Traders Brief - Struggling for Direction Ahead of the G20 Meeting

HLInvest

Publish date: Tue, 25 Jun 2019, 10:33 AM

MARKET REVIEW

Asian markets ended mixed ahead of the widely anticipated President Trump-Xi meeting at the 28-29 June G20 summit for any signs of de-escalation in a trade war that is damaging the global economy and souring business confidence. Sentiment was also dampened by the heightened Middle East geopolitical tensions as US is planning to impose further sanctions against Iran after Tehran claimed it downed an American drone that violated its airspace.

After rallying 43.6 pts last week to a three-month high of 1682.2, KLCI lost 6.1 pts at 1676.1on profit taking, led by major decliners such as SIMEPLT, GENTING, AXIATA, IOICORP and MAXIS. Trading volume decreased to 1.81bn shares worth RM1.68bn as compared to Friday’s 2.22bn shares worth RM3.05bn. Market breadth was negative with 294 gainers as compared to 518 losers.

In a listless trade, the Dow inched up 8 pts at 26728 as investors looked ahead to President Trump-Xi meeting during G20 summit and tracking heightened geopolitical tensions in the Gulf. Meanwhile, rising geopolitical tensions in Middle East and the prospects of lower Fed rates saw safe havens such as gold spiked 1.7% to USD1423 and the 10Y Treasury yields slipped 0.048% to 2.018% while WTI oil jumped 0.6% to USD57.8.

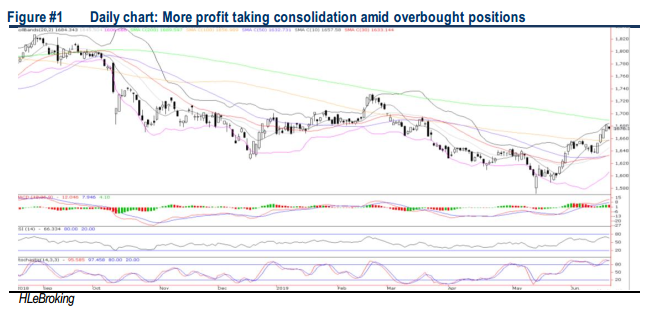

TECHNICAL OUTLOOK: KLCI

Following a 7% relief rally from 1572 (14 May) to 1682 (21 June) and a 2.7% surge WoW, KLCI slipped 6.1 pts yesterday at 1676.1, recording its 1st decline after a 4-day winning streak. Ahead of the G20 summit and prevailing geopolitical uncertainties in Iran, KLCI is expected to engage in a profit taking consolidation amid weakening technical indicators. Resistance is pegged around 1682, 1690 (200D SMA) and 1700 psychological barrier while supports are near 1657 (100D SMA), 1650 and 1645 (20D SMA) levels.

Given that nothing significant is expected from the US-China trade talk at G20 meeting, except for willingness to return to negotiating table, as well as surging geopolitical tensions in Middle East, KLCI is expected to continue its profit taking mode after rallying 6.6% from 1572. However, any retracement is likely to be cushioned by potential 1H19 window dressing activities. For big cap proxies to window dressing, we like MAYBANK, CIMB and RHBBANK.

TECHNICAL OUTLOOK: DOW JONES

Following a 9% relief rally from a low of 24680 (3 June) to a high of 26907 (21 June) and a 2.4% surge WoW, the Dow gained 8 pts after hovering within a tight 26723-26806 range. On the back of the formation of a shooting star and toppish indicators, we expect the Dow to consolidate in the near term, with formidable resistances at 26900-27000 while supports fall on 26300-26500 territory.

In the US, sentiment may cautious after recent 8.3% rally from YTD low of 24680 to 26728, mainly driven by the dovish Fed and US-China trade war optimism. Consensus are expecting a more conciliatory tone when President Trump and Xi meet during the G20 summit, with a possible agreement to refrain from further tariff hikes or other punitive actions. Overall, we expect the Dow to trend in tight range bound within 26400-27000 levels this week.

TECHNICAL TRACKER: CLOSED POSITIONS

Yesterday, we had squared off our positions in PECCA (+8.3% gains), SUPERMX (0.0% gain) and NADIBHD (0.0% gain).

