【Airasia三部曲终极篇】:怎么最大化利润!!!

twot

Publish date: Thu, 26 May 2016, 08:46 PM

Airasia的业绩终于出炉了!

Net Profit:877m!!!

比我的预期好很多很多很多!

现在已经无须再为Airasia找什么缺点,或担忧的风险了。。。

Net Operating Profit都有521m!

以目前未来的近期状况,这个Profit足以cover一切“潜在风险”

现在最大的问题Airasia会起多少?

怎么把利润最大化!

有兴趣的朋友,可以去看我之前的两篇文章:

1. 《【必看!】还有什么理由不在至少这个季度拥有AIRASIA?!!!》

http://klse.i3investor.com/blogs/iamtyz/94946.jsp

2. 《如果连冷眼都买了Airasia!》

http://klse.i3investor.com/blogs/iamtyz/95753.jsp

说回重点,怎么最大化可以在Airasia赚取的利润

很简单,就是买Call Warrant (CW)!

Call Warrant并不是什么“魔鬼”,无须对它感到惧怕,

它只是一种可以放大化 升幅或跌幅 的“工具”而已

说白了,不敢买Call Warrant的人,只是对自己所持有的股票不够自信罢了。。。

以Airasia是现在大马股市这个季度难得Net Profit增加那么多的公司,又是

2016年,大马股市最厉害的强势股,难道不该买点Call Warrant吗?

不过,那么多CW,该买那一只呢?

经过分析计算,我个人认为可以买的CW只有三支:

C31,C33,C34

(事先说明!这篇文章只是我的个人分享,无任何买卖建议性质,后果自负)

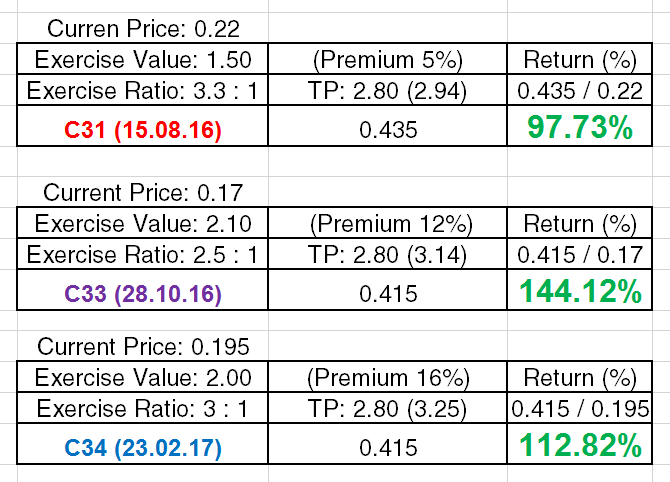

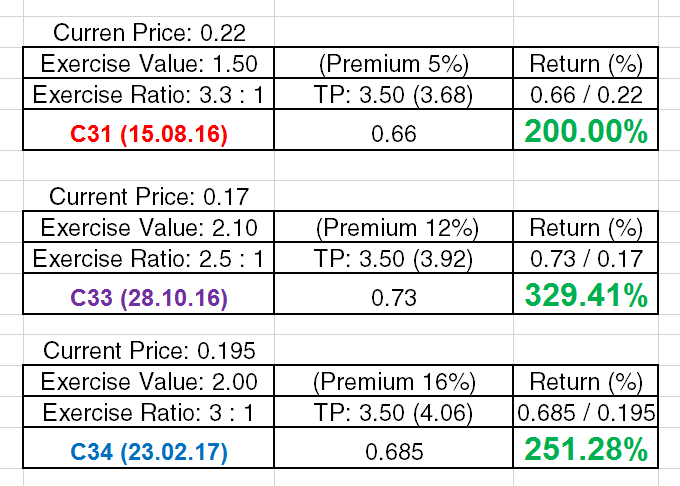

请看这两张图:

现在,很多人对Airasia有很多不同的Target Price (TP)

如果,Airasia这一整年可以保持如此亮眼的成绩,

要上到5块8块不是不可能的,但那还很遥远。。。

先假设这两个星期的TP是RM2.80,一个月的TP RM3.50,好吗?

