TFP (0145) - Bullish Biased - Potential Beneficiary of SST Implementation !!

Investhor

Publish date: Fri, 10 Aug 2018, 12:53 PM

So, recently the government had passed the Tax Bill for implementation of SST in 2018. Article below referred:

http://www.theedgemarkets.com/article/parliament-passes-sales-tax-bill-2018-0

One counter that recently caught my attention is TFP Solutions Berhad (BSKL:0145). There are a few points to note on this company :

1. Potential Beneficiary of SST Implementation

The company website is referred:

http://www.tfp.com.my

TFP specializes in providing business productivity solutions and services for business enterprises. Therefore, as SST is being reimplemented back into our financial system, businesses and corporations will be engaging companies such as TFP to reorganize and restructure their tax systems in order to comply with government regulations.

2. Technical Analysis Point of View - Bottom Fishing With Higher Upside Potential

Refer below daily chart for TA point of view :

TFP has been on a downtrend since March 2018. However, there are few signs that the bottom might have been reached and trend has changed. Refer numbered circles :

1. Potential breakout above 15 will take it to test 17.5 and 20 respectively

2. Daily macd crossed upwards indicating bullish momentum

3. Stochastics moving from and oversold position, upwards

4. Increasing volume indicating more participation from market members

5. RSI moving upwards indicating short term bullish momentum

3. Financial Analysis Point of View - Potential of Earnings and Profit Growth

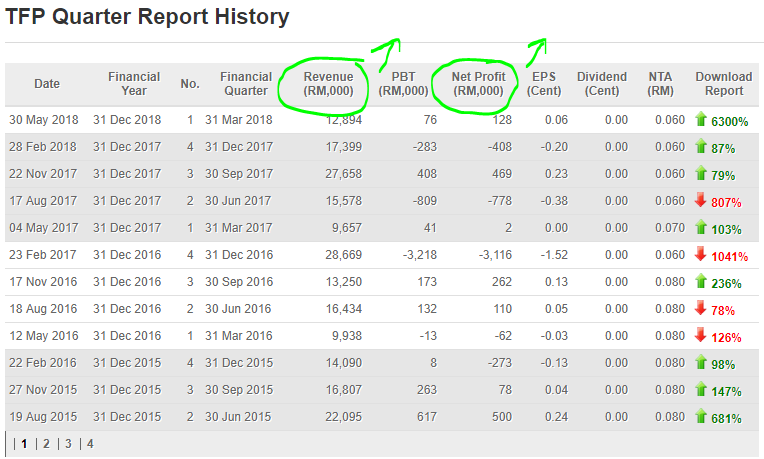

Below past quarter reports referred:

As you can see,the previous quarter had recorded profit eventhough it is small. With the upcoming SST implementation, the earnings potential of TFP could be reaching toward Revenue RM 20 - 30 million and net profit between RM 500k to RM 2 million. Therefore, I see that the worst is over for TFP.

In addition, last year August, TFP recorded a lss of RM 778,000 against revenueof RM 15.578 million. Thus, it is foreseen that this month August 2018 report should be showing improvement compared to last year corresponding quarter.

4. Conclusion

With the above opinions, I am setting a personal target of below for TFP:

Target Price 1 - 17c

Target Price 2 - 20c

Target Price 3 - 25c

-Short Term - bullish bias

-Medium to Long Term - slight bullish (pending Kumo breakout)

Thanks for reading :)

Yours Hammer Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

jeffng570

haha..talk alone here

2018-10-10 11:02