(Icon) Teck Guan - A Neglected Exporter Trading At 3.6 Times PER

Icon8888

Publish date: Thu, 08 Oct 2015, 11:47 AM

(Teck Guan is principally involved in production of palm kernel oil)

1. Introduction

On 25 September 2015, Teck Guan released its financial results for the quarter ended July 2015.

For two consecutive quarters, the group has been reporting spectacular profit growth.

Based on share price of 96 sen and 12 months EPS of 3.3 sen, the stock is trading at historical PER of 29 times.

However, based on annualised EPS of 27 sen (being 6 months EPS of 13.5 sen x 2), prospective PER is only 3.6 times.

(Note : I use the latest six months figure to calculate prospective earnings as I believe it is most reflective of the group's short term earnings capacity, which is boosted by strong USD)

Quarter Result:

| F.Y. | Quarter | Revenue ('000) | Profit before Tax ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|---|---|

| 2016-01-31 | 2015-07-31 | 66,090 | 4,261 | 2,586 | 6.45 | 2.0082 |

| 2016-01-31 | 2015-04-30 | 54,205 | 4,074 | 2,842 | 7.09 | 1.9437 |

| 2015-01-31 | 2015-01-31 | 72,295 | 1,997 | 1,035 | 2.58 | 1.8688 |

| 2015-01-31 | 2014-10-31 | 63,838 | -5,724 | -5,157 | -12.86 | 1.8430 |

| 2015-01-31 | 2014-07-31 | 45,694 | -2,312 | -1,864 | -4.65 | 1.9716 |

| 2015-01-31 | 2014-04-30 | 82,225 | 5,330 | 3,771 | 9.40 | 2.0181 |

| 2014-01-31 | 2014-01-31 | 62,266 | 1,826 | 1,770 | 4.41 | - |

| 2014-01-31 | 2013-10-31 | 45,876 | 3,211 | 1,822 | 4.54 | 1.8799 |

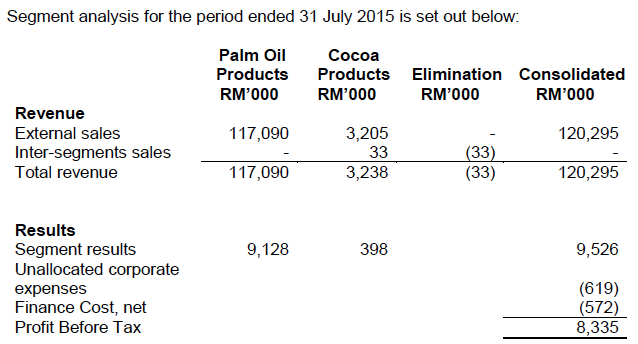

2. Principal Business Activities

Teck Guan derives the bulk of its revenue and earnings from production and sale of palm kernel oil and operation of oil palm plantations.

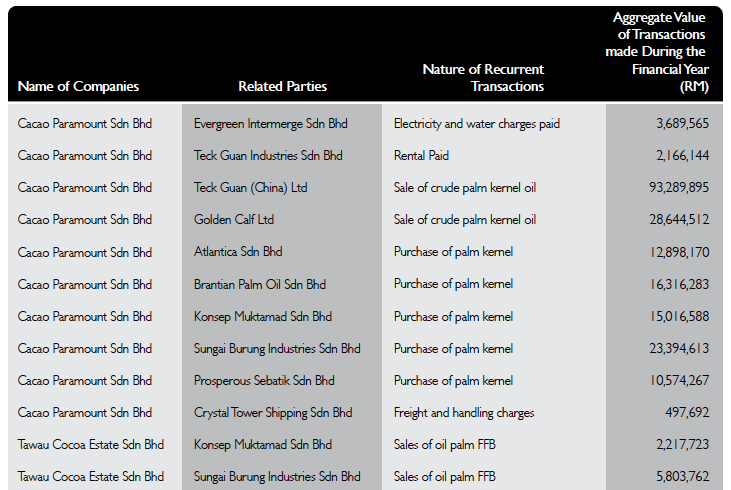

The group purchases palm kernels from its sister companies (non listed). The palm kernel oil produced is also sold to its sister company, Teck Guan (China) Ltd.

