Mplus Market Pulse - 23 Mar 2022

MalaccaSecurities

Publish date: Wed, 23 Mar 2022, 08:53 AM

Turning sideways

Market Review

Malaysia:. The FBM KLCI (-0.1%) edged mildly lower after erasing all its intraday gains, dragged down by the extended profit taking in selected banking heavyweights yesterday. The lower liners, however, extended their recovery, while the broader market closed mostly positive, led by the plantation sector (+2.3%).

Global markets:. Wall Street rebounded and the Dow (+0.7%) recovered all its previous session losses, as investors brushed off the hawkish tone from the US Federal Reserve on interest rate direction and focus on the economic growth. The European stockmarkets were upbeat, while Asia stockmarkets closed mostly higher.

The Day Ahead

The FBM KLCI slide marginally but we expect the downside move could be well supported by the plantation and energy stocks. Also, following the overnight gains on Wall Street, we opine that the market sentiment will remain positive on the local front, as investors are brushing off concerns over the Fed’s monetary policies and Russia-Ukraine conflicts, while focusing on economic growth at least for the near term. Besides, the declining trend noticed in new Covid-19 cases may bode for the recovery theme. Commodities wise, the crude oil price is trading around the USD115 per barrel mark, while the CPO hovered around RM6,000.

Sector focus:. We reckon the technology sector will continue to trend higher following the overnight gains in Nasdaq. Meanwhile, we remained optimistic on the plantation stocks given the elevated CPO price. We expect airport and aviation sector may stay positive bias following the reopening of travel borders, while the construction sector might be favourable ahead of anticipated GE15 going forward.

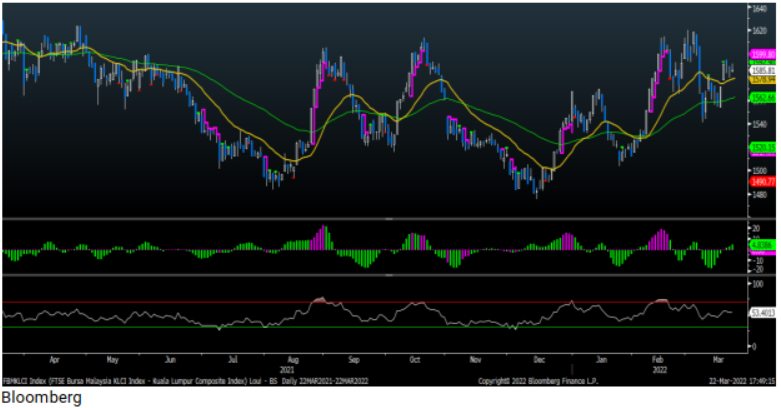

FBMKLCI Technical Outlook

The FBM KLCI stayed above the daily EMA9 level after booking marginal losses for the second straight session. Technical indicators remained positive as the MACD Histogram extended a positive bar, while the RSI hovered above 50. Next resistance is envisaged around 1,600-1,620, while the support is set at 1,550.

Company Brief

Supermax Corporation Bhd via its US-based subsidiary Maxter Healthcare Inc will build an advanced manufacturing Facility in Brazoria County, Texas, United States. The new facility will be the company’s 18th manufacturing plant worldwide and its first in the United States. The new 215-ac. manufacturing facility will showcase cutting edge capabilities through expanded use of artificial intelligence and robotic engineering and will comprise a total of eight buildings. Phase one will begin construction in 2Q22 with glove production expected to start in 2Q23. (The Star)

Malaysia Airports Holdings Bhd’s (MAHB) airport network handled 4.7m (+186.2% YoY) passenger movements in February 2022. Malaysia and Sabiha Gokcen International Airport (SGIA) in Istanbul recorded 2.5m and 2.1m passenger movements, respectively with both operations equally contributing to the February 2022 growth. (The Star)

After seeing air travel brought to a near standstill in 2020, AirAsia Aviation Group Ltd (AAAGL), the airline arm of Capital A Bhd, expects its passenger capacity to recover to 90.0% of its pre-Covid-19 levels by the end-2022 and reach 100.0% in the 1Q23, as Malaysia gears up for a full reopening of its international borders beginning next month. (The Edge)

