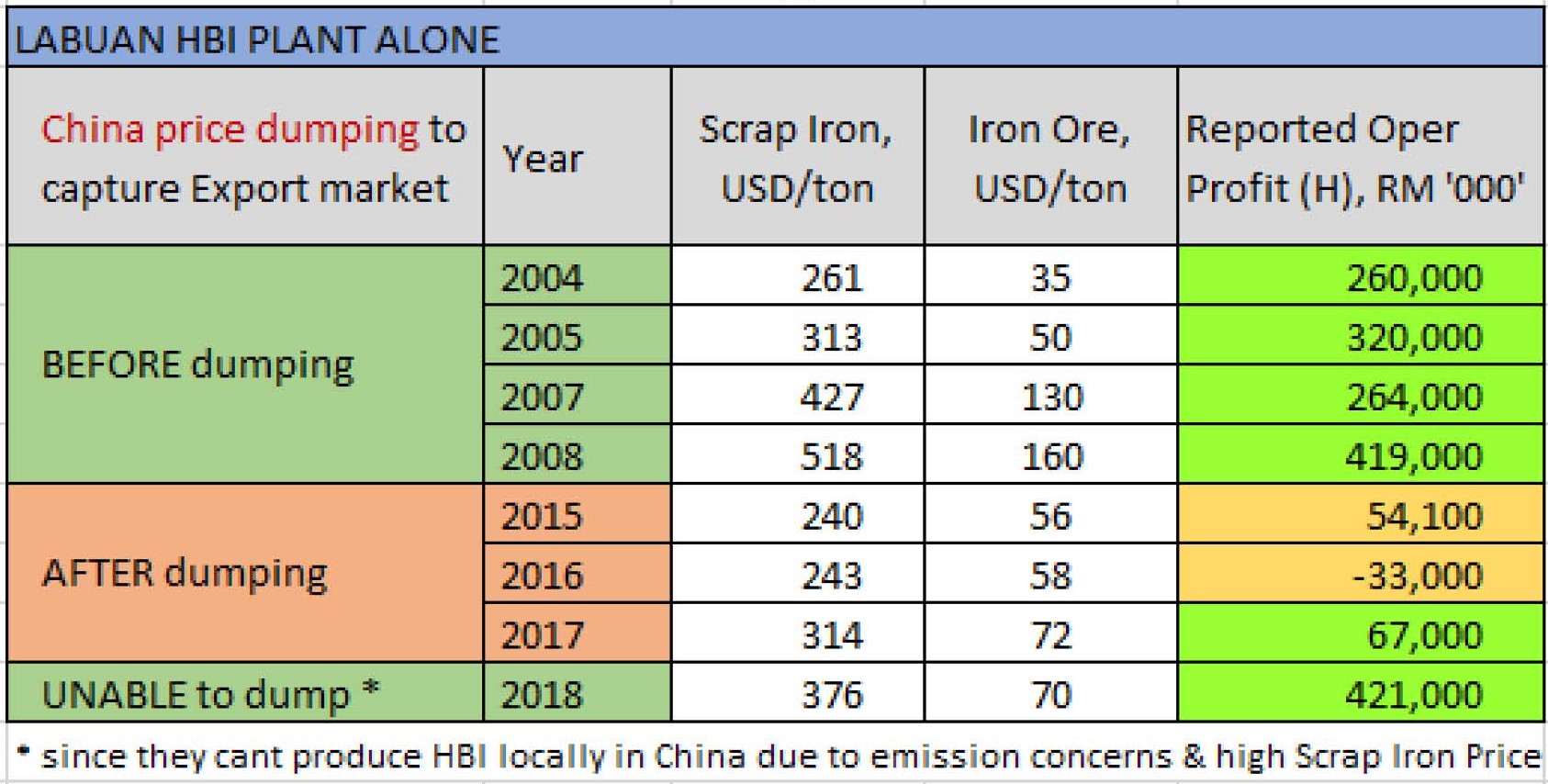

We can see from numerous annual report data the HBI plant used to report such fantastic earnings. Refer 2009 annual report extract below which shows it had reported a Profit of 419 million in 2008:

Actual Operating profit of HBI plant alone, reported on their Annual Report 2004 till 2008 before China dumping is shown in Table below which is self-explanatory:

The Scrap Iron prices were obtained from historical publishing. Note if one goes through these annual reports, operation at 90% of its rated capacity was a norm before China dumping.

