(Icon) Mieco - Decent Earnings, Improving Balance Sheets

Icon8888

Publish date: Sun, 24 Jan 2016, 06:02 PM

1. Background Information

Mieco is one of the largest particle board manufacturer in South East Asia. It originally has 3 manufacturing plants in Semambu, Gebeng and Kechau Tui in Pahang. However, in 2014, it disposed of its leasehold industrial land in Semambu and relocated the plant and equipment to its Gebeng site (which already has a manufacturing facility there).

(Semambu, Gebeng and Kechau Tui)

The simplified concept of how particle boards are manufactured are shown in the few diagrams below.

(Wood are cut into small chips, which are then washed and blasted with steam to soften them)

(The chips are then mixed with glue (resin). Once dried, they form a continuos fibre mat)

(The mat goes through a hot press to compress it into board with 1 / 40 of its original thickness)

(The boards are subsequently slot into a giant wheel to dry)

2. P&L

Mieco has not done well in the past. It returned to profitability in FY2014 due to stronger demand for particle board by furniture manufacturers. Profitability in FY2015 was further boosted by lower raw material price (rubber wood and resin for making glue).

Annual Result:

| F.Y. | Revenue ('000) | Profit Attb. to SH ('000) | EPS (Cent) | NAPS |

|---|---|---|---|---|

| TTM | 327,687 | 30,964 | 14.75 | 1.3800 |

| 2014-12-31 | 321,889 | 18,277 | 8.70 | 1.3000 |

| 2013-12-31 | 294,713 | -63,625 | -30.30 | 1.2100 |

| 2012-12-31 | 307,691 | -7,001 | -3.33 | 1.5200 |

| 2011-12-31 | 301,221 | 6,425 | 3.06 | 1.5500 |

| 2010-12-31 | 174,208 | 1,616 | 0.77 | 1.5200 |

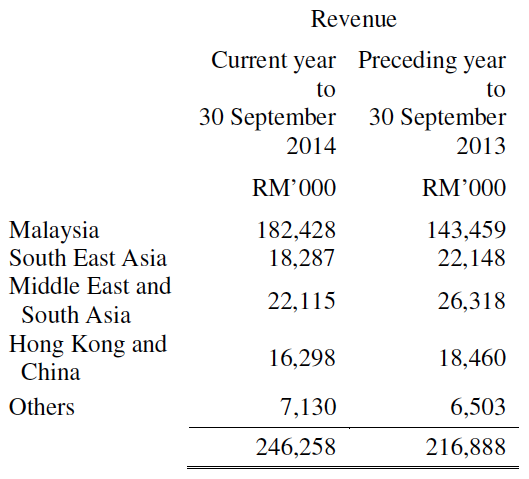

Mieco does not export much. It sells 75% of its products domestically :

The table below sets out the details of Mieco's past few years and quarter's performance :-

Key observations :-

(a) Beginning June 2015 quarter, the group saw significant improvement in profitability. EBITDA margin increased from 8.4% to around 14%. The higher EBITDA margin is due to lower raw material cost (mostly glue) as oil price came down.

(b) In September 2015 quarter, the group reported EBITDA of closed to RM11.6 mil. If annualised, full year EBITDA would be RM46.4 mil.

(c) Depreciation charges is approximately RM15 mil per annum.

(d) Interest expenses had been on declining trend. In FY2013, the amount was RM9.7 mil, dropped to approximately RM7 mil in FY2015. The decline is due to the group's continued paring down of borrowings.

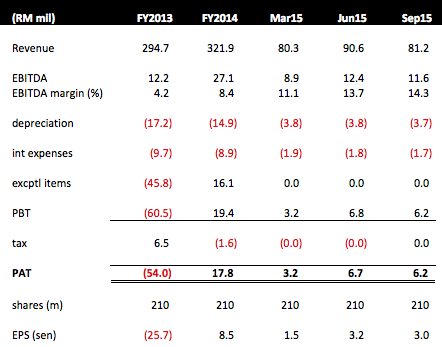

(e) Low tax rate is due to tax and capital allowances.

