(Icon) JHM Consolidation (1) - Capex Bearing Fruits. Growing Like A 16 Year Old

Icon8888

Publish date: Wed, 30 Dec 2015, 06:37 AM

1. Principal Business Activties

JHM is listed on the ACE market. It is principally involved in design and manufacturing of the following microelectronic components ("MEC") :-

(a) components related to High Brightness Light Emitting Diode;

(b) fine pitch connector pins; and

(c) others.

JHM's strength is in its design and development capabilities for complex MEC. The Group would normally be involved from the conceptual phase to the designing and ultimately commissioning of the components for mass production at optimal cost efficiency.

The cutting edge capabilities in designing have enabled the Group to not only penetrate multinational corporations (“MNCs”) but also allowed the Group to enlarge its customer base to cover larger market applications. MEC are catered to a wide base of industries such as electronic, telecommunication, semiconductor and automobile.

The company's head office is in Penang while its factory is located in Sungai Petani.

2. Background Financials

Based on 123 mil shares and price of 46 sen, JHM has market cap of RM57 mil.

The group has reasonably strong balance sheets. Based on net assets of RM34 mil, cash of RM3 mil and borrowings of RM14 mil, net gearing is approximately 0.32 times.

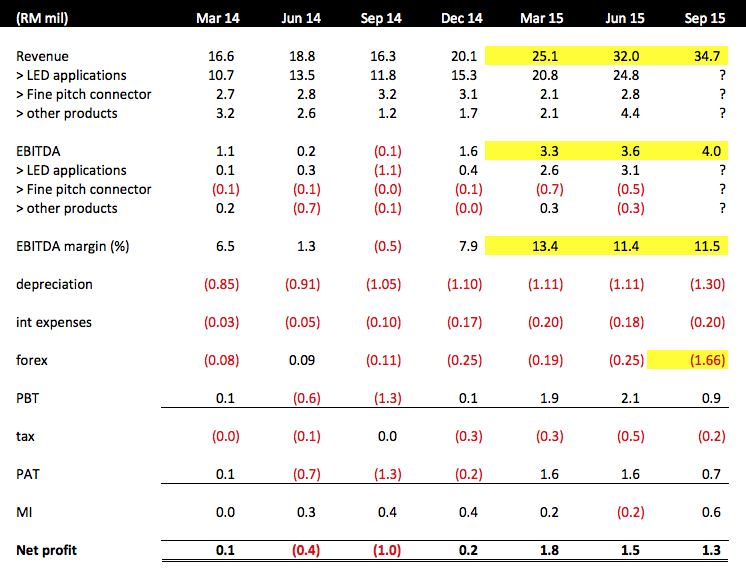

The group's past few quarter P&Ls are as set out below :-

Note : the company stopped providing segmental breakdown for revenue and EBITDA in its latest quarterly report

Key observations :-

(a) Since the beginning of FY2015, both the Group's revenue and profitability improved substantially. EBITDA margin expanded from the previous average of approximately 3.8% to 12%.

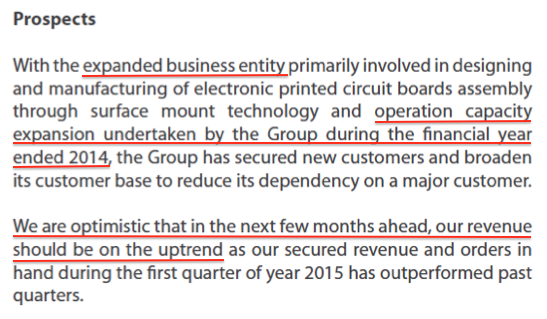

The dramatic turnaround was mostly due to its capex programme in 2014. The following was what the company said in its FY2014 annual report :

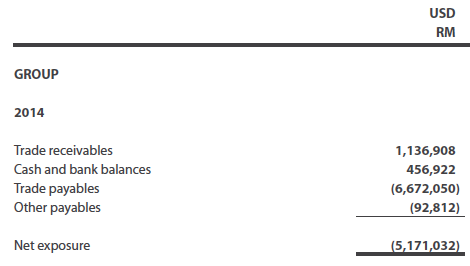

(b) In the latest quarter ended September 2015, the group incurred forex loss of RM1.66 mil. This is not surprising as according to FY2014 annual report, the group has net exposure to USD liabilities :-

The company did not provide details of USD liabilities in its quarterly reports. However, the Ringgit depreciated by closed to 15% in Q3 vs. the USD. So the impact was quite severe.

(c) The group reported net profit of RM1.3 mil in the latest quarter. However, if you add back the RM1.66 mil forex loss, and after making relevant tax adjustment (assume 25%), adjusted net profit for the quarter should be approximately RM2.5 mil.

