(Icon) Reshuffling My Portfolio

Icon8888

Publish date: Sat, 30 Jan 2016, 11:19 PM

1. A More Balanced Portfolio

In stock market, many things can happen in just a few days. Ringgit traded at approximately 4.40 last week, but yesterday it closed at 4.14.

Together with many other forum members, I started playing the export theme since December 2014. Common sense tells us that the party will end one day.

I didn't really have a feel of when it will happen, but decided to diversify my portfolio at beginning of 2016 by taking position in some non export stocks :-

(a) JHM Consolidation Bhd - Manufacturer of High Brightness LED. The group derives 94% of its revenue from Malaysia. It has done well in past few quarters due to strong demand of its products. Completion of new factory this year should provide further boost to earnings.

http://klse.i3investor.com/blogs/icon8888/88849.jsp

(b) Mercury Industries Bhd - Principally involved in manufacturing and trading of car paints. The group derives 80% of its sales from Malaysia. It is a beneficiary of low oil price. The strengthening of Ringgit should allow it to lower import cost.

http://klse.i3investor.com/blogs/icon8888/90017.jsp

(c) Mieco Chipboard Bhd - Manufacturer of particleboard. It derives 75% of its sales from Malaysia. It is a beneficiary of low oil price as the glue it uses in the manufacturing process is a petroleum derivative. The strengthening of Ringgit should allow it to lower import cost.

http://klse.i3investor.com/blogs/icon8888/90305.jsp

(d) Luxchem Bhd - Manufactures and trades Unsaturated Polyester Resin and gloves related chemicals. It derives 75% of its sales from Malaysia. It is a beneficiary of low oil price. I bought it at around RM1.10 in July 2015 but took profit end 2015 at RM1.65. Recently I bought it back at RM1.70. I am hoping that low oil price will turn in quarter after quarter of super profit for the group. The strengthening of Ringgit should allow it to lower import cost.

http://klse.i3investor.com/blogs/icon8888/80653.jsp

http://klse.i3investor.com/blogs/icon8888/90513.jsp

2. Keeping My Export Stocks

Despite recent strengthening of Ringgit, I am of the view that USD will remain strong going forward (even though might not be as high as 4.40). This is consistent with my July 2015 article :-

http://klse.i3investor.com/blogs/icon8888/80293.jsp

My abovementioned view was backed by historical precedence. In the past two rounds USD bull run, strong Dollars lasted for 7 years in both cases. Please go through the article for more details.

I still have 40% of my money in export stocks (40% in non export cum low oil price beneficiary, 20% in others). The major exporters in my portfolio are as follows :-

(a) Thong Guan Industries Bhd - My exposure is through the Warrants. It was the star performer in my 2015 portoflio, went up from 90 sen (my cost) to as high as RM2.50 within one year.

http://klse.i3investor.com/blogs/icon8888/86450.jsp

I haven't sold a single unit. Recently it has gone down to RM1.74.

I have no regret for not selling at recent peak. For me, Thong Guan is a very rare opportunity, I would like to let it unleash its full potential (whether achievable or not is a different thing).

Thong Guan benefited a lot from weak Ringgit. However, it has other strengths that make it resilient and defensive :-

(i) Capacity expansion still ongoing and hence yet to be fully priced in;

(ii) Low oil price stimulates demand for more plastic packaging material, creating new market that previously did not exist;

(iii) Investment in new technology and machineries allows it to differentiate from competitors, thereby commanding better profit margin; and

(iv) Turning net cash soon. If it starts paying out strong dividend (can be as quick as this year), valuation will be propelled to an entirely new level.

The only black spot is recent Yen weakness, which should have an adverse impact on demand.

