Mplus Market Pulse - 26 May 2022

MalaccaSecurities

Publish date: Thu, 26 May 2022, 10:00 AM

Slight relieve

Market Review

Malaysia:. The FBM KLCI (+0.3%) snapped a 4-day losing streak, lifted by gains in selected plantation heavyweights yesterday. The lower liners, however, extended their decline, while the broader market ended mostly lower with the construction sector (-1.1%) underperformed.

Global markets:. Wall Street advanced as the Dow (+0.6%) as investors digested the latest Federal Reserve minutes meeting that is pointing towards half a percentage point rate hikes over the next 2 meetings. The European stock markets also rebounded, while the Asia stockmarkets ended mostly higher.

The Day Ahead

The FBM KLCI rebounded from a 4-day losing streak amidst mixed regional performances as investors scooped up beaten-down shares. Despite the rebound on Wall Street, we believe the market sentiment will remain cautious on the back of concerns over global supply chain crisis which may slowdown the pace of economic recovery. Meanwhile, under the current inflationary environment, investors may favour sectors that are benefitted from the commodity boom. We remained optimistic on the energy sector as crude oil price remained on the high side around USD114. Meanwhile, the CPO is priced around RM6,400.

Sector focus:. Investors may favour the energy stocks following the solid set of results from HIBISCS and ARMADA underpinned by firm crude oil price. Meanwhile, investors may look at the REITs sector as business recovery bodes well for the occupancy rate. Selectively, traders may lookout for technology stocks amid the rebound on Nasdaq.

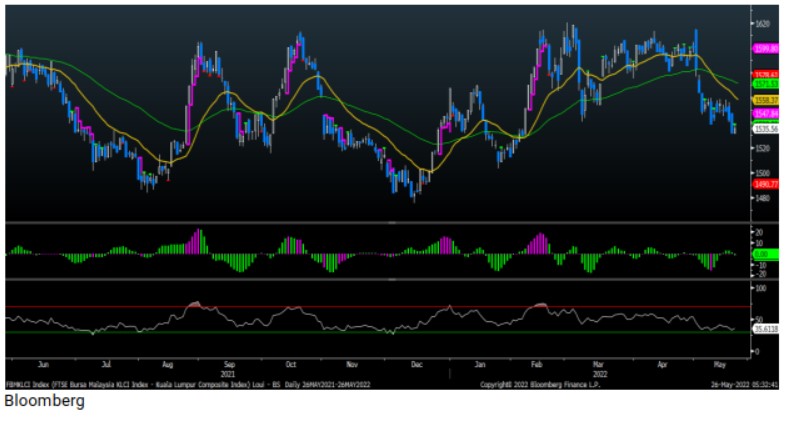

FBMKLCI Technical Outlook

The FBM KLCI reversed to close higher but the key index remained below SMA200. Technical indicators, however is negative as the MACD Histogram crossed below zero, while the RSI hovered below the 50 level. Support is positioned around 1,500- 1,530, while the resistance is set at 1,570-1,580.

Company Brief

Supermax Corporation Bhd’s 3QFY22 net profit tumbled 98.7% YoY to RM13.0m, as sales continued to be adversely impacted by the withhold release order (WRO) imposed by the United States coupled with the downtrend in selling prices and demand. Revenue for the quarter sank 79.0% YoY to RM407.8m. (The Star)

Axiata Group Bhd’s 1QFY22 net loss stood at RM43.0m vs. net profit of RM75.6m recorded in the previous corresponding quarter, on a weaker Ringgit and the Sri Lankan rupee caused unrealised foreign-exchange (forex) losses of almost RM500.0m and higher tax contributions due to the one-off Cukai Makmur. Revenue for the quarter, however, increased 6.7% YoY to RM6.47bn. (The Star)

Sime Darby Property Bhd has reported that group’s profitability in FY22 may be affected by margin erosion brought by higher building material costs and labour shortage. Still, FY22 performance will be underpinned by unbilled sales which remain strong at RM2.90bn and gives the company revenue visibility as 60-70% of the unbilled sales will be reflected in FY22. (The Edge)

