(Icon) Oceancash Pacific - Making Inroad Overseas

Icon8888

Publish date: Fri, 30 Jan 2015, 09:04 AM

Executive Summary

(1) Featured in The Edge few weeks ago. Share price came down recently due to latest quarter losses (caused by exceptional items). Cheaper pricing warrants a revisit.

(2) Manufactures Felts and Non Woven Products (please refer to Section 1 below) by using plastic resin and other petrochemicals.

(3) Growing market share in Japan.

(4) Beneficiary of strong US dollars as the bulk of products exported.

1. Principal Business Activites

Oceancash's business activities are segmented into Wooven Products (Felts) and Non Wooven Products respectively. The group's factories are located at Bangi, Selangor and Bekasi, Indonesia.

In April 2012, the company started a trading company in Guangzhou, China. This represents a big step forward for the company as it ventures into the competitive and challenging automotive market in China.

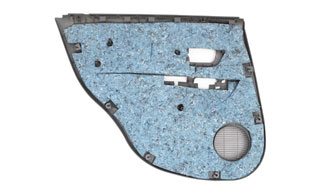

(a) Woven Products - Resinated Felts and Thermoplastic Felts

(a1) Resinated Felts

(Semi Cured Jute Felts)

• Mouldable

• Mixture of Denim / Cotton, and Jute with Phenolic Resin

• Process involves Hot Press moulding

Applications

Insulator dash outer, insulator hood, insulator cowl top, rear parcel shelf, headlining, and wheel housing cover.

(Cured Felts)

• Non-mouldable

• Mixture of cotton as main material and phenolic resin as binder

• Can be produced in roll form, sheet form, and cut in shapes

• Can be sprayed with glue or laminated with double sided tape

Applications

Floor carpet underlay, dashboard insulator, roof pad insulator, parcel shelf lining, trunk compartment lining, door trim lining, and trim pillar lining.

(Fire Retardant Felts)

• Non-mouldable

• Fire retardant felts which can achieve UL94 Standards

Applications

Noise damper for compressors of split unit air conditioners.

(a2) Thermoplastic Felts

(Flexi-c)

• Non-mouldable

• Commonly used as alternative to Cured Felts

• Can be produced in roll form, sheet form, and cut in shapes

• Can be sprayed with glue or laminated with double sided tape

Applications

Floor carpet underlay, dashboard insulator, roof pad insulator, parcel shelf lining, trunk compartment lining, door trim lining, and trim pillar lining.

(Flexi-d)

• Denim based felts

• Commonly used as alternative to Flexi-c and Cured Felts

• Can be produced in roll form, sheet form, and cut in shapes

• Can be sprayed with glue or laminated with double sided tape

Applications

Floor carpet underlay, dashboard insulator, roof pad insulator, parcel shelf lining, trunk compartment lining, door trim lining, and trim pillar lining.

(Flexi-m)

• Mouldable

• Process involves Cold Moulding

Applications

Inner dash panel and floor carpet.

(Flexi-Lite)

• Non-moudable

• Light weight felts

• Can be produced in roll form, sheet form, and cut in shapes

• Can be sprayed with glue or laminated with double sided tape

Applications

Floor carpet underlay, dashboard insulator, roof pad insulator, parcel shelf lining, trunk compartment lining, door trim lining, and trim pillar lining.

(b) Non Woven Products

(b1) Thermal Bonded Non-woven Fabric

- Basis weight from 14g/m2 to 60g/m2

-

Non-woven made of;

- 100% Polypropylene fibers

- 100% Bi-component (PP/PE) fibers

- Combination of (1) and (2)

- Combination of (1) or (2) with Rayon fibers

-

Non-woven features;

- Soft hand feeling.

- Tensile strength according to customer specific requirements.

- Even web formation.

- Improved diffusion.

- Available in Hydrophilic and Hydrophobic type.

(b2) Air Through Bonded Non-woven Fabric

- Basis weight from 18g/m2 to 60g/m2

-

Non-woven made of;

- 100% Bi-component (PP/PE) fibers

- 100% Bi-component (PET/PE) fibers

- Combination of (1) and (2)

- Combination of material up to 4 type

-

Non-woven features;

- High loft.

- Soft and smooth hand feeling.

- Tensile strength according to customer specific requirements.

- Even web formation.

- Improved diffusion and low re-wet.

- Available in Hydrophilic and Hydrophobic type.

(b3) Acquisition Distribution Layer (ADL) Fabric

- Basis weight from 30g/m2 to 60g/m2

-

Non-woven made of;

- 100% Bi-component (PP/PE) fibers

- 100% Bi-component (PET/PE) fibers

- Combination of (1) and (2)

- Combination of material up to 4 type.

-

Non-woven features;

- High loft.

- Soft and smooth hand feeling.

- Tensile strength according to customer specific requirements.

- Even web formation.

- Improved diffusion and low re-wet.

- Available in Hydrophilic and Hydrophobic type.

(b4) Two layers Non-woven Fabric

- Basis weight from 20g/m2 to 40g/m2

-

Non-woven made of;

- 100% Bi-component (PP/PE) fibers

- 100% Bi-component (PET/PE) fibers

- Combination of (1) and (2)

- Combination of material up to 4 type

- Combination of small dtex fibers

-

Non-woven features;

- High loft.

- Soft and smooth hand feeling.

- Tensile strength according to customer specific requirements.

- Even web formation.

- Improved diffusion and low re-wet.

- Available in Hydrophilic and Hydrophobic type.

