(Icon) Pansar Bhd - Supplier of Industrial Equipment, Construction Products, etc

Icon8888

Publish date: Mon, 16 Feb 2015, 09:58 AM

|

Open

0.45

|

Previous Close

0.45

|

|

|

Day High

0.46

|

Day Low

0.45

|

|

|

52 Week High

08/6/14 - 0.56

|

52 Week Low

12/15/14 - 0.42

|

|

|

Market Cap

126.0M

|

Average Volume 10 Days

37.3K

|

|

|

EPS TTM

0.04

|

Shares Outstanding

280.0M

|

|

|

EX-Date

09/5/14

|

P/E TM

10.1x

|

|

|

Dividend

0.02

|

Dividend Yield

5.00%

|

Pansar Berhad is formerly known as PWE Industries Bhd.

The company’s Building Products segment sells and distributes steel bars, cement, roofing materials, construction chemicals, and industrial materials.

Its Marine and Industrial segment supplies and distributes power generating and water pressure systems, welding and pump sets, etc.

The company’s Wood Engineering and Supplies segment supplies steel wire ropes, packaging systems, precision measuring instruments, and wood treatment chemicals, etc.

Its Electrical and Office Automation segment sells and distributes lighting and air-conditioning systems. This segment also provides office automation solutions, including photocopier, fax machines and key phones, and computers, etc.

The company’s Mechanical and Electrical segment designs and installs air-conditioning and ventilation, plumbing, and fire protection systems.