Lionind HBI plant earnings deteriorated after the Chinese steel dumping activity. 2017 is the year of turnaround

3.2 Case study on what happened in 2004 for such spectacular earnings:

It has all to do with Scrap Iron differential against Iron Ore!

We can see from below news in 2004 the Scrap Iron cost had shot up.

See the TheStar news in 2004 by C.S Tan below which validates the rise in HBI price together with Scrap Iron above.

https://www.thestar.com.my/business/business-news/2004/04/05/lion-groups-hbi-plant-on-a-roll/

Please read and understand every word mentioned by C.S Tan on the above news in 2004, 14 years ago!! ![]()

And do go through MITI publications on Scrap Iron price for last 7 months.

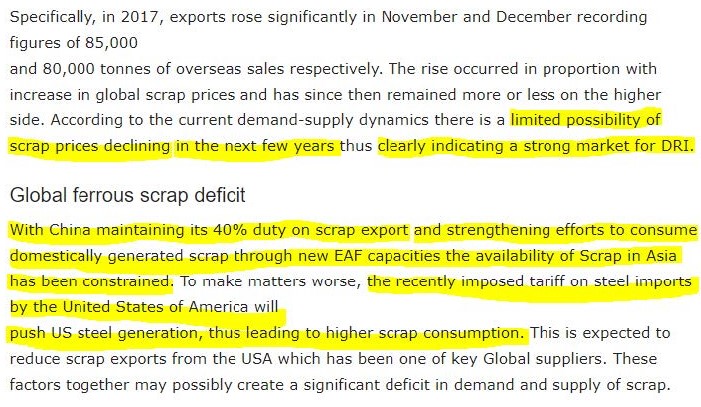

3.3 HBI demand prospect 2018:

Go through the below news: Can India cross 1 mnt in DRI exports? By 360 Editor

4 July 2018

https://www.steel-360.com/stories/iron-ore/can-india-cross-1-mnt-in-dri-exports

Trade routes obtained from Midrex Publications:

From the above chart, we can see that only the Labuan plant is placed strategically to cover East Asia. The Labuan plant mainly supplies to the growing EAF Steel making plants in Vietnam. The Labuan plant is pivotal to supply the East Asian region demand coming from Vietnam & China.

There is increasing demand for HBI reported worldwide and due to the rising electrode price for EAF plant which makes it more economical to use HBI instead of Scrap Iron.

http://www.recyclingtoday.com/article/steelmaking-electrode-shortage/

Lionind would be forced to increase its throughput to its stretchable limits (825,000 tons/yr or higher) as its HBI is used in its Banting EAF plant (refer annual reports) and the plant is restarting currently.

Banting plant restart news: 26 June 2018

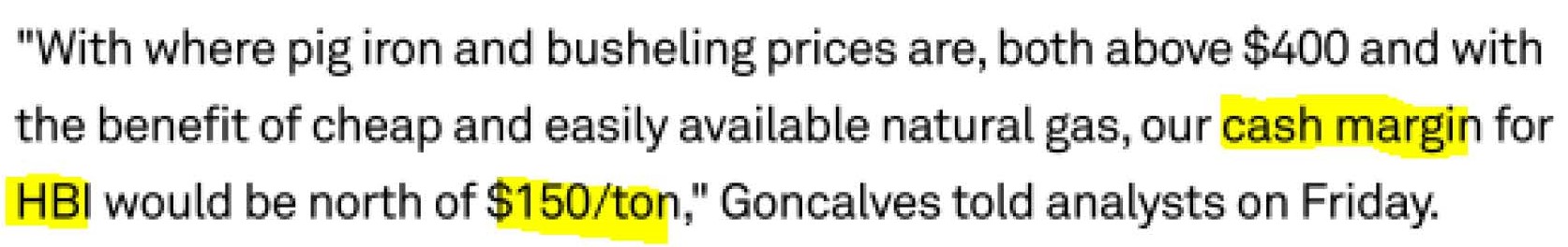

3.4 HBI profit margin prospect 2018:

Analysis: Direct reduced iron margin outlook against pig iron healthy, says US miner Cleveland-Cliffs,

23 July 2018

Note in our above derivation in 2018 2nd scenario at 87% throughput, we had only used 132 USD/ton cash margin (refer (I) on the derivation Tables).

With current foreign exchange rate favoring export it is even more likely to have HBI margins expanding to generate profits seen in 2004 to 2008.

PART 4: What could other Steel making plants of Lionind offer on EPS going forward?

