(Icon) SYF Resources - Manufacturer of Rubber Wood Furniture and Particle Board

Icon8888

Publish date: Wed, 18 Mar 2015, 06:41 PM

Syf Resources Bhd (SYF) Snapshot

|

Open

0.46

|

Previous Close

0.46

|

|

|

Day High

0.47

|

Day Low

0.46

|

|

|

52 Week High

06/17/14 - 0.66

|

52 Week Low

04/24/14 - 0.32

|

|

|

Market Cap

281.0M

|

Average Volume 10 Days

788.1K

|

|

|

EPS TTM

0.04

|

Shares Outstanding

610.9M

|

|

|

EX-Date

04/10/06

|

P/E TM

11.5x

|

|

|

Dividend

--

|

Dividend Yield

--

|

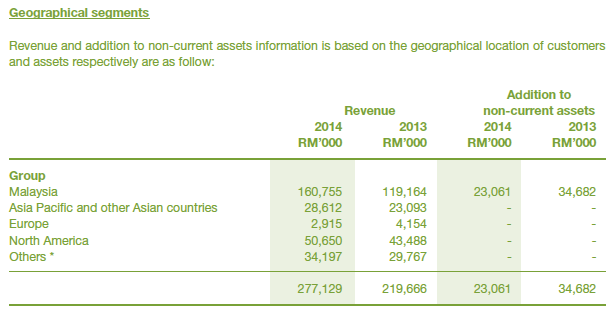

SYF Resources manufactures and trades in rubberwood furniture and component parts in Malaysia, the Asia Pacific, Europe, North America, etc.

The company is based in Semenyih, Malaysia.

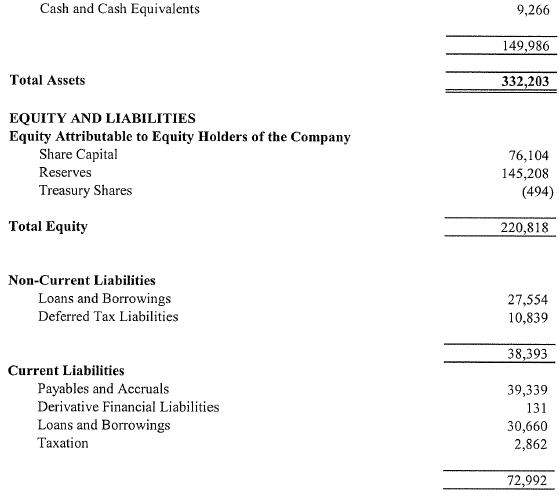

The group has healthy balance sheets. With net assets of RM221 mil, loans of RM59 mil and cash of RM9.3 mil, net gearing is 0.22 times only.

The group reported net profit of RM22 mil in latest financial year. Based on market cap of RM281 mil, historical PER is 12.8 times.