FGV Holdings Bhd which owns about 5.0% of oil palm plantations in Indonesia, expects to benefit from Jakarta’s recent decision to lift the ban on palm oil exports. (The Edge)

Serba Dinamik Holdings Bhd group managing director (MD) and group chief executive officer Datuk Dr Mohd Abdul Karim Abdullah has been forced to sell more shares involving 17.0m shares representing a 0.5% stake. The forced disposal of the shares was done in two blocks of 3.5m and 13.5m shares on 23rd May 2022 and 24th May 2022 respectively. This latest round of forced selling has trimmed his stake in Serba Dinamik to 20.4% or 755.6m shares. (The Edge)

Telekom Malaysia Bhd’s (TM) 1QFY22 net profit rose 4.4% YoY to RM339.8m, thanks to lower finance costs subsequent to the group's early redemption of its RM2.00bn sukuk in March 2021. Revenue for the quarter grew 3.0% YoY to RM2.89bn. (The Edge)

Tropicana Corp Bhd’s 1QFY22 net loss stood at RM33.4m vs. net profit of RM2.3m recorded in the previous corresponding quarter, largely dragged down by the weakness in hotel business. Revenue for the quarter slipped 7.2% YoY to RM223.3m. (The Edge)

Pos Malaysia Bhd’s 1QFY22 net loss narrowed to RM30.3m, from RM46.8m recorded in the previous corresponding quarter, due to effective cost management across the board. Revenue for the quarter, however, fell 18.6% YoY to RM484.4m. (The Edge)

Velesto Energy Bhd’s 1QFY22 net loss narrowed to RM46.2m, from RM60.5m recorded in the previous corresponding quarter, mainly due to higher activities in the drilling segment. Revenue for the quarter climbed 76.2% YoY to RM77.4m. (The Edge)

UEM Sunrise Bhd’s 1QFY22 net profit stood at RM19.0m vs. a net loss of RM4.3m recorded in the corresponding quarter, as revenue jumped on the recognition of contribution from the sale of 19 industrial plots in Iskandar Puteri. Revenue for thw quarter increased 64.8% YoY to RM416.5m. (The Edge)

MBM Resources Bhd’s 1QFY22 net profit jumped 89.8% YoY to RM89.3m, as the group recognised a one-off gain from disposal of a piece of leasehold land with factory buildings and some plant and machinery. Revenue for the quarter rose 14.4% YoY to RM478.5m. (The Edge)

Bumi Armada Bhd’s 1QFY22 net profit increased 14.1% YoY to RM185.8m, on lower depreciation of property, plant and equipment, tax expense and finance costs. Revenue for the quarter, however, fell 2.0% YoY to RM529.0m. (The Edge)

Chin Hin Group Bhd’s 1QFY22 net profit grew 73.3% YoY to RM26.3m, due to a gain on disposal of Solarvest Holdings Bhd shares, as well as share of results of associates and joint-venture companies. Revenue for the quarter increased 14.0% YoY to RM351.0m. A first interim dividend of 1.0 sen per share, payable on 5th July 2022 was declared. (The Edge)

Genting Plantations Bhd’s 1QFY22 net profit jumped 83.0% YoY to RM116.6m, on higher palm products selling prices. Revenue for the quarter, however, declined marginally by 1.1% YoY to RM530.4m. (The Edge)

Mega First Corporation Bhd’s 1QFY22 net profit rose 10.9% YoY to RM81.3m, underpinned by higher profit contribution from the Renewable Energy and Packaging divisions. Revenue for the quarter rose 40.6% YoY to RM272.4m. (The Edge)

Hap Seng Plantations Holdings Bhd’s 1QFY22 net profit surged 246.2% YoY to RM101.7m, on the back of higher average selling prices (ASPs) of crude palm oil and palm kernel. Revenue for the quarter jumped 99.6% YoY to RM242.2m. (The Edge)