Lionind has other EAF Steel making plants as per the following capacity.

1. Amsteel Mills EAF and billet casting line in Banting, Selangor: 660,000 tons/year

2. Antara Steel Mill's EAF and billet casting line in Pasir Gudang, Johor: 700,000 tons/year

These plants as a minimum should be able to generate RM 180/ton Gross profit margin matching Masteel (the lowest gross profit/ton locally). If they operate both these plants at 80% of rated capacity, their throughput of products would exceed Masteel current throughput of 850k tons/yr by 25%.

A quick workout adds RM 190 Million gross profit per year on top of the HBI plant earnings. That easily translates to additional Net Profit of 135M or extra EPS of 20 cents per annum on top of HBI earnings.

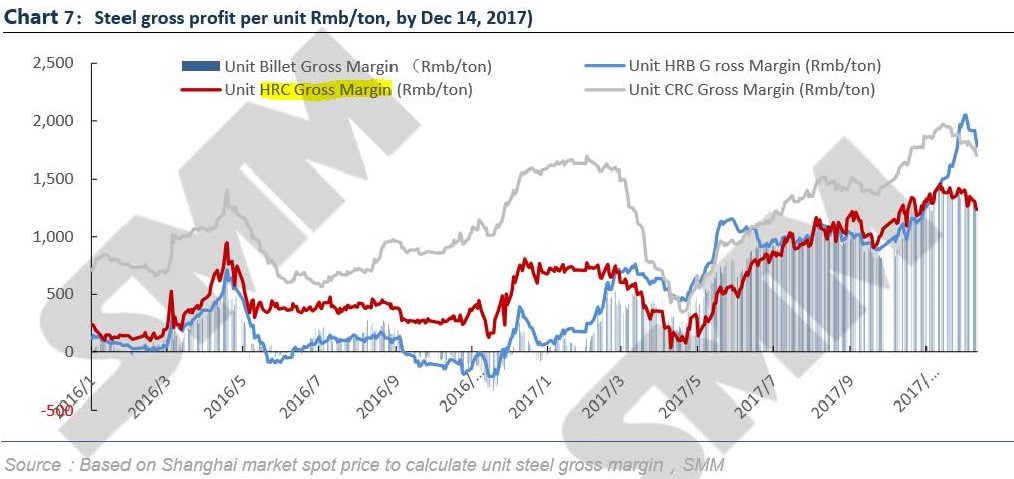

3. Parkson & Megasteel acquisition prospect

It is possible for Parkson to have had completely turnaround and will start contributing positively to Lionind (even giving extraordinary gains in coming qtr results).

On Megasteel potential acquisition, I hope the below chart on HRC mills margins can speak a thousand word:

HRC chart: http://imgqn.smm.cn/production/admin/company/OaHjd20171218154439.pdf

I

If one investigates Megasteel’s past poor performance thoroughly, the causes fall on its huge Financial cost burden, high depreciation and its ignorance on its monopolistic position effects it had to local consumers competitiveness, which eventually led to shrinking of its local HRC demand. It was further compounded by the depressed margin during the china steel dumping period.

There is nothing wrong with Megasteel EAF plant technology as such for making HRC, and that is all Lionind is buying at a cheap price. Lionind is simply acquiring a quality asset at an extremely cheap price during an attractive business prospect period as shown on above margins chart.

PART 5: Concluding statement

In my opinion market is totally unaware of the Iron Export contribution to Lionind and mistreating it just like the rest of the local Steel players.

Market has clubbed Lionind with other local steel players like Masteel, Southern Steel which do not have Iron making facilities into the same, and missed the fact that a significant portion of Lionind current bottom line contribution is already from the Export market which are unaffected by the local government policies on infrastructure HSR, ECRL and other mega projects planned by the previous government.

I believe 70% percent of the 8.9 cents EPS reported for Q1 was from the HBI Exports contribution as derived in 2018 1st Scenario Table. The contribution from Johor and Banting plant has yet to reflect on Lionind’s earnings. Also, the full effects of the steep Scrap Iron price spike in Q1-18 will only be reflected in their Q2-18 report. Refer the TheStar news in 2004 above on this time lag effect.

The prospect for the Scrap Iron – Iron Ore price differential to sustain or even expand further is very high due to China’s adamant Blue Sky policy which prevents HBI or Pig Iron makings using Iron Ore locally in China (or for Export regionally) and forced to rely on Scrap Iron (recycled steel) as its Steel making raw material or use Imported HBI from limited producers regionally like Lionind.