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | PE | NAPS | ROE (%) |

|---|---|---|---|---|---|---|

| TTM | 275,058 | 22,311 | 7.98 | 5.77 | 0.7300 | 10.93 |

| 2014-07-31 | 277,113 | 21,794 | 7.96 | 14.83 | 0.6800 | 11.71 |

| 2013-07-31 | 219,666 | 11,855 | 4.35 | 13.80 | 0.6000 | 7.25 |

| 2012-07-31 | 198,570 | 50,718 | 23.04 | 1.96 | 0.5500 | 41.89 |

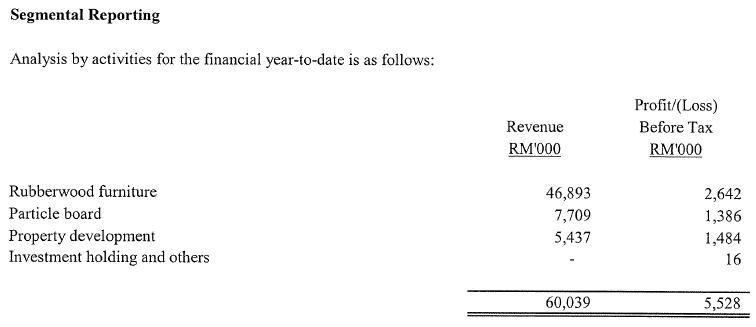

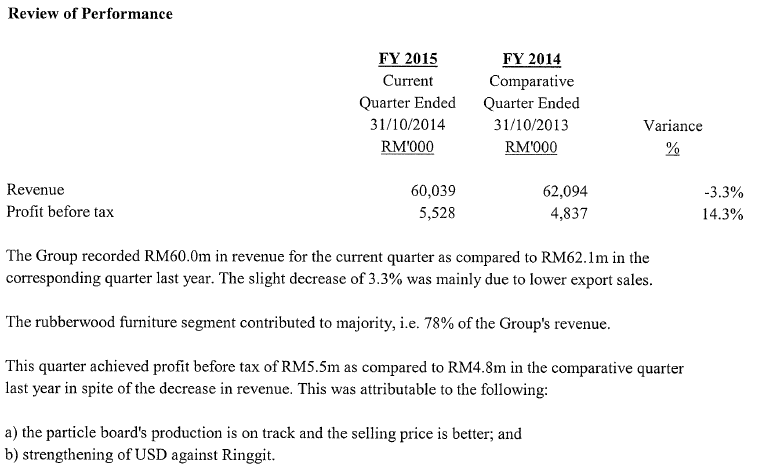

In the latest financial quarter ended 30 October 2014, the company reported net profit of RM5.15 mil. Based on 610 mil shares, EPS was 0.84 sen.

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | DPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2015-07-31 | 2014-10-31 | 60,039 | 5,528 | 5,152 | - | 0.7300 |

| 2014-07-31 | 2014-07-31 | 63,846 | 7,851 | 5,368 | - | 0.6800 |

| 2014-07-31 | 2014-04-30 | 74,781 | 8,978 | 7,386 | - | 0.6600 |

| 2014-07-31 | 2014-01-31 | 76,392 | 5,445 | 4,405 | - | 0.6300 |

| 2014-07-31 | 2013-10-31 | 62,094 | 4,837 | 4,635 | - | 0.6200 |

| 2013-07-31 | 2013-07-31 | 57,744 | 184 | 642 | - | - |

| 2013-07-31 | 2013-04-30 | 49,944 | 2,315 | 2,272 | - | 0.6000 |

| 2013-07-31 | 2013-01-31 | 53,907 | 4,047 | 4,043 | - | 0.5900 |

| 2013-07-31 | 2012-10-31 | 58,071 | 4,902 | 4,898 | - | 0.5800 |

Management's comments on the company's October 2014 quarter performance :-

Management's comments on prospects :-

The company will release its January 2015 quarterly report by end of this month (March 2015).

Approximately 42% of the group's products are exported. It should benefit from the strong US dollars.

