(Icon) Ho Hup - Major Shareholder Busy Buying

Icon8888

Publish date: Wed, 11 Feb 2015, 07:32 PM

Ho Hup Construction

Background Information

(a) Principally involved in construction and property development.

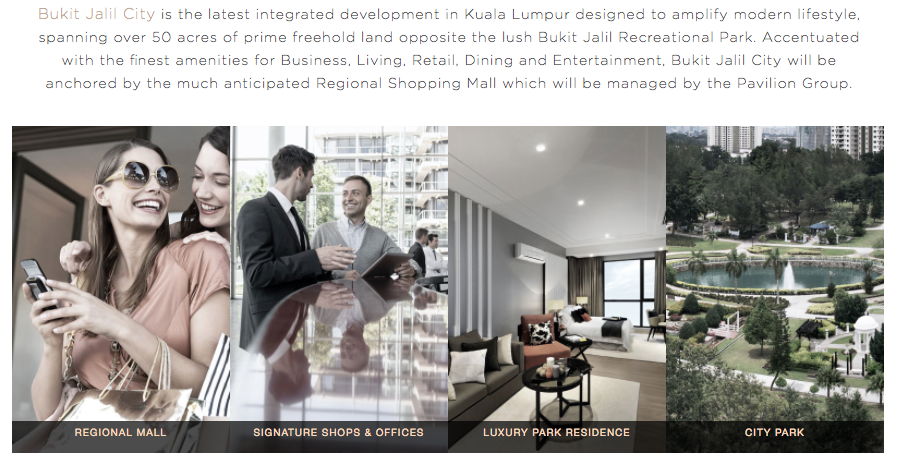

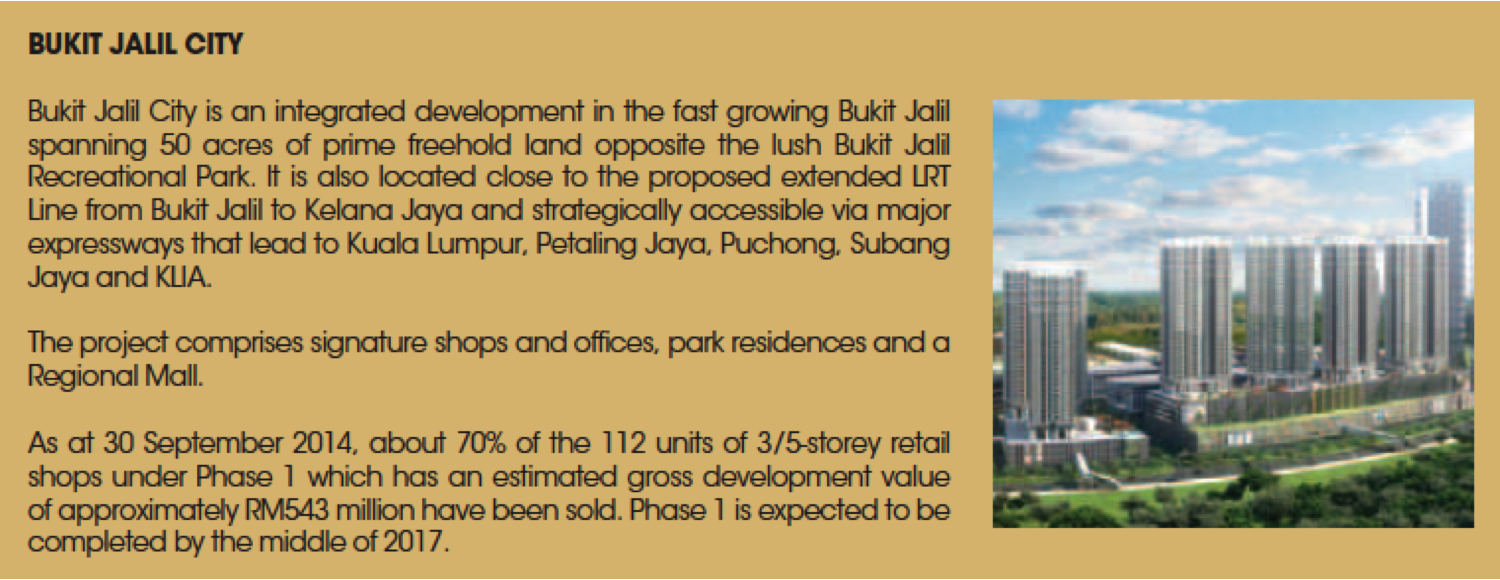

(b) Jewel of the crown is 60 acres of land in Bukit Jalil out of which 10 acres to be self developed and 50 acres JV with Malton. The JV project is called Bukit Jalil City.

