HSR, ECRL - IMPACT TO STEEL INDUSTRY, a mere 1% ?

FutureEyes

Publish date: Fri, 01 Jun 2018, 10:55 AM

Ever since GE14, BURSA is fuelled with speculative news and stocks are dancing abruptly to its tune, and our IB's are smart enough to capitalize on this. Very few care to investigate the real implications of these projects, namely HSR and ECRL cancellation to the STEEL INDUSTRY.

In i3, as the very word suggest one should emphasize on having intelligent information to make prudent investment decision.

As usual let me present the hard facts:

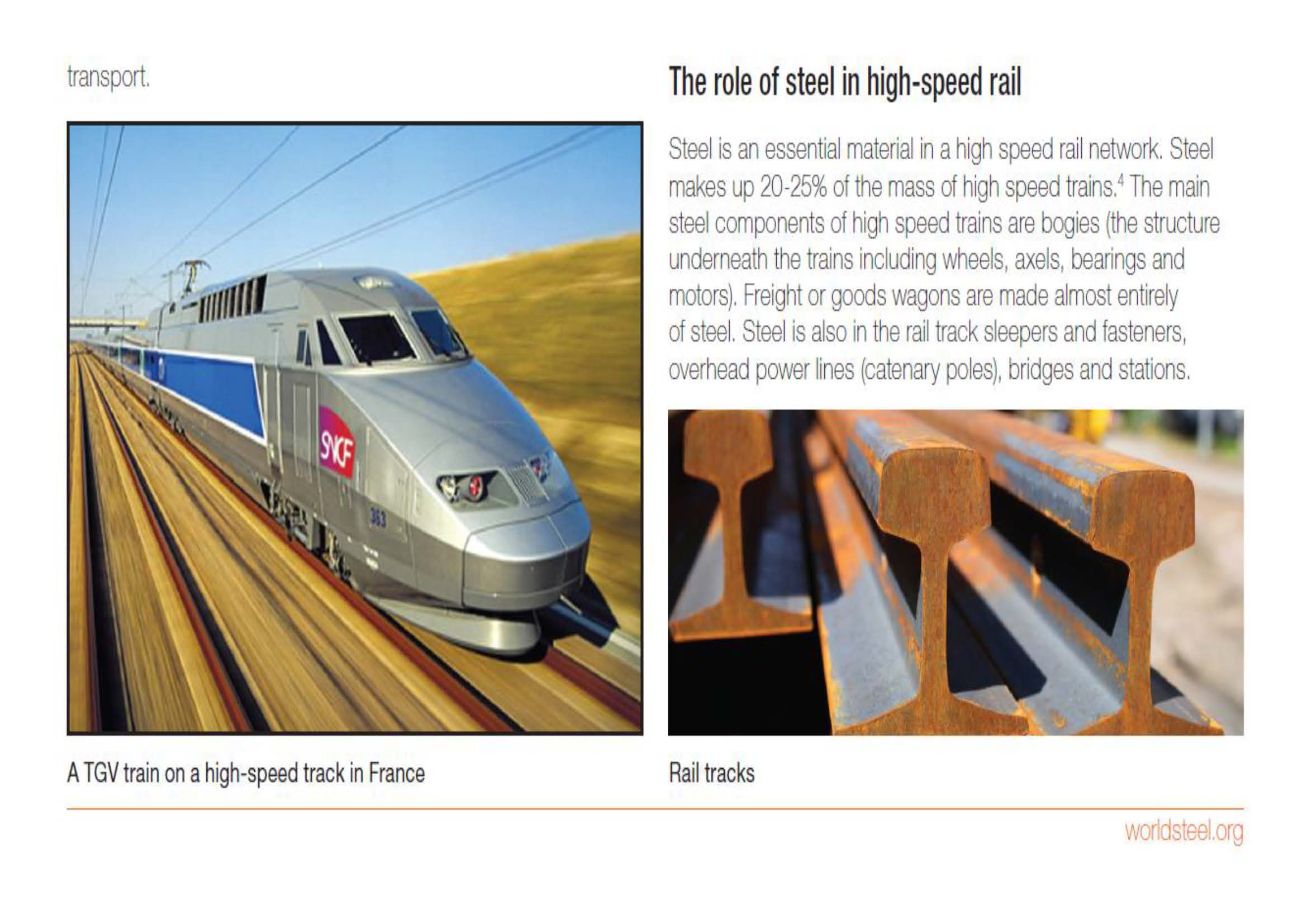

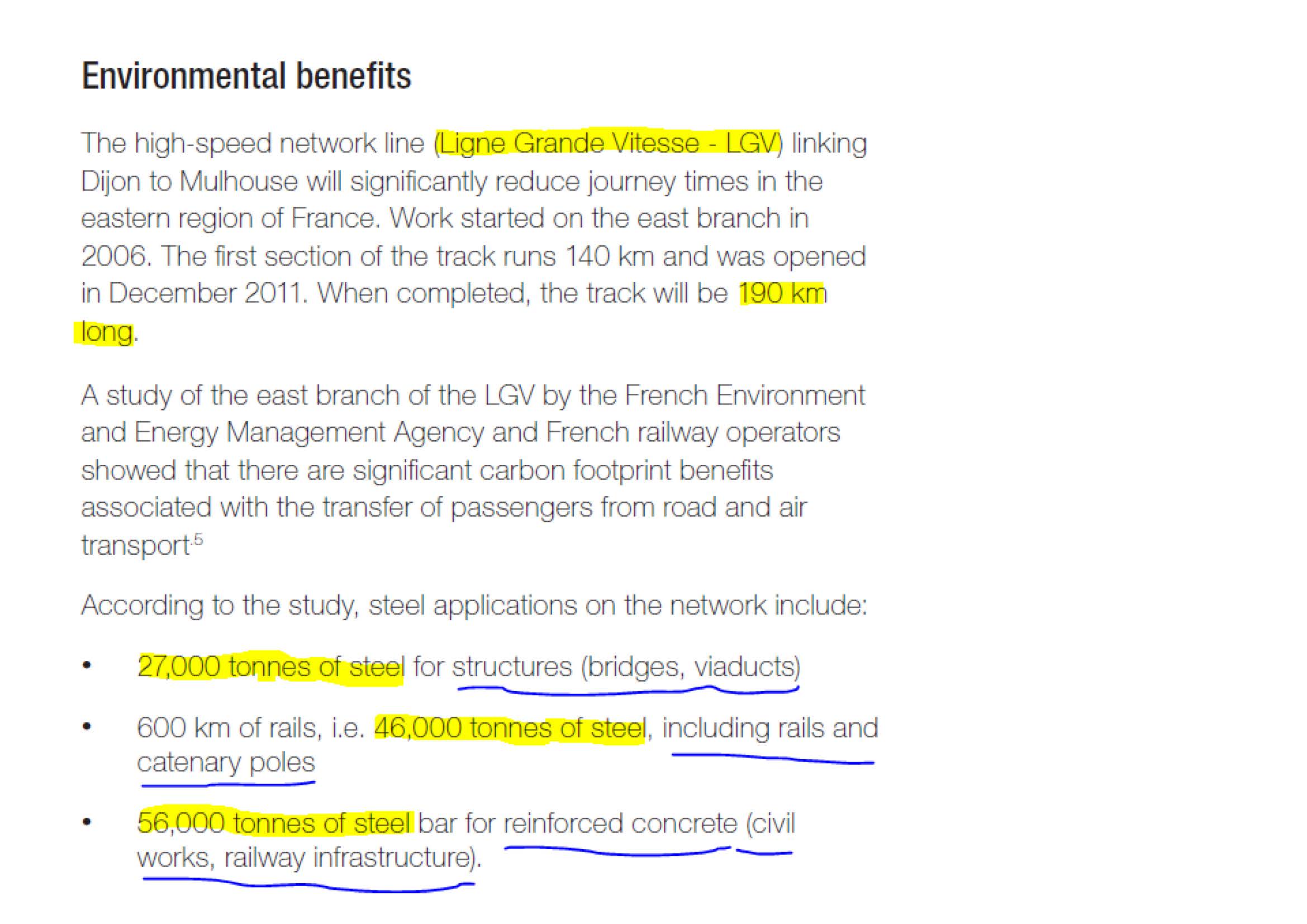

(PART 1) What is the steel consumption per KM High Speed Railway (HSR)?