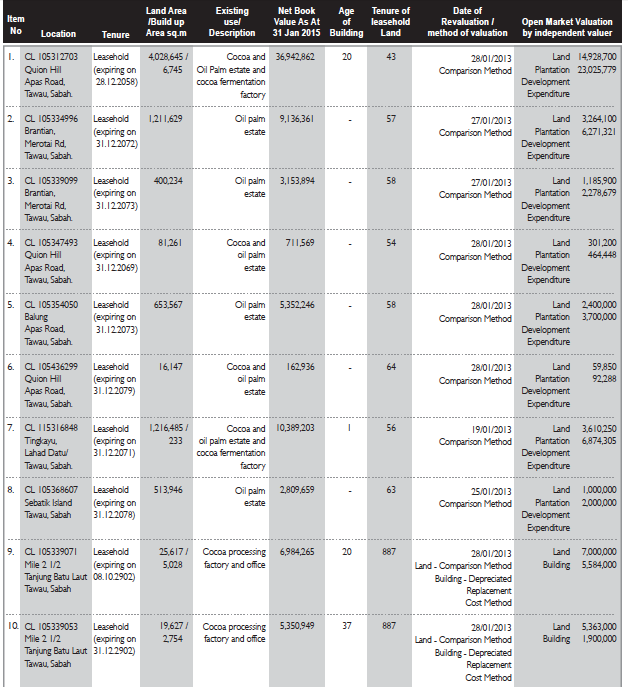

The group also owns approximately 2,000 acres of oil palm plantations in Tawau, Sabah with average age of 13 years.

The plantations has book value of RM38 mil. This works out to be RM19,000 per acre (RM47,000 per hectare).

The FFBs produced are sold to sister companies to be processed into CPO.

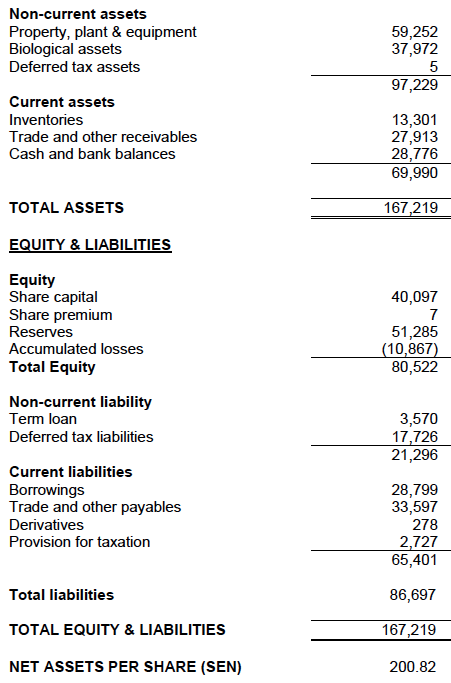

3. Balance Sheets

The group has strong balance sheets. As at 30 July 2015, the group has cash of RM28.8 mil and borrowings of RM32.4 mil. Based on net assets of RM81 mil, net gearing is 5% only.

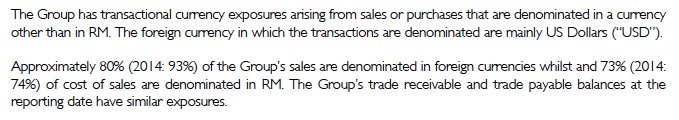

4. Beneficiary of Strong US Dollars

The group is a beneficiary of strong USD as the bulk of its revenue is in USD while its cost is mostly Ringgit denominated.