(c) Under the JV agreement, Malton agrees to pay Ho Hup 18% of the GDV (estimated to be RM4.5 billion). This works out to be RM810 mil. The project will be completed within 10 years. This means that on average, every year Ho Hup is entitled to approximately RM80 mil cash proceeds from Malton.

In June 2014 quarter, Ho Hup received RM11.9 mil payment from the JV and reported RM9.8 mil gross profit. This translates into gross margin of 83%. The high profit margin is because Ho Hup doesn't need to do anything. All construction and funding costs will be borned by Malton. Based on this gross margin and 25% tax rate, average net profit per annum from the JV is approximately RM50 mil.

(d) The remaining 10 acres are being developed by Ho Hup. The project is called Aurora Bukit Jalil. The properties were launched in 2012 and has been well received. The group is currently booking in the profit from the project.

Ho Hup Construction Co Bhd (HO) Snapshot

|

Open

1.36

|

Previous Close

1.36

|

|

|

Day High

1.36

|

Day Low

1.34

|

|

|

52 Week High

04/24/14 - 1.72

|

52 Week Low

10/8/14 - 1.12

|

|

|

Market Cap

466.1M

|

Average Volume 10 Days

1.0M

|

|

|

EPS TTM

0.32

|

Shares Outstanding

342.7M

|

|

|

EX-Date

09/5/01

|

P/E TM

4.3x

|

|

|

Dividend

--

|

Dividend Yield

--

|

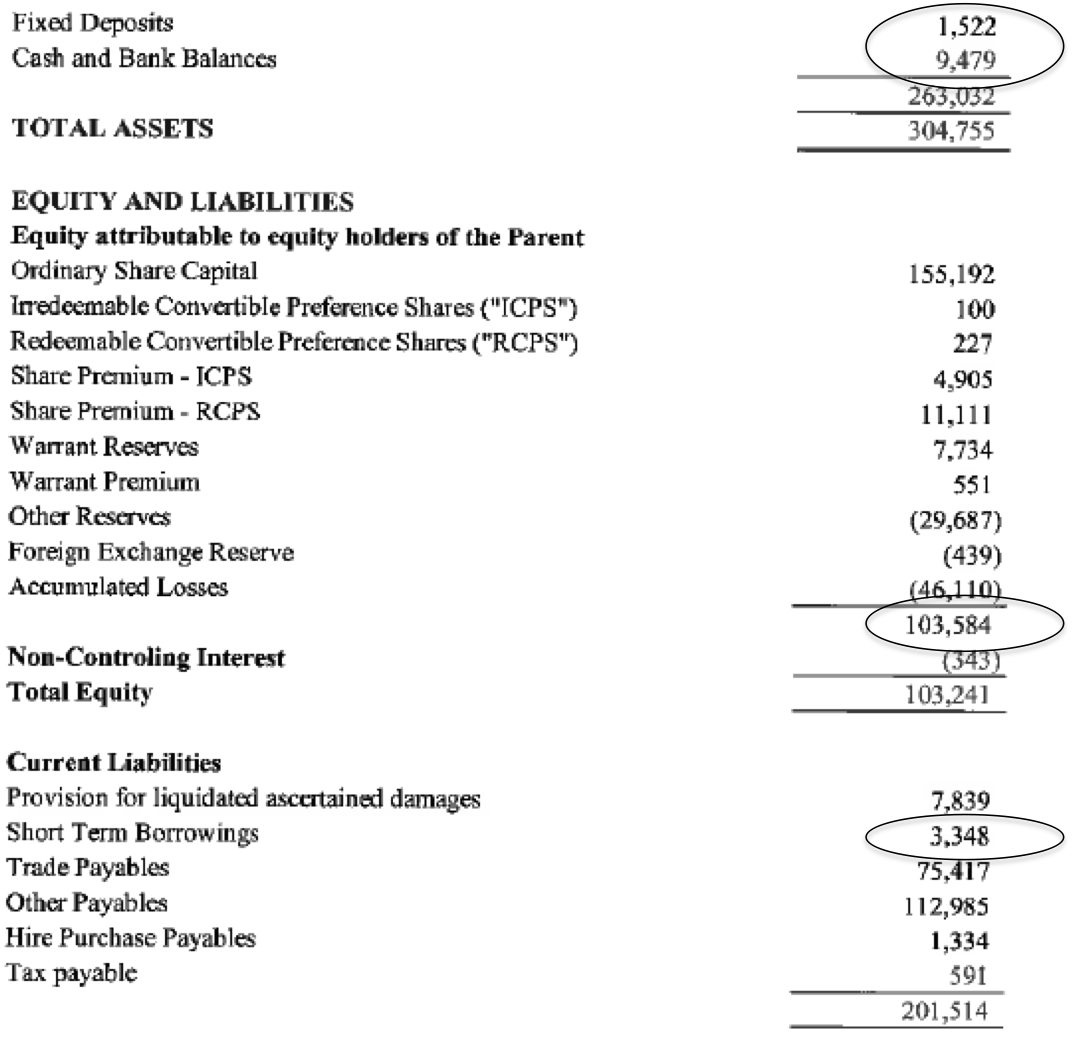

Strong balance sheets with only RM3.3 mil borrowing :-

The group's earnings grew substantially since December 2013 quarter.