......................................................................................................................................................

Every KM of HSR track only needs about 670 to 780 tons total steel per KM of HSR.

First article:

The above adds up to:

= 27,000 + 46,000 + 56,000

= 129,000 for 190 km HSR (Ligne Grande Vitesse)

= 678 tonnes per km

Second article:

https://theconversation.com/nine-ways-steel-could-build-a-greener-economy-57506

From above we can see that its approximately 282 + 500 = 782 tonnes per km

Now we know the total length of the HSR track is only 350 km and the ECRL at 688 km (including phase 1 and phase 2 from below links:

https://en.wikipedia.org/wiki/MRL_East_Coast_Rail_Link

https://en.wikipedia.org/wiki/Kuala_Lumpur%E2%80%93Singapore_high-speed_rail

Using the first article data, the Total Steel required for both the projects would be:

= 678 (ton/km) x 1033 km

= 700,000 tonnes

The project duration is estimated around 6 years.

This means on average, the steel consumption per year due to both HSR and ECRL is only:

= 116,000 tonnes/annum

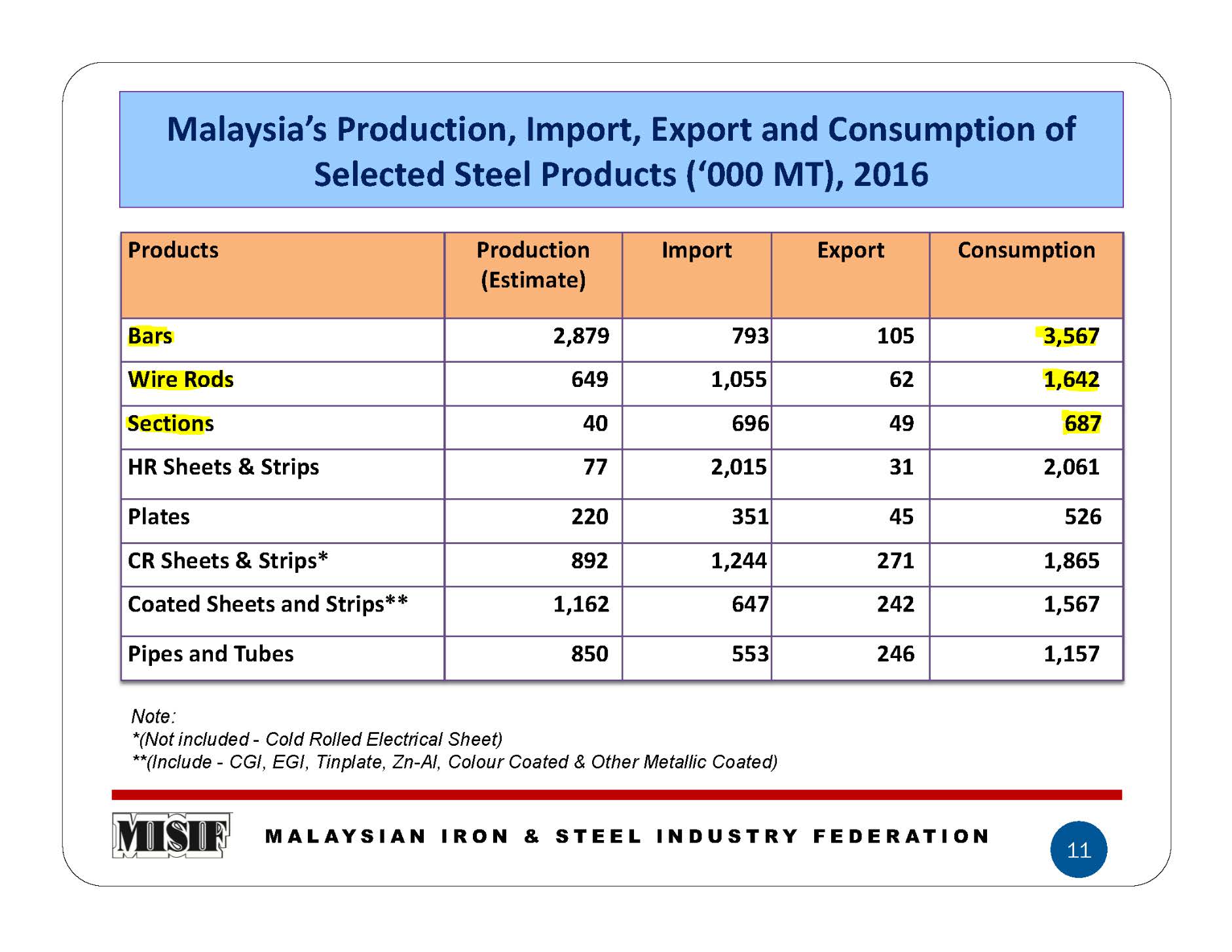

(PART 2) What is Malaysian Long steel consumption per annum?

..................................................................................................................................

Malaysian long steel consumption is already at 5.8 Million tonnes per annum in 2016 based on MISIF data. The total steel consumption per annum is at 13 Million per annum. Refer Bars and Wire Rods , Sections Consumption below:

http://seaisi.org/seaisi2017/file/file/full-paper/Malaysia%20Country%20Report.pdf

(PART 3) What is the impact to Local Steel Demand if both the HSR and ECRL projects are cancelled?

........................................................................................................................................................................

So then, what is the contribution of these project in terms of % impact after cancellation? That is simply part 1 HSR and ECRL demand divided by the total Malaysian consumption.

= 116,000 tonnes/annum divided by 5,800,000 tonnes/annum

= 2 % (yes, just two percent!)