以目前的Profit来说,是太保守了!

我是以“高估”来计算C31,和“低估”C33,C34的方式来计算

所谓“高估”和“低估”当然是以Premium的多少。

我会给C31比较低的Premium是因为它的Maturity Date将近

再加上Gearing过低,无法起到更大杠杆的作用,所以很难引起投资(机)者的关注去“炒”它

C33现在的Premium是19.10%,而C34是21.93%

但如图显示,我只给他们分别12%和16%的Premium。

从两张图可以看到,C33的升幅最高,C34其次,而C31最低

这是因为C33的杠杆作用是最大的,你想想看它的Exercise Value是2.10

Exercise Ratio是2.5,也就是说“理论上”,Airasia每起2.5sen,C33会起1sen!

而C31,Airasia每起3.3sen,它才起1sen。

假设,Airasia起10sen,C31就会起3sen,而C33会起4sen。

但C31的股价是0.22,起3sen,才13.64%的return;

C34大约会起3.5sen,股价0.195,Return是17.95%;

而C33股价才0.17,起4sen,Return将会是23.53%!

所以,现在,你们可以了解到所谓的“杠杆”效应。

而且,当Airasia的股价起越多的时候,差距会更大!

如果,还不了解的朋友,可以尝试用这个Formula去计算:

(Current Stock Price - Exercise Value) / Exercise Value

就是那么简单!

当然“水能载舟,亦能覆舟”,股价下跌的时候,效果也是一样

所以,应该根据自己所能承担的风险,来选择哪一支Call Warrant。

(重申!这篇文章只是我的个人分享,无任何买卖建议性质,后果自负)

好吧,“三部曲”结束,往后应该不会再写关于Airasia的文章了。

三个月的煎熬等待,终于等到了今天!

只能帮大家到这里了。

NOW EVERYONE CAN HUAT!!!

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on The Wolf of Taylor's

Discussions

lol talk soldier on paper

Call Warrant并不是什么“魔鬼”,无须对它感到惧怕,

(事先说明!这篇文章只是我的个人分享,无任何买卖建议性质,后果自负)

see these two sentence already LDM... so contradict

except C31 1% premium (today), the rest u really lead ppl to holland...

hold until so long? time decay till mother also cant recognize

-Fundamentally, there is a 400mil as the foreign exchange gain (and 600mil is unrealized) in the recent quarter earnings, which contribute much to the net profit. if exclude this gain, the EPS is only 15 (appx).

If today the EPS is fully from its business, the share price wont be at the previous resistance so less, should have up 20-30% today.

-Technically, stocks price has already show some bear divergence sign, if this resistance breakout but MACD cant do higher high, dont know how many people will die holding the warrants with the stock price consolidation (maybe 3 months consolidation or more?), and with the time decay of the warrant if premium too high

Im not saying that Airasia cant reach your TP, but encouraging people to hold warrant for such a long time is really leading people go to holland, with all the risk and things which possible to happen in such a long period. Many investor will just merely buy n wont cutting loss with the share price dropping. This is such a irresponsible post. Q3 have a high chance where by the revenue wont be so nice, and once funds get stuck, they hardly will cut the losses.

And fyi, your theory on warrant is so nicely calculated. But the real warrant price is control by the issuer, those parameters can be easily changed by them. today's warrant is so nice will turn nightmare anytime.

2016-05-27 17:56

For all Those of you who want to play airasia call warrants my advice :

C31 is the best option with almost no premium

C28 is good but very low volume traded so not advisable to trade.

C34 n C33 longer expiry date but premium too high for just 3 extra month of time value.

For C31 you can always switch over to other options if you want to continue holding beyond the expiry period as you don't need to bear the premium upon expiry.

Take your pick your money your choice. Happy trading

2016-05-27 18:16

VenFx

Twot , good works.

2016-05-26 21:06