(CHOIVO CAPITAL) Nuts and Bolts of Investing Overseas (Opening a Foreign Brokerage Account – Interactive Brokers)

Choivo Capital

Publish date: Sun, 03 May 2020, 02:37 PM

For a copy with better formatting, go here, its alot easier on the eyes.

Nuts and Bolts of Investing Overseas (Opening a Foreign Brokerage Account – Interactive Brokers)

========================================================================

Over the last month, given the incredible discounts seen in mid-late March to early-mid April, I have been very active in purchasing foreign shares, with foreign equities going from less than 1% of portfolio, to approximately 50% of portfolio.

So much for these plans.

One of the questions I get asked quite often these days by both friends and other investors, is how does one go about investing in foreign shares?

Which broker? Can trust one anot? How do i deposit in money? How do i withdraw money? etc.

Well, this was a topic I studied for some time in order to find (and procrastinated a lot), in order to find what I would consider to be the best solution for a long-term investor, in terms of price (people close to me would know my love of penny pinching and its occasional and expensive detriment) and option.

This will not be an extremely comprehensive piece as much of of details can be done via your own reading of the processes in the brokerage website.

However, i think it helps answer the important questions on why you should use a foreign broker versus a local one, which broker to use and why, and also the most cost efficient way of transferring money.

Lets begin.

Local vs Foreign Brokerages

As many of the uncle and aunties here will ask, Why not just get access via our local brokerages such as CIMB, Maybank Kim Eng etc?

Well,

Fees!

For our local markets, depending of which Exchange/Country you’re looking at, the fees range from 0.4% to 0.7%, with extremely high minimum order prices.

For example:

| Transaction Fees | Local Brokerage | Interactive Brokers |

| NYSE | 0.4%, minimum USD25 +SST 6% | USD 0.005 per share, min USD 1 |

| SGX | 0.42%, minimum SGD28 +SST 6% | 0.08%, min SGD 2.5 |

| HKEX | 0.42%, minimum HKD150 +SST 6% | 0.08%, min HKD 18 |

All of this build up to a very significant amount even after just a few transactions.

And the biggest difference in cost for the ikan bilis retail investors like us, is the Dividend Handling Fees and Corporate Exercises fees.

On average, local brokers charge RM50 or so each time they collect dividends on your behalf, while companies like Interactive Brokers don’t charge anything for this.

For a list of the fees in Interactive Brokers, refer below.

Interactive Brokers Fee Listing

There is quite simply no comparison.

Options!

Overall, foreign brokerages like Interactive Brokers offer far more flexibility in terms of the kind of instruments available, as well as the amount of markets covered.

Using Interactive Brokers, you have access to Options, CFD’s, Shorting and Futures, which you can use for hedging, or expressing a certain view on the markets or each stock. And you can do it in a very transparent, intuitive and convenient manner.

The only downside is that certain markets (which I like) such as Thailand, Indonesia, Korea, Taiwan, Vietnam and Malaysia are not available on it.

Why? Their fees are too low, if these Exchanges were to allow them to operate in these markets, the local brokerages will go bankrupt.

Even in Singapore, they are not allowed to give Singaporean’s access to Singapore markets via Interactive Brokers, instead Singaporeans when buying shares must go through local brokerages.

Why Interactive Brokers?

Which brings us to the second question.

Who is this Interactive Broker and why do you constantly recommend them?

Well, those more familiar with my writings, will note that i actually considered them a wonderful company in a speech i made in March 2019. I didn’t recommend it as a buy then due to the very expensive price, however, the economics of the business is fantastic.

So, back to the question, why Interactive Brokers? Why not E*Trade, TD Ameritrade, Fidelity, Charles Schwab etc?

Market Reach

None of the other brokerages offer the width and breath of Interactive Brokers period.

Interactive Brokers Covered Markets and Products

And when they do offer it, they require you to either call the brokerage desk like local brokers, or charge you far higher commission rates.

This one is quite key for me.

Fees

Talking about rates, you may now ask, but wait, isn’t E-Trade, TD Ameritrade etc offering “Zero Commission”?

