Grabbing A Slice of RM 418 Million Market (& Growing) !!!

Investhor

Publish date: Sat, 05 Oct 2019, 09:39 PM

Hi to all fellow investors and traders !

Today I would like to highlight the following counter:

SEDANIA INNOVATOR BERHAD or SEDANIA (Code 0178, ACE Market, Telco & Media)

SEDANIA - Grabbing A Slice of RM 418 Million Market (& Growing) !!!

Here are my thoughts :

1. Size of the Current MALAYSIA E-Sports Market (RM 418 million & Growing)

https://www.mida.gov.my/home/-the-gaming-industry:-a-new-game-of-growth/posts/

Refer above article by MIDA which highlights Gaming Industry as a new engine of growth.

It was mentioned that in 2018, the Gaming Industry alone contributed to USD 100 million to Malaysia's revenue (translating to about RM 418 million), with expectation of an annual growth rate (CAGR 2018-2023) of 10.9%, resulting in a market volume of RM 702 million by 2023.

During budget 2019, a total of RM 10 million was allocated to develop e-Sports. With this commitment shown by the government, e-Sports in Malaysia is expected to boom in the coming years, as Malaysia aspires to be the e-sports hub in the region.

2. Smart Partnership To Capture A Slice of the MALAYSIA E-Sports Market

Below article from the Edge Markets on 3rd October 2019, mentioning that SEDANIA has ventured into E-Sports business, via a special vehicle which they will have a 42.55% stake in, to launch a global E-Sports tournament and media network.

The JV Company is called Esports Pte Ltd (ESPL), which is incorporated in Singapore.

https://www.theedgemarkets.com/article/sedania-innovator-ventures-esports-business

I do not want to repeat what the article said, however I do wish to highlight that SEDANIA had been smart in choosing partners for this venture.

Their first partner is iCandy Interactive Limited, which is listed on the Australian Stock Exchange (https://www.investing.com/equities/icandy-interactive-ltd-company-profile). iCandy will also hold a 42.55% stake in the JV. iCandy is a company specializing on the mobile games market.

Website - https://www.icandy.io/

The third partner is Michael Broda, who will hold the balance 14.9% stake. Michael Broda is the former chief of eSports.com AG, which is one of the leading company in the E-Sports space. He will also be the CEO of the JV Company, ESPL.

Looks like they are NOT WASTING ANY MORE TIME. They are taking fast action. Refer below article, which mentions that ESPL has announced that it will create a global e-sports tournament and media network, starting with national e-sports competitions in ASIA, starting in 2020. They will be targeting amateur gamers with a path to become professionals.

One of the likely games is MOBILE LEGENDS !!! This game is currently famous and crazy among kids as young as 10 years old up to working adults. I am sure if they execute a proper strategy to penetrate this market, they will be able to capture a slice of the big pie.

3. Potential Contribution of Earnings by the JV Company

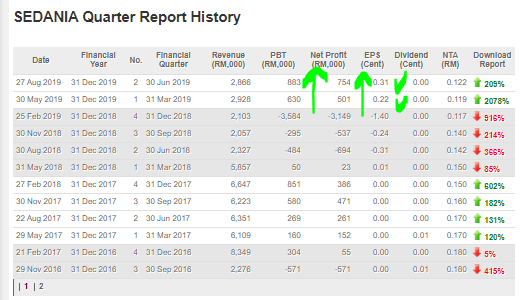

Refer below latest QR summary of SEDANA. Their net profit has been improving for the past 2 quarters, with the latest quarter posting net profit of RM 754,000 (EPS 0.31 cts) on the back of RM 2.886 million revenue.

The below calculation is purely theoretical, and my own opinion on the estimated earning contribution by the JV company.

Let's say ESPL is able to capture a 3% market share (being a new player, but with expertise from good partners in the JV) with a 20% net profit margin. This would mean a total revenue of RM 12.54 million and net profit of RM 2.508 million.

SEDANIA's portion of the earning will be RM 1.067 million, which translates to about 0.43 cts EPS. If this is added to the current earnings of the company, it would mean about 0.74 cts EPS per quarter, translating to about 2.96 cts full year. This gives a fair value of around 30 cts for a 10 X PE Ratio, as a long term target.

Of course, should the JV be able to capture a larger market share with higher margin, then the fair value price would be higher than 30 cts in the long term.

4. TA Analysis - Ichimoku Cloud Breakout With Strong Volume

Refer below daily chart of SEDANIA. A few observations below:

i. SEDANIA hit a recent high of 31 cts, in early April, then retraced to a recent low of 12 cts, before closing at 17 cts on Friday, 4th October 2019

ii. Solid Marubozu candle appeared on Friday 4th October 2019, with significant volume increase

iii.. Price has broken ICHIMOKU Cloud, with bullish momentum indicated by the MACD crossing the signal, and stochastics on upward trend

iv. Resistances seen at 20 cts, 25cts and 30 cts

CONCLUSION

Based on my opinion, I believe SEDANIA should be seeing interesting trend in the weeks ahead. based on below:

i. SEDANIA smartly chose partners to penetrate the Huge E-Sports Market of RM 418 million in 2018 and Growing up to RM 702 million by 2023

ii. Potential Fair Value of 30 cts in the long term by capturing a 3% slice of the market, with 20% profit margins

iii. ICHIMOKU Cloud breakout, indicating further bullish momentum towards resistances 20, 25 and 30 cents

Thanks for reading and see you in the next post.

THE ABOVE IS NOT A BUYCALL AND ONLY A PERSONAL OPINION ARTICLE AS A SHARING TO BSKL COMMUNITY MEMBERS.

Yours Truly,

INVESTHOR

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Investhor's Mighty Hammer of Wisdom

Created by Investhor | Sep 27, 2021

Created by Investhor | Aug 14, 2021

Created by Investhor | Aug 07, 2021

Created by Investhor | Mar 20, 2021

Created by Investhor | Aug 22, 2020

Discussions

Up only post..retailet pandai pandai. Talk about e sport..go to US share market. Better prospect for e sport stock.

2019-10-06 10:24

Calvin was right.2.5 million per year....Too small.Some-more only beginning(come out profit or not is another problem...Expect profit taking starting Monday 7/10/2019-9/10/19.

2019-10-06 21:53

@calvintaneng - you lost my respect with this not-so-smart comment..the comparison is totally not apple to apple..the potential revenue & profit that SEDANIA stands to gain from this JV is very significant compared to its current financials..with the current share price on the low range, there is alot more potential upside compared to downside

Just bcoz you missed the bandwagon on this, don’t become a sourgrape and use my post to ask people to join your elephant ride..

2019-10-06 22:15

@Michael Kwok - another newbie comment..from Calvintan follower i guess..

Tip for beginner like u..invest at the early startup stage is where the biggest gains are made..as compared to chasing a stock which already moved up alot and so many promoters calling for it to go up to unload their low price stocks..

Profit taking is normal..in a bigger trend..be smart and catch in on a forced selling day..

2019-10-06 22:18

hahaha now sudah go up, of course can say how great it is. Let me see what u say when the share price starts going back downtrend

2019-10-07 12:02

speakup

kids today no need study, just play games better.

2019-10-05 22:54