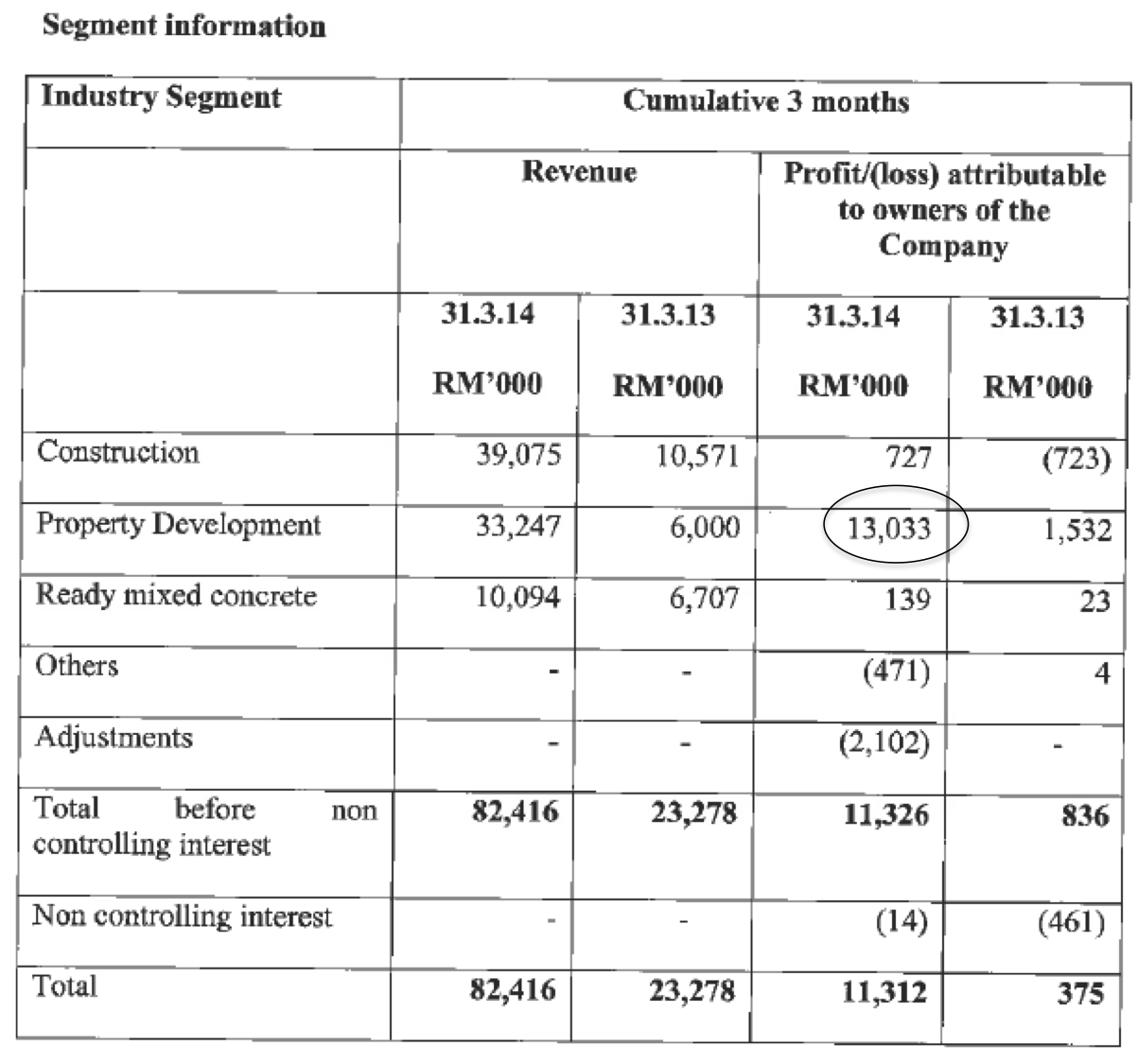

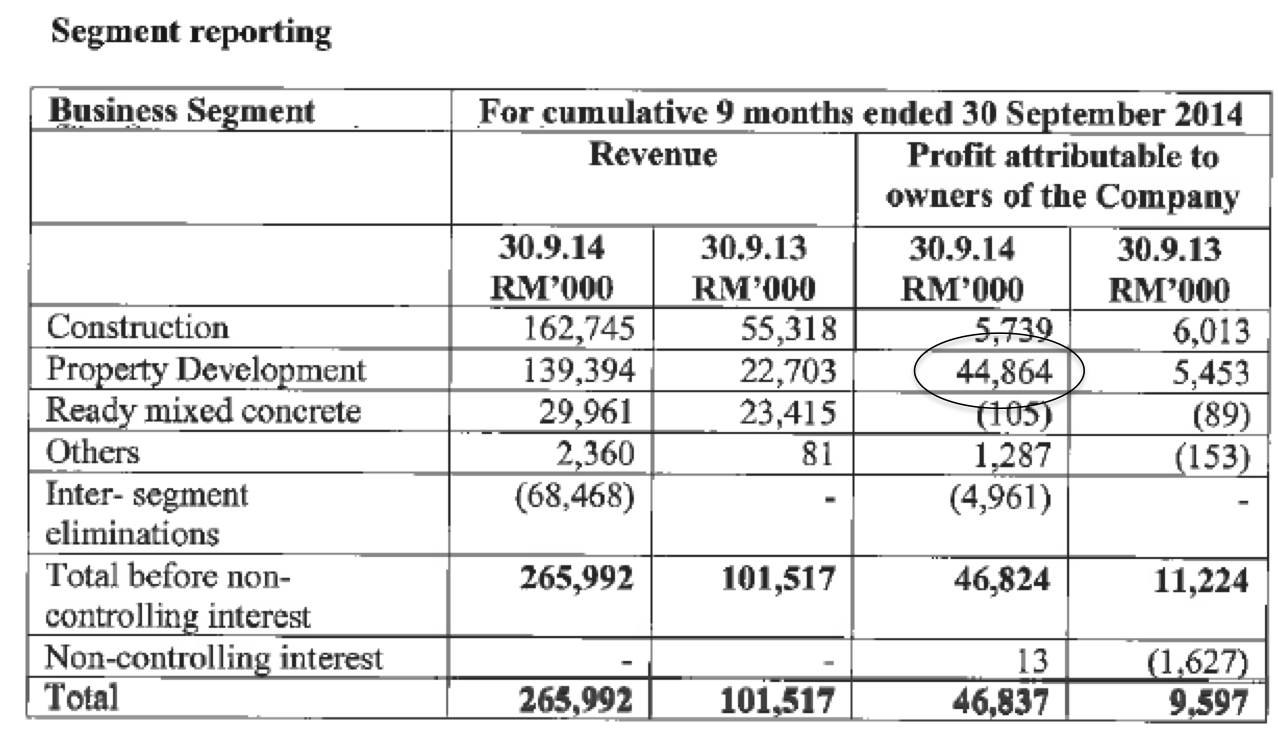

Growth accelerated during June and September 2014 quarters :-

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-09-30 | 95,045 | 24,464 | 18,481 | 6.00 | - | 0.3300 |

| 2014-12-31 | 2014-06-30 | 88,531 | 16,734 | 17,044 | 6.65 | - | 0.2800 |

| 2014-12-31 | 2014-03-31 | 82,416 | 11,326 | 11,312 | 6.66 | - | 0.3000 |

| 2013-12-31 | 2013-12-31 | 47,846 | 9,025 | 12,899 | 12.65 | - | 0.8100 |

| 2013-12-31 | 2013-09-30 | 61,586 | 4,235 | 2,773 | 2.72 | - | -0.4200 |

| 2013-12-31 | 2013-06-30 | 16,654 | 6,153 | 6,450 | 6.32 | - | -0.4400 |

| 2013-12-31 | 2013-03-31 | 23,278 | 836 | 375 | 0.37 | - | -0.5000 |

