Mplus Market Pulse - 12 Apr 2022

MalaccaSecurities

Publish date: Tue, 12 Apr 2022, 10:00 AM

Turning choppy ahead of US inflation data

Market Review

Malaysia:. The FBM KLCI (-0.2%) started off the week on a wobbly note after erasing all its intraday gains as selling pressure took precedence following the stricter lockdown measures in China. The lower liners also turned downbeat, while the plantation sector (+1.5%) was the sole winner amongst its sectorial peers.

Global markets:. Wall Street turned volatile as the Dow (-1.2%) slipped on the unabated concern over the inflationary pressure ahead of the 1Q22 earnings reporting season. Both the European and Asia stock markets closed mostly negative as the latter was affected by the China’s rising Covid-19 cases.

The Day Ahead

The FBM KLCI slumped alongside regional peers on the back of broad-based selling pressure. We expect investors to trade in a risk-off mood following the negative sentiment on Wall Street, especially the selldown in technology stocks triggered by rising bond yields ahead of the US inflation data may spillover on our local technology stocks. Nevertheless, the daily Covid-19 cases dropped below 10,000 in Malaysia should support economic recovery, thereby benefiting the recovery-themed. Commodities wise, the FCPO rose above RM6,000, while the crude oil price scaled back below USD100 per barrel mark as investors anticipated a lower demand from China amid Covid-19 lockdowns.

Sector focus:. The recovery-themed sectors including consumers, aviation, and transportation & logistics may be the focus amid the declining Covid-19 cases in Malaysia. Meanwhile, investors may position themselves in the plantation stocks ahead of the May reporting season. On the other hand, investors may continue to avoid technology stocks in anticipation of hawkish move in the US.

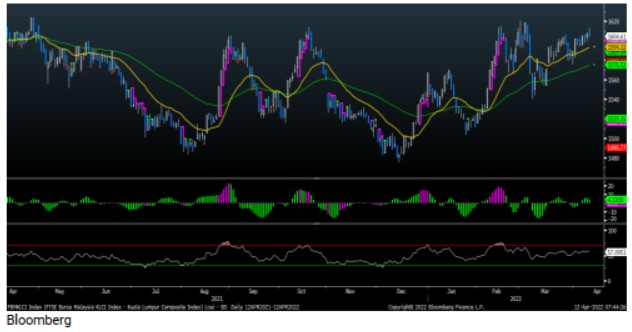

FBMKLCI Technical Outlook

The FBM KLCI remained well-supported above the 1,600 level despite a mild pullback. Technical indicators were positive as the Histogram remained above the zero line, while the RSI hovered above 50. The key index may climb towards resistance at 1,620, while the support is set at 1,580.

Company Brief

Axis Real Estate Investment Trust’s (Axis-REIT) trustee, RHB Trustees Bhd has entered into a sale and purchase agreement to acquire a 1.5m sqf logistics warehouse facility in Pelabuhan Tanjung Pelepas (PTP), Johor from Equalbase PTP Sdn Bhd (EPSB) for RM390.0m. Upon the completion of the proposed acquisition, which is expected to be by mid-2022, the property will be leased back to EPSB for a fixed term of 10 years. The starting monthly rental will be RM2.2m for the first 3 years with subsequent upward adjustments at the start of year 4 until year 10. The proposed acquisition will be funded by bank financing. (The Star)

Serba Dinamik Holdings Bhd has failed to obtain a stay from the Court of Appeal over the High Court decision in February 2022 requiring it to reveal the fact-finding update of its special independent review done by Ernst & Young Consulting Sdn Bhd. (The Edge)

Tanco Holdings Bhd has reported that it is unaware of any reasons for the surge in its share price, except for the progress in its pharmaceutical and construction ventures. This is in response to an unusual market activity (UMA) query by Bursa Malaysia. The research services agreement with Universiti Malaya under its pharmaceutical segment for the latter to undertake a study on dengue infection is still in progress. Meanwhile, one of two contracts worth RM41.5m in its construction segment that was secured from Sri Medan Holding Sdn Bhd for the East Coast Rail Link project has commenced and is in progress. (The Edge)

Caely Holdings Bhd, which has appointed an independent forensic auditor to look into allegations of suspicious and irregular transactions has reported that it will not be able to ascertain the financial and operational impact of the matters until the investigation is completed. Upon receipt of the forensic audit report, it will take all necessary recourse available under the law. (The Edge)

ATA IMS Bhd has reported that an independent assessment found that its Johor Bahru facilities adhered to both local and international labour standards, 4 months after allegations of labour issues resulted in the withdrawal of key client Dyson. Its contract with Dyson, which makes up 80.0% of its revenue has been scheduled for termination from 1st June 2022 onwards. (The Edge)

CN Asia Corporation Bhd has entered into a framework agreement with Markmore Energy (Labuan) Ltd and Caspioil Gas Llp, after negotiating for further terms and conditions in relation to a project at the Rakushechnoye Oil and Gas Field in Kazakhstan. The framework was in relation to the drilling, extraction, processing and production of natural gas extracted from the field and the establishment of the central processing complex in Ak Kum, Mangistau, Kazakhstan to process natural gas into liquefied petroleum gas and condensate. (The Edge)

Malaysia Airports Holdings Bhd’s (MAHB) unit Malaysia Airports (Sepang) Sdn Bhd has appealed against a High Court dismissal of its application to strike out the RM479.8m suit by Capital A Bhd and AirAsia X Bhd (AAX) over alleged negligence of the management of klia2. (The Edge)

Scomi Group Bhd may be delisted from the Main Market of Bursa Malaysia on 22nd April 2022, after its request to extend the deadline to submit its regularisation plan was rejected by Bursa Securities. The company will need to file an appeal against its delisting by 18th April 2022 to prevent its securities from being removed from the bourse. (The Edge)

Dagang NeXchange Bhd (DNeX) 90.0%-owned subsidiary Ping Petroleum Ltd's final investment decision on Ping's proposed crude oil production within the Avalon oilfield in the North Sea is anticipated later this year, after the UK's North Sea Transition Authority indicated it had no objection to Ping's planned development concept for the oilfield. With a total estimated recovery of 23.0m barrels of oil, production from Ping's second oilfield asset Avalon is scheduled to begin between mid-2024 and mid-2025, subject to availability of key materials and equipment. (The Edge)

Source: Mplus Research - 12 Apr 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

AIRPORT2024-11-17

CAPITALA2024-11-16

AAX2024-11-15

AIRPORT2024-11-15

DNEX2024-11-15

TANCO2024-11-15

TANCO2024-11-14

CAPITALA2024-11-14

TANCO2024-11-13

AXREIT2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-13

CAPITALA2024-11-12

AXREIT2024-11-12

DNEX2024-11-12

DNEX2024-11-11

ATAIMS2024-11-11

CAPITALA2024-11-11

CAPITALA2024-11-08

AXREIT2024-11-05

AIRPORTMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024