Well, like “Free Shipping”, there is no such thing as “Zero Commission”.

Like “Free Shipping”, “Zero Commission” means the commissions is included in the price you pay for the stock.

How?

Very simple.

These brokerages sell your order flows to high frequency traders like Virtu Financials and Citadel Securities, who in those split seconds, know the price you are willing to pay for the stock, buy it off the market before you and sell it to you at a slightly higher price you would have otherwise paid for it.

At the end of the day, its been shown that on average, including fees etc, Interactive Brokers get you a far better final price.

Now, recently the company started a “Lite” version, where it is zero commission and employs similar methods as other brokers to hide the price, but this option is not available Non-US Residents.

Personally, I prefer and use the “Pro” version anyway as its just better and cheaper.

Margin Rates

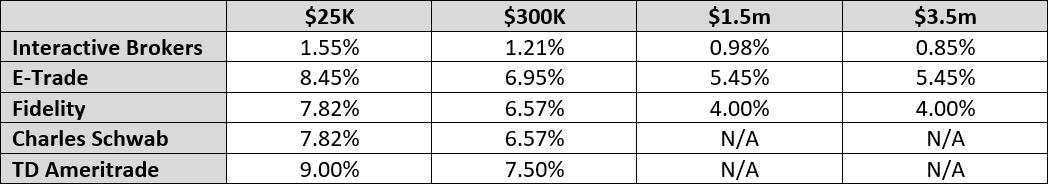

As a comparison, these are the USD margin rates offered by Interactive Brokers.

Not much more needs to be said.

Interactive Brokers also offer margin at very competitive or the best rates across different currencies.

EDIT: Do Note that if you open your account via Tradestation, your margin Rates are similar to those of the other Brokers. Its an error on my part, i apologize.

Can I Trust Interactive Brokers?

Well, among other things, your account at Interactive Broker is protected by SIPC, up to USD500,000 and a cash sublimit of USD250,000.

They are also one of the most conservative brokers in terms of the reserves.

If after reading the above and you’re still unsure, well, all I can say is, the company is founded 42 years ago, was the first to come out with electronic/online trading for shares and other financial instruments in the world.

It is also listed on the NYSE, and the market capitalization of the company is larger that of Maybank.

If you don’t trust Interactive Brokers, what makes you think you can trust Maybank Investment Bank?

Opening your Interactive Brokers Account (and other Nuts and Bolts)

Do you intend to deposit, more than USD100K or less than USD100k?

For account with average equity balances of less than USD100k in a calendar month, Interactive Brokers charges at USD10 monthly maintenance fees, which can be netted off against whatever transaction cost during the month.

For inactive investors like me (who is also very kiamsiap), this amount is likely higher than my monthly transaction costs.

(If you’re an active trader on the other hand and expect to spend more than USD10 in brokerage fees per month, you should open your account directly with Interactive Brokers.)

Therefore, in cases like these, what you should go for is an Interactive Broker’s white label account.

A white-label account is where an independent broker uses the Interactive Broker to provide trading services, however, in exchange for the USD10 per month maintenance being waived, the transaction fees charged are slightly higher.

The white label broker i personally use, is TradeStation.

In short,

| Amount | Broker Links |

| Less than USD100k | Trade Station – Interactive Brokers White Label Account |

| More than USD100K | Interactive Brokers Account |

Now, one thing to note is that when you create an Interactive Brokers account, it can be domiciled in different countries, depending on where you are.

For example, if you entered Interactive Brokers website from Malaysia, it may lead you to the HK or Australian site, and if you create it from that website, your account will now be domiciled in HK or Australia.

Usually most people do not notice it, and for most cases, its does not really matter where your account is domiciled.

However, if you want an account serviced by Trade Station, it can only accept those of certain countries, such as UK. In which case, what you need to do is to create it from the Trade Station website, and it will automatically domicile it in UK.

One thing to be clear here, regardless of where your account is domiciled, or under which broker, your account access and benefits is the same, you still use the same platform, have the same reach, get the same margin rates.