Non Wooven Products applications - top-sheet, back-sheets and ADL for diapers and sanitary napkins, wet wipes, surgical apparels including caps, and masks.

2. Background Financial Information

The company has market cap of RM71 mil (based on 223 mil shares and RM0.32).

Based on cumulative twelve months net profit of RM7.3 mil, historical PER is approximately 9.7 times

(Note : latest quarter net loss of RM0.48 mil was due to exceptional items amounting to RM1.69 mil. Excluding those items, net profit would be RM1.21 mil).

The group has strong balance sheets. Based on net assets of RM57 mil, loans of RM12 mil and cash of RM10 mil, net gearing is 4% only.

(Historical share price)

3. Historical Profitability

The group has been consistently reporting net profit over past few quarters. The latest September 2014 quarter losses was mostly due to exceptional items.

|

(RM mil) |

Mar 13 |

June 13 |

Sep 13 |

Dec 13 |

Mar 14 |

June 14 |

Sep 14 |

|

Revenue |

14.7 |

15.7 |

19.1 |

19.2 |

17.4 |

19.9 |

17.7 |

|

Net profit |

0.995 |

1.1 |

1.9 |

2.5 |

1.8 |

1.8 |

-0.48 |

|

Adjusted net profit (excludes EI) |

0.995 |

1.1 |

1.9 |

2.5 |

1.8 |

1.8 |

1.21 |

4. Impact Of Strong US Dollars

As can be seen from table below, for the 9 months ended 30 September 2014, approximately 32% and 68% of the group's sales are to Malaysia and overseas customers respectively :-

| FY2012 revenue | FY2013 revenue | 9 months FY2014 revenue | ||||

| (RM mil) | (%) | (RM mil) | (%) | (RM mil) | (%) | |

| Malaysia | 24.4 | 41.5 | 24.2 | 35.3 | 17.8 | 32.4 |

| Indonesia | 18.3 | 31.1 | 23.1 | 33.7 | 15.4 | 28.0 |

| Japan | 13.3 | 22.6 | 15.7 | 22.9 | 15.1 | 27.5 |

| Others | 2.8 | 4.8 | 5.6 | 8.2 | 6.7 | 12.2 |

| TOTAL | 58.8 | 100.0 | 68.6 | 100.0 | 55.0 | 100.0 |

However, this does not necessarily mean that the entire 68% of the group's revenue is denominated in US dollars. This is because Oceancash has a subsidiary in Indonesia. This subsidiary produces in Indonesia and also sells its products locally (not sure whether also exports to other countries). For those Indonesia based sales, the underlying currency could be Rupiah indstead of US dollars.

However, I believed that the Indonesia subsidiary might not account for much of its sale. According to annual report, Malaysian operations account for RM29.5 mil of fixed assets while the Indonesian operation only accounts for RM5 mil :-

| Non-Current assets | (RM mil) | (%) |

| Malaysia | 29.5 | 69.7 |

| Indonesia | 5.0 | 11.8 |

| Others | 7.8 | 18.4 |

| TOTAL | 42.3 | 100.0 |

As Indonesian manufacturing operation only accounts for 12% of total fixed assets, its size should be relatively small compared to that in Malaysia. Meaning that the bulk of the Indonesian sales might be through export of products from Malaysia (In the annual report, it was mentioned that the group exports Non Woven Products to Indonesia. This is not surprising as the plant in Indonesia only produces Felts).

Based on the foregoing, it is likely that the bulk of the group's 68% overseas sale is indeed denominated in US Dollars.

However, the group imports resin and other petrochemical as raw material. The strong US dollars, on stand alone basis, could have an adverse impact on its manufacturing cost. However, prices of resin and other petroleum based products had also declined recently. Hopefully this could mitigate the adverse impact of strong US dollars. In any event, the rise in input cost, if any, would mostly affect domestic sale. For export market, there will be a natural hedge if sale is denominated in US dollars.

After taking into consideration the decline in resin prices and the fact that the majority of its products are exported, it is likely that the group is a net beneficiary of strong US dollars.

5. Concluding Remarks

(a) I first learned about Oceancash through Edge's article. However, that article generated a lot of excitement and share price went up substantially. In view of the lofty valuation, I decided to ignore the stock.

However, the group reported a loss when it released its September 2014 quarterly result. Even though the loss was mostly due to exceptional items, share price still took a beating. After retracing to a more reasonable level, I believe it is time to revisit.

(b) Another thing that hold me back when I first read about Oceancash is unfamiliarity with its products. As such, in this article, I have spent time and efforts to provide more details. A more indepth understanding of the group's business activities and products will hopefully provide a better feel, which I think is important for making an investment decision.

(c) The group's sale in Malaysia has more or less been stagnant (approximately RM24 mil per annum from FY2012 to FY2014). However, sales to Japan has been growing at leaps and bounds (RM13.3 mil in FY2012, RM15.7 mil in FY2013 and estimated to be RM20.1 mil in FY2014 (annualised figure)). Looking forward to the next quarter to see whether the group can sustain the growth.

(d) Strictly speaking, the stock at approximately 10 times PER is not really undervalued. However, the strong US dollars should provide a boast to earnings over the short term.

There is insufficient information to ascertain the group's growth trajectory. But the group seemed to be making inroad in certain overseas markets. For an export oriented stock, the potential for further growth is there, provided they have the right product offerings and able to manage operating cost effectively.

Have a nice evening.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Ricky Kiat

good jobs, icon888.

2015-02-01 10:42