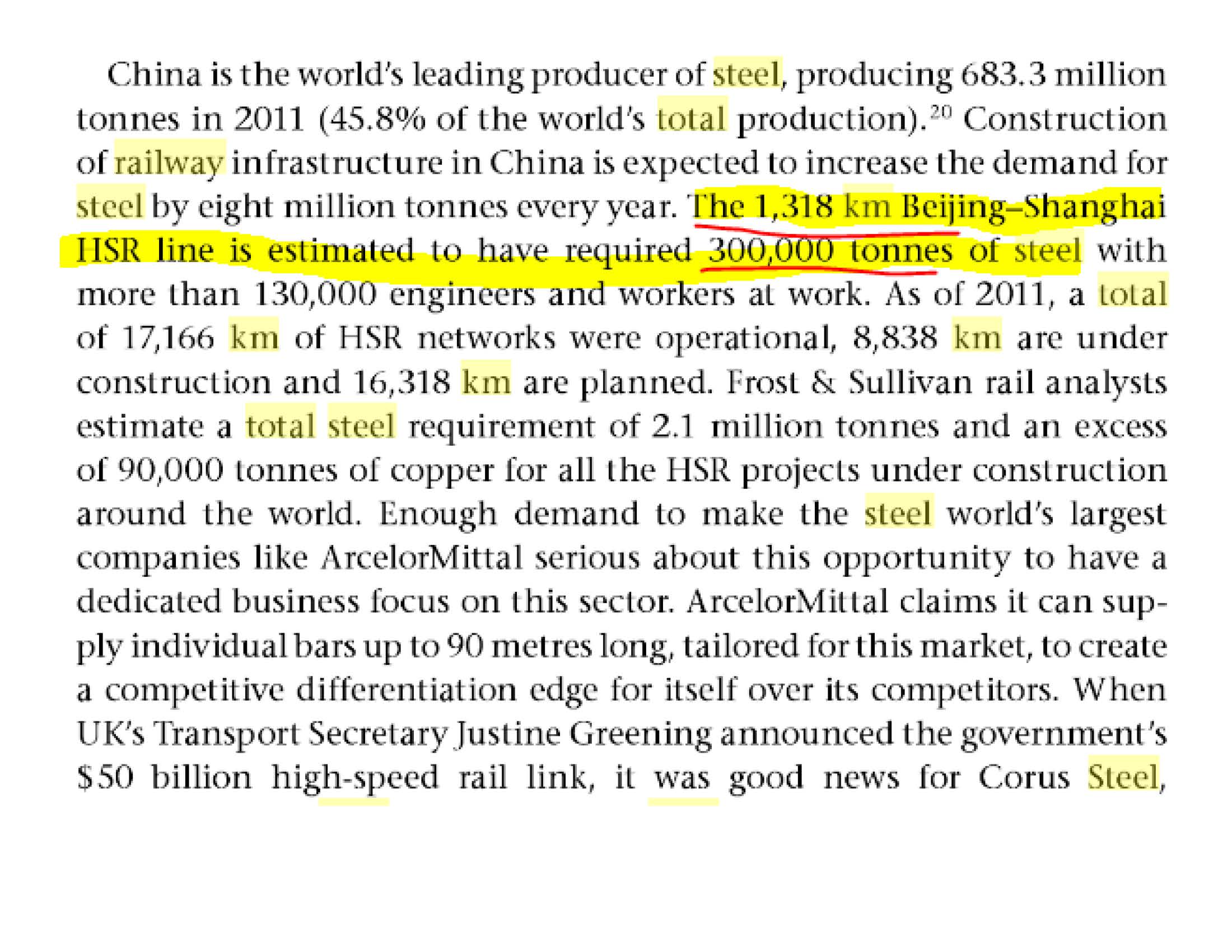

Note that the above estimation was done assuming the HSR is ‘elevated’ with supports and much bridges, tunnels etc, similar to the ‘state of the art’ HSR build in Europe. However, the China made HSR are known to be 1/3 cheaper than Europe as per below:

Reason being the tracks are made on flat track (unelevated) for long distances without extra structures (very similar to Malaysia).

One can see from below link and corresponding snapshot that China only consumed 300,000 tonnes of steel for a 1,318 km HSR project. That translates to 230 tonnes/km, i.e one third (1/3) lesser than France LGV steel material requirements.

That means, the actual effects to the local Steel industry could be very well below 1% in terms of total reduction in Demand. This negative effects should be negligible in comparison to the positice effects of steel capacity cuts taking place in China.

This then comes to the question whether the recent sell down on steel stocks justified? They had survived so long without these projects, what has changed so much now?

It is unbelievable to see that IB from Kenanga and UOB chose to capitalize on this news to give a derating on the local steel stocks while both Lionind and Annjoo had clearly expressed optimism on their business going forward in their recent quarterly financial reports.

NOTE: the above article was made assuming the ECRL project is cancelled but this is not the case currently.

More articles on Hard Datas

Created by FutureEyes | Aug 10, 2018

Created by FutureEyes | Aug 04, 2018

Discussions

All the steel companies in their QR prospect said the demand is supported by infrastructure projects. Now you said the so called demand is only 1%? Are you kidding?

2018-06-01 11:23

That is because the company management felt the stock price are depressed and wanted to give some good news as a catalyst. They can survive without these projects.

Posted by aslm > Jun 1, 2018 11:23 AM | Report Abuse

All the steel companies in their QR prospect said the demand is supported by infrastructure projects. Now you said the so called demand is only 1%? Are you kidding?

2018-06-01 11:28

That is for the construction companies, not steel.

Posted by davidkkw79 > Jun 1, 2018 11:31 AM | Report Abuse

Where got only 1 % ? At least 60% lar.