Management's comments for March 2014 quarter :-

Management's comments for June 2014 quarter :-

Management's comments for September 2014 quarter :-

----------------------------------------------------------------------------------------------------------------------------

"Aurora", Ho Hup's ongoing development project in Bukit Jalil with GDV of RM1 billion.

----------------------------------------------------------------------------------------------------------------------------

Bukit Jalil City

JV between Ho Hup and Malton.

According to Malton's 2014 annual report :-

--------------------------------------------------------------------------------------------------------------------

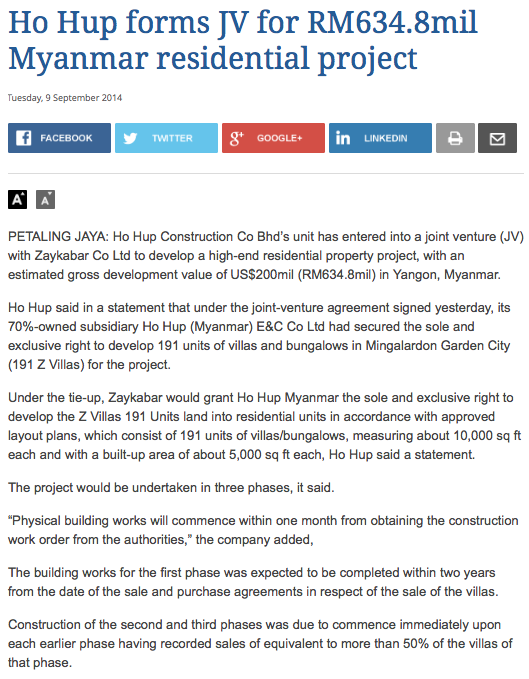

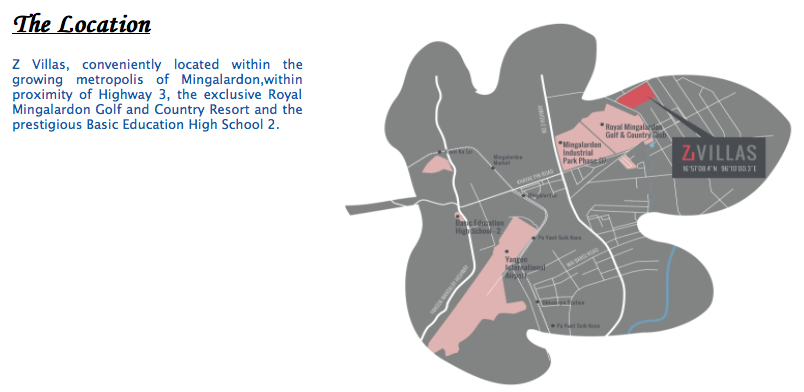

Myanmar Property Development JV

-----------------------------------------------------------------------------------------------------------------------------------

Major shareholder has been busy buying from the open market. Between 27 November 2014 and 9 February 2015, Dato' Sri Thong Kok Khee, through Insas Plaza Sdn Bhd, acquired closed to 3 mil shares, increasing his shareholding from 35.6 mil shares to 38.4 mil shares.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon888,

The moment I see the word HOHUP I jump in already. You write ad I no need to write liao....