Hibiscus Petroleum Bhd's 3QFY22 net profit soared 860.2% YoY to RM307.5m, supported by the newly acquired assets, high average realised oil price, coupled with careful management of costs and efficient operational performance. Revenue for the quarter grew 37.5% YoY to RM297.1m. (The Edge)

Hong Leong Industries Bhd’s 3QFY22 net profit decreased 36.9% YoY to RM63.8m, impacted by supply chain disruptions, which affected production and sales of its motorcycle business. Revenue for the quarter slipped 14.8% YoY to RM635.2m. A second interim dividend of 35.0 sen per share, payable on 23rd June 2022 was declared. (The Edge)

Matrix Concepts Holdings Bhd’s 4QFY22 net profit declined 22.2% YoY to RM61.1m, in line with lower revenue as well as higher administrative and general expenses. Revenue for the quarter dropped 35.4% YoY to RM250.8m. A fourth interim dividend of 3.75 sen per share, payable on 7th July 2022 was declared. Matrix Concepts has also proposed to undertake an issuance of up to 417.1m bonus shares on the basis of 1 bonus share for every 2 existing shares, on an entitlement date to be announced later. (The Edge)

Source: Mplus Research - 26 May 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-17

ARMADA2024-11-16

ARMADA2024-11-16

HIBISCS2024-11-16

POS2024-11-16

SUPERMX2024-11-16

VELESTO2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

AXIATA2024-11-15

CHINHIN2024-11-15

CHINHIN2024-11-15

CHINHIN2024-11-15

CHINHIN2024-11-15

CHINHIN2024-11-15

CHINHIN2024-11-15

GENP2024-11-15

GENP2024-11-15

HIBISCS2024-11-15

MATRIX2024-11-15

SIMEPROP2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TM2024-11-15

TROP2024-11-15

TROP2024-11-15

UEMS2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

GENP2024-11-14

HIBISCS2024-11-14

MATRIX2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

SIMEPROP2024-11-14

TM2024-11-14

TM2024-11-14

TM2024-11-14

TROP2024-11-13

GENP2024-11-13

MATRIX2024-11-13

SLVEST2024-11-13

SLVEST2024-11-13

SLVEST2024-11-13

TM2024-11-13

TM2024-11-13

TM2024-11-13

TROP2024-11-12

AXIATA2024-11-12

AXIATA2024-11-12

FGV2024-11-12

GENP2024-11-12

HIBISCS2024-11-12

MATRIX2024-11-12

MATRIX2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SIMEPROP2024-11-12

SLVEST2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TM2024-11-12

TROP2024-11-12

UEMS2024-11-11

ARMADA2024-11-11

AXIATA2024-11-11

GENP2024-11-11

GENP2024-11-11

SIMEPROP2024-11-11

SIMEPROP2024-11-11

SLVEST2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TM2024-11-11

TROP2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

AXIATA2024-11-08

FGV2024-11-08

FGV2024-11-08

FGV2024-11-08

GENP2024-11-08

SIMEPROP2024-11-08

SIMEPROP2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TM2024-11-08

TROP2024-11-08

TROP2024-11-07

AXIATA2024-11-07

FGV2024-11-07

GENP2024-11-07

HSPLANT2024-11-07

MFCB2024-11-07

SIMEPROP2024-11-07

SIMEPROP2024-11-07

SIMEPROP2024-11-07

SUPERMX2024-11-07

SUPERMX2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TM2024-11-07

TROP2024-11-06

AXIATA2024-11-06

HLIND2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

SIMEPROP2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TM2024-11-06

TROP2024-11-05

ARMADA2024-11-05

AXIATA2024-11-05

GENP2024-11-05

GENP2024-11-05

SIMEPROP2024-11-05

SIMEPROP2024-11-05

SIMEPROP2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TM2024-11-05

TMMore articles on M+ Online Research Articles

Created by MalaccaSecurities | Nov 15, 2024