When your equity balance starts to exceed USD100k, you can directly remove Trade-Station as a broker from your account, it usually takes less than 30 seconds to do so and about a day to be finalized.

The process of registering for an account is fully online, and all you need to do is follow instructions, click, click, click, click until you reach “Confirm”.

Do note that in order to trade in certain financial instruments, you need to have a certain net worth and income, these are self-declared. Its up to you to be as honest as you want.

There is no difference in the commission rates for cash and margin account unlike Malaysia.

It’s also very easy to activate margin finance in the future (if you choose Cash Account during the registration). Its just a click and 1 day for approval, unlike in Malaysia where you need to sign/pay for stamp duties etc etc.

Kindly read up on their margin calculation very clearly in the event you plan to use their margin finance, you can also email/ask them on any questions your have).

After your complete your registration, it typically takes 3 days to 1 week to confirm your account.

Now, this may take longer these days due to high volumes of people opening their accounts.

How do I deposit in money to Interactive Brokers

Interactive Brokers accepts deposit in a multitude of currencies in account all around the world, however, Malaysia and RM is not one of them.

SGD and HKD however does happen to be one of them.

Whenever you transfer money into Interactive Brokers, you will be given a special account number for whichever bank account Interactive Brokers have in whichever country.

The moment the money it arrives in the account, your account is usually updated within 30 minutes.

The question here is cost.

If you are to do an international bank transfer from your Malaysian account to their SG, HK or US etc accounts, you are likely to get chopped your bank around 2-3%, on a combination and of transfer fees, and forex rates given. This is a very significant amount especially over time.

There are a few ways to do international bank transfers cheaply for Malaysians.

- Open a foreign bank account in Singapore (specifically a Maybank one, or CIMB if necessary).

For Maybank, if you open an ISavvy account, they give you very close to spot rates for Maybank Msia to Maybank Sg Transfers. (RM to SGD). The same goes for (SGD to RM).

For CIMB, if you open a Fastsaver account, they give relatively decent rates for SGD to RM, but horrible rates for RM to SGD.

In any event, whichever account you hold it does not really matter, as the account is mainly fow withdrawing money from Interactive Brokers, for international transfers, a far cheaper way is via money transfer fintech services like Instarem or Transferwise.

- Use money transfer fintech services like Instarem or Transferwise

One major thing to note here, you cannot transfer money to the US Interactive Brokers account using Instarem or Transferwise. However, you can do so for EUR, HKD, SGD. I have not tried for other denominations. I typically transfer in HKD or SGD as these are the two currencies i like, and i also buy stock in currencies denominated in these currencies.

Just to get it out the way, these two services providers are regulated by BNM. The money transferred to them goes into a “Trust Account” held by a Local Bank.

This means your money cannot be used for any other reason for these companies and that they are safe.

The way these two companies get cheap rates is by not actually transferring money across borders — instead, it matches up payments with those going the opposite direction. So “your” money never actually leaves the country — it’s just rerouted to someone who’s being sent a similar amount by someone overseas. Your foreign recipient, meanwhile, receives their funds from someone trying to send money out of their own country.

Its quite like the Islamic “Hawala” system.

And because of this, the transfers can be done very cheaply as there is no need to pay the numerous types of fees when it comes to international transfers.

A comparison is below.

As you can see, there is quite frankly, no comparison.

On average, Maybank’s international transfer fees are 3 times higher than that of Instarem and Transferwise.

One thing to note, is that sometimes, Instarem is cheaper, sometimes Transferwise is cheaper. (On the day I did this comparison, Transferwise just happened to be cheaper.

This is due to Instarem locking in rates for 24 hours, while Transferwise locks in rates at 44 hours. There are other little things like Instarem not charging for FPX transfers, while Transferwise charges RM1.1 (Both charge nothing for Bank Transfers).

They also give rebates albeit at different rates and the fixed fees do change (usually downwards).

Personally, I have accounts in both and usually check both for prices before transferring.

You can register by clicking the links below.

Transferwise

(This is my invite link, if you use it to register, I get a discount on my future transfers and so will you.)

Instarem

(My invite code is, XHkWTn , by using this when you register and make your transfer, i will get a discount on my future transfers and so will you.)