========================

Appendix 1 - The SYF Resources Group

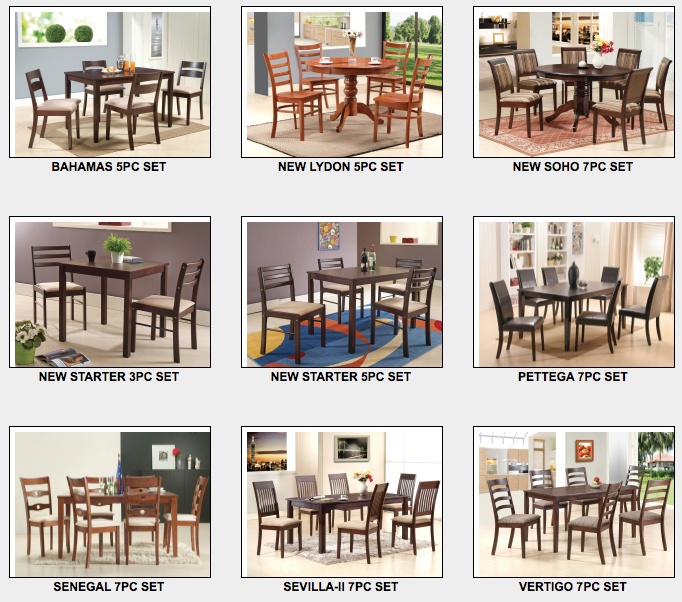

Dinner Set

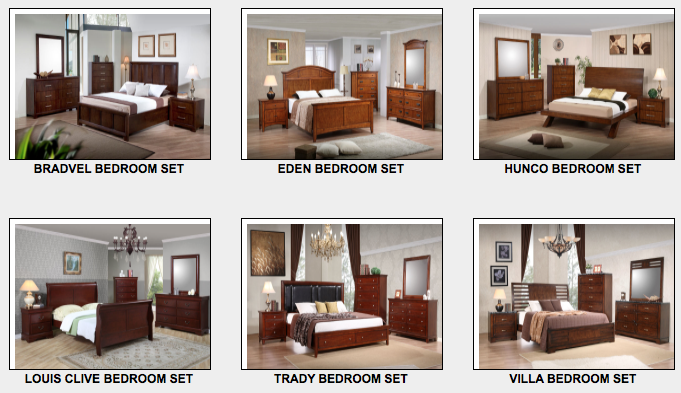

Bedroom Set

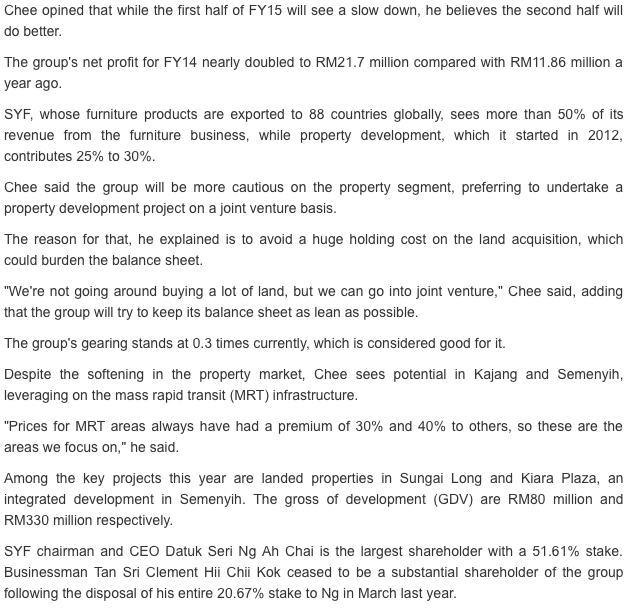

Appendix 2 - Article by The Sun

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Dr Duit what landmark project ? i haven't really studied in depth. can tell more ?

2015-03-18 18:55

A dead cat bounce -owner/sharks want the retails to HELP chase/push up to 0.55/0.58 so they can unload and push down to 0.22-0.18 to do their buyback for the next rally (after having cashed out RM1.00 n above for 6 months between June-December2014) ikanbilis who cannot risk their savings should stay away,or get other safer counters.........

2015-03-20 06:49

Midas touch.... Apa Icon sentuh apa shoot up ar...

Later we have enough money to pay car park fees at Paradigm mall ya.....

and got spare money to watch Cinderella ar.......

2015-03-20 10:27

lu cakap apa??? dont tell me zaman sekarang masih ada orang evaluate stock's potential based on PE sahaja.......... sikarang all pakai hybrid formula ma..... all geng strategist and CFO put PE on tertiary joh........ my kindergarten view la... cetek view only

hahahahaha.... aku nyanyok sahaje... usah peduli.........

2015-03-20 11:48

duitKWSPkita

Like their diversified business model... Especially the project on Landmark......

Continue to LIKE since last December.

Thanks respected Icon8888.

2015-03-18 18:44