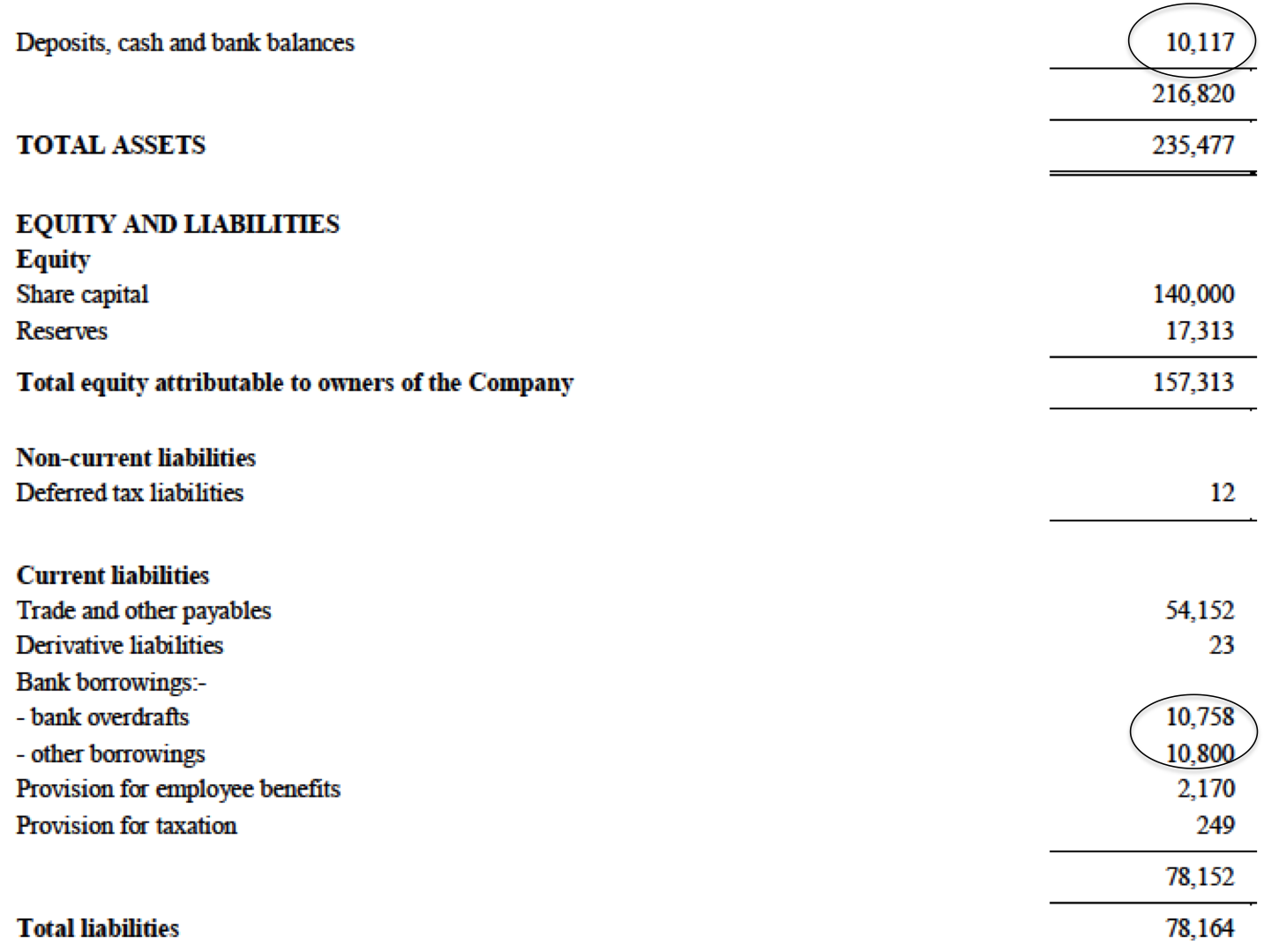

Strong balance sheets with almost zero gearing :-

Consistent earnings over past few years :-

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2015-03-31 | 2014-12-31 | 101,378 | 3,357 | 2,435 | 0.87 | - | 0.5600 |