HOHUP my Top 3 lover in 2015. Same same like my 150% gain TEXCHEM last year.

Great counter...cant runaway from ur eyes lo..... You are superB!!!!!!

2015-02-11 21:33

why revenue=profit??

I tot +VE can become -VE but -VE revenue always -VE profit??

not meh??? correct me if I m wrong

2015-02-11 21:43

which one bro???

we can discuss it in Paradigm ma... if not we can go Paradigm 2 or Pavilion 2 also.....

tell me which one u nt sure???

2015-02-11 21:50

why revenue=profit??

I tot +VE can become -VE but -VE revenue always -VE profit??

not meh??? correct me if I m wrong

2015-02-11 21:57

icon... jz now somebody quoted this... I asked him back... but he deleted it... now I catch fire jor....

jhey.... HOHUP is my Top 5 picks

2015-02-11 21:59

Hohup......diam diam counter...

One day will shoot to RM1.70 before heading to RM1.92 then RM2.35 in the making...

anyway, I haven discuss with my boys...........

2015-02-11 22:08

duitKWSPkita, i am the one who posted revenue=profit lol

what i meant is that the joint venture of hohup with malton

due to hohup dont need to pay a single cent for the development and construction cost, so revenue = profit.

2015-02-11 22:09

Yoloooooooo profit = revenue - land cost - tax

Gadang has a similar JV. In their circular, they calculated the profit as above

2015-02-11 22:11

Icon8888, oic, your equation is more accurate

mine one is just a roughly calculation without including tax or interest

2015-02-11 22:14

YOLOOOO........

hav u visited the site???? hahahaha...

No la... nt really revenue=profit even though they involve in construction only..

Basically, the GDV will be disstributed evenly based on the JV ratio.... and Malton & HOHUP will again receive the "sales" then net profit lo....

For PAVILION 2 HOHUP has no direct risk on the mall operation but at the same time it has little cake from the shopping mall recurring profit..... allllll same same only...... really need to write a long long essay for u to comprehend the whole structure with their risk management.

2015-02-11 22:17

YOOLOOOO,

jz a quick sharing...

for construction work. The margin sometime could be eaten up by sudden raw material price surge up such as steel bar, cement and wood. And we usually will assess their contigency budget

for property development, there is a better position to mark down GDV(gross development value) profit margin. Also got risk but the bigger scope can offset some smaller risks.

For HOHUP, they have one property development in Bukit Jalil and right beside is the small share holding project with MALTON. I m more concern on their township planning together with EXIM and Berjaya Land since a good township planning will boost up the area..............

hahahahha....... you raise ur concern... we will value your opinion.

2015-02-11 22:21

Icon8888,

I have not buy yet.... Now still enjoy in high risk counter.

bro... I finalzed HOHUP not because of the business background but is BUSINESS BACKGROUND + OWNER BACKGROUND..............

got 2 well known persons inside........

Posted by Icon8888 > Feb 11, 2015 10:18 PM | Report Abuse

Duit what price u entered ?

2015-02-11 22:24

YOLOOOO...

my pleasure..... mine nt necesssary correct

usually before I call a long term 100% above counter...

I will go n interview their top management and really vert through their business model... Of course site viewing and get insight from the existing workers. If they LIKE n PRAISE their company then got hope, if they HATE their company but jz fulfill the employer-employee relationshio when come to month end... Then I will pull back....

same technique I did for BOILERMECH, SCICOM, QL, TEXCHEM n a few more...

because we responsible and accountable for wat we call in the public

2015-02-11 22:28

YOLOOOOO,,,

after I finalized I will share with you.

