Traders Brief - Tug-a-war Match to Continue

HLInvest

Publish date: Mon, 20 Jun 2022, 11:26 AM

MARKET REVIEW

Global. MSCI All Countries Asia Pacific index slipped 1.48% to 156.81 (-5.6% WoW) as nagging concerns over the aggressive tightening policies by global central banks could accelerate the pace of rapid economic slowdown. Ahead of the Juneteenth holiday on 20 June, the Dow eased 38 pts to 29,888 (-4.8% WoW) in a volatile session whilst the Nasdaq staged a 1.4% relief rally to 10,798 (-4.8% WoW). Risk-off mood remained amid lingering worries that a hawkish to combat red-hot inflation may inadvertently trigger a US recession button, reflected by several economic indicators ranging from retail sales to housing starts and industrial production already pointed to slower economic activity.

Malaysia. Tracking overnight rout on Wall St, KLCI slid 16 pts to 1,456.7 (-37.2 pts WoW and -86.9 pts YTD) last Friday amid a resumption of foreign exodus, led by selloff in NESTLE, PMETAL, PETGAS, PBBANK, PETDAG, and CIMB. Market breadth (gainers/losers) weakened to 0.37 from 0.71 a day before, and traded below 1.0 in 9 out of 12 sessions in June. Foreign institutions remained as major net sellers (-RM111m, 5D: - RM511m; YTD: +RM6.45bn), logging 10th day of net outflows out of 12 sessions in June, vis-à-vis net buying trades by domestic institutions (+RM58m; 5D: +RM289m; YTD: - RM7.83bn) and local retail investors (+RM53m, 5D: +RM223m; YTD: +RM1.38bn).

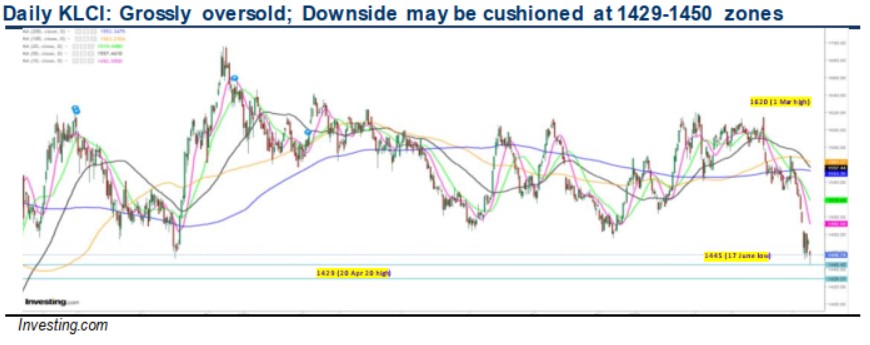

TECHNICAL OUTLOOK: KLCI

Although KLCI is grossly oversold, prevalent headwinds will keep the benchmark in a tug-a war within our envisaged support at 1,429-1,445 and resistances near 1,483-1,500 levels until a decisive breakout or breakdown evolves. A major breakout above 1,500 may lift the index to revisit 1,530-1,550 zones whilst failure to defend 1,530-1,550 support will trigger a steeper selloff towards 1,390-1,400 zones.

MARKET OUTLOOK

Bursa Malaysia may witness further volatility in the short term as investors recalibrate risks around (i) elevated inflation, (ii) potential capital outflows amid aggressive Fed and QT, (iii) protracted Russia-Ukraine war, (iv) heightened US-China conflict and (v) political fluidity amid speculation of GE15 in 2H22. However, the hammer candlestick pattern last Friday and a steeply oversold market may cushion further slump in KLCI with major supports at 1,429-1,445 levels (resistances: 1,483-1,500). Hence, current beleaguered market presents a buying opportunity as the positives from reopening will still outweigh in 2H22 to drive economic recovery. We prefer ARMADA, DNEX, EVERGRN, FOCUSP, KOBAY, TENAGA, SUNWAY, ASTRO, PMETAL, SIMEPLT, BURSA and RHBANK.

Source: Hong Leong Investment Bank Research - 20 Jun 2022

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-22

ARMADA2024-11-22

ARMADA2024-11-22

BURSA2024-11-22

BURSA2024-11-22

BURSA2024-11-22

DNEX2024-11-22

EVERGRN2024-11-22

FOCUSP2024-11-22

FOCUSP2024-11-22

PMETAL2024-11-22

RHBBANK2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SDG2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

SUNWAY2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-22

TENAGA2024-11-21

BURSA2024-11-21

BURSA2024-11-21

FOCUSP2024-11-21

FOCUSP2024-11-21

RHBBANK2024-11-21

RHBBANK2024-11-21

RHBBANK2024-11-21

RHBBANK2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SDG2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

SUNWAY2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-21

TENAGA2024-11-20

BURSA2024-11-20

RHBBANK2024-11-20

SDG2024-11-20

SDG2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

SUNWAY2024-11-20

TENAGA2024-11-20

TENAGA2024-11-20

TENAGA2024-11-19

BURSA2024-11-19

PMETAL2024-11-19

RHBBANK2024-11-19

RHBBANK2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SDG2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

SUNWAY2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-19

TENAGA2024-11-18

ARMADA2024-11-18

ARMADA2024-11-18

BURSA2024-11-18

PMETAL2024-11-18

PMETAL2024-11-18

RHBBANK2024-11-18

RHBBANK2024-11-18

SDG2024-11-18

SUNWAY2024-11-18

SUNWAY2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-18

TENAGA2024-11-16

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

ARMADA2024-11-15

PMETAL2024-11-15

RHBBANK2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SDG2024-11-15

SUNWAY2024-11-15

SUNWAY2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-15

TENAGA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

ARMADA2024-11-14

BURSA2024-11-14

BURSA2024-11-14

RHBBANK2024-11-14

RHBBANK2024-11-14

SDG2024-11-14

SDG2024-11-14

SUNWAY2024-11-14

SUNWAY2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-14

TENAGA2024-11-13

PMETAL2024-11-13

PMETAL2024-11-13

RHBBANK2024-11-13

SDG2024-11-13

SDG2024-11-13

SDG2024-11-13

SDG2024-11-13

SUNWAY2024-11-13

SUNWAY2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-13

TENAGA2024-11-12

DNEX2024-11-12

DNEX2024-11-12

RHBBANK2024-11-12

SDG2024-11-12

SDG2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

SUNWAY2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA2024-11-12

TENAGA