3. Cash Flow

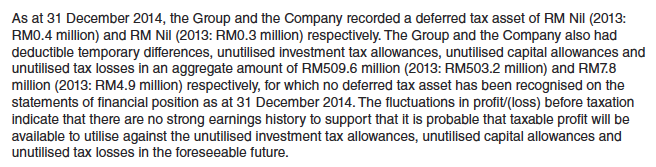

The table below sets out the details of the group's cash flow over past few years :

Key observations :-

(a) In the existing operating environment, the group seemed to be able to generate net operating cash flow (before WC changes) of approximately RM45 mil per annum. This is consistent with the EBITDA figure mentioned in P&L section above.

(b) In 2014, the group disposed of its leasehold industrial land in Semamabu, Pahang for cash consideration of RM23 mil (gain of RM16.1 mil). The plant and warehouses erected thereon will be moved to Gebeng, Pahang. The relocation is targeted to be completed by end 2015.

(c) Not much of the group's cash flow is tied down in working capital. Over a period of five years, the average amount was only RM1.5 mil (being -10.4 + 4.5 + 17 - 13.8 - 4.5 / 5).

(d) In recent years, the group's average capex per annum is approximately RM5 mil per annum. This is substantially lower than depreciation charges of RM15 mil per annum. One possible interpretation is that equipment wear and tear is lower than the theoretical figures predicted by accounting method (straight line depreciation).

(e) From FY2011 until 2015, the group pared down RM105 mil of its term loans.

4. Balance Sheets

As at September 2015, the group has net assets of RM290 mil, cash of RM16 mil and interest bearing debts of RM130 mil, comprises the following :-

On 25 September 2015, Mieco announced that it is disposing of its forest management subsidiary for cash consideration of RM35 mil. Upon completion (still pending), the disposal will give rise to gain of RM34.95 mil.

The disposal will not affect earnings as the subsidiary is dormant. It also will not affect raw material supply as Mieco nowadays mostly use rubber wood for chips.

How will the group's balance sheets look like after the disposal ?

According to the company, the cash proceeds will be used to pare down borrowings as well as for working capital purpose. The details can only be determined after negoatiation with lenders.

For discussion purpose, let's assume the proceed is used to fully retire the remaining term loan of RM32.4 mil. The group will then be left with RM51.8 mil Bankers' Acceptance (BA) and RM46.2 mil shareholder's advances.

The BA is for purchasing of raw material. Like an overdraft, it can be perpetually rolled over. In my opinion, the group should keep the BA as a permanent feature in its balance sheets. A small amount of debt is good as it enhances Return on Equity without exposing the group to excessive financial risk. With BA as the only borrowings, gearing will be a healthy 0.18 times.

As mentioned in Cash Flow section above, the group generates net operating cash flow of approximately RM45 mil per annum. After capex of approximately RM5 mil and setting aside let's say RM10 mil for working capital purpose, there is approximately RM30 mil net cash flow per annum.

Let's assume that there is no need to pare down the BA (as suggested above), the net cash flow of RM30 mil to be generated in the coming 12 months will then be available for the following two purposes :-

(a) paring down shareholders advances; and / or

(b) dividend payment to Mieco shareholders.

It is not meaningful for me to speculate about the eventual outcome. A better way is for me to layout all possible scenarios.

Scenario 1 - Fully Pare Down Shareholders' Advances First

Under this scenario, Mieco shareholders will not receive much dividend over next 18 months. However, the full repayment of advances will lead to interest saving of RM2.5 mil. EPS will be enhanced by approximately 1 sen. Based on PER of 10 times, share price will be enhanced by 10 sen (for discussion sake).

Scenario 2 - Fully Paid Out As Dividend

If the entire RM30 mil is paid out as dividend, DPS will be 14 sen. Based on existing price of RM0.95, dividend yield will be closed to 15% (best case scenario).