As the Ringgit has not changed much in Q4 of 2015 (October to December), the coming quarter should not have any major forex losses. As a result, I believe RM2.5 mil is a good estimate of the coming Q4 earnings.

If that is the case, FY2015 net profit could potentially be RM7.1 mil (being RM1.8 mil, RM1.5 mil, RM1.3 mil and RM2.5 mil for Q1, 2, 3 and 4 respectively).

Based on market cap of RM57 mil, I would argue that prospective PER is approximately 8 times.

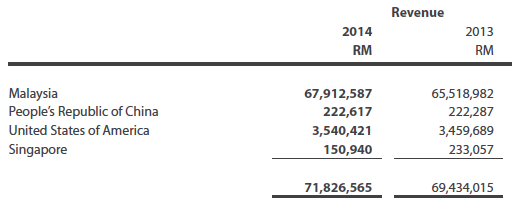

(d) The group derived the bulk of its revenue from Malaysia :-

3. Concluding Remarks

This counter is not an export play, which is all the rage now.

But this is exactly what I want. A forum member asked me recently why I bother to write about Mudajaya ? And the following is my answer :-

I found this little company simple and nice. It seemed that its recent capex has put it on stronger footing, allowing it to grow its revenue and profitability at an impressive rate.

With the recent devaluation of Ringgit, Malaysia's manufacturing industry is experiencing a renaissance of sort. Even though the group currently does not directly benefit from export market, spill overs from other exporting companies could potentially benefit it. As a small size ACE company, there is room for further growth.

Balance sheet strength is reasonable. Prospective PER is also not demanding.

For me, the stock is a BUY at this price.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Very happy with the prototype??

Icon you are having test run on some sort of icon system or 8888 system? :O

2016-01-01 15:27

Yes Master Icon8888. Your head profile seen to be a professional , u r too humble. Eagerly to read your p.(2) , like d decent taste with out too many additives. Especially Msg. I like spicy a lots.

2016-01-01 15:32

hahahah I like this Icon. He has a wicked sense of humor :p

ok take your time, no rush anyways :D

2016-01-01 15:36

Ha ha since I cannot convince u to drop the master title, I will reciprocate by calling you Master Ven Felix. Now we are equal, and I no more feel uncomfortable

2016-01-01 15:36

let me try also...

Master Icon8888,

tonight what dish? what special menu? goose liver again?

2016-01-01 15:39

We are supposed to rely on quarterly result to deliver capital gain, ha ha... The write is meant to compliment...

Right ???

2016-01-05 18:23

JDH....this is from the 2014 AR.

"Industry Trends and Development

Year 2014 was indeed a challenging year for the Group. The

economy of Malaysia was affected by the global economic

slowdown and volatility following uncertainties over monetary

policy adjustments in advanced economies.

Weakening of the Malaysian Ringgit against the US Dollar and

other major currencies towards the end of 2014 has added cost

pressure on the industry. This has resulted in a higher material

cost besides the rising operational cost facing by the Group.

Close attention was accorded throughout the year in improving

production efficiency and yields, with emphasis on cost control

and consistent product specification. "

the depreciation of the ringgit have been very bad for this company. and will continue to bad for the last quarter. ....very likely to report a loss for the last quarter......

But, But........

This is a very good company, good management, good products.

manufacturer of LED......can you imagine that?

This company will fly ....soon, , and some times this year.

if you can get the share between 38 sen and 44 sen..........you will make very good money if you keep for a year.

I think the Company is doing every THING right and revenue is soaring.....soon, the profits will follow....but not the Dec ending quarter yet......the share has not shown any sign of that yet. ...BUT IT WILL.

2016-01-12 22:58

JDH....it is undeniable the company has a bright future., sales are surging, diversifying.

from the 2014 AR

Prospects

With the expanded business entity primarily involved in designing

and manufacturing of electronic printed circuit boards assembly

through surface mount technology and operation capacity

expansion undertaken by the Group during the financial year

ended 2014, the Group has secured new customers and broaden

its customer base to reduce its dependency on a major customer.

and testified by the figures.

the profits will flow....just not yet in Dec 2015 quarter.

2016-01-12 23:30

Desa2020 are u still plan to accumulate this Donut Jhm ? Better hurry, hehe ikan bilis are line up to buy.. qtr results are expected to be good. Furthermore, once a counter spotted with good result delivered ikan bilis don't mind to take a step further to mitigate from buying high. I'm hoping Donut will demonstrate a bullish cup & handle price pattern. Ist Donit got to take off the $0.60 first.If u r going to buy big , $0.45-0.46 might able get it (juz guessing) Whish u luck and happy collecting.

2016-01-12 23:45

so why did the company do a Bumi issue as follows:

On 11 November 2015, the Board announced that the Company proposes to undertake a special Bumiputera issue of up to 21,100,000 new ordinary shares

of RM0.10 each in the Company, representing approximately 12.5% of the Company’s enlarged issued and paid-up share capital,

....

no money, of course....