(b) EG Industries Bhd - I am a late comer to this stock, only started buying EG-WC recently at 64 sen. The group should benefit from weak Ringgit. However, same as Thong Guan, it has a beautiful growth story that I hope could shield it from a strengthening Ringgit. Will buy more if it comes down further.

http://klse.i3investor.com/blogs/icon8888/90015.jsp

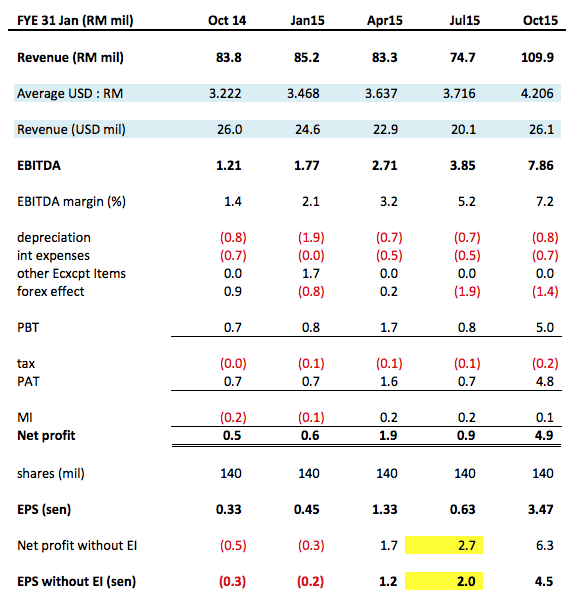

(c) Comintel Corporation Bhd - I am keeping Comcorp in my portfolio. According to analysis in my previous article, the group reported EPS of 2 sen in July 2015 quarter (yellow highlighted at table below) when USD was 3.72 per Ringgit.

Based on annualised EPS of 8 sen and current price of 64 sen, prospective PER would be 8 times. If USD is > 3.72, maybe EPS will be even stronger ?

Please refer to my previous article for further details.

http://klse.i3investor.com/blogs/icon8888/88366.jsp

Apart from the above, I still hold some Dufu, Jaycorp, etc. But their weightage is not as high as the above few stocks.

3. Construction Stocks

Recently, George Kent declined to as low as RM1.50. I took the opportunity to add more to my portfolio.

I am still holding Gadang and Mudajaya.

I have exposure to the abovementioned stocks not because I am bullish about the construction sector. In fact, with current low oil price, I am cautious about that industry.

Push come to shove, the government might need to postpone some of the future projects. But so far, Malaysian government has a tradition of respecting sanctity of contracts. It won't simply cancel contracts that have already been awarded unless it is absolutely necessary. We are far from that kind of situation.

I keep GKent, Gadang and Mudajaya in my portfolio because of their good earnings visibility (of course, things don't always work out as expected, especially for Mudajaya). My experience over the years is that as long as earning is strong, share price will be resilient.

That is how I kicked start 2016. Let's see how things work out going forward.

After a turbulent 2015, another exciting year is ahead of us.

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

Icon8888,

I read one article some key factors are developing and when too obese will turn down Crude Oil to USD7 ............ I read I also scared although I "hope" it will never happen

2016-02-01 09:37

At the end of the day, the only members of the public who makes money from the stockmarket are people like my wife.

She probably makes two or three transactions a year, only focuses on shares of the highest quality.

Told me specifically not interested in any of the shares promoted by the i3 people...KYY or Icon included. Doesn't like shares that go up and down. Bought a fair bit of IGB Reits recently

When oil price came down to US$ 28....she says she wants to buy SK Petrol but I discouraged her.

2016-02-01 09:54

This one I agree....

Usually big shot earn big money jz 2-5 transactions per year....and the volume and trend is significant.........

everyday trade quality drop hence, lose more than EARN and consume energy........

I think there are many discipline traders earn big money from Icon/OTB/KYY comments also....depend on how discipline .....

Posted by Desa20201956 > Feb 1, 2016 09:54 AM | Report Abuse

At the end of the day, the only members of the public who makes money from the stockmarket are people like my wife.

She probably makes two or three transactions a year, only focuses on shares of the highest quality.

Told me specifically not interested in any of the shares promoted by the i3 people...KYY or Icon included. Doesn't like shares that go up and down. Bought a fair bit of IGB Reits recently

When oil price came down to US$ 28....she says she wants to buy SK Petrol but I discouraged her.

