Gloves: The Bad Guy Loses (From Time to Time)

Ben Tan

Publish date: Sat, 09 Jan 2021, 01:42 AM

The past week was a roller coaster for every shareholder of Bursa listed glove stock. After regulated short selling (RSS) was allowed again following 9 months of ban, a gigantic short position was opened on the 4 major Malaysian glove manufacturers at the start of trading on Monday morning. The totality of the short position on Top Glove, Hartalega, Kossan, and Supermax, amounted to almost RM925 million, comprising 97.5% of the entire value of every opened RSS short position on the Malaysian stock market as of Monday (January 4, 2021). Throughout the week, the pressury hardly subsided. The value of the newly opened short positions on these 4 counters comprised 90.8% on Tuesday, 84% on Wednesday, 93% on Thursday, and 90.3% on Friday, out of the total value of all RSS short positions for the corresponding days. I have been following the situation and I have been updating the figures daily here.

Albeit all that, and albeit a sharp dive on Monday, the market price of the stock of the 4 glove companies jumped dramatically, particularly on Friday. Below is a comparison between the closing prices for each of the stocks as of December 31, 2020 (the last trading day for the year), the closing prices as of Monday, and the closing prices as of Friday:

| Company | 31 Dec 2020 (Thursday) (RM) | 4 Jan 2021 (Monday) (RM) | 8 Jan 2021 (Friday) (RM) |

| TOPGLOV | 6.12 | 5.50 | 6.50 |

| HARTA | 12.14 | 10.48 | 12.50 |

| KOSSAN | 4.50 | 3.94 | 4.50 |

| SUPERMX | 6.01 | 5.51 | 7.30 |

In other words, as of end of day Friday, the stock price of Supermax was 21% higher, of Top Glove was 6% higher, of Hartalega was 3% higher, and of Kossan was unchanged, as compared to the closing price from last Thursday. In this case, the important question that remains is:

Has the price increased because the short seller has closed their short position or because of normal market activity?

I realized that many readers may not be familiar with the concept of short selling, so a quick explanation is in order. Short selling involves two counterparties, and a few steps:

Step 1: Participant A borrows shares of Company Z from Participant B. Note that this means that Participant B must own the shares in order for this to happen. Participant A pays a fee to Participant B for every day (for instance) for which he/she holds the borrowed shares.

Step 2: Participant A sells the shares on the open market, expecting/hoping that the price will fall.

Step 3: After the price falls, Participant A buys back the shares, and returns them to Participant B. The short position is closed.

As you can see from this trade, at the end of the day Participant A doesn't own any shares of Company Z. The profit of Participant A is the difference between the price he/she sells the shares for, and the price he/she buys them back for, minus the fee he/she has to pay to Participant B for borrowing the shares. With other things equal, this is a sum negative game for Participant A, because of the fee payable to Participant B.

However, in cases where Participant A might be able to short sell an enormous amount of stock, so that it would substantially affect the normal flow of the market, he/she stands to earn handsomely. It is very important to note that in this scenario in Step 2, Participant A sells a large amount of shares, so the market price goes down substantially. But in Step 3, Participant A has to buy back the same amount of shares. That is why, ideally, the closing of the position should happen slowly - so that Participant A wouldn't cause a swing momentum in which the share price would skyrocket.

We know that the arrangements for Step 1 must have been done some time before Monday, and the bigger part of Step 2 was taken on Monday, with smaller parts taken at later points during the week. We also know that the share price of the gloves stocks is now higher (in the case of Supermax - substantially higher) than the price as of opening of trade on Monday. Our task now is to figure out if one of the following two things has happened:

Scenario A. After the big short seller has offloaded their short position, the market has naturally moved towards lifting the price up;

Scenario B. The short seller has actually been closing his/her short position, thereby causing the significant rise in share price.

