<< WHY I THINK THIS STOCK MIGHT POST A SUPERB MAY 19' RESULT !!! >>

Investhor

Publish date: Sat, 04 May 2019, 11:22 AM

Hi to all fellow investors and traders !

Today I would like to highlight a stock which I think might be posting a superb/consistent quarter result in May 2019. That stock is PCCS GROUP BERHAD or PCCS (Code 6068, Main Board, Consumer Products/Services).

PCCS (BSKL Code 6068)

Personal TP Short To Mid Term : 57c, Long Term : 81c

Here are my thoughts :

1. Study of Latest 4 Quarter Results - Important Findings !!!

Please bear with me while I explain my findings on the latest 4 Quarter Results analysis:

i. Undervalued Counter - Currently Trading at PE Ratio of 5.2 of Forward PE

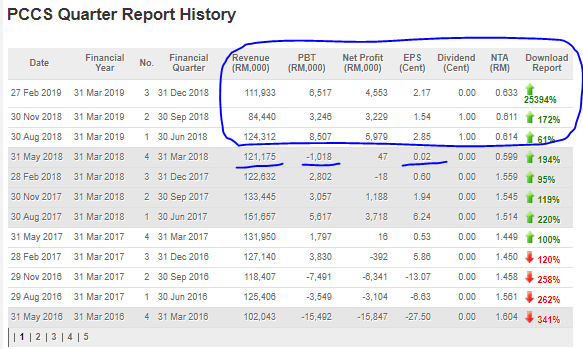

Refer below screenshot for PCCS QR summary. Latest 3 quarter results shows total EPS of 6.56 cents. NTA of company remains at 63.3 cents as of recent quarter.

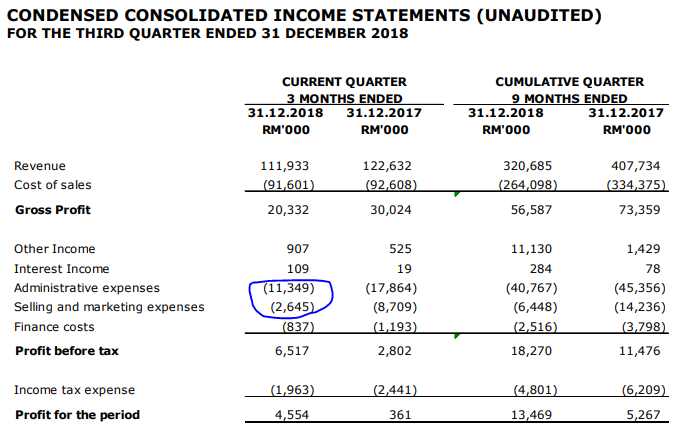

Last year May 2018 report, PCCS has recorded a small net profit of RM 47,000 on the back of revenue of RM 121 million. This was mainly due to the high administrative & selling/marketing expenses incurred.

If we take a conservative 2 cents EPS for May 2019 target, the full year EPS will be at 8.56 cents. This means at current price of 44.5 cents, the company is merely trading at 5.2 ratio of forward PE !!!

Taking a reasonable 9-10 PE Ratio as TP, the stock should be worth around 77 - 86 cents in the longer term !!