Now, some of you may now ask, why not BigPay?

Well, I personally don’t use BigPay for things like these because it’s a loss-making company.

End of the day, as my money is held in a trust account, if the provider goes down, I will still get my money back.

However, its going to be a hassle regardless. As BigPay is also not a better provider, i’d rather just not bother with it.

Additional Note: It does not matter which currency you fund your account in, as you can do foreign exchange for pretty much any currency within the Interactive Broker account itself. The exchange rate used is spot rate, with USD 1 fee.

Withdrawing Money from Interactive Brokers.

One thing to note is that Interactive Brokers will only allow your to withdraw money into a bank account with your name on it.

Now as it is very expensive to transfer to a local Malaysian bank account, as the local bank will again chop you on the fee and forex rate.

Now, do note I have not withdrawn money, as quite frankly, I’ve never withdrawn any money from my investment accounts since I started investing. In fact, as around 80% of my salary goes into my investment accounts, i sometimes wonder if i’m working for the sake of enjoying the money or just to buy shares.

However, the process is quite straight forward, open a Singaporean Bank account, whether CIMB or Maybank.

Why these two banks? Its the easiest and they have some perks.

The registration forms is below.

The pre-requisite is that you need a Malaysian Accounts in those banks in order to open the Singaporean ones. You need to maintain about SGD500- SGD1,000 in those accounts to avoid maintenance fees.

You can try opening the bank account using other Banks in Singapore, however, its very hard or close to impossible these days for people who are not working there, unless you want to buy Insurance Products, or is a Premier client.

You then withdraw your money from Interactive Brokers to the Singaporean Bank Account, and then use Transferwise to transfer the Money from Singapore to Malaysia. In terms of fintechs, you can only use Transferwise as other fintech’s require a Singaporean Address.

Alternatively, you can use CIMB SG, to transfer from your CIMB SG account to CIMB MY account. Its still relatively cheap.

Conclusion

All the best, I hope this was helpful. I know I wish I had this before when I was thinking of investing overseas.

In addition, personally I far prefer overseas markets. Malaysian stocks are usually very overpriced, especially for great/wonderful companies, due to PNB and EPF needing to invest the bulk of their money locally. Even the mediocre ones are overpriced tbh.

And to be frank, when it comes to investing, the macroeconomics of the country matter to quite a large extent.

This is a very simple rule to applies across all asset classes, for a simple comparison, just look at property in Malaysia.

Where are the places where property prices have skyrocketed over the last 30 years?

Selangor (Specifically Sunway, Parts of Petaling Jaya, Small Parts of Shah Alam, Subang, Mont Kiara, Damansara, Bangsar), Penang, Johor Bahru.

What does these places have in common?

It is packed with people who are very focused on making money, pragmatic, logical and very hardworking in this regard. (I don’t want to be more specific than this, but you are logical and have imagination, you can come to your own deeper conclusions.)

If you had bought property in Kelantan 30 years ago instead, I doubt the price have even moved.

In fact, if you had bought property in Putrajaya, (where the government tried so hard to make it a good place economically by making it the center of government, except without attracting people who are very focused on making money), you may even be underwater today.

Good luck.

Disclaimers: Refer here.

====================================================================

Facebook: Choivo Capital

Website: www.choivocapital.com

Email: choivocapital@gmail.com

More articles on Choivo Capital

Created by Choivo Capital | Dec 09, 2020

Created by Choivo Capital | Dec 05, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 09, 2020

Created by Choivo Capital | Nov 03, 2020

Discussions

Yep.

For rights issue, I'm not sure, but as I understand it should give you the option.

2020-05-03 20:44

kk summary

1) instarem KL interbiew

2) tradestation global acc ready

3) instarem wire MYR/USD (kantoi cannot), go EUR then IBKR internal convert

4) ??

5) profit

2020-05-03 20:45

tradestation global charges US stock trading $1 per trade ya..

remember, $1 per trade ya....

if you hoot 2 trades in one day, same stock e.g., Gilead buy 50 and buy 10 again, IBKR eat $2

sekian

2020-05-03 20:47

Yeah this tax all kena, but i make sure to focus on non div paying co's. most co's in US focus on buybacks anyway.