For the entire week (Monday to Friday), the following amounts of shares were short sold for each of the 4 glove manufacturers via RSS trades:

| Company | Total RSS Volume for the Week | % RSS Volume of Total Outstanding Company Stock |

| TOPGLOV | 196,194,500 | 2.40% |

| HARTA | 33,705,800 | 0.99% |

| KOSSAN | 41,652,500 | 2.26% |

| SUPERMX | 13,158,100 | 0.49% |

We also have two more pieces of information, specifically regarding Top Glove stock. Before Monday, there was an open short position on the stock equal for 17,992,700 shares, equivalent to 0.22% of the outstanding company stock (Source). Additionally, we know that on Tuesday, EPF lent out 40 million shares (equal to 0.49% of the outstanding stock of Top Glove) to someone via the Securities Borrowing and Lending (SBL) model (Source). We do not know if EPF has done the same thing at any point later during the week. We also do not know if the SBL-borrowed stock has been counted within the RSS numbers reported by Bursa daily here. What we do know is the total amount of currently open net short positions for each of the stocks. You can refer to the official document here. According to Bursa's daily released documents, the document presents "The Total Net Short Position refers to Paragraph 5.1(2) of POs’ Directive on Regulated Short Selling (No. 8-002)." In other words, we can assume that the short sales done via the SBL model are also counted as RSS trades. Below are the numbers as reported by Bursa after end of trade on Friday:

| Company | Total Net Short Position | % Volume of Short Positions Closed |

| TOPGLOV | 2.34% | 2.5%-11.6% |

| HARTA | 0.91% | 8% |

| KOSSAN | 1.30% | 42.5% |

| SUPERMX | 0.51% | n/a |

As you may notice, the calculation for Supermax doesn't work out, because the volume of reported open net short positions on the stock (13,688,804) is larger than the total amount of short sales reported in the daily short selling reports released by Bursa for the week (13,158,100) by 530,704 shares, or 0.02% of the outstanding company stock. This discrepancy could be explained by some residual outstanding net short positions that were below the minimum reportable limit (0.1% of the outstanding stock) as of January 4, 2021 (Monday). Another thing to be noted is that it is possible that the aforementioned 0.22% residual open short position for Top Glove from 2020 might have been closed at some point as well. Thus, the figure for Top Glove is given as a range.

In any case, what these figures show us is that the short position on Supermax has not been closed at all, and the short positions on Top Glove and Hartalega have been closed only to a minimal extent. The short position on Kossan has been closed to a larger extent, and at the same time the company's stock price hasn't moved higher than it was on Monday, as we saw in the beginning of the post.

This means that with the exception of Kossan, scenario A appears to be in play - the short seller has NOT closed their short positions, and the increase in share price is largely based on natural market movement, which is of course great news.

Before getting too excited, however, it is important to remember that a market player who can unload short positions totalling approximately RM1.6 billion in the span of 1 week, might have the capacity to do something similar again. The limitation for RSS net short positions is 4% of the outstanding company stock (Source), so there is still ample amount of space for the short seller to continue on with the activity. However, seeing as the general market momentum has categorically swerved towards very positive sentiment regarding glove stocks, throwing more money to defend the opened short positions might not be the best course of action for the short seller.

Update: January 10, 2021

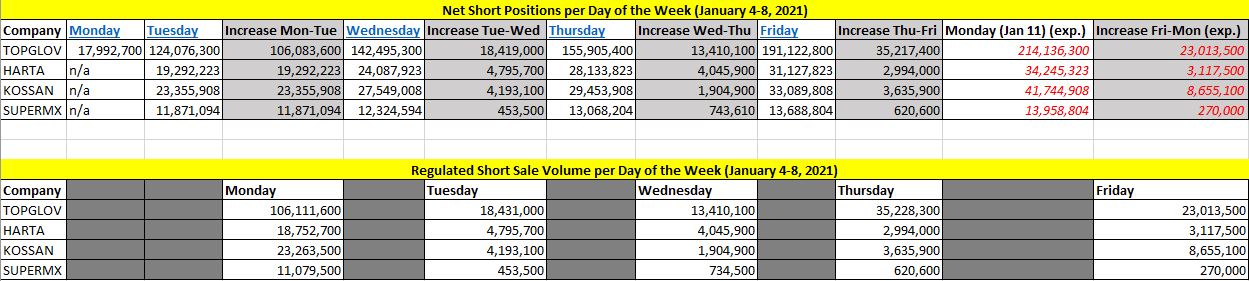

Some fellow forum members (invest200 and treasurehunt) mentioned in the comments section below that it is possible that the net short position data is lagging one day behind. Below is a table of the reported net short positions for each of the days of the last week, and the corresponding RSS volumes for each of the days:

What does this mean?