Business is very good but the depreciation of the ringgit played havoc with cashflows and planning.

the company will survive, I have no doubt and do very well in 2016.

2016-01-13 00:01

the 4 quarter result will be disastrous.

third quarter already bad...4 th quarter will be worse....but, after the Bumi issue...after having more time to adjust to the havoc, the company will rise from the ashes.

2016-01-13 00:03

felix....analysts are not accountants, they are not even businessmen.

Only lazy analysts pay so much attention to core profits and add back forex losses already charged to the PL.

Looking at the second half of 2015, expect 4Q results of this Company to be worse than 3 Q results. ...the Bumi issue already tell you that... The share price is another very good clue.

2016-01-13 00:16

The Bumi special issue are In order to comply to Malaysia Nation Economic plan. Last time was 30% . Juz like others counter did , e.g. Mmsv from 30% reduced to 15% . The said Bumi issue are planned to be completed by 1H 2017. Desa2020, do u think Donut Jhm are desperately need new fund from the Bumi issuing ?

2016-01-13 00:17

Donut didn't ask a single cents during its 2013 proposal for their new capex to establish a $25mil facility plant, it start produce income end of ladt year. Pls read their annual report again. Anyway, thx for your kind sharing here.

2016-01-13 00:22

yes, the needed the fund very desperately...the company is growing very fast. The capital is very small. Just not enough to support the operations, the bankers wouldn't increase the facilities. The Bumi Issueis their savior.

They cannot do a right issue because I don't think the shareholders are rich people.

2016-01-13 00:22

felix...you shouldn't talk nonsense...

That time every thing worked according to plans...They did not have a currency crisis and a run away inflation with costs and GST.

go read the Chairman statement.

2016-01-13 00:24

bee bee...I challenge you to keep the shares to see the 4 q results.

Things cannot bluff one.

2016-01-13 00:26

Hi! Koon bee, your Awc are quite stable at the moment. Likely to ranging from $0.42 -$0.48 based on Recently Ta trending. May plan your necessary strategy. Its a solid company.

2016-01-13 00:29

You will eventually make money if you buy between 38 sens and 44 sens.............just make you you lock it up.

2016-01-13 00:35

that is from memory...don't know much about this AWC

political companies are notoriously difficult to analyse

2016-01-13 01:03

Gd morning all, since Desa2020 has some cincern over Jhm financial though, would like to draw Desa2020 attention for d following :-

1. (Whuch has Clearly highlighting by Icon8888 articke)

The group has reasonably strong balance sheets. Based on net assets of RM34 mil, cash of RM3 mil and borrowings of RM14 mil, net gearing is approximately 0.32 times.

2. (Clearly stated in their 2014 Annual report)

Out from the total short term borrowing of apprx $8mil ($5mil is B.A.)

hope abive will address Desa2020 doubt. Huat ah...

2016-01-13 08:39

Furthermore, Donut Joe still a baby for me, and he has d criteria I need.

2016-01-13 08:42

Forex loss you add back to get normal profit, for export stocks, do U deduct forex gain to arrive at normal profit???

2016-01-13 12:09

newbird...if you think forex losses are not real cash....try to tell your creditors that.

2016-01-13 12:27

Hi! Bird, a simple parameter is, d fluctuations Rm vs Usd for 4th qtr is $4.20-4.40 (5%); pls look back for 3rd qtr , our Rm vs Usd has experiencing a water fall from $3.60 - $4.20 (almost -20%). Hope this will address your concern. Jhm are niw heading to a very progressive stage.

2016-01-13 12:29

felix

ringgit above RM4 is no longer an abnormal event where you try to adjust the PL to get core or normal profits.

Ringgit above RM4 is here to stay...adjust the business accordingly or go out of business...simple as ABC.

2016-01-13 12:35

Desa2020, I hv talk based by figure, figure will back my talk here. Results are as expecting. That's it no hard feeling.

2016-01-13 15:37

Yeap, I would be great if u not juz bluffing here but show me with your figure to prove that , I'm wrong.

2016-01-16 19:25

felix..may I suggest you stop play play shares. Go buy Maybank...and don't waste my time.

2016-01-16 19:28

all these obscure miniature companies is at best given PE 6 by market. as Never, ever, will have any fund mgr look into these segment of listed co.

its just too mediocre and illiquid and unproven.

and we have malaysian moron given them mkt PE of big cap tech. hair. i donno laugh or cry leg.

2016-01-31 02:20

Icon8888

jack I am busy cooking... got to add a lot of ingredients and spice... (you can have a feel of the cooking process in Part 2)

so far I am very happy with the Prototype, you should like it....

please bear with me ya....

2016-01-01 15:23