2018-06-01 11:33

Market is irrational to sell-down AnnJoo, LionInd and SSteel.

Look at their earning capability and current ultra-low PE, so mis-match.

The long steel companies have been making good profit in past 2 years without the HSR project, so what's so bad when HSR was cancelled.

2018-06-01 12:05

What so bad, you will know later, big impact on construction, material supply co. like cement, steel cables, etc....

2018-06-01 12:10

good article sharing ….. actually is 0% impact …. haha …. ECRL if tender project, once China companies successfully bid the project, steel will from China side or Alliance Steel …. so I wont take ECRL into the factoring for impact ….. for HSR project ….. implementation stage still far away maybe couple years later …. so who know couple years later HSR will put on the table again ….

For steel companies, should buy on dip ….. 1st choice go for lionind …. haha

2018-06-01 12:19

where got so much steel on cables? Its copper la!

look at this way...

When you have no HSR or ECRL...more cars and public transport on the road...

Cars and Buses made of what? Plastic kah?

Its so easy to fill up the entire highway lengths with transport vehicles....easy to do the maths on steel required on these new transport versus a few trains functioning for the entire HSR

2018-06-01 12:21

In a nut shell, scrapping HSR and ECRL will only drive demand in other type of transportations and infrastructure which consumers even more steel to cater the logistics need of Malaysians.

enough of cerita dongeng of these IBs...

2018-06-01 12:23

Even if you double the below figure considering the reinforcement steels for the concrete supports required, it only comes to about 280 tonnes max per km!

https://www.quora.com/How-much-steel-is-required-for-1-km-of-high-speed-rail

" a quick google search suggests that typical steel rail cross sections weigh between 40-70kg/m (26-48lb/ft) so for a kilometer of rail, we are looking at 40,000kg to 70,000kg. Of course a train requires two rails. This means a kilometer of rail will require about 80,000kg to 140,000kg of steel for the rail. This does not account for an bridges or other structural steel. but for flat ground rail should be a good ballpark estimate of the amount of steel required."

2018-06-01 13:33

but u still don't know whether they will maintain their level of profits......

2018-06-01 14:07

u can read this 10 times but u still don't know whether they will maintain their level of profits......

2018-06-01 14:08

ANNJOO already clearly mentioned, current rise in Electrode costs and Scrap steel is highly advantages to its BOF business.

LIONIND is exporting its Iron (not steel) produced from Antara Steel.

why should there be any significant impact on margin?

when China is continuously reducing its steel output.

2018-06-01 14:12

If government help local Long steel makers just to capture market share by another 5% from those import figures of 2,500,000 tonnes per annum for Long steel alone (refer MISIF 2016 chart above), it is like having 3 x (HSR + ECRL) new projects in Malaysia.

2018-06-01 20:28

Thanks for doing the maths. You did miss out the stations, but I’d bet that the buffer you built into your calculation for the tracks more than covered for the steel usage in building the stations.

The sad fact is that, the vast majority doesn’t know how to quantify. Ppl who don’t understand things get panic easily.

2018-06-01 22:10

Long Steel Players Bull Run now over.

SSteel, Masteel, AnnJoo, Lionind as well as Prestar.

With Project after Project cancelled the demand will shrink.

Same goes for all cement counters.

Today I bought cement at Rm13.50 for a 50kg bag.

This was Year 2008 prices - 10 years ago. At its peak I bought one bag of cement for Rm20.00 (48% higher)

SO BOTH LONG STEEL & CEMENT STORY NOW OVER. BETTER SELL ALL AND GET OUT!!

The Good Ones Are Flat Steel

Flat Steel as Opposed to Long Steel for Infrar works cater to consumers

As GST will be scrapped this June to Sept 2018 there will be a rise of demand for Cars, Fridge, TV panels & all things made for consumers

Flat steel stock like CSCSteel will be fantastic as it produce Flat Steel Sheets for Car Roof, Doors, Bonnets, Fridge Doors & TV panels.

