MJPERAK (BSKL Code 8141) - Time to Catchup with brother KUB ??

Investhor

Publish date: Mon, 18 Mar 2019, 05:35 PM

Hello investors of BSKL,

For today, i came across an interesting stock which I feel I should share with everyone. Below my thoughts on it:

MJPERAK (BSKL Code 8141 - MAJUPERAK HOLDINGS BERHAD, Sector : Property, Main Board)

TP 1 - 26c (short term) , TP 2 (on breakout) - 30-33c, TP 3 (long term) - 60c

Lets look at this counter from the 3 different angles again which are share float, Fundamentals and Technical Analysis.

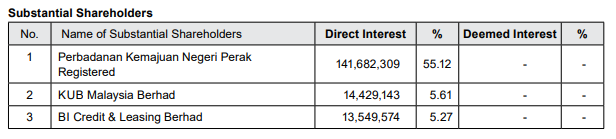

1. Share Float & Major Shareholders

First of all, you must be wondering why the title of the article is so. Please refer to below extract taken from 2017 company annual report :

Total float shares for this company is 257 million, of which 55% is being held by PERBADANAN KEMAJUAN NEGERI PERAK. Therefore this leaves about 45% float remaining or about 116 million shares.

Refer to number 2 biggest shareholder, which is KUB. I trust a lot of you are aware that KUB (Stock Code 6874) was trading at 24c in December 2018, but there was a big interest in this stock and the price has skyrocketed to 40.5c as of today, making KUB a whopping 66% return for those who held the stock at lower prices.

Due KUB owning 5.6% of MJPERAK, I believe that the market will adjust and realize the true value of this counter as they are both interlinked.

2. Financial Analysis

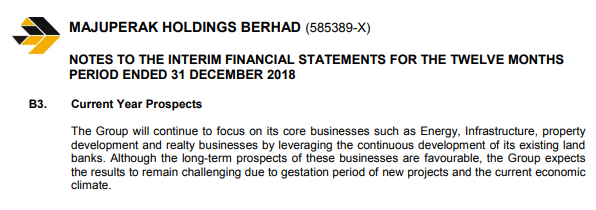

Below extract from latest quarter report analysis for MJPERAK on its latest assets and prospects:

From the above, what I can see is that the company is trading way below its official Net Tangible Asset (NTA) Value of 70c (discount of about 68% for current price 22.5c). Refer circle 1, where company has RM 113 million worth of land that is held for property development.With improving economy and affordability of Malaysians, I trust that this landbank would be put to good use in the near future.

3. Technical Analysis

Refer below weekly chart of MJPERAK:

As you can see, ths counter has been on a downtrend since June 2017 and there had been 2 attempts to break the downtrend at Circle 1 and 2. Recently, there had been a lot of buyer support around 20-22c area (circle 3) which had caused MACD to cross upwards and cause bullish momentum (circle 4). We could also see the volume increasing at a good rate (circle 5) and RSI pointing upwards (circle 6).

Below is mirror chart for same period for KUB. We can see that KUB experienced a spike of price recently, whereas MJPERAK had not yet experienced such a spike.

CONCLUSION

From the above thoughts which I have elaborated, I believe that MJPERAK trend is bullish based on the following:

a. Interlink with KUB - lagging behind KUB which is a major shareholder of MJPERAK (5.6% ownership)

b. Huge assets with potential to be unlocked - trading way below NTA of 70c which assets could be used by company for development or profits unlocked via sale

c. Bullish weekly chart - crossing of MACD, building volume and upwards RSI

Until next time, thanks for reading.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020