ii. Reduction of Expenses - Company Commitment to Improve Bottom Line

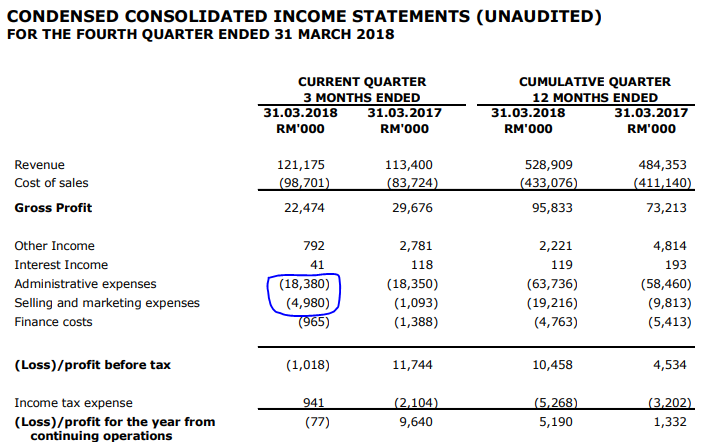

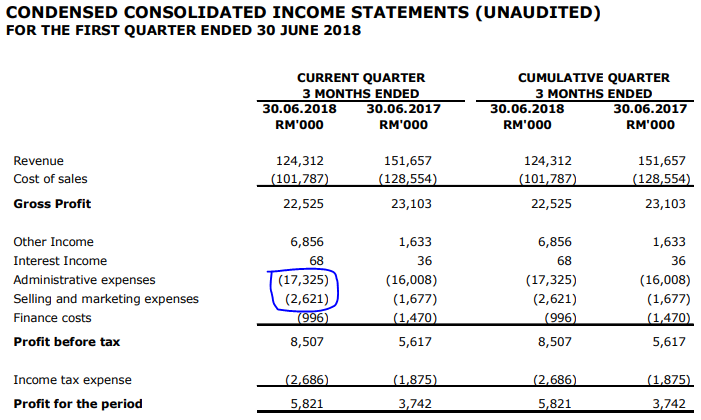

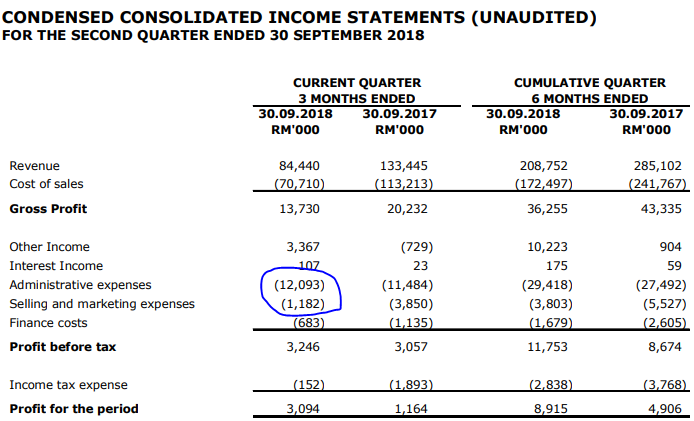

Refer below the latest 4 quarters income statements. I had circled the issue which I wish to highlight here, which is the Administrative & Selling/Marketing Expenses.

We can see, that the Company has SIGNIFICANTLY reduced its administrative & selling/marketing expenses in the latest 2 quarters (from 23.4 m, to 19.6 m, to 13.2 m and 13.9 m). Cost savings of roughly RM 6-10 million (30-50%) to improve company bottom line. I foresee that this improvement shall carry on to the latest QR of May 2019, indicating the company's commitment and consistency in reducing costs to improve profit for its shareholders.

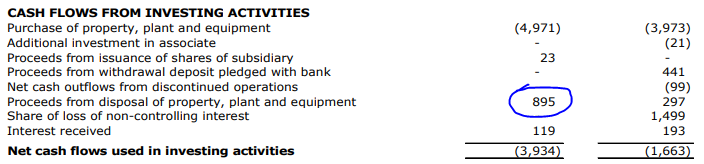

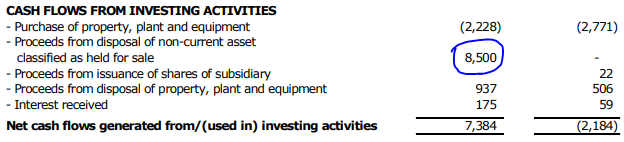

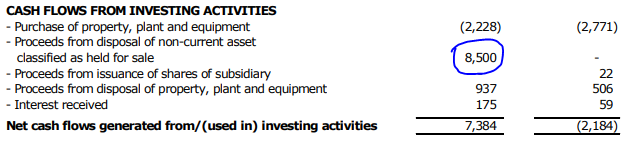

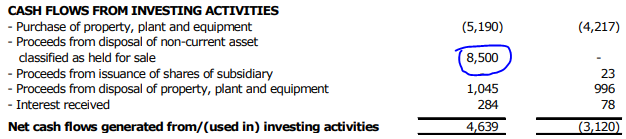

iii. Disposal of Asset Worth RM 8.5 million, Yet to Be Captured as Profit ???

Refer again the latest 4 quarters Cash Flow Statement as below. I will circle the part which I wish to highlight.

If you notice, there was no disposal of RM 8.5 million captured in the May 2018 QR. However, this item started to appear in Aug 2018, Nov 2018 and again in Feb 2019 report. I believe this disposal was still in progress and therefore has not yet been reflected as a gain in the income statement.

There is a high possibility that this RM 8.5 million disposal might appear as a realized gain, whether in May 2019 or August 2019 QR, as usually assets take about 6-9 months for disposal and realization of gains. Should this gain appear in May 2019, this would positively boost up the EPS of this counter and reflect a higher target price.

May 2018 QR:

Aug 2018 QR:

Nov 2018 QR:

Feb 2019 QR:

2. Technical Analysis - Consolidation in Bullish Flag Formation About to End

Refer below daily chart of PCCS. Price had peaked to 56.5 cents on 9 April 2019 and had since then been in retracement along the bullish flag pattern.