If readers understood the presentation above and the implication of the HBI price rise at current exchange rate, the insane valuation at PE = 1 should slowly start to emerge to their rational mind and, hopefully to their feelings eventually.

I am more than willing to clarify on any technical queries the reader may have.

at the best of my knowledge,

FutureEyes

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Hard Datas

Created by FutureEyes | Aug 10, 2018

Discussions

There are so many PE 10 or PE 20 stock with bigger greater Elephants sitting in the middle the house...

why keep harping on this PE = 1 stock liao??...Lol!

Posted by mneo > Aug 4, 2018 05:50 PM | Report Abuse

There are so many stocks in Bursa to choose from....especially at this depressed market...why risk to buy questionable LionInd...... wait for a while and the truth will surface itself...

2018-08-04 17:56

China's Steelmakers Are Smashing Production Records

Bloomberg News

August 1, 2018, 2:09 AM GMT+4 Updated on August 1, 2018

https://www.bloomberg.com/news/articles/2018-07-31/china-fires-up-steel-plants-to-extremes-after-xi-supply-squeeze

China’s steelmakers are smashing production records by pushing:

"furnaces beyond their typical limits, offsetting nationwide closures"

....................................................................................

that may be even more swingeing than government estimates, according to Goldman Sachs Group Inc.

The world’s top producer has trumpeted sweeping reforms in the past two years that have shuttered aging and illegal plants, and shackled winter output in the dirtiest regions. At the same time, official data shows output at record highs. That’s partly because, with demand robust and margins high, mills have rewritten their steel-making recipes to push output beyond normal capacity, says Goldman’s Hong Kong-based analyst Trina Chen.

“For the same blast furnace, mills can deliver an extra 10 percent or more steel than before,” Chen said by email. Operators are using iron-rich ores to boost productivity, and raising the portion of steel scrap in their feed-stock to as much as 30 percent from about 10 percent historically.

“The trend is continuing this year but they are approaching their stretchable limit,” she said.

...................................................................................

China’s average daily output was a record in June, taking first-half volumes to a best-ever 451 million metric tons, more than half world production. The unprecedented run-rate has yet to trouble a prolonged period of profitability that,

most analysts attribute to steady demand growth,

.................................................................

on top of the reforms driven by President Xi Jinping as a pillar of his economic agenda.

Baoshan Iron & Steel Co., the listed unit of China’s biggest producer, climbed in Shanghai on Wednesday, and other mills advanced after the country’s leaders signaled a fresh focus on bolstering economic growth.

Reinforcement bar futures surged to their strongest level in five years.

........................................................................

Goldman said in July that Chinese steel stocks could rally:

"ANOTHER 60 PERCENT in the next year",

and that’s after profits already jumped 151 percent in the first half, according to the China Iron & Steel Association.

2018-08-04 18:00

If one goes through the Tables above showing the cost of production derivation, one would notice that electricity tariff hike has almost negligible (zero) implication on its DRI/HBI production costs.

The tariff hike news had been capitalized by many speculative traders recently to push down the stock price.

The electricity costs has a considerable effect on EAF Scrap Iron melting plants only, where the consumption can go up to 500 kwh/ton. Even then, this is very small in comparison to other factors.

2018-08-04 19:59

False precision is too high.

You're expecting a plant restart to go on perfectly. That there is no advancement in technologies from other producers which will reduce their cost and competitiveness.

Lionind is cheap ish I guess. But trying to predict quarters with such precision is likely to induce over confidence.

The more important question is, if the quarter is bad, are you willing to hold and average down?

2018-08-05 03:26

Probability,

If China start back steel furnaces, this is very bad news.

The reason why steel price is even high now is because they closed the furnaces killing supply.

Like I said, high price result in higher supply, resulting in lower price.

You so sure boh?

You wrong in predicting hy and master quarter still not enough is it. How much money you want to lose?

Go out in fd better for you I think.

2018-08-05 03:28

Since AnnJoo also can use iron ore as raw material, it will also beneficial like LionInd to take advantage of lower iron ore price vs scrap iron price.

2018-08-05 09:17

value88, your IQ is 10 times higher than Jon whom i think is only good in writing English literature essays

2018-08-05 09:55

OTB, WC's reputation has not being good and well-liked by market for the longest time. What makes u think it will be different this time?

Having said that, this deal may be good for LionInd in the longterm.

