Mplus Market Pulse - 23 Feb 2021

MalaccaSecurities

Publish date: Tue, 23 Feb 2021, 09:58 AM

Market Review

Malaysia: The FBM KLCI (-0.9%) reversed all its previous session gains as selling pressure was largely evident in gloves heavyweights with net foreign fund outflow recorded at RM225.5m the highest over the past 4 weeks on local exchange. The lower liners ended mixed, while the broader market was mostly lower with the technology sector (2.2%) taking the heaviest beating.

Global markets: US stockmarkets closed mixed as the Dow added 0.1%, but the S&P 500 (-0.8%) and Nasdaq (2.5%) extended their losses as technology stocks suffered a setback. European stockmarkets were in the red, while Asia stockmarkets closed mixed closed mostly lower as China after the People’s Bank of China looks to dial back their accommodative stance.

The Day Ahead

Selling pressure in glove heavyweights triggered as Covid-19 could come to an end with the arrival of Covid-19 vaccine. Despite selling activities on Wall Street overnight, we believe there could be some fresh buying support given the IDSS and PDT short sale have been extended for another 6 months. We believe traders may lookout for bashed down stocks yesterday. Also, we observed that the Brent oil price has climbed strongly overnight above USD65.

Sector focus: With the Covid-19 vaccine arrival, traders may focus on recovery theme sectors such as aviation, gaming, breweries and NFOs. We expect bargain hunting activities to emerge within technology sector after being bashed down yesterday. Meanwhile, traders will shift their attention again on O&G stocks following the firmer Brent oil price.

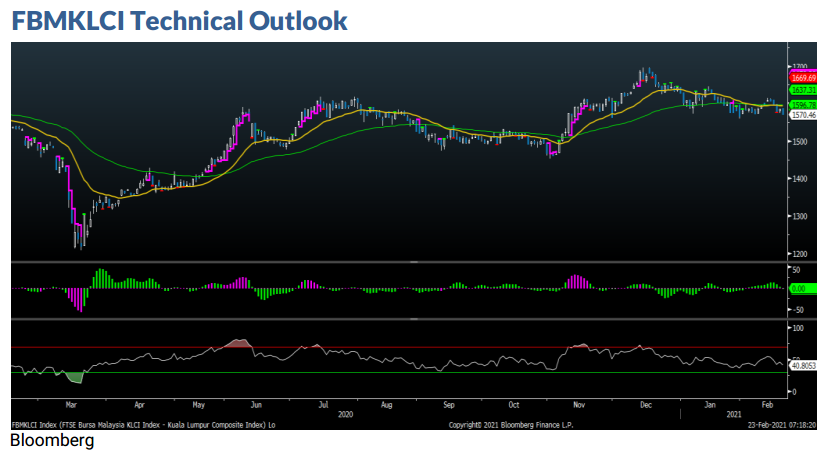

The FBM KLCI saw a pullback to close below the EMA120 level yesterday, forming a bearish engulfing candle. Technical indicators remained negative as the MACD Histogram has extended another red bar, while the RSI hovers below 50. We expect the key index to continue trading sideways, with support pegged around 1,550, and resistance located around 1,590-1,600.

Company Brief

Petronas Gas Bhd (PetGas) will be constructing and installing a 42-km long gas pipeline costing RM541.0m which link from its existing Peninsular Gas Utilisation (PGU) II to a power plant in Pulau Indah, Selangor. The 36-inch diameter pipeline will transport natural gas to, amongst others, a prospective 1,200-MW gas fired, combined-cycle gas turbine power plant in Pulau Indah, and the related industrial areas along its route. This project is estimated to be completed and commissioned in 1Q2023.

Separately, PetGas’ 4QFY20 net profit rose 3.7% YoY to RM503.4m, on lower operating costs and higher contribution from its regasification and gas transportation segments. Revenue for the quarter grew 1.5% YoY to RM1.39bn. A fourth interim dividend of 22 sen per share and a special interim dividend of 5 sen per share, payable on 22nd March 2021 was declared. (The Star)

Duopharma Biotech Bhd’s 4QFY20 net profit increased 34.6% YoY to RM16.2m on lower operating expenses. Revenue for the quarter, however, contracted 2.7% YoY to RM134.1m. A second interim dividend of six sen per share was proposed. (The Edge)

Hibiscus Petroleum Bhd's 2QFY21 net profit grew 19.8% YoY to RM12.0m, mainly due to better performance by its North Sabah segment. Revenue for the quarter rose 30.7% YoY to RM190.3m. A first interim dividend of 0.5 sen per share, payable on 8th April 2021 was declared. (The Edge)

Panasonic Manufacturing Malaysia Bhd's 3QFY21 net profit rose 15.9% YoY to RM33.4m, supported by effective cost reduction exercise in lowering the cost of materials and other fixed costs. Revenue for the quarter, however, slipped 2.4% YoY to RM261.0m. (The Edge)

KPower Bhd’s 2QFY21 net profit surged 397.3% YoY to RM9.3m on higher contribution from construction related activities, as well as property development and investment, and healthcare segments. Revenue for the quarter jumped 560.3% YoY to RM90.1m. (The Edge)

Karex Bhd’s 2QFY21 net profit soared 27.4x YoY to RM2.8m, thanks to strong condom sales and noteworthy personal lubricant sales. Revenue for the quarter rose 6.1% YoY to RM115.8m. (The Edge)