A few things. First, it means that the net short position data indeed lags 1 day behind the RSS data. You will notice, for instance, that the Tuesday increase in net short sales matches almost perfectly the reported RSS volumes for Monday. This is extremely important. It means that two adjustments are needed to my explanations above:

1) There has been 0 (zero) closing of short positions for any of the 4 glove companies, at any point between Monday and Thursday. It has been entirely and only short selling, and no buying back.

2) It also means that we still don't know what exactly has happened on Friday. However, except for on Monday, the short selling has been most intense on Thursday and Friday. We are yet to understand if that intense short selling on Friday has been coupled with intense buying back and covering of positions opened earlier in the week. It will be easy to calculate - if the corresponding figures for the net short positions are smaller than the expected figures given in the "Monday (Jan 11) (exp.)" column in the table above, it would mean that the short seller has started closing some of the short positions.

In any case, the pattern is quite clear that the short seller has been trying to mitigate the effect of the MCO news on Thursday and Friday by offloading significantly larger amounts of short sales as compared to the amounts from Tuesday and Wednesday, in particular in regards with Top Glove, which is by far the largest, and therefore the most expensive short position of the short seller, comprising 60% of the value of the overall short position. It is possible that on Friday some panic buying back might have occurred, but we will know if that might have been the case tomorrow evening.

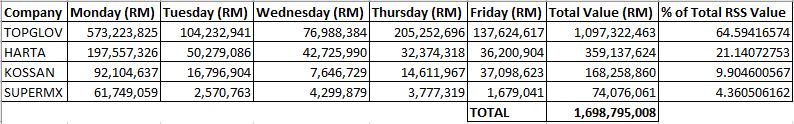

And a bonus table with the total value of all the short sales for the 4 glove counters for the last week. On Friday it reached the whooping amount of RM1.7 billion!

Important disclaimer: Any views expressed are for informational and discussion purposes only. None of this information is intended as, and must not be understood as, a source of advice. It is imperative that you always do your own research and that you make any decisions based on your personal situation and your own personal understanding.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-23

HARTA2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

KOSSAN2024-07-22

SUPERMX2024-07-22

SUPERMX2024-07-22

TOPGLOV2024-07-22

TOPGLOV2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

KOSSAN2024-07-19

TOPGLOV2024-07-18

HARTA2024-07-18

HARTA2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-18

KOSSAN2024-07-17

HARTA2024-07-17

HARTA2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

KOSSAN2024-07-17

TOPGLOV2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

KOSSAN2024-07-16

SUPERMX2024-07-16

TOPGLOV2024-07-16

TOPGLOV2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-15

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

KOSSAN2024-07-12

TOPGLOVMore articles on Trying to Make Sense Bursa Investments

Created by Ben Tan | Jun 04, 2021

Created by Ben Tan | May 09, 2021

Created by Ben Tan | May 04, 2021

Created by Ben Tan | May 01, 2021

Discussions

U must think outside the box.

what u can see the short position is not a REAL..

2021-01-09 14:20

Posted by FutureGains > Jan 9, 2021 2:20 PM | Report Abuse

U must think outside the box.

what u can see the short position is not a REAL..

________________________________________________________

Haha. That is data provided by Bursa. You mean to say what Bursa is telling us is not REAL or TRUE ?

2021-01-09 14:22

Recovery play...a recovering economy play..sectors like financials, consumer related , travel, etc....???

.

2021-01-09 14:31

I bought Harta a few daysago and when I click on the seller info, JP appears. Very obvious it is JP. Is the short seller

2021-01-09 14:40

Correct @treasurehunt, GLOVES are on an upward trajectory after being being pressed shamelessly /manipulatively by IBs. to cover their asses. ie call warrants. As mentioned by Morhpeus time and time again.

------------------------------------------------------

treasurehunt Gloves sector is on recovery play after being downplaying for 3 months.

09/01/2021 1:44 PM

2021-01-09 14:53

Wow! I chose a bad moment to go for lunch apparently.

Thank you everyone for your comments and for this great discussion. I just want to request that we keep it civil. We all want to know the truth and different factors point at different directions.

For instance, while the initial short position was opened by a foreign institution, later on during the week, local institutions were net sellers on Bursa, so it might have been a "joint exercise". We will likely never know.

What we know is the publicly available data, which points (at least for now) towards an unpleasant scenario for the short seller(s). However, let's not forget that they still have a significant amount of space to open a yet larger short position on each of the 4 stocks, which would result in further volatility in order to try and cover their existing short position at lower net loss. The most important thing is to think rationally in times like this, with as little emotion as possible.