IHH Healthcare Bhd has submitted a confidential, conditional, non-binding and indicative proposal to acquire 100.0% of Ramsay Sime Darby Health Care Sdn Bhd for RM5.67bn. Ramsay Sime Darby is an Asian joint venture equally owned by Ramsay Health Care and Sime Darby Holdings Bhd. (The Edge)

Unisem (M) Bhd held a groundbreaking ceremony to commemorate the start of construction of its new semiconductor production facility on a piece of industrial land in Gopeng, Perak. Phase 1 of the new Gopeng Plant with an aggregate built up area of about 57,000 sqm with cleanroom facilities, is expected to be completed in April 2023 at an approximate cost of RM300.0m. (The Edge)

Wah Seong Corp Bhd is selling its remaining 30.0% stake in pipe manufacturing unit Spirolite (M) Sdn Bhd to Lesso Malaysia Holdings Sdn Bhd for RM30.8m, cash, as part of its plan to divest non-core businesses within the group to streamline its operations and resources. Wah Seong has exercised the put option on 22nd March 2022 to sell the stake. (The Edge)

Kejuruteraan Asastera Bhd (KAB) has inked 5 Rooftop Solar Power Generating System Construction and Power Purchase Agreements worth RM46.8m with an estimated aggregate capacity of 4,284-kWp in Thailand. The agreement requires KAB to construct the Grid-Connected Photovoltaic solar system for Siam Machinery and Equipment Co Ltd and four subsidiaries of Aapico Group of Companies. (The Edge)

United Malacca Bhd’s 3QFY22 net profit jumped 120.2% YoY to RM30.2m, on the back of higher crude palm oil prices. Revenue for the quarter rose 38.2% YoY to RM147.8m. A dividend of 5.0 sen per share was declared. (The Edge)

Scomi Energy Services Bhd has reported that its independent and non-executive chairman Stephen Fredrick Bracker has retired. Bracker, 68, did not seek re-election at the group’s annual general meeting on 22nd March 2022. Meanwhile, Raja Ahmad Murad Raja Bahrin and Ruziah Mohd Amin were re-elected as directors of the group. (The Edge)

The Federal Land Development Authority (Felda), which owns 62.3% of Encorp Bhd, has entered into a joint-venture agreement with the latter to jointly complete the development of a project involving low- and medium-cost housing for Felda settlers in Chuping, Perlis for an estimated total cost of RM57.3m. The project will be split into two phases for the development of 25-ac and 21-ac respectively. (The Edge)

Hong Seng Consolidated Bhd has inked a collaboration and commitment agreement with the National Disaster Management Agency (NADMA) on foreign workers recruitment and quarantine management at a panel of selected hotels. The agreement was signed and would be executed by Hong Seng's 52.-%-owned subsidiary eMedAsia Sdn Bhd and NADMA, while the panel of selected hotels was represented by Cahaya Pengurusan Cekap Sdn Bhd and Faz Group Sdn Bhd. (The Edge)

Source: Mplus Research - 23 Mar 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

AIRPORT2024-11-17

CAPITALA2024-11-17

UNISEM2024-11-16

SUPERMX2024-11-15

AIRPORT2024-11-15

IHH2024-11-15

IHH2024-11-15

IHH2024-11-15

IHH2024-11-15

SCOMIES2024-11-15

SCOMIES2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-15

UNISEM2024-11-14

CAPITALA2024-11-14

IHH2024-11-14

IHH2024-11-14

IHH2024-11-14

WASCO2024-11-14

WASCO2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

IHH2024-11-13

IHH2024-11-13

IHH2024-11-13

IHH2024-11-13

UNISEM2024-11-13

UNISEM2024-11-12

IHH2024-11-12

IHH2024-11-12

IHH2024-11-12

IHH2024-11-12

IHH2024-11-11

CAPITALA2024-11-11

CAPITALA2024-11-11

IHH2024-11-11

IHH2024-11-11

IHH2024-11-11

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

IHH2024-11-08

WASCO2024-11-08

WASCO2024-11-08

WASCO2024-11-07

IHH2024-11-07

IHH2024-11-07

IHH2024-11-07

IHH2024-11-07

SUPERMX2024-11-07

SUPERMX2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-07

UNISEM2024-11-06

IHH2024-11-06

IHH2024-11-06

IHH2024-11-06

IHH2024-11-06

IHH2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-06

UNISEM2024-11-05

AIRPORT2024-11-05

AIRPORT2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

IHH2024-11-05

IHHMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024