Scenario 3 - A Mixture of Both

50% of the net cash flow of RM30 mil is used to pare down advances while the remaining 50% paid out as dividend. DPS will then be 7 sen, translating into yield of 7.4% (based on 95 sen).

Which is the most likely scenario ? In my opinion, Scenario 2 is unlikely. Most likely will be Scenario 3, but the amount might not be that high. My guess is that over the next 12 months, DPS of 5 sen is possible. Based on 95 sen share price, dividend yield of 5.2%.

5. Prospects

Mieco's profitability is determined by three major factors :-

(a) Selling price of its products;

(b) Rubber wood price; and

(c) Glue price.

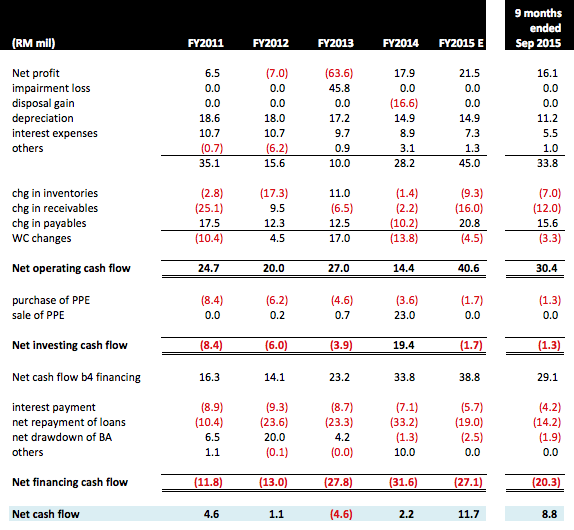

The following information is extracted from FY2014 annual report :-

It is difficult to look too far ahead, but I think the favorable operating environment should last for at least another twelve months due to the following factors :-

(a) fruniture makers are expected to continue to do well. The Ringgit might strengthen, but unlikely to go back to previous height so soon. Malaysian exports will remain competitive, with the benefit spilling over to Mieco;

(b) Low rubber price will continue to encourage planters to cut down trees to replant. There should be an abundant supply of rubber wood; and

(c) Oil price is likely to remain low, which will continue to keep glue cheap.

6. Concluding Remarks

If you ask me, I would say that Mieco does have an interesting story. However, I notice there is still a lot of selling pressure. No harm waiting until a lower price level. Market is very volatile, no need to hurry.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon, I'm tempted to buy Miecro for some time already.

Now more promising to buy.

2016-01-24 18:29

I believe you should wait for 85. This stock very weak syndicate play. Always laosai when market bad

2016-01-24 18:36

The company did not pay dividend for many years already. With improved earnings prospect in fy15 and fy16, do you think they will start giving dividend?

2016-01-24 19:58

Nice to see icon's report on mieco :)

Icon sifu will you do next report on pohuat?

Koonbee and tkp2 awaiting pohuat at 1.68, hope this dont happen hehehe

2016-01-24 21:05

guys, no new development cannot simply write... Will make people fall asleep...

2016-01-24 21:09

Icon I have one question will TPP Affect export counter and if oil

Rebound,ringgit strengthen then what to play

Hahaha

2016-01-24 21:23

that is why I recently write about non exporters loh (JHM, Mercury, Mieco)

I still have exporters, no need panic so soon

Play by ears

2016-01-24 21:24

dailou, why u so early write about Mieco, wait for it relocation of new plant first la, now i cannot accumulate the shares liao lo

2016-01-25 10:05

with a parent like BRDB, it will be a miracle if this stock can sustain-ably perform. Show me a miracle!.

This is an orphan child, Out of 1000 orphans, only 1 gets to graduate.

2016-01-25 13:32

subtly put it, this orphan child has been neglected for years and years.

no direction, no management, no strategy, no nothing.

2016-01-25 13:35

Mieco aside, let me give you a word of caution - you have been away for too long, you are not ready for this market of the information age

that is all I can say at this stage

2016-01-25 13:44

yes, I keep underestimating the power of con con.