2021-01-09 15:15

Love what you wrote. Do keep writing more, I would love to read more of what you have in mind.

2021-01-09 15:18

Thanks for the great article . I bought both Topgloves and Supermx on Tuesday and Wedneday seeing the great opportunity to buy at super low prices for stocks which have super growth rate , super.cash flow , super margin , super.ROE and super low forward PE .As for Topglove super high dividend yield of 15 %. It was a big mistake for the institutions to short such good stocks with great fundamentals and higher earnings for the next few qtrs

2021-01-09 16:05

we can only speculate or deduce, but we will never know the truth behind. Commonly in a RSS, the lender or the borrower, do not do it for a short period of time, i.e., one week or one month, it is for a period of more than 1 month, 3 months, 6 months or more. From another angle, players can also churn RSS. Sell, buyback (closed position), sell again, buyback again (closed position again) on the same day. Lender can call back the share anytime (in RSS). This is a risk borrower cannot avoid.

2021-01-09 16:28

Good write up Ben Tan. As you mentioned Shorties still have much space to do ss. So it looks like there will be more volatility ahead. BTW anyone knows how many trading days short positions can remain open and must be closed?

2021-01-09 16:58

Big funds RSS to press down price for them to collect low. They had been collected few days and pushing up higher and higher. I don't think they are on losses next week.

2021-01-09 17:17

Great info

Do u know d costs involved ie how much is borrowing cost etc

Posted by sosfinance > Jan 9, 2021 4:28 PM | Report Abuse

we can only speculate or deduce, but we will never know the truth behind. Commonly in a RSS, the lender or the borrower, do not do it for a short period of time, i.e., one week or one month, it is for a period of more than 1 month, 3 months, 6 months or more. From another angle, players can also churn RSS. Sell, buyback (closed position), sell again, buyback again (closed position again) on the same day. Lender can call back the share anytime (in RSS). This is a risk borrower cannot avoid.

2021-01-09 17:31

I m thinking while stil hv TopGlove in hand EPF lent to SS to RSS won't tis makes its TopGlove holdings to lose value?

Return from lending is bigger thn drop in value?

2021-01-09 17:40

pjseow, sosfinance, bpsiah, williamtkb, Orlando, thank you for your comments!

sosfinance, precisely. That is why above in the comments I mentioned that we can only analyse the publicly available data and nothing more. This is an over-the-counter deal, so we cannot know:

- Who the short seller is;

- Who the short seller borrowed the shares from (except for the 40 million shares borrowed from EPF);

- How much the short seller pays for borrowing the shares;

- How long the short seller can hold the shares;

- Any other parameters of the arrangement;

- Any future plans of this or any other short seller.

(This is relevant to bpsiah's and to Orlando's questions as well.)

However, fortunately the publicly available information gives us some important pieces of data, such as the daily RSS volumes, and the net short positions still open. This is sufficient for our main purposes, and we can derive from it directly or indirectly information on:

- What percentage of the short positions have been closed up to now;

- How close the currently open short positions are to hitting the limit;

- What paper losses might exist for the short seller, excluding any unknown fees (not part of the article, but mentioned by treasurehunt above in the comments section).

We can also extrapolate one more piece of information. As the Kossan short sale position has been closed to a much larger extent than the ones on the other 3 glove counters, this may signify that the short seller's plan has indeed been to close the position relatively quickly - potentially within these 2 weeks since the beginning of the year. I have no doubt that this is what would have happened with all of the counters should the MCO-related news not have arrived at this time.

2021-01-09 18:11

Hi Ben, very well written and detailed explanation. Keep it up the good work.

I guess we might be able to see another ATH or in other word well deserved valuation, taking into account all the circumstances above.

2021-01-09 21:03

roadtomillionaires, thank you for your comment.

I think it might be a bit too early to predict on that. The rally at the end of this week was mostly provoked by the news for a new round of tighter movement restrictions. However, as with many other overreactions on Bursa - this piece of news actually has no material value as far as the glove companies are concerned in isolation from any other factors. The big glove companies have no significant business in Malaysia, and only a minuscule part of their revenue is derived from the country. The only way this piece of news impacts the glove companies is via ringgit's exchange rate movement, and even then to a very small extend.

