(Icon) Thong Guan (2) - Buy on Weakness

Icon8888

Publish date: Mon, 09 Mar 2015, 09:49 PM

Executive Summary

(a) In January 2015, Thong Guan was heavily promoted by analysts and bloggers (including some in i3).

The principal reasons given were (i) beneficiary of strong US dollars (ii) capacity expansion will drive earnings growth in coming quarters / years (iii) lower raw material cost following decline in oil price, etc.

(b) However, on 27 February 2015, Thong Guan announced a loss of RM4 mil for the quarter ended 31 December 2014. In reaction to the announcement, share price declined by closed to 20% from RM2.40 to RM1.90+.

The losses was principally due to RM9.9 mil exceptional items comprises forex loss of RM4.4 mil and bad debt of RM5.5 mil.

I wasn't surprised by the drop in share price as that is a normal reaction when a company announced an unexpected loss. However, what surprised me was that the selling pressure has sustained for so long. As at the date of this article, there are still disillusioned investors patiently queuing to sell at RM2.05 and above.

(c) This provides a good opportunity to gain exposure. In my opinion, all the positive factors are still valid and intact. Thong Guan remains a company with strong market position, excellent management, good dividend yield, strong balance sheets, well positioned to grow in the immediate term and is a beneficiary of weak Ringgit.

With that in mind, I decided to add Thong Guan to my portfolio.

Thong Guan Industries Bhd (TGI) Snapshot

|

Open

2.03

|

Previous Close

2.02

|

|

|

Day High

2.05

|

Day Low

2.03

|

|

|

52 Week High

09/2/14 - 3.10

|

52 Week Low

12/17/14 - 1.75

|

|

|

Market Cap

215.7M

|

Average Volume 10 Days

291.0K

|

|

|

EPS TTM

0.17

|

Shares Outstanding

105.2M

|

|

|

EX-Date

11/5/14

|

P/E TM

12.4x

|

|

|

Dividend

0.03

|

Dividend Yield

5.37%

|

Thong Guan manufactures stretch films; garbage bags; flexible packaging products; and polyvinyl chloride food wraps. Thong Guan was founded in 1942 and is headquartered in Sungai Petani, Malaysia.

Almost 75% of the group's products are exported :-

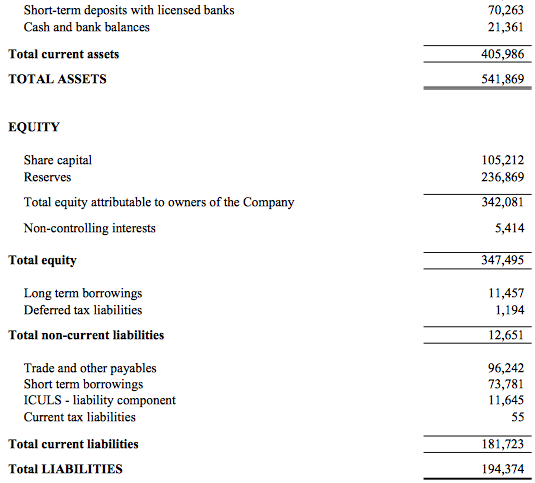

The group has strong balance sheets. With net assets of RM342 mil and loans of RM86 mil, net gearing is 0.25 times only.

(I have chosen to ignore the cash of RM91 mil as it will be used soon for the group's capital expenditure).

The group has reported net profit of approximately RM27 mil per annum in past few years. Based on market cap of RM322 mil (being RM2.05 x 158 mil shares assuming full conversion of ICULS), PER is 12 times.

I believe this is reasonable as there is potential upside to earnings going forward due to strong US dollars (resulting in higher profit margin or increases in market share due to pricing competitiveness) and capacity expansion.