The following paragraphs are extracted from the company's FY2015 Annual Report :-

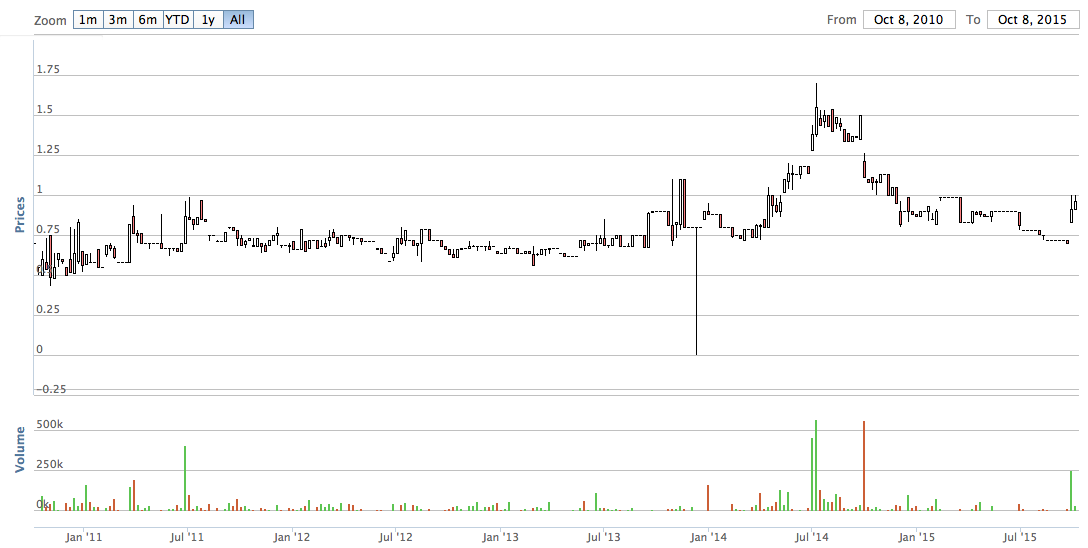

5. Illiquidity

The stock is extremely illiquid. This is mostly due to its small paid up capital of 40 mil shares. That is the main reason it is so undervalued.

Based on latest share price, market cap is only RM38 mil.

Hopefully a bonus issue or share split in the future will address the liquidity issue and unlock value.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Sorry I don't have answer

This group does not put in much effort to provide info. They simply explained that it was due to "weaker operating margin"

2015-10-08 13:14

Icon, good article! Could you also write about PETRONM? I notince its annualized EPS based on last 2 quarters is also very promising!

2015-10-08 13:45

Usd to myr anytime 4 or below soon! Anyone still trying to sell idea of weak myr going to get trap soon!

2015-10-08 21:44

paperplane2, why don't you just shut up and provide a better constructive idea.

Go open a thread and talk about your stockpick.

2015-10-09 00:01

too much related party transaction, easy for controlling shareholders to manipulate p&l.

2015-10-09 00:01

It's been a year since we crazily pursueing cpo counters promoted by kyy, lol

The current ratio is almost 1, that's mean they're running on a tight cash flow, any timum taohu, the cffo will be in negative.

Icon, I dislike the way u ignore trade payable to tell a good story. Although trade payable is not as prior as bank borrowing, but eventually they still have to repay it within one year.

if u dun pay, who're going to supply u material.

Ur payable is other's receivable, if u like to tuo, than no body likes to do biz with u one

2015-10-09 09:20

why do we need to separately worry about trade payables ? If the gearing is low (5%), they can always rely on bank loans to pay creditors in the event of a liquidity crunch. Am I not right ?

2015-10-09 09:54

fellow sifus, why there is no correlation at all between CPO price with its profit?

Since the business is integrated from plantation to process to sales, its profit should move in tandem with CPO price? The higher CPO price is, the higher its profit is? Please correct me if i am wrong.

2016-01-04 19:25

Icon, if TECGUAN wants to give bonus issue, it should come from Reserves or Accumulated Profit?

2016-01-04 21:35

Some of the stocks affected are:

1. Rubber stocks (Avoid) - Kossan, Topglov, Hartalega, Karex, Carepls, Ruberex...Spermx, etc

2. Furniture and freboards (Avoid) - HEVEA, HEVEA,WB. EVERGREEN, MIECO, SYF, LATITUD, HOMERIX, POHUAT, LIIHEN,

3. IT /Telco stocks - (Avoid) - UNISEM, GTRONIC, JCY, DIGI, AXIATA,

4. Others: TecGuan,

2016-02-02 11:41

tkp2

bro, i spotted this counter too after their QR, but the volume and liquidity is very low.

2015-10-08 12:38