2018-08-05 10:51

May I point out a big error in the article? Iron making is the process of removing OXYGEN, not CARBON. Iron ore exists as oxide, ie rusts. To make steel, you need to remove the OXYGEN, typically with high calorific carbon such as coking coal. At high temperature, carbon combined with oxygen to produce CO2 thus Fe2o3 becomes Fe. Carbon is then added to Fe in minute quantity to create a steel alloy that is strong and tough.

2018-08-05 13:56

soojinhou, the article was meant to give a simple understanding of the process. There is no need for such detail understanding.

Reason i had mentioned carbon is because it is something more tangible for the readers.

What is important is the Inputs, i,e the raw material and energy in the form of Natural Gas and Electricity required by the Shaft Furnace process.

http://www.businessdictionary.com/definition/direct-reduced-iron-DRI.h...

Extract from above: "to burn off carbon and oxygen content"

Alternative iron source produced by heating an iron ore (generally having 65 to 70 percent iron) at a temperature high enough to burn off its carbon and oxygen content (a process called reduction) but below iron's melting point(1535°C or 2795°F). The output is sold as pellets or briquettes (called hot briquetted iron or HBI) and contains from 90 to 97 percent pure iron, the rest being mainly carbon with trace amounts of other impurities.

Posted by soojinhou > Aug 5, 2018 01:56 PM | Report Abuse

May I point out a big error in the article? Iron making is the process of removing OXYGEN, not CARBON. Iron ore exists as oxide, ie rusts. To make steel, you need to remove the OXYGEN, typically with high calorific carbon such as coking coal. At high temperature, carbon combined with oxygen to produce CO2 thus Fe2o3 becomes Fe. Carbon is then added to Fe in minute quantity to create a steel alloy that is strong and tough.

2018-08-05 15:23

I have to applaud the research you have done. Don't worry about Jon Choivo or Ricky Yeo pouring cold water on your work, we are after big money and we want to position ourselves BEFORE market reacts. They are more conservative and prefer to buy and hold for long term and so they won't be interested in cyclicals. I appreciate you showing how you derived your estimation of the throughput of the Labuan plant, because that's a figure I can't get from probability's writeup. The supporting data you provided appears to support your profit derivation, and I look forward to the company's results to confirm your thesis.

Jon Choivo, yes, high price leads to higher supply. But do note that in the case of steel, the rise in steel price we see now is not extraordinary, but the NORMALISATION of profits. The severe depression a few years ago was abnormal supply caused by dumping. Don't forget also, the massive supply from China is due to the propping up of loss making steel plants, or zombies, which should have been closed a long time ago. China itself has allocated massive funds to assist ex-steel workers who lost their jobs as China undergoes reform and stop the practice of subsidizing ailing state owned enterprises.

2018-08-05 15:30

Aiya FutureEyes, even if Lionind sells at 0.10 at PE = 0.1, those who are not invested will focus on any irrelevant negative aspects they can find...

They will talk as if even if you sell these Lionind shares free, they still dont want.

Still want to talk about WC meh? Isnt all the while WC has been a major shareholder of Lionind and they were interested in lionind?

Laughable liao!

Any engineers should understand a plant technology is a technology that performs the same no matter where and who operates that.

I think these investors should admit their poor understanding of HRC steel making process and unnecessarily link past poor performance of Megasteel "management" with the "plant" Lionind is interested to acquire.

2018-08-05 15:34

FutureEyes, carbon or oxygen doesn't affect the financial numbers you present. Thanks for the computation. I've stopped adding lionind after the megasteel deal was announced. Hopefully the circular on the acquisition will shed more light on the financial implication of the acquisition.

2018-08-05 16:00

Why is it pouring cold water? If I write 99 pages of thesis that doesn't lead to what I predicted, then someone should point to me that my writeup is BS. I'm not saying what is being written here is nonsense, I'm just asking does the difference in manufacturing process will lead to higher profit in coming quarter? which if it does, would it surprise the market? which if yes then push up the price substantially and therefore allow one to gain superior return?

2018-08-05 17:19

Ricky sorry if I've offended you coz I didn't thought you will be interested in cyclicals. You are after all one of the rational writers in i3. Having said that consider these facts:

1) China produces more steel than the rest of the world combined. The implication from that is that they are the price setters. Given the buoyant steel price in China, Malaysian domestic price can't fall too much before export becomes a viable option, notwithstanding the slowdown in domestic infrastructure and property sectors.