But hmm i definitely need to raise this in terms of ETF's. For SP500 ETF, you guys would want to buy the one listed in London, not in the US, or you will kena with holding tax.

Also one thing to note, there is 30% estate tax if you die, so make sure your family members know how to sell everything in the event of your passing and withdraw the cash quickly.

===

Alex™ ah jon why u no warn ppl that usa eat 30% div?

03/05/2020 8:46 PM

2020-05-04 12:13

Philip ( buy what you understand)

I invest using td ameritrade, as I like being in control of when and how I buy. I don't like being forced to buy/sell every month and being charged $10 a pmonth as a fee.

Yes it is a small amount, around RM45 after conversion. but imagine being forced to spend RM600 a year to use this service? I'm a cheap guy, as there is no way there is a good deal to buy and sell every month, I buy when it is needed, not because I have to.

TD ameritrade suits me better, they also have an office in singapore, and I can choose not to buy any stocks for 2 years and not have to pay any "penalty".

>>>>>>>>>>>

Accounts with balances of $100,000 or less must meet a minimum of $10 a month in trade commissions, or Interactive Brokers will charge the difference as a monthly fee. Accounts with an equity balance of $2,000 or less must meet minimum trade commissions of $20.

2020-05-07 10:35

Tdameritrade sg charges more than $10 commission per trade. I don’t see why it is a preference choice. Philip securities is a better choice than tdameritade as they offer multi markets with similar charges. IB has the most competitive margin rates I have encountered and their service center are prompted. Commission per trade are very competitive as well. Webull is one good choice too, in aspects they are quite close to IB. They offer free real data quote. Maybe Jon sifu can have a look with webull too

2020-05-07 17:24

hi Choivo, thanks for writing the article i found it very useful, in fact i am trying to open an account with them now. I have a few questions, in the application the use 'First Name, Last Name' order but our naming system is the opposite. What is the format you submitted in your application? Did you encounter any problem with the identity verification process? Did you encountered any problems with transferring and receiving funds, since our banks in Malaysia and Singapore using 'last Name, first Name' format that will be different from InteractiveBrokers or TradeStation's record?

2020-05-08 02:47

Philip ( buy what you understand)

I only bought foreign stocks twice in the past 1 years. So I only paid 20 USD in commissions for 1 years.

Compare that to if I was with interactive brokers. Whether or not I bought stocks, if I did the same thing I would need to pay 120 USD in commissions or capacity payments even if I did not buy stocks at all.

For me as someone who only has 2 stocks in their portfolio ( both which do not pay dividends).

But one thing too be definitely sure of. The capital protection limit is the same 200k usd, so it might be a good idea to spread your accounts around to protect yourself.

In the end just get whatever makes you feel comfortable. But one thing I do not recommend, never overtrade. One of the big problems with new investors is that they buy and sell too many stocks, and they lose out of the hidden costs of trading.

IB system is designed to make you trade more.

Thinkorswim is more suitable for my investing style as I don't have to keep buying and selling every month. Last year when I bought stoneco I bought 200k shares in one afternoon. After that 1+ year of inactivity.

Fyi I use tdameritrade USA. Cheaper rates, not as low as IB, but acceptable for me.

>>>>>>>>

Posted by popo92 > May 7, 2020 5:24 PM | Report Abuse

Tdameritrade sg charges more than $10 commission per trade. I don’t see why it is a preference choice. Philip securities is a better choice than tdameritade as they offer multi markets with similar charges. IB has the most competitive margin rates I have encountered and their service center are prompted. Commission per trade are very competitive as well. Webull is one good choice too, in aspects they are quite close to IB. They offer free real data quote. Maybe Jon sifu can have a look with webull too

2020-05-08 05:54

tq for useful info, not sure abt prospects in Overseas, meaning US ?

pls share your insights, any potential market down in the pipeline n what to do then?

newbie here,haiz...