<Icon8888 > Jan 25, 2016 01:44 PM | Report Abuse

Mieco aside, let me give you a word of caution - you have been away for too long, you are not ready for this market of the information age

that is all I can say at this stage>

2016-01-25 13:52

@Icon8888 - Thanks for the article Icon bro. You articles covered some points which I didn't take notice of.

2016-01-26 07:17

Posted by fayeTan > Jan 24, 2016 07:58 PM | Report Abuse

The company did not pay dividend for many years already. With improved earnings prospect in fy15 and fy16, do you think they will start giving dividend?

--------------------------------------------------

If history is of any reference, looking back at Hevea as the best example, it's unlikely that they will start giving dividends. Even if they do, it's not gonna be very high. (Unless they use the entire RM30 mil from disposal and pay as special dividend, that's of course another story.)

This is because they still have some USD denominated loans amounting to 11,494 mil (out of total 89,438 mil borrowings). From the managements' perspective, If I'm them, I will clear the USD loan ASAP first, then use the currency windfall advantage to clear the remaining MYR debt as much as possible, before MYR rebounds.

In my humble opinion, dividends is never too much of a focus, as you can always declare HIGHER dividends in the future to compensate back the shareholders from the dividends lost during the years.

2016-01-26 07:29

Amount due to immediate holding company $44.874 million and people want to talk about dividend................

KYY right....more people should study accountancy.

2016-01-26 07:40

Ezra, I am happy that you find the article useful. That is the benefit of blogging, it helps u to flush out a lot of details.

I think there will be some dividend this year. But like what u pointed out, maybe not much until they clear most of their debts.

I paid attention to this stock as it is non export. Nowadays I try to diversify a bit. I have too many export stocks in my portfolio.

2016-01-26 08:35

The reason I bought this stock is very simple. I don't expect much from my stocks, if can get 25% return, I am happy.

I bought at 95 sen. Few months ago, it went up as high as 1.34.

I don't want to be too greedy. If can go up to RM1.20, I can meet my 25% targeted return already. Anything more than that will be bonus.

2016-01-26 08:43

You're being too humble Icon8888 bro, haha. And yes, nothing beats your own homework & research.

By the way, you're smart cause you also saw the currency windfall is certainly a double edged sword. There's a proverb in Chinese called "物極必反 (when things reach an extreme, they can only move in the opposite direction)". Hence we can never know when MYR may rebound. So it's best to take the free lunch in investing - diversification.

2016-01-26 08:44

wow, it seemed that you only commented on mieco, hevea and gkent... you are quite selective Ezra, LOL

2016-01-26 08:51

Haha don't lah, cannot even compare to the stocks you've brought.

I don't always comment in the stocks I buy anyways, maybe only a small portion of them only haha. My portfolio are mostly consisting of defensive stocks due to high level of market uncertainty.

稳中求胜 is my objective. If can achieve 15% p.a. I'm already satisfied already. Higher expectation = higher risk.

2016-01-26 08:59

Aiyo, plane pepper always jealous with Icon8888 , can't make any sense to me.

2016-01-26 11:09

based on my observation, most of the animosity towards me is due to jealousy

paperplane, Desa... all like that...

2016-01-26 11:17

Desa and paperplane walked into i3 thinking they are very good. Suddenly they saw this old man Icon keep tossing out one idea after another, they feel very offended

"who the hell does he think he is ?"

that is how all the animosity started

2016-01-26 11:23

Amount due to immediate holding company $44.874 million and people want to talk about dividend................

KYY right....more people should study accountancy.

2016-01-26 11:26

exporters and export stocks are the only hope for Malaysia to climb out of the hole.

<paperplane2016 > Jan 26, 2016 08:57 AM | Report Abuse

safe the last dance. Bye Bye to Export stocks>

2016-01-26 11:43

what has descended will climb when results are out. I keep chipboard. not expensive n sellable.We will see it fly when export is increased. Welcome export stocks.....anytime.even local selling if in the money.

2016-02-17 14:38

77huat77

Icon When is pohuat turn? Hahah

Teck guan part 2

2016-01-24 18:06