Innature Bhd’s 4QFY20 net profit rose 17.2% YoY to RM7.7m, largely driven by its businesses in Vietnam and Cambodia, where the Covid-19 situation is better controlled. Revenue for the quarter increased 7.6% YoY to RM44.9m. (The Edge)

Tiong Nam Logistics Holdings Bhd’s 3QFY21 net profit jumped 260.1% YoY to RM6.4m, thanks to growth in its logistics and warehousing services segment, alongside better cost management. Revenue for the quarter gained 2.2% YoY to RM159.2m. (The Edge)

CSC Steel Holdings Bhd’s 4QFY20 net profit jumped 203.1% YoY to RM21.4m, on higher revenue, better margin and lower cost. Revenue for the quarter climbed 9.9% YoY to RM367.5m. A final single tier dividend of seven sen per share was proposed. (The Edge)

EITA Resources Bhd’s 1QFY21 net profit slipped 0.7% YoY to RM6.0m, on lower revenue. Revenue for the quarter fell 5.5% YoY to RM66.2m. (The Edge)

Hextar Global Bhd's 4QFY20 net profit grew 48.2% YoY to RM11.5m, on the back of strong performance by its agrochemical segment. Revenue for the quarter rose 21.7% YoY to RM100.8m. A fourth interim dividend of 0.8 sen per share, payable on 26th March 2021 was declared. Separately, the group also announced a bonus issue of up to 492.4 m new shares on the basis of three new shares for every five existing shares. (The Edge)

United Plantations Bhd has proposed a special dividend of 50 sen, besides a final dividend of 15 sen for the financial year ended 31st December 2020 (FY20). The dividends will be paid out on 7th May 2021. (The Edge)

Hong Kong’s Stanley Choi Chiu Fai has emerged as a substantial shareholder in AirAsia Group Bhd, following the group’s private placement exercise. Choi, through his private vehicle Positive Bloom Ltd, acquired 167.1m AirAsia shares on 18th February 2021, raising his shareholding in the group to 332.5m shares or 9.0% stake. (The Edge)

Kejuruteraan Asastera Bhd (KAB) has secured a contract worth RM23.4m from CNQC Engineering & Construction (Malaysia) Sdn Bhd for design, supply and maintenance work in Agile Embassy Garden, Kuala Lumpur. The contract will bring the group’s outstanding order book to approximately RM390.0m and provide earnings visibility for the next few years. (The Edge)

Hong Leong Bank Bhd (HLB) has entered into two collaborations relating to its solar photovoltaic financing programme. Samaiden Group Bhd and Solarvest Holdings Bhd had both separately inked memorandums of understanding with HLB to be service providers, and to enable accessibility of the financing of solar businesses across Malaysia, through HLB’s solar photovoltaic financing programme. The respective contracts will be in effect for two years, and may be renewed every two years with notice from HLB. (The Edge)

Source: Mplus Research - 23 Feb 2021

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-26

CAPITALA2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HEXTAR2024-11-26

HIBISCS2024-11-26

HIBISCS2024-11-26

HIBISCS2024-11-26

HIBISCS2024-11-26

HLBANK2024-11-26

HLBANK2024-11-26

HLBANK2024-11-26

PETGAS2024-11-26

PETGAS2024-11-26

SLVEST2024-11-26

SLVEST2024-11-26

SLVEST2024-11-26

SLVEST2024-11-26

SLVEST2024-11-26

UTDPLT2024-11-26

UTDPLT2024-11-25

CAPITALA2024-11-25

CSCSTEL2024-11-25

CSCSTEL2024-11-25

CSCSTEL2024-11-25

EITA2024-11-25

HIBISCS2024-11-25

HIBISCS2024-11-25

PETGAS2024-11-25

PETGAS2024-11-25

RENEUCO2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

SLVEST2024-11-25

UTDPLT2024-11-25

UTDPLT2024-11-25

UTDPLT2024-11-25

UTDPLT2024-11-22

HIBISCS2024-11-22

HLBANK2024-11-22

KAB2024-11-22

KAREX2024-11-22

PETGAS2024-11-22

PETGAS2024-11-22

SLVEST2024-11-22

SLVEST2024-11-22

UTDPLT2024-11-22

UTDPLT2024-11-22

UTDPLT2024-11-21

CAPITALA2024-11-21

DPHARMA2024-11-21

HIBISCS2024-11-21

HLBANK2024-11-21

PETGAS2024-11-21

PETGAS2024-11-21

SLVEST2024-11-21

UTDPLT2024-11-21

UTDPLT2024-11-21

UTDPLT2024-11-20

DPHARMA2024-11-20

HEXTAR2024-11-20

HEXTAR2024-11-20

HIBISCS2024-11-20

HIBISCS2024-11-20

HLBANK2024-11-20

PETGAS2024-11-20

PETGAS2024-11-20

SLVEST2024-11-20

UTDPLT2024-11-20

UTDPLT2024-11-19

DPHARMA2024-11-19

HEXTAR2024-11-19

HEXTAR2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-19

HIBISCS2024-11-19

HLBANK2024-11-19

PANAMY2024-11-19

PETGAS2024-11-19

PETGAS2024-11-19

SLVEST2024-11-19

UTDPLT2024-11-18

HIBISCS2024-11-18

HLBANK2024-11-18

HLBANK2024-11-18

PANAMY2024-11-18

PETGAS2024-11-18

PETGAS2024-11-18

SLVEST2024-11-18

UTDPLT2024-11-15

DPHARMA2024-11-15

PANAMY2024-11-15

SAMAIDENMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024