(Icon) Clash of The Titans (2) - Ooi Teik Bee Demystified

Icon8888

Publish date: Mon, 04 Jan 2016, 07:39 AM

(Friendly match among the Sifus. We all can learn something from it)

1. Introduction

In "Clash of the Titans (Part 1) - Traders vs. Investors", I mentioned that Value Investors are guided by Classical Investment Theories (Warren Buffett, etc). However, Value Traders such as Ooi Teik Bee are not well understood, even though they are quite common nowadays.

The following is extracted from that article :-

I undertook further study and discovered an article written by James P. O' Shaughnessy which is in my opinion, relevant to the topic.

I am happy to share the information here. Hopefully, it can move us one step closer towards better understanding of Value Trading.

(Shaughnessy was previously the Top Management of Bear Stearns Asset Management)

2. Shaughnessy's Study

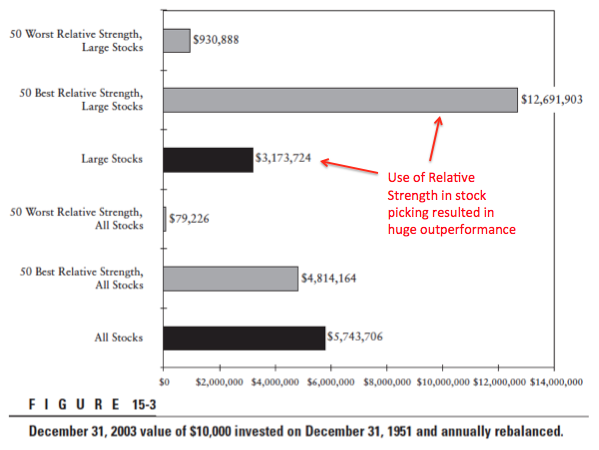

In the article, Shaughnessy studied the stock picking strategy of focusing on buying previous year's biggest winners (with good fundamentals and reasonable valuation).

According to Shaughnessy's definition, stocks with strong previous year price performance are called "High Relative Strength Stocks" while those that underperformed are called "Low Relative Strength Stocks", apparently drawing inspiration from Technical Analysis concept of Relative Strength Index (RSI), which measures Overbought and Oversold.

What have that got to do with the topic of "Value Traders vs. Value Investors" ?

It is related to the topic because Chasing Winners is exactly what Value Traders do.

As discussed in Part 1 (my previous article), Value Investors pick stocks based on their long term prospects (via the concept of moat).

Value Traders are different, they try to benefit from stocks that are flavour of the month / year.

At one end of the spectrum are Drift Woods, who wait passively. At the other end are the Surf Riders, who try to profit from as fast as the next quarter's result. Anglers are in the middle. They all share one thing in common - they don't crave for moat.

Our forum member Ooi Teik Bee is a good example. His famous slogan is "TA first, FA second". He only goes for (good) stocks that have "broken out" (in Shaughnessy's words, "High Relative Strength Stocks").

I hope at this point, my readers are convinced by my argument that Value Traders such as OTB are the same animal that Shaugnessy studied and discussed in his article.

Shaugnessy's article cannot be reproduced here as it was part of a book, which is not friendly for a blog article with limited space. The following is an internet article written by another author, Michael Carr, discussing Shaughnessy's findings. To fully digest the essence, it is advisable for you to go though the article line by line, instead of just focusing on the underlined parts.

Before I proceed further, I would like to apologize to my readers for "finetuning" Shaughnessy's study to suit my "Traders vs. Investors" analysis. Shaughnessy have not done any direct study on Traders vs. Investors. His Relative Strength FA Investing study is the closest I can get. I hope I havn't given you the impression that I am shoving something down your throat.

Let's assume that Shaughnessy's observation of Value Trader outperforming Value Investor is true. But what is the underlying reason for that phenomenon ?

It is actually not difficult to explain. Value Traders jump into a stock only when it shines, both in terms of share price as well as fundamentals.

Velocity is higher when momentum is strong. It is only natural that they reap the benefit faster than Value Investors.

3. Hold On To Your Champagne ...

If you are a seasoned investor or a businessman, at this point, you would be on high alert instead of pulling out your champagne. This is because moneymen always know that there is no free lunch in this world. Everything comes with a catch.

So what is the catch ? It happens that there are two major ones.

First of all, higher and faster return also comes with higher volatility (price fluctuation). Come to think about it, it is as natural as breathing. The reason Value Trading beats Value Investing (according to that study) is because you decided not to wait, but jump in to join the crowd. You enjoy fast return but at the same time, there are many ahead of you, and many are also rushing in right behind you. This is a recipe for chaos and disorder.

Compared to a Value Investor, a Value Trader needs to endure more stomach churning moments.