Dividend yield is decent at 3.4%.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | DPS (Cent) | DY | NAPS | ROE (%) |

|---|---|---|---|---|---|---|---|---|

| TTM | 732,590 | 17,485 | 16.62 | 12.34 | 7.00 | 3.41 | 3.2500 | 5.11 |

| 2014-12-31 | 732,590 | 17,485 | 16.62 | 11.26 | 7.00 | 3.74 | 3.2500 | 5.11 |

| 2013-12-31 | 720,276 | 28,180 | 26.79 | 7.88 | 8.00 | 3.79 | 2.7500 | 9.74 |

| 2012-12-31 | 631,193 | 27,216 | 25.87 | 5.18 | 7.00 | 5.22 | 2.4900 | 10.39 |

| 2011-12-31 | 540,013 | 27,036 | 25.70 | 4.48 | 6.00 | 5.22 | 2.3000 | 11.17 |

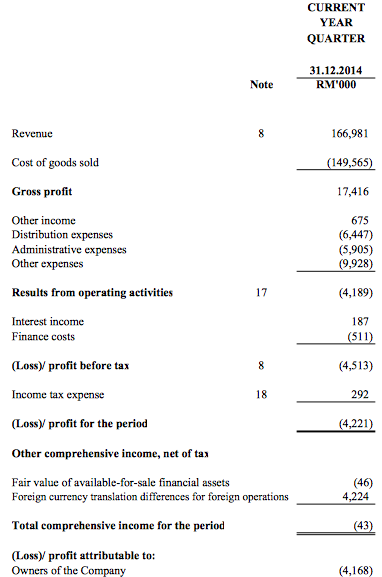

The group's latest quarterly result was affected by one off items (bad debts and forex loss reflected as "other expenses") :

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|---|

| 2014-12-31 | 2014-12-31 | 166,981 | -4,513 | -4,168 | -3.96 | 4.00 | 3.2500 |

| 2014-12-31 | 2014-09-30 | 191,875 | 4,398 | 4,915 | 4.67 | - | 2.8700 |

| 2014-12-31 | 2014-06-30 | 195,974 | 9,000 | 8,025 | 7.63 | 3.00 | 2.8900 |

| 2014-12-31 | 2014-03-31 | 177,760 | 9,938 | 8,713 | 8.28 | - | 2.8100 |

| 2013-12-31 | 2013-12-31 | 184,586 | 4,372 | 6,270 | 5.96 | 8.00 | - |

| 2013-12-31 | 2013-09-30 | 188,123 | 13,494 | 11,058 | 10.51 | - | 2.6800 |

| 2013-12-31 | 2013-06-30 | 178,944 | 6,579 | 5,311 | 5.05 | - | 2.6200 |

| 2013-12-31 | 2013-03-31 | 168,608 | 7,423 | 5,485 | 5.21 | - | 2.5500 |

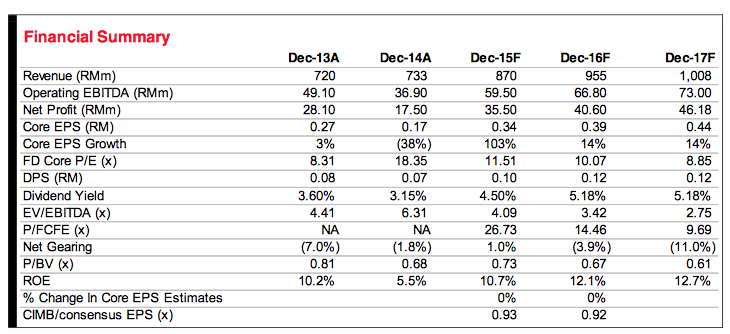

The following information is extracted from CIMB's analyst reported dated September 2014 :-

The table below is CIMB's earnings projection for Thong Guan as set out in 1 March 2015 anaylst report.

Despite recent quarter losses, the analyst remains confident and expects RM35 mil net profit for FY2015 :-