However, the more important thing - the length of the COVID crisis, and therefore the length of the extraordinary earnings the glove companies are expected to record over the next few quarters, hasn't been understood by the broader market and hasn't been factored in the recent rally. Additionally, most people haven't realized that there is a fundamental shift in the hygiene perception around the world, which runs through a broad range of industries and is here to stay. My personal expectation is that if anything near a ceiling is to be reached, that would happen at some point around the third quarter of this calendar year.

2021-01-09 21:50

Another excellent write up by Ben! I wonder if the short participants dare to extend their shorts till 4% on RSS aggregated net short position. If yes, what will happen if cancellation of 178,361,800 treasury shares by Top Glove? Over 4% and short squeezing triggered? Ermm...

2021-01-09 23:41

Just a question, if short sellers havent close their positions, wouldnt it just mean that they will try and push it down next week?

thanks for the well written article Ben.

2021-01-09 23:52

Super_newbie,

Can’t cancel shares, as it will technically move TSLWC’s stake above 33% as well, trgigering a mandatory GO

2021-01-10 00:01

Ben,

Note that supermax amongst the four are least shorted as well, think part of the reason why that may be could be the free float are tighter and EPF isn’t a direct shareholder hence shorties aren’t able to source for shares to borrow. In conclusion, the volatility that we saw, could be down to EPF’s holdings held in custodian accounts which. As lend out to shorties.

Do please also research and talk about ‘cum-ex dividend stripping’ by short sellers. Now given that top glove shares goes ex on the 11th, are short sellers returning the shares to EPF cum or ex dividends? All of us as EPF contributors or have monies in EPF should know the processes behind this

2021-01-10 00:06

One of the best write up. Thank you and hope to have more write up in the future. God bless you.

2021-01-10 10:03

Ben, thank you for the effort to share this piece of valuable information and analysis. I am also tracking the PSS and RSS data since early December. From my understanding, the date printed on the net short position from bursa should be for a day earlier closing. For example, the latest net short data from bursa stated for 8/jan/2021 was actually for the closing of 7/jan/2021. However the date for total short selling for the day is correct. If you do the net short position date adjustment, you will find that the short seller/s hardly cover any of their position(for all Big4) from Monday to Thursday. We will need to wait for next Monday bursa’s data to see the short position for last Friday. If it still show no cover of short position, the short sellers are in greater risk. A point to note, there were a few days (21 and 22 December) that the short position didn’t change, but all changes were appeared on the 23 December(the changes were more than the total trade volume for the Big4 on 23 December), this could be due to either bursa ‘lazy’ to update or the shorties didn’t update bursa properly. This will confuse the market.

2021-01-10 12:18

I was just thinking if the intention of the short seller was to press down the price so that they can collect more shares at a lower price where for example they shorted a certain amount of shares but when the price went lower, they bought back 2 or 3 times more of the number of shares they shorted so that not only they already bought back enough shares to return to the lender but also made a handsome profit from the additional shares that they bought at a lower price after they pressed down the price?

2021-01-10 12:43

Sometimes it market just act illogically.

Still remember there was 1 glove put call warrant during time of glove super bullish ?

However, things must get to back to it's where it shud be after the craziness.

That's all I can say.

2021-01-10 12:47

Force must be use it right

Else it can bring damages or disaster in the short term.

If the forces are to navigate on par with the broader market, next question is

Will there be any fat meat left ?

2021-01-10 12:49

Agreed. Bursa is slightly lagging to update the data in Net Short Position. I also can’t tally the figures RSS daily report for Harta and Supermax for last week. The difference is small and less than 10% of Net short positions.

Posted by invest200 > Jan 10, 2021 12:18 PM | Report Abuse

Ben, thank you for the effort to share this piece of valuable information and analysis. I am also tracking the PSS and RSS data since early December. From my understanding, the date printed on the net short position from bursa should be for a day earlier closing. For example, the latest net short data from bursa stated for 8/jan/2021 was actually for the closing of 7/jan/2021. However the date for total short selling for the day is correct. If you do the net short position date adjustment, you will find that the short seller/s hardly cover any of their position(for all Big4) from Monday to Thursday. We will need to wait for next Monday bursa’s data to see the short position for last Friday. If it still show no cover of short position, the short sellers are in greater risk. A point to note, there were a few days (21 and 22 December) that the short position didn’t change, but all changes were appeared on the 23 December(the changes were more than the total trade volume for the Big4 on 23 December), this could be due to either bursa ‘lazy’ to update or the shorties didn’t update bursa properly. This will confuse the market.