2020-05-08 08:46

the transaction fees is negligible if you just buy and hold. one of the reasons i use local broker (HL) is because it is easier to structure the will/inheritance.

2020-05-08 08:54

Didnt you buy a few million USD worth of Stonco before this?

Only USD20 fees ah?

Is it TD Ameritrade ah?

IB if you're above 100k, you wont kena the fees.

====

Philip ( buy what you understand) I only bought foreign stocks twice in the past 1 years. So I only paid 20 USD in commissions for 1 years.

Compare that to if I was with interactive brokers. Whether or not I bought stocks, if I did the same thing I would need to pay 120 USD in commissions or capacity payments even if I did not buy stocks at all.

2020-05-08 14:54

Nope, dont have a problem with that.

Any verification is with real human beings. So its fine.

===

blood7 hi Choivo, thanks for writing the article i found it very useful, in fact i am trying to open an account with them now. I have a few questions, in the application the use 'First Name, Last Name' order but our naming system is the opposite. What is the format you submitted in your application? Did you encounter any problem with the identity verification process? Did you encountered any problems with transferring and receiving funds, since our banks in Malaysia and Singapore using 'last Name, first Name' format that will be different from InteractiveBrokers or TradeStation's record?

08/05/2020 2:47 AM

2020-05-08 14:55

By Size

1) Google

2) FB

3) Stoneco

4) Berkshire

5) Master

6) Visa

7) Aercap

8) Netflix

Got a few co's like Credit Acceptance, Synchrony Financials, Ulta Beauty, Collectors Universe, Discovery, Disney etc that i'm stills studying, but it just seems to much simpler to buy more FB or Goog instead.

===

Flintstones Jon, which US stocks do you hold?

07/05/2020 10:22 AM

2020-05-08 15:00

Philip sifu, i had one account used to be tdameritrade USA too, but they transfer my account to tdameritrade sg now. Not sure why they didn't transfer yours but mine instead. I personally like thinkorswim trading platform better than IB. But most of my portfolio is with IB now as I am using IB margin facility which is incredibly cheap (below 1%). Also IB waived USD 10 monthly maintenance fees if our equity balances are more than USD 100k. I believe its not a problem for you as well.

>>>>>>>>>>>>>>>>>>>>>

Posted by Philip ( buy what you understand) > May 8, 2020 5:54 AM | Report Abuse

I only bought foreign stocks twice in the past 1 years. So I only paid 20 USD in commissions for 1 years.

Compare that to if I was with interactive brokers. Whether or not I bought stocks, if I did the same thing I would need to pay 120 USD in commissions or capacity payments even if I did not buy stocks at all.

For me as someone who only has 2 stocks in their portfolio ( both which do not pay dividends).

But one thing too be definitely sure of. The capital protection limit is the same 200k usd, so it might be a good idea to spread your accounts around to protect yourself.

In the end just get whatever makes you feel comfortable. But one thing I do not recommend, never overtrade. One of the big problems with new investors is that they buy and sell too many stocks, and they lose out of the hidden costs of trading.

IB system is designed to make you trade more.

Thinkorswim is more suitable for my investing style as I don't have to keep buying and selling every month. Last year when I bought stoneco I bought 200k shares in one afternoon. After that 1+ year of inactivity.

Fyi I use tdameritrade USA. Cheaper rates, not as low as IB, but acceptable for me.

2020-05-08 21:32

Foreign brokerage are offering very attractive rates. The trouble seems to be withdrawing funds from the brokerage account into local bank account. Maybank and CIMB has tightened criteria and no longer accept singapore account application without employer pass or education proof (please correct me if I am wrong)

2020-05-09 13:53

1) Google - p/fcf > 30...apu....

2) FB - ads...

3) Stoneco - warren punya

4) Berkshire - recent after agm kena

5) Master - no comment

6) Visa

7) Aercap

8) Netflix

follow me SEIC (10%), confirm u like. Buy lower than me $52

2020-05-11 15:21

.png)

hpcp

Hi Choivo. Thanks for the very informative write-up. By the way, how do we participate in rights issue? And where does the dividend go? Into trust account? Thanks

2020-05-03 20:36