Traders Brief - KLCI to Retest 1400-1418 Levels Amid a Strong Comeback by Dow and Surging Oil Prices

HLInvest

Publish date: Fri, 15 May 2020, 09:13 AM

MARKET REVIEW

Global: Asian markets were in the sea of red as a grim US economic forecast from Powell poured cold water on hopes for a quick recovery. Sentiment was also dampened by worries of a second wave of COVID-19 infections could be ahead if lockdowns in any part of the world are eased prematurely. Meanwhile, Dow staged a remarkable turaround from a 459- pt plunge to end 377 pts higher 23625, led by battered financial and oil & gas stocks as investors overlooked grim weekly jobless claims of 2.9m and somber comments from Powell about the US economic outlook, and hope for future possible coronavirus relief bills to blunt the devastating effects on the economy and health-care system.

Malaysia: Tracking sluggish regional markets, KLCI ended flat at 1397.3 after falling as much as 8.3pts amid warning of a prolonged economic weakness by Powell and expectations of a tepid 1Q20 results season. Trading volume was active at 7.0bn worth RM4.0bn after hitting an all-time high of 9.59bn shares valued at RM5.1bn Wednesday. After the buying climax on Wednesday, market breadth turned negative with 345 gainers vs 616 losers due to strong profit taking activities.

TECHNICAL OUTLOOK: KLCI

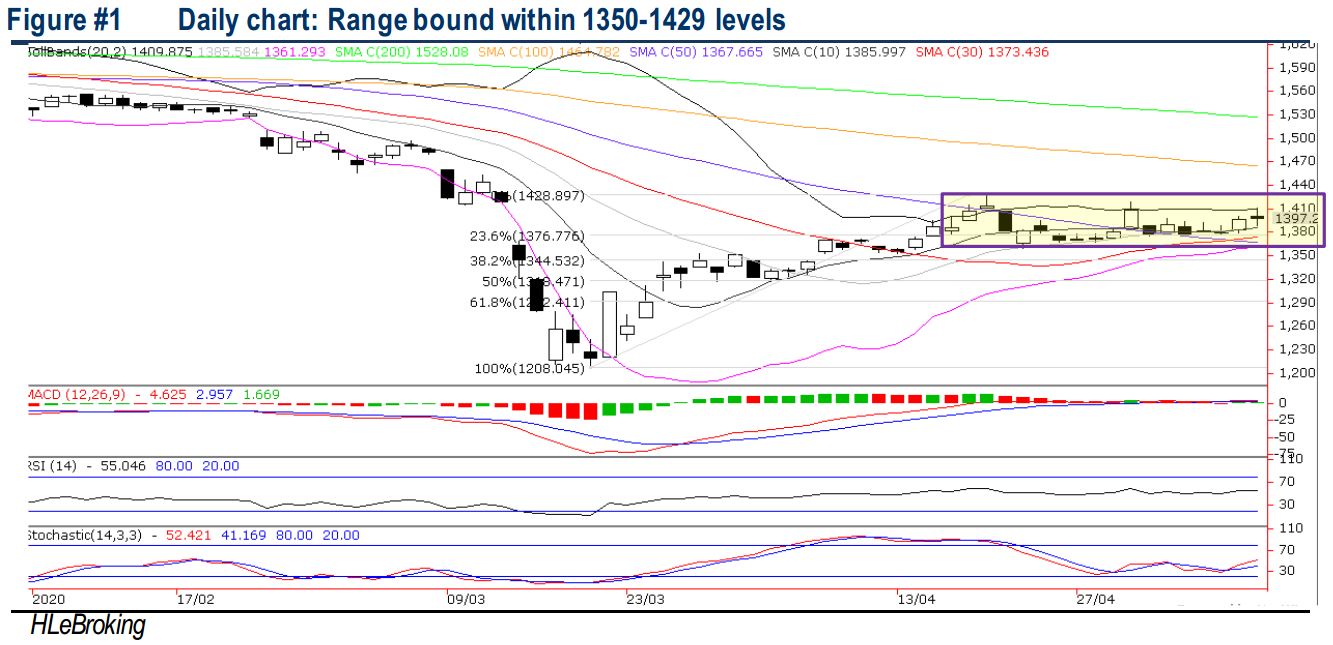

We reiterate our stance that KLCI would lock in a short term consolidation unless it can stage a solid breakout above stiff double resistances at 1418 (18 Apr) and 1429 (20 Apr). Conversely, violating the supports at 1386 (20D SMA) and 1368 (50D SMA) could put the bears in the driving seat again, pushing the index lower towards 1359 (22 Apr low) and 1344 (38.2% FR) levels thereafter. Both the MACD and RSI are flattening out whilst the slow stochastic indicator is inching upward, signalling more consolidation ahead.

MARKET OUTLOOK

Although overnight remarkable comeback by Dow and a rally in oil prices could spur local sentiment today to retest the 1400-1418 zones, KLCI could experience some degree of profit taking (with key short term supports at 1350-1370) as market is digesting this week historic trading volumes. On local stocks, we believe focus would remain on the COVID-19 winners such as gloves and healthcare-related stocks but recent upmove has sent these stocks into extremely overbought levels and elevated valuations, and hence profit taking pullback could cap further gains.

Source: Hong Leong Investment Bank Research - 15 May 2020

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-09-03

ECONBHD2024-09-03

ECONBHD2024-09-03

ECONBHD2024-09-03

INARI2024-09-03

INARI2024-09-03

INARI2024-09-03

ROHAS2024-09-02

ECONBHD2024-09-02

ECONBHD2024-09-02

ECONBHD2024-09-02

GBGAQRS2024-09-02

INARI2024-09-02

INARI2024-09-02

INARI2024-09-02

INARI2024-09-02

INARI2024-09-02

PHARMA2024-09-02

PHARMA2024-09-02

SURIA2024-08-30

ECONBHD2024-08-30

EDGENTA2024-08-30

GBGAQRS2024-08-30

INARI2024-08-30

MEDIA2024-08-30

PHARMA2024-08-30

UNISEM2024-08-29

INARI2024-08-29

INARI2024-08-29

INARI2024-08-29

INARI2024-08-29

MEDIA2024-08-29

MHB2024-08-29

MHB2024-08-29

MHB2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-29

TALIWRK2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

INARI2024-08-28

MEDIA2024-08-28

MEDIA2024-08-28

ROHAS2024-08-28

ROHAS2024-08-28

ROHAS2024-08-28

ROHAS2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

INARI2024-08-27

ROHAS2024-08-27

TALIWRK2024-08-26

ECONBHD2024-08-26

FOCUSP2024-08-26

FOCUSP2024-08-26

INARI2024-08-26

INARI2024-08-26

MHB2024-08-26

TALIWRK2024-08-23

FOCUSP

.png)