Source: Hong Leong Investment Bank Research - 25 Jun 2019

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-07-18

CIMB2024-07-18

GENTING2024-07-18

IOICORP2024-07-18

MAXIS2024-07-18

MAYBANK2024-07-18

MAYBANK2024-07-18

RHBBANK2024-07-18

RHBBANK2024-07-17

CIMB2024-07-17

CIMB2024-07-17

CIMB2024-07-17

CIMB2024-07-17

CIMB2024-07-17

CIMB2024-07-17

IOICORP2024-07-17

IOICORP2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAXIS2024-07-17

MAYBANK2024-07-17

MAYBANK2024-07-17

MAYBANK2024-07-17

MAYBANK2024-07-17

RHBBANK2024-07-17

SDG2024-07-16

AXIATA2024-07-16

AXIATA2024-07-16

AXIATA2024-07-16

AXIATA2024-07-16

CIMB2024-07-16

CIMB2024-07-16

CIMB2024-07-16

CIMB2024-07-16

CIMB2024-07-16

CIMB2024-07-16

GENTING2024-07-16

GENTING2024-07-16

IOICORP2024-07-16

MAXIS2024-07-16

MAYBANK2024-07-16

MAYBANK2024-07-16

RHBBANK2024-07-16

RHBBANK2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

CIMB2024-07-15

GENTING2024-07-15

GENTING2024-07-15

IOICORP2024-07-15

MAXIS2024-07-15

MAYBANK2024-07-15

RHBBANK2024-07-15

SDG2024-07-15

SDG2024-07-15

SDG2024-07-15

SDG2024-07-15

SDG2024-07-15

SDG2024-07-15

SDG2024-07-12

CIMB2024-07-12

IOICORP2024-07-12

MAXIS2024-07-12

MAXIS2024-07-12

MAYBANK2024-07-12

RHBBANK2024-07-11

CIMB2024-07-11

GENTING2024-07-11

IOICORP2024-07-11

IOICORP2024-07-11

MAYBANK2024-07-11

MAYBANK2024-07-11

RHBBANK2024-07-11

RHBBANK2024-07-11

SDG2024-07-11

SDG2024-07-11

SDG2024-07-10

CIMB2024-07-10

CIMB2024-07-10

CIMB2024-07-10

CIMB2024-07-10

CIMB2024-07-10

CIMB2024-07-10

CIMB2024-07-10

CIMB2024-07-10

IOICORP2024-07-10

MAYBANK2024-07-10

MAYBANK2024-07-10

RHBBANK2024-07-10

SDG2024-07-10

SDG2024-07-09

AXIATA2024-07-09

AXIATA2024-07-09

CIMB2024-07-09

CIMB2024-07-09

CIMB2024-07-09

CIMB2024-07-09

CIMB2024-07-09

IOICORP2024-07-09

MAYBANK2024-07-09

MAYBANK2024-07-09

MAYBANK2024-07-09

MAYBANK2024-07-09

MAYBANK2024-07-09

MAYBANK2024-07-09

MAYBANK2024-07-09

RHBBANK2024-07-09

RHBBANK2024-07-09

SDGMore articles on HLBank Research Highlights

Discussions

Sure enough, this Dick just announced he would be imposing 10% tariff hike on remaining USD 300 billion Chinese goods starting 1 Sept 2019.

China already anticipated that when they put in Zhong Shan to counter the hawks from America.

If Chinese prepare to eat grass for next 5 years, then Americans will be eating bark for even longer period of time........That is so called Long March mah

2019-08-02 09:29

Response from China:

1. No more US farm produce for Chinese market

2. Let RMB find its own equllibrium without interference from Central Bank. RMB may go to 8 for one USD.

3. No more rare earth minerals for US.

4. No more Chinese tourists heading for US.

5. Selected US companies will be placed under Unreliable Entity List.

6. Unfriendly US companies will be facing sanctions and curtailment to operate in China market. That could include all fast food chains like KFC, McDonald, popular soft drink like coca cola etc.

7. Depend on which side Apple taking side, either you want to remain relevant in China market or not is up to you to choose.

2019-08-07 00:59

Donald Dick imposed 30% tariff on 250 billion imports from China effective 1 Oct 2019.

Another 300 billion at 15% tariff effective 1 Sept 2019.

Now you must 100% convinced Donald Dick is in fact is a 4th category human being.

4 categories of Human being:

1. 100% trustworthy - a credible and reliable person at all times

2. 75% trustworthy - a credible and reliable person most of the time.

3. 50% trustworthy - not credible and not reliable person most of the time.

4. 25% trustworthy - not credible and not reliable person at all times.

2019-08-24 11:08

ks55

G20 is a non-event this round.

President Xi- Donald Dick meeting will not yield anything good.

Very likely 2 Jul, this Dick will impose 25% on Chinese goods.

If not, this Dick will be doing that latest by 2 Sept.

2019-06-25 11:05