| 2015-03-31 | 2014-09-30 | 104,660 | 5,876 | 4,200 | 1.50 | 2.25 | 0.5500 |

| 2015-03-31 | 2014-06-30 | 102,149 | 5,519 | 3,984 | 1.42 | - | 0.5600 |

| 2014-03-31 | 2014-03-31 | 86,835 | 2,343 | 1,776 | 0.63 | - | 0.5500 |

| 2014-03-31 | 2013-12-31 | 118,026 | 6,225 | 4,606 | 1.65 | - | 0.5400 |

| 2014-03-31 | 2013-09-30 | 116,738 | 5,854 | 4,341 | 1.55 | 2.00 | 0.5300 |

| 2014-03-31 | 2013-06-30 | 104,191 | 5,031 | 3,753 | 1.34 | - | 0.5300 |

| 2013-03-31 | 2013-03-31 | 100,477 | 4,129 | 3,078 | 1.10 | - | - |

| 2013-03-31 | 2012-12-31 | 112,980 | 4,911 | 3,870 | 1.38 | - | 0.5000 |

| 2013-03-31 | 2012-09-30 | 107,900 | 7,160 | 5,280 | 1.89 | 2.00 | 0.4900 |

| 2013-03-31 | 2012-06-30 | 108,578 | 7,002 | 5,232 | 1.87 | - | 0.4900 |

| 2012-03-31 | 2012-03-31 | 92,031 | 2,311 | 1,455 | 0.52 | - | - |

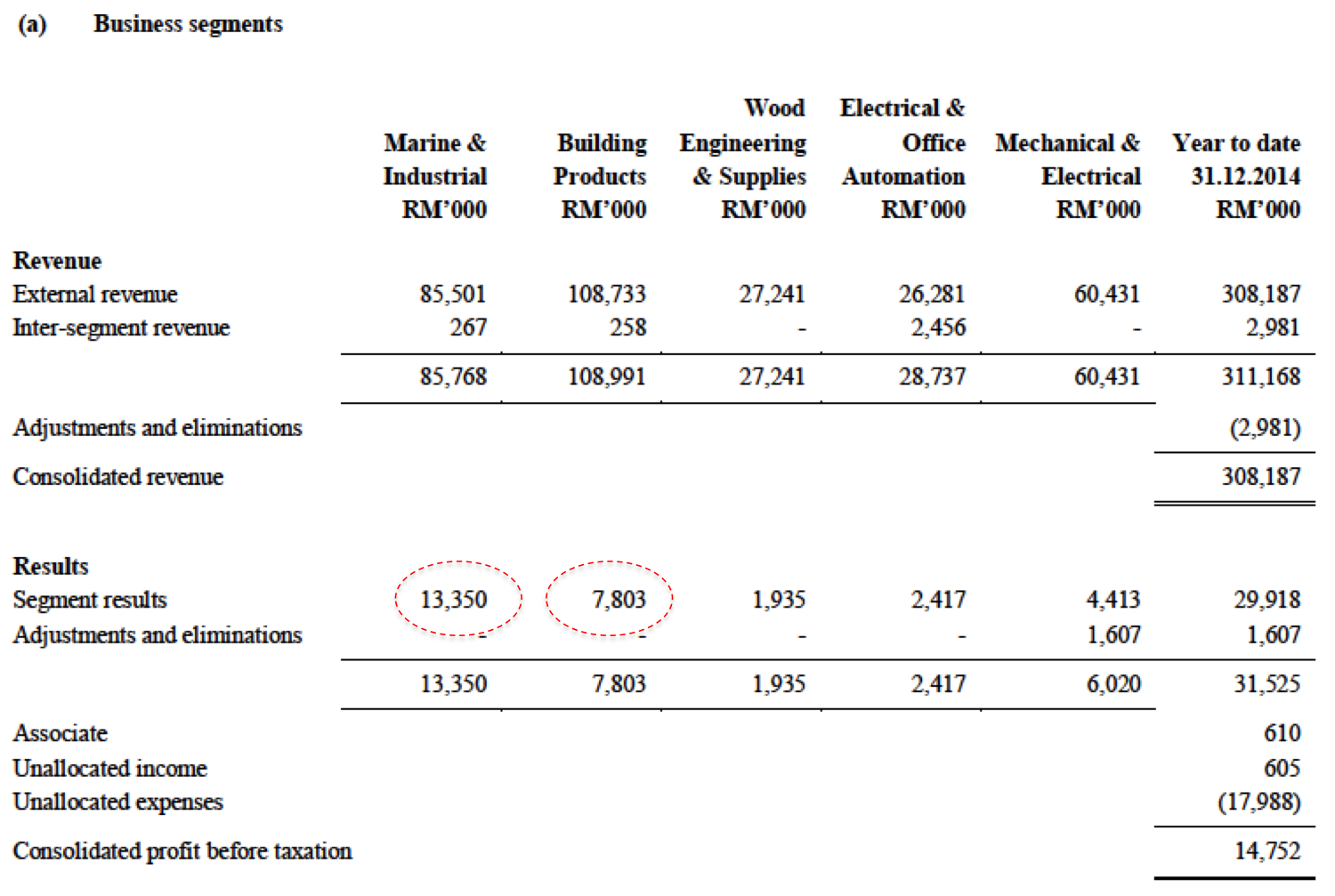

As can be seen below, marine / industrial and building products accounts for the bulk of the earnings. As such, I will incorporate more information of these two divisions into this article.

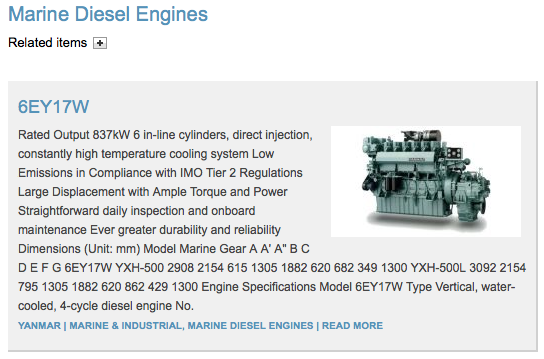

Marine / industrial division distributes the following equipment :-

Building products division distributes the follwoing equipment :-

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

you are welcomed matakuda. The info I presented is very basic. But at least it kick start the process of knowing this company (and many others)

2015-02-16 10:26

matakuda

Drop in quarterly earning, so as its share price. 130k volume done as of now, considered relatively high volume for this counter. This presents opportunity to accumulate. Add 25k into my portfolio. TQ icon8888.

2015-02-16 10:18