2) Manufacturing process plays a part in profitability in steel making. One of the reason why iron ore based process is more profitable is because the price of graphite electrode has gone up 10x due to China's push into EAF and the shutdown of polluting graphite mines in China. Iron ore based steel making doesn't require graphite electrode.

Do note that Malaysian domestic rebar price has softened in Q2, so, there's a risk Q2 may be weaker than Q1. But then, the annualised PE from Q1 is merely 2.2.

2018-08-05 20:51

Hot charging of DRI for lower cost and higher productivity Steel making

http://www.millennium-steel.com/wp-content/uploads/articles/pdf/2004/pp55-58%20MS04.pdf

- Reduces specific EAF electrical power requirement

by 120–140kWh/t

- Reduces EAF electrode consumption by

0.5–0.6kg/t

- Reduces refractory consumption

- Increases EAF productivity or allows EAF electrical

system to be downsized

- Promotes low-nitrogen steel for flat products like all

DRI-based melt shops

2018-08-05 21:09

from the management record and the fluctuation of HRC margin shown in the chart (from several hundreds rmd within few months), the acquire of Mega more likely is ballot

2018-08-05 22:37

Soujinhou,

There is no such things are normalisation of profits in cost based industries

Perfect competition result in perfect destruction of incremental capital over time once inflation is taken into account for the entire industry on average.

You may win if your have an inherent cost based advantage or you are selling specialised steel etc.

The only way to make money from cost based cyclical industries, is to buy when people are highly pessimistic and its trading at price to book valaution. And sell when people start valuing it using pe.

Old plants can be restarted if the demand is there. When Donald trump put steel tariff. Dead plants in the US were restarted.

Im just saying your thesis here is very very very dependent on the next quarter. If its bad, you can go Holland. Because I doubt you will be willing to hold or average down.

So it's in effect a gamble. You're calculation of the expected value better be correct.

At 0.8, it may very well be a decent bet. But given the current market, they are many more better companies selling at cheaper prices.

I just don't see why this article goes into so much detail for no reason.

Its like a gambler thinking he's an investor.

Nothing wrong with gambling btw. But if you're gambling but you think you're investing, your sizing is likely to be very wrong.

2018-08-05 23:29

Hope a steel company will offer author a job as CEO.

For investment purposes, we need financial numbers, yes, financial numbers to crunch, if necessary. Technical mambo jumbo gets one no where................cheers and Good Luck!

2018-08-06 06:21

aiyah this Calvin is all around talking shit here and there...many people get burnt badly because of his chui kong lanpah song only.Dont follow this conman.He is a total freak and disaster.

2018-08-06 07:14

The steel company need writer to make up good story for the company? ha.ha.. ya..if that is the case... the writer is a good candidate....but I think there are better writers in the forum...good in essay writing to cheat investors.....

2018-08-06 08:51

It is not easy to gather so much hard data and complete the good article above. We should appreciate the author as he is giving us for free.

I may have doubt on the financial forecast, and the coming earnings may deviate from what have forecasted above. But, the reasoning and the logic of why iron ore price decreases and scrap iron price increases, and why LionInd has good earnings prospect from its HBI operation is there. We can take away the useful facts after reading the article above. I personally have benefited from it.

2018-08-06 08:57

makhluk apa ni?..tulis pelik2 tak masuk akal...

Posted by Jon Choivo > Aug 5, 2018 11:29 PM | Report Abuse

Soujinhou,

There is no such things are normalisation of profits in cost based industries

Perfect competition result in perfect destruction of incremental capital over time once inflation is taken into account for the entire industry on average.

You may win if your have an inherent cost based advantage or you are selling specialised steel etc.

The only way to make money from cost based cyclical industries, is to buy when people are highly pessimistic and its trading at price to book valaution. And sell when people start valuing it using pe.

Old plants can be restarted if the demand is there. When Donald trump put steel tariff. Dead plants in the US were restarted.

Im just saying your thesis here is very very very dependent on the next quarter. If its bad, you can go Holland. Because I doubt you will be willing to hold or average down.

So it's in effect a gamble. You're calculation of the expected value better be correct.

At 0.8, it may very well be a decent bet. But given the current market, they are many more better companies selling at cheaper prices.

I just don't see why this article goes into so much detail for no reason.

Its like a gambler thinking he's an investor.

Nothing wrong with gambling btw. But if you're gambling but you think you're investing, your sizing is likely to be very wrong.