As we can see, the 42-43 cents area had become an RTS (Resistance Turned Support) Area, which buyers had been supporting lately. There had been 5 times where this counter had stepped into this RTS band, and price has rebounded from the lows.

MACD is consolidating towards a crossing soon, whilst stochastics indicated that the counter is oversold and starting to buck the trend.

I foresee, that a breakout of this flag pattern shall allow this counter to trend back towards its recent high of 57 cents, then move towards its long term target of 81 cents.

CONCLUSION

Based on my opinion, PCCS should be reporting a good/consistent May 2019 QR which will support its uptrend continuation, based on below:

i. Total anticipated EPS full year at 8.56 cents. Taking 9-10 PE Ratio, the stock should be worth around 77 - 86 cents.

ii. SIGNIFICANT reduction of RM 6-10 million (30-50%) in its administrative & selling/marketing expenses in the latest 2 quarters, indicating company commitment to improve bottom line.

iii. Asset Disposal of RM 8.5 million, pending to be captured in the income statement

iv. Ending Its Bullish Flag Consolidation - Potential Uptrend To Recent High of 57 cents, and long term TP of 81 cents

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

Lets refer to few similar retailers in apparel business:

1. Padini trading at 15x PE

2. Bonia trading at 13x PE

3. Aeon trading at 19x PE

4. Parkson trading at -11x PE

(All figures taken from www.malaysiastock.biz)

Therefore I believe PE of 9-10 should provide a conservative outlook for the stock’s fair value

2019-05-04 12:42

I just see directors disposing heavily recently. NOT like Padini and Bonia share buy back frequently.

https://www.malaysiastock.biz/Corporate-Infomation.aspx?securityCode=6068

2019-05-04 12:55

Anyway, PCCS using blue highlight, and another Edaran using green highlight, very colorful.

2019-05-04 12:56

@ramada - I have to correct your mistake there u said ‘directors’ but recently in 2019 only 1 particular ‘director’ has pared down some insignificant stakes in the company, which I see as a non issue as this particular director had subscribed to the rights issue exercise last year, which means he is supporting the company when required.

Maybe you don’t understand such basic reasonings as you only wish to criticize without brains.

2019-05-04 13:08

No news is good news, when this post come out mean the banker already get enough cheap shares, why don't write when 27 FEB the quarter financial report out but now 04 MAY almost 2 months after. The share price at 28 FEB only 0.255 to 0.265, yesterday is 0.420 to 0.455.

2019-05-04 13:08

@megacity - I am writing at the point the company is on retracement. I had only recently had the time to conduct a detailed study on the financials.

I would think this is better than writing an article when the company was at top price of 56.5 cents in early April 2019.

2019-05-04 13:12

If no brain, how do I win for 5 years continuously, especially last year when others were hit badly. Think about it, kid. I just analysis with facts and figures.

2019-05-04 13:15

@ramada - ok go ahead and boast.i know many winners out there and as a fact they don’t boast openly like u

Anyways thanks for your feedback, it is noted

Maybe you should contribute more to society by doing your own opinion article instead of just stopping by others and criticizing

2019-05-04 13:19

Who says I always criticizing others? I always thank davidtslim and Wah Lau for their articles, because they talk with facts and figures.

2019-05-04 13:25

Ok then, because my articles are also based on facts and figures laid out in quarter report and charts. But seems you have a negative bias towards me because you never thanked me even though I have taken my own time and effort to do my sharings with the community.

But it’s ok i am not looking for recognition. I will continue to contribute sharings based on facts and figures to the community, as much as i can

2019-05-04 13:30

Ramada has got a point on why directors are disposing heavily where they should be buying. Rocket needs a booster, seems to have lost steam here (hence appearance of this article?). Red flag here.

2019-05-04 16:27

You can use either traffic exchanges or autosurfs to generate more clicks for your promoting articles. It really work!

2019-05-04 16:31

But no readers will read it thoroughly. Top article so what. Cheat yourself only.

2019-05-04 16:33

@ramada - sorry i don’t use such fake actions to promote traffic. If you have such negative bias towards me, then you don’t need to waste your time here.

@teareader819 - noted on the disposal of director however we don’t really know the intention of disposal. However, as i mentioned earlier they had susbribed to rights issue exercise in 2018, therefore paring some stakes when the price spikes is normal as they had forked out cash when other investors would not have. Selling has stopped since 25/4/2019.

Recently Ekovest also saw disposal by major shareholders/directors during price spike, but it didn’t stop price from moving higher.

2019-05-04 16:52

I dont see how reducing administrative & selling/marketing expenses is a commitment to improve bottom line? Unless you mean improve short term bottom line and destroy long-term bottom line

2019-05-04 16:53

i dont comment on your overall analysis. But i found one thing which is false and misleading. I'm not sure whether you are aware or you are not skillful in reading financial report. You have more room to improve your analytical skill.