2021-01-10 12:54

Big volume on Friday. Possible of Shorties cut loss. I doubt Bursa update Net short position in an exact timely manner.

2021-01-10 12:59

Bursa's Net Short Position as at 8/1/2021 is for the closing of 7/1/2021. Then the actual net short position is very tally with the RSS from last Monday to Thursday. We need bursa to update Net Short Position as at 11/1/2021(Monday) to know the actual net short at 8/1/2021. The whole of last week data showed that shorties did not cover their short position, or very negligible even they did as there might be some small balance amount from PSS. There might be some panic short cover on last Friday but we will need next report from bursa on the coming Monday.

2021-01-10 14:20

Clarification, I meant from last monday to thursday, the short seller did not cover their short position.

2021-01-10 14:25

Mayb they will continue short..

Those with profit (bought on last week), drop sikit will take profit liao

Those with loss (bought in 2020), no much bullet left..

They still can control the price.

2021-01-10 15:31

super_newbie, sagaraken, seanyap1, Michael Teng, Sales, invest200, jian90, VenFx, treasurehunt, ming, thank you very much for your comments and for your incredible input!

First, please note that I updated the article to reflect the concerns expressed by invest200 and treasurehunt. The net short position reporting indeed lags 1 day behind, so we will know the exact amount of any short positions that might have been closed on Monday evening (usually after midnight).

sagaraken, that might be the case. However, the net short position for this past week is equivalent to RM1.5 billion in value. It is hard to imagine that a player could offload more of this amount of cash in order to try and again press the price down. This amount alone represents almost 0.5% of the gross domestic product of Malaysia!

seanyap1, thank you for pointing that out. Indeed that might be the case. The short seller needs to be able to secure huge amounts of shares per batch, so it might not be as easy for them to do that for Supermax shares as it might be for the other 3 companies. In particular, neither EPF nor KWAP are substantial shareholders of Supermax.

jian90, if it is an unscrupulous attempt for a sort of transfer of shares from one player to another, it has become an extremely expensive one. We can only guess as to if that might be the case.

2021-01-10 15:44

Best case scenario

Hot money coming in in 2021

Hot money wanted to buy cheap

Hot money shorted Mon to Thu

Hot money short covered n more on Fri

Hot money now waiting for big gain

2021-01-10 17:04

Ben Tan, Treasurehunt and Invest200, you guys do have an eye for details. I was equally puzzled and the data are indeed lagging by a day . Good jobs !

2021-01-10 18:46

Orlando and Michael Teng, thank you once again. Let's now patiently wait and observe the show on Monday.

2021-01-10 20:54

thanks for replying Ben, good article and thanks for sharing! Appreciated.

2021-01-10 21:58

Thanks Ben for sharing. Very insightful, looking forward to more analysis from you!

2021-01-10 22:01

oohlala, sagaraken, LCLY, keet68, I just wanted to thank you for your comments.

Let's just observe patiently. This week's market will be very volatile. In such times I always like to base my decisions on fundamentals, and at least as far as gloves are concerned, there might be no reason for any action to be taken this week. I would "go to sleep".

2021-01-11 12:09

Winner88, thank you for your comment. We will need to wait and see if Bursa might decide to reimpose the ban on short selling now with the new round of MCO.

2021-01-12 11:17

Just wondering if it is just us that imposes these kinda ban on the market during such circumstances? Does the ban make our market appear like a whimpy kid who can't take a challenge?

2021-01-12 23:40

CJkenho I have a different view.

Short selling activities do bring benefits vis-a-vis bringing liquidity to the market but the orchestrated attempt to bring down the entire Big 4 has been outrightly manipulative and brutal. Weekly sponsored ads stirring up negative news, ESG, languishing ASPs, vaccine roll-outs and the infamous 3.50 TP.

On 4th Jan, shorties trained their gun on glove companies causing RM13.65b market cap to be wiped off from the Big 4 glove counters and EPF abetted the massacre.

How is this level playing field?

2021-01-13 00:31

treasurehunt

Gloves sector is on recovery play after being downplaying for 3 months.

2021-01-09 13:44