Secondly, Shaugnessy's study showed that over a longer period of time (about 5 years), Value Investor outperformed Value Trader.

This outcome is actually not difficult to verify. The most successful investor in the world is Warren Buffett. He is a VALUE INVESTOR, not Value Trader.

It is not difficult to explain either. Value Trader chalked up faster and higher return in the initial years because they bother to ride the indutry upcycle (while Value Investor doze off, indifferent of the opprtunities prersented to them, as they only want to play the moat game).

As Value Traders are not protected by moat, their performance will not last forever. It turned out that according to Shaugnessy's study, 5 years are the time when industry upcycle tapers off, moat flexes its muscle and Value Investors catch up.

A classical case of Hare vs. Tortoise.

4. Concluding Remarks

(a) For Value Traders, there is no more need to feel guilty or suspicious about the fast money. Shaughnessy's study explains your (temporary) outperformance.

And you didn't get it for free - you pay the price of higher volatility.

(b) As for Value Investors, Shaughnessy's study confirmed the continued relevance of your method. You have chosen to forego fast money and be patient. Warren Buffett practises the same craft, and he becomes the richest person in the world. The concept is valid, the challenge is to figure out how to do it.

Have a nice day.

Appendix - Cut And Pastes From Shaughnessy's Book "What Works In Wall Street"

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

In my opinion... OTB is a hybrid of value trader and value investor. He goes for uptrending stocks that have good valuations and have more potential upside. His method is quite effective as those counters (most of them), are also being monitored and pushed by the insiders and funds. He doesn't need to wait for a long time to make a landslide or tsunami sort of killing in the stockmarket (e.g targeting for the lowest price). He can just ride the wave and make whatever % there is (e.g min 20% to multiple baggers) at any point of the stock market cycle.

2016-01-04 12:40

Hey Icon yea ure right. Mercury is an arbitrage opportunities which can still never materialized. Previously full of cash (low ROE) as you are aware, used it to bought a company venture into construction (higher ROE), and profit guarantee for 3 years. So we will see.

2016-01-04 12:55

OTB methods is a very tired, consumed energy and low risk method which involved combination of many methods....but highest return.... He is so love and enjoy his work... With his method, unless your are very hardworking, if not impossible to get the highest performance...

2016-01-04 13:04

I guess all of them are Trend followers.( long time never heard peoples use this term as it is not `fashionable' ) : )

2016-01-04 13:49

Hi Mr. Ooi,

If you don't mind, may I take a look on your template .

I would like to see what will make you think a company in good fundamental.

Posted by Ooi Teik Bee > Jan 4, 2016 11:17 AM | Report Abuse

I have my own template of FA report. I also know what is margin of safety, target price base on Intrinsic value of the stock, Potential gain, EV/EBIT and others important ratio.

I copy the best from all the best sifu on FA. I believe I am equally good in FA.

I do not simply buy stock base on TA only. I use TA comes first and FA comes second strategy. All my recommended stocks are guarantee to have very good FA.

Icon8888, are I right ?

Thank you.

Ooi

2016-01-04 15:07

research has shown that combining value with momentum will improve returns

2016-01-04 15:23

I personally think that no matter what methods you use, earning profit is of paramount importance (in decent way).

The difficulty for an investor is to CONSISTENTLY achieve APPLICABLE ANNUALIZED capital return (I believe using TA investors will be harder to achieve above target). Good profit for 3-4 years doesn't really prove anything. Consistent results for 10 years and above only can be considered as an capable investor (his/her wealth should have been significantly amplified during the 10 years).

I do not condemn Mr Ooi or praise Mr KC Chong, it is just my humble opinion.

I would recommend a book by Seth Klarman: Margin of Safety. His investing methods revealed in the book is quite orthodox to Warren Buffett but truly belong to value investing.

Investment is knowledge pay best interest

Investment is most intelligent when it is most business like. Benjamin Graham

2016-01-04 17:28

Sifu, how about FAVCO?do u know the TP? Tqvm for your written up those useful informations!

2016-01-04 17:31

OTB banyak rajin fella...I used to troll him a lot but now I secretly admire him.

His stock picks have very good risk/reward that's why he also never chase risk, aka. didn't play Geshen, Comcorp, KTC all those hot goring stuff and he still can get such decent returns.

Claps*

2016-01-04 17:31

Risk is come from you are not the to 3 persons faster to enter the counter.the person chase high = chase risk and will be the last person out ..wakakaka

2016-01-04 21:02

Icon8888, assuming that you ANTICIPATE that the KLCI will fall 100 points in this quarter, would you react as a Value Trader or as a Value Investor.