2018-08-06 16:52

value88, seriously if only we have more people who can comment like you, i3 would be truly an intelligent place to spend our time

Posted by value88 > Aug 6, 2018 08:57 AM | Report Abuse

It is not easy to gather so much hard data and complete the good article above. We should appreciate the author as he is giving us for free.

I may have doubt on the financial forecast, and the coming earnings may deviate from what have forecasted above. But, the reasoning and the logic of why iron ore price decreases and scrap iron price increases, and why LionInd has good earnings prospect from its HBI operation is there. We can take away the useful facts after reading the article above. I personally have benefited from it.

2018-08-06 16:54

probability, thanks. I enjoy your sharing in this i3forum too.

Some people in i3 forum are here to attract student, subscriber or investor, thus, they have to show their power and try to win in every arguments bcos they need to preserve their reputation.

For normal investor like me (I think u too) are not here for that purpose, therefore, we should argue less and learn more.

2018-08-06 18:30

perfectly agreed.... keep voicing your opinions... i3 needs more comments from sensible people like you..

2018-08-06 18:33

Whats the point of winning an argument.

You win or lose argument, does not mean your thesis is correct or wrong.

The goal is to find out what is right. And act accordingly.

You want to find the leng profit, need to go back almost 10 years. And you need to assume that all the factories in china won't reopen. You so sure boh?

China used to say they want to deleverage, barely 6 month later, when market slow down, they lower the capital requirements for banks in order to stimulate market.

They can turn around on policies.

I'm not saying he's analysis is wrong, he could very well predict next quarter. But this is a guy trying to jump over 7 foot pole. His margin of safety very low.

You see 2017 Q, everyone think sure super earning happen, show you a loss, why also you dunno.

I hope you guys make money, but i have no idea how to make this money.

In any event, people who write post predicting quarter result, rarely stick around to see it.

2018-08-06 18:44

Probability, just ignore him. I don't even bother replying. Here's for you:

http://www.mining.com/web/chinas-shandong-province-cuts-steel-coal-capacity-environment-plan/?utm_source=digest-en-mining-180805&utm_medium=email&utm_campaign=digest

2018-08-06 18:52

HENGYUAN Q2 EPS, Just 19 cents

Author: FutureEyes | Publish date: Fri, 11 Aug 2017, 09:50 PM

21-May-2018 results released 28.94 cents

Q3 EPS: HENGYUAN 130 cents, PETRONM 30 cents

Author: FutureEyes | Publish date: Sat, 11 Nov 2017, 09:03 PM

30-Nov-2017 results released 120.59 cents

HENGYUAN - Q1 2018 EPS 25 cents

Author: FutureEyes | Publish date: Fri, 6 Apr 2018, 01:36 AM

21-May-2018 results released 28.94 cents

.............................................

Predicting earnings does not matter?

Guess it does not matter if HY price moves up to 19 and comes down 6... lol!

2018-08-06 18:55

Ok soojinhou...posted abive before seeing your posting. Thanks for the sharings..

2018-08-06 18:57

I do not belittle people for doing in-depth research, I do not belittle people for spending time writing up their work and sharing with public. We need good content in i3. Whether the forecast is correct or not is moot, whether the article leads people to riches or holland doesn't matter. I also don't patronize others claiming my method is superior and others are crap. Most of all, I appreciate good content. So thanks to FutureEye for excellent content. The whole article consists of extensive network of data points taken from numerous sources, it took the author tremendous effort to piece together the whole picture. For that, his effort should be commended, not belittled.

2018-08-06 19:16

exactly soojinhou, only those who had prepared such an article before knows the level of effort involved.

Results no one can guarantee, one has to take calculated risks

2018-08-06 19:24

I wasn't aware that future eyes was doing charity.

So one should also commend bonescythe and pump and dump operations?

People write articles predicting quarters or sudden earnings, because they intend to take advantage of the price going up, and sell before the results come out.

You don't notice how result come out, it pops maybe 2-3% then goes down?

He post is definitely way above bonescythe etc, and he's likely to be more ethical than them.

But its not something worth commending as if he go to orphanage every weekend.

Imagine, he has RM250K in before he post the article, one post make him RM7.5k easy.

There is no such thing as a free lunch. If you are not paying for it, he ain't selling to you, you're the product!

If it was truly this amazing and this cheap. He will diam and just buy.

The only time people post is because

1) they are not sure and want feedback.

2) its so obvious anyone can see.

3) they want to sell to you (some do it in a far more unethical manner).

Next time when i buy car, i will commend my salesman for being good salesmen and manage to make me buy car and the upgrades summore.