I m very worried la.... all my counters masuk longkang one.... I scared my counters bring u to nowhere land... hope u understand my difficulty

Posted by YOLOOOO > Feb 11, 2015 10:28 PM | Report Abuse

duit, mind to share which ones are your top 5 picks?

2015-02-11 22:35

aiyo.... U happy I happy also ma...

me learning still....... sometime jadi clown also a MUST lo... if not ICON888 dunwan share info with me....

Icon888, today u got see my stalker bo??? He has gone to Mid Vally ar??? or to VIVA mall?>???

Posted by YOLOOOO > Feb 11, 2015 10:38 PM | Report Abuse

duit,

haha duit, you are so humorous

2015-02-11 22:40

ar????

so many also close buddy with her??? why me??

bcoz I m the most rubbish talk?????? aiyo... me tak halang ma if someone wanna to buddy with anyone...

I also buddy with u ma... luckily kita dua dua tak kena...

me everyday kena... tapi stalker busy in shopping mall buy new clothes... me duduk rumah apa pun talak.....

hahahaha.....

2015-02-11 22:48

fyh30......

yup..... tis is one of the three stock that wanna tell you...

but for sure will not come "tomorrow"...............

2015-02-11 22:53

I con... Dulu u ada cakap barakah tapi tak beli.Ho hup ni u dah beli?? Cakap je lagi or with conviction with this ho hup??

Under the JV agreement, Malton agrees to pay Ho Hup 18% of the GDV (estimated to be RM4.5 billion). This works out to be RM810 mil. The project will be completed within 10 years

Ni kalau land kat prime location why 18% only?? Biasa kalau prime location 20% to even 30% of GDV... lagi lagi ni over 10 years lagi kena tunggu lama

U pandai korek korek, take a look rm 810 for 50 acres of prime land over 10 tahun is it a good deal??? Or patut jual je???

2015-02-12 09:20

sarifahselinder......

correct me if I'm wrong...

Ho Hop already sold the prime land to Malton and invest back in certain stake.

Is it a 10-years project? I will clarify it for u.

2015-02-12 09:23

Not JV je??

Or u mean sold but getting the 810m slowly over 10 tahun, lagi teruk la!!

810m for 50 acres how much per acre? Is it good compare dengan market price? ?

2015-02-12 09:50

congraddddddddddddddddddd abang Icon888.....

your article No.1 Top Article............... happy for u!!!!!!!!

2015-02-12 12:01

Top article very useful.....

one day all come in to share their opinion n inssights lo....

then we can learn super sonic fast lo.... after all I am looking for learning opportunity.... gain money nt important at this stage

2015-02-12 12:14

I con.. how?? No answers for me ke??

Major shareholder beli to average down la

2015-02-12 13:45

Projects kat Middle East should be very dangerous la.. kalau pekerja tak mati kena tembak pun tak dapat payment nanti

2015-02-12 13:48

Kalau baik sangat why bagi Malton dapat share yang banyak sampai 82%??

Buat la development sendiri kan bagus??

2015-02-12 13:54

I rasa rasa Molton dapat better deal.. beli Malton kan better?? Molton pun dah turun juga

2015-02-12 13:58

Middle East con job. Wasted 2 years and 500k setting up a company there just coz I was promised a project. End of the day, they will make up 101 ways just to withdraw from it. I've learnt my lesson.

2015-02-13 12:20

I con... u nombor 1 sebab orang nak tengok ur replies la... orang check balik check balik macam tu la u nombor 1

2015-02-13 13:14

frankly speaking, i dun really like TKK (Insas) keeps buying Hohup as Im bearish on prop side.

The more he buys Hohup, the shorter term I'll hold insas

2015-02-15 23:36

tc88, I don't have answer for your question. I don't even know what price is Ho Hup trading at now.

Ho Hup for me is a long term investment.

I bought and chuck it aside and stop looking at it.

Not only Ho Hup, but many other stocks in my portfolio.

The reason I can afford to do that is because Ho Hup has strong balance sheets. I know it won't go bankrupt.

I believe that is the way to play stocks and win

2015-07-12 14:07

oregami

Buy Insas. Then u can have both Ho Hup & Inari.

2015-02-11 20:24