2016-01-05 02:55

Value Trader

Not by choice, but by definition

Value Investors buy shares based on moat, let moat drives earnings and price gain one year after another

I buy a company share even if it doesn't have moat

So I don't qualify as Value Investor

Most people here don't

2016-01-05 03:51

But I do buy shares as a value investor

Media prima, AmBank, Bimb-wa, etc

Those are bought bcos I believe they have moat

2016-01-05 03:55

Icon8888, if you are CONVINCED that the stock market will experience a sharp fall, will you eventually sell all your shares reserved for trading but still retain those with moat?

2016-01-05 04:26

it is tricky question... not impossible to answer, but required a lot of thoughts... not easy to do that at 5am.. ha ha

2016-01-05 04:54

Posted by alphajack > Jan 4, 2016 05:31 PM | Report Abuse

OTB banyak rajin fella...I used to troll him a lot but now I secretly admire him.

His stock picks have very good risk/reward that's why he also never chase risk, aka. didn't play Geshen, Comcorp, KTC all those hot goring stuff and he still can get such decent returns.

Claps*

Ans : It is my hobby and interest to learn in stock market. I spend many hours a day to analyse stocks. I want to improve my performance.

Thank you.

2016-01-05 06:36

Not yet leg. Today sent kids to school no time. Later go far roti canai and teh tarik.and after that sing song falling down falling down.

2016-01-05 09:00

ha ha, you are a loving father kah ? Usually moneymen very busy with works, seldom have time for kids.

Enjoy your roti canai and teh tarik, I am always here if you later on need some sparring exercise

2016-01-05 09:05

paperplane2016, a lot money generated from stock market? How you do it? I also hope I can be like you.

2016-01-05 12:25

Icon8888, sorry went to bed before your answer. Not nice of me to ask you a silly question especially at such an unearthly hour. Luckly you didn't attempt to answer. Anyway, let you know that I enjoy reading your articles, as they are informative, interesting and best of all profitable ($$$).

2016-01-05 23:09

Super investor is none of the above,

they make 100% return in Comcorp in two days

and they beat Warren Buffet into dust

2016-01-05 23:26

To become a super investor

one need to survive in a country full of scandals and unpredictable future and still make a profit from the greater chaos, in this country the problem is the shit can even drop Warren Buffet glass stock like MyEG, ifca, fgv, many glove counter, and many unreasonable investing experience.

2016-01-05 23:38

If Warren Buffet come here to invest, he may loss his fortune :) and become begger behind the street.

2016-01-05 23:40

Warren Buffet need to become super investor to make a fortune if he ever think of land his foot on this land.

2016-01-05 23:44

Do you know what is super investor advise to most newbie here?

Absolutely not about reading a book written by some very famous big money making born in first world country and successful story

2016-01-05 23:48

Love this information so much. Still hard to choose or balance value traders and value investor. Now I more toward value trader.

2016-01-06 00:09

I think u got OTB wrong. OTB is not one person. OTB is a group. OTB maybe makes use of value but OTB is definately not passive. OTB's group influence price. OTB is more like a very active shark is it? Thank u

2016-01-06 00:50

Definitely a good article. Would appreciate if Mr Icon8888 can illustrate with a case in study to differentiate the Value Investor from Value Trader. I invested in TienWah since last month, am I a Value Investor or a Value Trader?

2016-01-06 09:07

khingjoo have u read Part 1? Part 1 describe the differences between value trading and value investing

2016-01-06 09:09

Posted by BenBlurBlur > Jan 6, 2016 12:50 AM | Report Abuse

I think u got OTB wrong. OTB is not one person. OTB is a group. OTB maybe makes use of value but OTB is definately not passive. OTB's group influence price. OTB is more like a very active shark is it? Thank u

Ans : I hope I can be so powerful like what you said. I take it as a compliment.

Thank you

2016-01-06 11:14

I agreed dgn Ben sebab I juga dah lama sangsi OTB syndicate.

Mungkin Value Syndicate? Macam mana i con? Lagi terror!

2016-01-06 15:42

Hi Mr. Ooi,

Thanks for your reply.

I would suggest you might want to inspect a series of financial data instead of taking the lastest data only.

A good company will be doing better and better. And, this will be recorded by the financial statement.

Would like to share with you the template I am uinsg now - http://intelligentinvestor8.blogspot.com/search/label/Financial%20Statement%20Analysis%20Template

And, hope to exchange idea and learn from all sifu.

Cheers!

2016-01-06 16:24

Thank you my most respected Icon8888, I will try to look up your part one, as I am new here.

2016-01-06 17:25

Hi Mr Ooi,

If you don't mind, can you please share all your methods of computing the IV? I believe you are using about 5 to 7 methods. The template that you have given earlier on only shows one method.

Thanks.

2016-01-07 07:45

Julietzhu

Really enriched my knowledge in stocks. A big thank to u. Are u really an old old man?

2016-01-04 12:19