Good luck

2018-06-01 22:21

Thanks for pointing out Warn3r. There is definitely enough buffer.

Double it if you want but it never comes any where close to these figures:

https://www.reuters.com/article/us-china-steel/china-aims-to-meet-2020-target-for-steel-capacity-cuts-this-year-warns-on-resumption-idUSKBN1FR10M

China shut down 115 million tonnes of steel capacity between 2016 and 2017, and closed 140 million tonnes of induction furnaces that use scrap metal to make steel.

Analysis: China to continue steel capacity cuts in 2018

Mar 07

https://news.metal.com/newscontent/100784544/analysis%3A-china-to-continue-steel-capacity-cuts-in-2018

China will cut another 30 million mt of steel capacity in 2018 and intensify efforts to liquidate bankruptcies, reorganise so-called ‘zombie firms’, and resettle retrenched workers and debt, Premier Li Keqiang announced at the National People’s Congress on Monday March 5.

China plans to cut steel capacity by 100-150 million mt by 2020

2018-06-01 22:25

30 Million tonnes per annum steel capacity reduction in China for 2018 alone versus Total 3.5 Million tons of local Malaysian production per annum.

The magnitude of regional demand outpacing the shrinking supply speaks very loud and clear from above figures.

2018-06-01 22:30

FutureEyes, it’s sad to see that after you doing some maths, it didn’t occur to some people that they need to re-think the real impact, in the context of macro and local environment.

Admittedly, cancellation of mega projects has its secondary effect on other private developments. But trying to conclude the current / future market of long steel based on a personal one-off experience in buying one bag of cement... is just pure stupidity.

2018-06-02 10:33

Guan Eng on HSR: 'You can get something... for half the price.'

https://www.thestar.com.my/news/nation/2018/06/02/guan-eng-on-hsr-you-can-get-something-for-half-the-price/

Asked if the economic benefits outweighed the cost of the rail link, Lim replied: “Is it worth it? You can get something for cheaper, for half the price.”

“What we are seeing are projects that are double the market price,” Lim said.

2018-06-02 12:39

Appears like the project cost estimators intentionally over estimated the material requirements so that they can find loop holes to syphon money.

Actual material & construction engineering plus labor costs could be just 20%...remaining 80% all goes to BN cronies.

2018-06-02 12:53

Like FutureEyes estimated, what is 116,000 ton per annum local steel demand reduction compared to 30,000,000 ton permanent steel output reduction for 2018 alone by China?

Divide the 30,000,000 ton (reduced output by China) by 10 surrounding countries, you still get 10,000,000 ton per country reduction in competitive supply.

2018-06-02 12:59

HSR and ECRL steel tracks for sure are imported. Our Malaysian steel factories do not make this type of steel. So, wheather projects on or off, no effect on our steel industrial. But, it has impact on our debts. Better scrap these projects.

2018-06-02 16:22

Value investors should be interested in buying steel stocks on this low price level.

2018-06-02 16:28

y tecpower > Jun 2, 2018 04:28 PM | Report Abuse

Value investors should be interested in buying steel stocks on this low price level.

=============================

value investors should start from business sense.....not last year profits.

2018-06-02 16:33

http://www.sunsirs.com/uk/prodetail-927.html

China rebar price rebounded nicely.

2018-06-03 00:25

Warren Buffett Strategy: Long Term Value Investing

http://www.arborinvestmentplanner.com/warren-buffett-strategy-long-term-value-investing/

Long Term Value Investing

Benjamin Graham taught the long term value investing strategy of purchasing stocks at a price below their intrinsic value; then holding them until their price reflects the real value of the company. Warren Buffet described Benjamin Graham’s Intelligent Investor as “by far the best book on investing ever written”.

2018-06-04 00:08

FutureEyes, does that mean the steel guys are even more reliant on property development which is also slowing down?

2018-06-29 11:33

JayC

good article

2018-06-01 11:16