Mplus Market Pulse - Sentiment remain indifferent

MalaccaSecurities

Publish date: Fri, 30 Oct 2020, 10:16 AM

Market Review

Malaysia: The FBM KLCI (-0.3%) retreated as investors remained cautious amid surging Covid-19 cases and the recent political developments ahead of the Budget 2021 announcement. The lower liners ended lower, while the telecommunication sector (+0.7%) outperformed the mostly red broader market.

Global markets: US stockmarkets rallied overnight as the Dow (+0.5%) ended higher after four trading sessions of losses, boosted by technology stocks ahead of the companies’ quarter report. European and Asia stockmarkets closed mostly in red.

The Day Ahead

We reckon that the consolidation may prolong owing to uncertainties surrounding the political developments on the local front, impending US election, rising number of Covid-19 cases globally and pace of economic recovery in the final quarter of 2020. The lower liners are also in a purple patch as sentiment remain cautious with quick profit taking are limiting any significant gains. Hence, we continue to advocate the “hit and run” technique, keeping trades in a shorter time frame.

Sector focus: Under the prevailing volatility, we see the plantation stocks to be in favour as CPO prices remain steady above RM3,000/MT. In the meantime, the construction sector may come into focus as we approaching the tabling of Budget 2021.

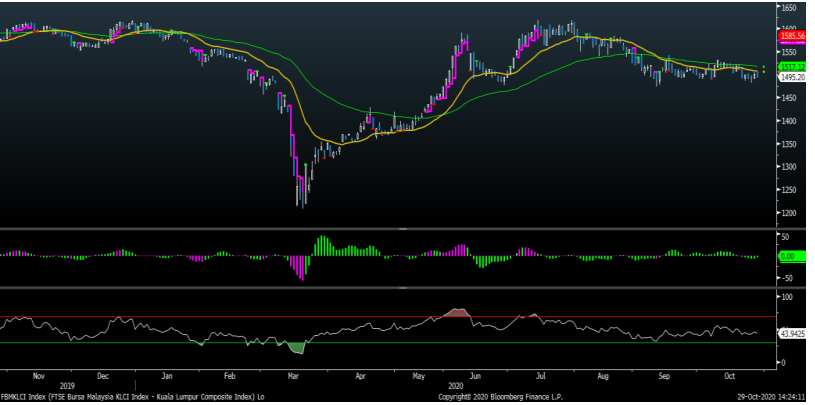

FBMKLCI Technical Outlook

Despite opening higher at the start of the trading bell, FBM KLCI erased most of its previous session gains to remain closed below the daily EMA9 level. The lack of follow-through buying support suggests that consolidation may prolong with the immediate resistances located at 1,520-1,530. The immediate support is at 1,470- 1,480. Indicators have turned negative as the MACD Histogram has turned red, while the RSI remains below 50.

Company Brief

Asia Poly Holdings Bhd’s 3QFY20 net profit stood at RM4.1m, as compared to a net loss of RM2.1m recorded in the previous corresponding quarter, mainly attributed to higher average selling price, lower material cost and better factory utilisation rate. Revenue for the quarter rose 49.1% YoY to RM30.1m. (The Star)

WCE Holdings Bhd has entered into a memorandum of agreement with Seriemas Development Sdn Bhd to build a proposed access from West Coast Expressway to a mixed development project in Kota Seri Langat. The proposed highway access, that includes the construction works of a bridge, main drainage and water pipes was valued at RM126.8m. (The Star)

Sunway Construction Group Bhd (SunCon) has secured a contract worth RM315.0m from the National Highways Authority of India via a consortium. The contract comes along with a 15-year operating and maintenance contract at approximately RM850,000 per annum. (The Edge)

AT Systematization Bhd, which is building its glove manufacturing factory in Perak, expects to reach a production capacity of up to 2.6bn pieces of medical-grade nitrile gloves per annum by June 2021. Each single former production line can run at a speed of 15,000 pieces of gloves per hour, whereas each double former production line can run at a speed of 24,000 pieces of gloves per hour. (The Edge)

Lotte Chemical Titan Holding Bhd’s 3QFY20 net profit fell 13.7% YoY to RM78.8m, due to lower revenue, higher share of associate losses and higher operating cost resulting from Hurricane Laura. Revenue for the quarter dropped 10.5% YoY to RM1.94bn. (The Edge)

ATA IMS Bhd's 2QFY21 rose 68.4% YoY to RM52.3m, mainly due to higher sales orders. Revenue for the quarter rose 43.8% YoY to RM1.34bn. (The Edge)

Samchem Holdings Bhd's 3QFY20 net profit gained 79.5% YoY to RM9.5m, thanks to higher sales volume and better margin. Revenue for the quarter added 9.1% YoY to RM288.6m. (The Edge) The Cabinet has agreed to the recommendation for the termination of the Federal Land Development Authority's (Felda) land lease agreement (LLA) with FGV Holdings Bhd. However, a statement released did not mention the compensation that Felda needs to pay FGV, in which it holds a 33.7% stake, as a result of the termination of the LLA. (The Edge)

HeiTech Padu Bhd has been awarded a second contract by the National Registration Department in 2020, with the latest one worth higher at RM51.0m. The contract is for a period of 36 months commencing from 1st November 2020 to 31st October 2023. (The Edge)

British American Tobacco (Malaysia) Bhd’s (BAT) 3QFY20 net profit rose 16.7% YoY 16.7% YoY to RM63.7m following higher sales. Revenue for the quarter increased 14.8% YoY to RM627.5m. (The Edge)

CapitaLand Malaysia Mall Trust's (CMMT) 3QFY20 net property income (NPI) fell 17.2% YoY to RM40.8m, mainly due to higher vacancies and the rental relief granted to affected tenants, as they progressively resumed operations under the Recovery Movement Control Order (RMCO). Revenue for the quarter declined 16.3%

Source: Mplus Research - 30 Oct 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-16

BAT2024-11-16

WCEHB2024-11-15

CLMT2024-11-15

SUNCON2024-11-15

SUNCON2024-11-14

CLMT2024-11-14

SUNCON2024-11-14

SUNCON2024-11-14

WCEHB2024-11-14

WCEHB2024-11-14

WCEHB2024-11-13

SUNCON2024-11-13

SUNCON2024-11-12

ASIAPLY2024-11-12

ASIAPLY2024-11-12

FGV2024-11-12

HTPADU2024-11-12

HTPADU2024-11-12

HTPADU2024-11-12

SUNCON2024-11-12

SUNCON2024-11-12

SUNCON2024-11-11

ATAIMS2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

HTPADU2024-11-11

SUNCON2024-11-08

FGV2024-11-08

FGV2024-11-08

FGV2024-11-08

SUNCON2024-11-08

SUNCON2024-11-08

SUNCON2024-11-07

FGV2024-11-07

LCTITAN2024-11-07

LCTITAN2024-11-07

LCTITAN2024-11-07

LCTITAN2024-11-07

LCTITAN2024-11-07

LCTITAN2024-11-07

SUNCON2024-11-07

SUNCON2024-11-07

SUNCON2024-11-06

ERDASAN2024-11-06

ERDASAN2024-11-06

ERDASAN2024-11-06

SUNCON2024-11-06

SUNCON2024-11-05

HTPADU2024-11-05

SUNCON2024-11-05

SUNCON2024-11-05

SUNCON2024-11-05

SUNCONMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024