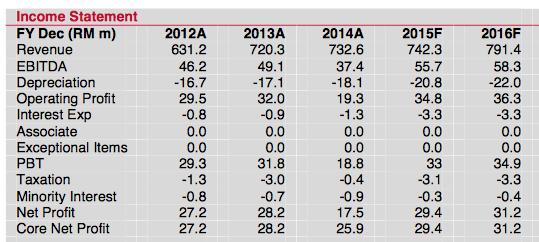

Kenanga, in its 2 March 2015 report, is more conservative :-

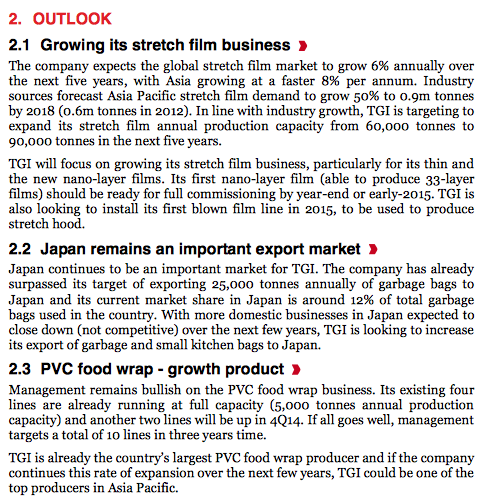

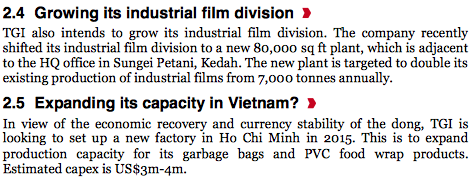

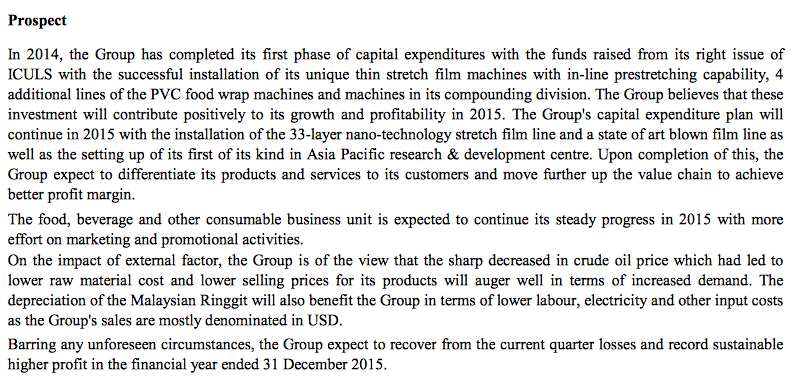

Company's comments on prospects (source : Dec 2014 quarterly report) :-

Appendix - The Star Article

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

GST dept allows us to classify 6 months old receivable as bad debt & the tax paid is refundable.

2015-03-10 08:18

beneficiary of strong US dollars

is a beneficiary of weak Ringgit.

forex loss of RM4.4 mil

What is wrong with this picture?

This is contradictory isn't it???

In Q414 RM has already weaken ler

2015-03-10 08:24

I know Q414 RM has already weaken cos AirAsia has been turned upside down by forex loss.. hit kau kau in Q414 ler

Same as you I have put in money in AirAsia due to low oil prices though

2015-03-10 08:30

If that contradiction can be explained... will help to restore confidence ler

2015-03-10 08:35

currency movement will affect both balance sheets and P&L

tguan got hit because they have forex denominated trade payables (impact on balance sheets)

but that will not be recurrent

on the other hand, the weak RM will enhance profit margin (impact on P&L)

it is not contradictory at all

2015-03-10 08:43

1st off

forex denominated trade payables (impact on balance sheets).... wouldn't this be coming from forex purchases as such hitting the income statement???

And since from forex purchases won't this normal state of affair and will be continuing?

2015-03-10 08:57

on the other hand, the weak RM will enhance profit margin

And... since purchases in foreign currency.. this won't happen

2015-03-10 09:18

I don't take it as an opportunity to buy, I take it as mismanagement. this counter should avoid at the current moment. especially for those who are new to this counter. scientx or scgm are better choice if you like the business nature

2015-03-10 09:26

Agreed on urs Icon8888....

Out of control. Management struggle hard to capture this golden opportunity to harvest US dollar profit....

trust them always.......... cheers everyone

Posted by Icon8888 > Mar 10, 2015 09:35 AM | Report Abuse

selling pressure very strong

this stock will take a while to rebounce

2015-03-10 18:52

gearing ratio too high, i prefer to take bpplastic, CPIB or Welcall anytime

2015-03-10 23:53

agreed GGmalaysia. should wait.Big waves in DOW,n US dollar. Will buy Thong Guan when reasonable, interms of expected returns.All else same.GST is another poser.TGuan is mature company.stable.

2015-03-11 00:19

Even if excluding the 9 mil loss, its revenue for 4th Qtr also not impressive. Lowest compare to other 3 Qtr in 2014.

2015-03-11 00:46

Go get gadang, and I must thank you icon8888 for your continuing efforts in sharing the info on this stock since April 2014.

2015-03-11 05:26

oregami

Normally in accounting policy 6 months old receivable can be classified as bad debt. But they might be unwinding of bad debt in the future.

2015-03-10 06:24