Quoting your point from "iii. Disposal of Asset Worth RM 8.5 million, Yet to Be Captured as Profit ???"

I expect you have read the whole relevant QR, since you captured it on your post. Did you find out the "Non-current asset classified as held for sale" under SOFP is zero? Because you are telling me this asset haven't been realized yet, so there should be 8.5 million value under this column.

"There is a high possibility that this RM 8.5 million disposal might appear as a realized gain, whether in May 2019 or August 2019 QR, as usually assets take about 6-9 months for disposal and realization of gains. Should this gain appear in May 2019, this would positively boost up the EPS of this counter and reflect a higher target price."

You read the figures from QR but you don't understand the figure. From SOCF, 8.5 million is stated under "Proceeds from disposal of non-current asset classified as held for sale". It means the proceeds of disposal is received by the company.

Based on reporting requirement, any profit/losses must be recognized under the same quarter the company receive the full payment.

You know the asset is worth 8.5 million. But do you know the cost of the asset? How you know it be would realized as a gain on disposal? How much profit it would be realized? Did you find the book value of the asset from annual report?

The disposal is only considered as profit when the selling price is higher than book value.

Since you are putting effort on doing research on this company, did you look through the company announcement too?

The answer is here:

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5683829

Whenever there is huge amount of transaction company must make announcement of it. The company cannot hide it.

I expect you have read the FIRST QUARTER ENDED 30 JUNE 2018 Report, since you captured it on your post.

Did you find out,

under explanatory note, Performance review section.

The higher profit was mainly due to gain on sales of land and building amounting to RM4.5million in Perusahaan Chan Choo Sing Sdn. Bhd. ??

2019-05-04 17:13

@syndicates - your comment is noted with thanks. i do admit that there is room for improvement, and will be more thorough in future.

Despite that, with the consistent revenue and cost control measures company is embarking, even without asset disposal gain (proven in February 2019 report where there was no asset disposal gain), the company is still able to deliver EPS of 2.17 cents.

2019-05-04 17:31

Padini, Bonia, Aeon, Parkson I got see before lah. This one what shop they open ah? PCCS? Never heard or see before leh

2019-05-04 17:37

Their main apparel business is now focused in Cambodia and China..read the quarter reports

2019-05-04 17:43

FINANCIAL EFFECTS OF THE PROPOSED DISPOSAL

10.1 Earnings

The Proposed Disposal will not have any material effect on the

earnings of PGB for the financial year ending 31 March 2018.

10.2 Net Assets

The Proposed Disposal will not have any material effect on the net

assets of PGB for the financial year ending 31 March 2018.

10.3 Gearing, Total Issued Capital and Substantial Shareholders

The Proposed Disposal will not have any effect on the gearing, total

issued capital and substantial shareholders’ shareholdings of PGB.

2019-05-05 18:46

Thank you Investhor for this article. I have been following PCCS for quite some time after looking at it result keep improving since the 4th quarter of 2017. If u read the Financial Report for 2018 also show the sign that this company's result is improving. However, this is not a hot counter in the past and had been traded much lower than NTA for long time. Well, I believe a lot ppls use the same method by KYY, as such, I also some at low price.

Regarding the heavily sale by director name Chan Chow Tek, it do raise a concern to me be honest, but he already 62 years old and he disposing it share even good qr issued. As such, I don't think is a big concern to me.

It business mainly focus in China and Cambodia. In it latest article mentioned that Apparel sale in China is challenging but remain profitable. Also the Company has show it effort to reduce the admin expenses. I believe the result for 2019 is very convincing.

Based on TA, Investhor is right that retracement happened after it spike to new high. But looking at few high volume u can see from chart, I believe smart money still there. I will keep my holding.

2019-05-05 19:07

Yes director keep sell however there is support on 42 cent till 45 cent. Seem that someone is acquiring. Possiblw new high in short termcoming

2019-05-05 21:46

29-Apr-2019 Insider MR CHAN CHOW TEK (a company director) disposed 889,000 shares at 0.460 on 25-Apr-2019.

2019-05-05 23:06

Disposal of assets is usually a bad sign. Why do this if you are progressive?

2019-05-06 10:09

Investhor, Thanks for the article. The asset disposal gain have already happen as you outlined in its Cash Flow Statement,ie, PCCS received the sum of RM8.5M.

The reason you are not able to see it in the income statement is because the gain of RM 0.45M (RM8.5m - RM8.05m) is grouped into Other Income along with other related items.

2019-05-06 10:11

Mc_Wei

Any reason why you think 9-10x PE is reasonable for this company?

2019-05-04 12:28