======================================================================

Posted by soojinhou > Aug 6, 2018 07:16 PM | Report Abuse

I do not belittle people for doing in-depth research, I do not belittle people for spending time writing up their work and sharing with public. We need good content in i3. Whether the forecast is correct or not is moot, whether the article leads people to riches or holland doesn't matter. I also don't patronize others claiming my method is superior and others are crap. Most of all, I appreciate good content. So thanks to FutureEye for excellent content. The whole article consists of extensive network of data points taken from numerous sources, it took the author tremendous effort to piece together the whole picture. For that, his effort should be commended, not belittled.

2018-08-06 19:35

I don't see why the integrity and ability of WC is in question here.

Is his integrity and ability dependent only on profit?

Put a top management in a rubbish industry, or an industry whose moat is destroyed, and they will look stupid.

Was the management of STAR genius last time, and stupid today? I dont think so. I think they were just normal people, who were in a a really good industry that turned into a really bad one.

WC last time everyday buy back parkson share because it was cheap. Very shareholder minded. His companies are all conservatively capitalized.

His reputation dont need any more building.

His only fault is not being a genius and getting out of certain industries early. Something anyone can fall for.

===================================================================================

Ooi Teik Bee Dear sherlock,

I agree with you. In actual fact, you are very good and sharp.

To be honest with you, earning and PER of Lionind is the best among 4 major steel stocks.

Most investors are not happy with the management of WC.

It takes time for WC to build his reputation.

Hope WC turns into a new leaf.

Thank you.

Ooi

04/08/2018 17:36

2018-08-06 19:44

Having said so much, yeah, this is the best pick for steel i think.

I just think as pretty much everyone here betting that this round quarter will be better on QOQ and YOY basis.

Its damn risky, and it has gone up already, how much left is there to price in.

Whats the expected value? I really don't know the answer.

2018-08-06 19:51

the below is a very wrong concept to have..

a salesman does not own the cars he sells to you

look at it in another context...

many times durian traders will have to buy the musangking at high price due their own 'perceived value of the durians'..and then ensure that they can sell at a higher price within a certain time frame..like call warrants

there is nothing wrong for them making money in exchange to the value they offer to the buyers...

in this case, they create value by "making the durians accessible" to the buyers..

the same way, an article written to expose the real value of a stock should be welcomed.....

its a win/win interaction

.........................

you can ask Icon, how many times he would have bought at a higher price than the time he wrote the articles...

having the ability to know the true values of a stock can be a blessing in disguise especially when we have lots of 'professor like idiots' in bursa and i3....

Posted by Jon Choivo > Aug 6, 2018 07:35 PM | Report Abuse

The only time people post is because

1) they are not sure and want feedback.

2) its so obvious anyone can see.

3) they want to sell to you (some do it in a far more unethical manner).

Next time when i buy car, i will commend my salesman for being good salesmen and manage to make me buy car and the upgrades summore.

2018-08-06 20:02

Downside risk is about 10% but upside opportunity at 50% at current price RM0.88.

2018-08-07 16:14

Iron ore cost-effective for steel mills as price diverges from scrap

http://blogs.platts.com/2018/03/08/iron-ore-steel-mills-price-diverges-scrap/

Over the past five years, the price differential between domestic scrap and iron ore imports has averaged $200/mt. However, since scrap prices began to elevate precipitously in October 2017, the differential increased to a high of $332/mt in late December.

2018-08-09 19:36

The upgrade to 900,000 ton/yr was done in 2006 from 800,000 ton/yr in 2005.

This means the actual throughput potential is much higher than what C.S Tan mentioned in 2004 where it had produced 825,000 tons the previous year with effective productivity measures.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/subscribe/4235/option2#/?category=AR

2018-08-11 15:19

I think the stock market should be treated as a chess game, a war, You die better than I die. Plenty of liquidity, plenty of margin accounts, plenty of syndicates. Let the lucky ones survive.

But I don't promote fake news like this fellow....

http://klse.i3investor.com/servlets/forum/600168169.jsp

I think the authorities should close them down.....Fake news is very damaging......margin accounts, perfectly legit, perfectly legal.

2018-08-11 15:41

Hi Future Eyes, may i know where you get the value for the electrical tariff, RM0.0152 per kwh? Thank you.

2018-08-18 10:53

probability

RM 800/ton for HRC??...Thats why all the China Steel companies are minting record profit!!

2018-08-04 17:52