2016-02-01 09:58

your wife is smart, your son doing well, you must have done well in your career

that is why you approach this public forum with an elite mentality

you have shut yourself down, no more capable of learning, because you have very high regard for yourself and your family (which btw, I would like to send my warm regards and best wishes)

I am different, I absorb i3 forum members' wisdom like a sponge absorbs water

I learn many many things from different forum members

have a nice day

Posted by Desa20201956 > Feb 1, 2016 09:54 AM | Report Abuse

At the end of the day, the only members of the public who makes money from the stockmarket are people like my wife.

She probably makes two or three transactions a year, only focuses on shares of the highest quality.

Told me specifically not interested in any of the shares promoted by the i3 people...KYY or Icon included. Doesn't like shares that go up and down. Bought a fair bit of IGB Reits recently

When oil price came down to US$ 28....she says she wants to buy SK Petrol but I discouraged her.

2016-02-01 10:01

icon, my portfolio down -2.7% now, I am really poor compared to someone -12%. kesian me sikit can? Don't always use vulgar language personal attack me. I nak cari makan only

2016-02-01 10:10

if you billionaire macam KYY, no need so many transactions a year mah

2016-02-01 10:14

i pity you because of your character and personality, not your portfolio

it takes a lot of foolishness to be able to behave like you, especially some one who believes in buddhism

Posted by paperplane2016 > Feb 1, 2016 10:10 AM | Report Abuse

icon, my portfolio down -2.7% now, I am really poor compared to someone -12%. kesian me sikit can? Don't always use vulgar language personal attack me. I nak cari makan only

2016-02-01 10:15

I see a lot stock god during bull time

I also see a lot stock god turn stock shit when turn to bear

hope ur portfolio continue make money...

2016-02-01 10:16

Icon8888 and all,

Happy day ahead.... I wish you a productive week ahead.

2016-02-01 10:18

if you dare to share the portfolio, mean u very confident to stock market skill, u're Stock God already (my definition)...hehe

2016-02-01 10:34

I put it there for discussion lah, bro... stock god stock ghost what is the relevance ? can eat meh ? most important your own wallet happy mah... everything else is BS...

2016-02-01 10:38

whatever it is,tq icon for your postings,quite informative,keep it up but please hold fast with your conviction ,don't be like some bloggers who sway from their purpose after their conscience being hijacked by greed n employ pump n dump tactic.Don't worry about those critics because they like salt in the dish,without them the dish you cook will taste bland,right?lol

2016-02-01 11:14

Thanks for sharing Icon!

I agreed with your point of investment diversity, and I'm still a strong believer of export counters due to benefit from low material cost and local low demand concern.

The revocation of Iran sanction, which have threatening saudi's position. due to keen of US commitment, Saudi would continue to hold they market prime as strong as possible, cutting down the oil supply seem hard to happen unless the agreement signed among OPAC and don't forget Saudi oil cost is just about 5 dollar. hence, I believe the oil price will be sideway move for sometimes.

Just my humble opinion :)

2016-02-01 11:20

in my opinion, nobody knows what is ahead of us

last year around June, Ringgit also strengthened. But from August onwards, it was like diarrhoea and slided all the way to 4.40

that is why I don't dare to write off export counters

u never know

2016-02-01 11:29

Yes why should u write off export counters ?

The ringgit although do strengthen abit, it is still good for export counters.......bcos msia still competitive based on currency.

Our nearest competitor BAHT, is at around baht 35 v USD 1 whereas

Msia Rm 4.14 v USD 1

This mean Msia still have huge price advantage in short term loh....!!

Msia political situation still no good....the current development still look like window dressing only mah.....!!

Raider see even Ringgit move towards Rm 3.80 v USD 1.....the export counters still can adjust & compete efficiently loh.....!!

The strategy why u buy export counters, is bcos it is a proxy.....to move your monies oversea to hedge agst msia mah.....!!

The problem is some of the export counters price move too much ahead, this trigger profit taking mah....!!

Still raider suggest undervalue export counters & not to overpay loh...!!

2016-02-01 11:43

Secrets of Long-Term Investing Revealed

I’m married. Marriage is about commitment and patience. Marriage is not for the impulsive or the fickle. There are going to be ups and downs, good times and bad times. Through all of that, I firmly believe marriage is ‘worth it’ a million times over.

What does marriage have to do with long-term investing?

Keep reading to see why commitment matters in marriage, and in your investment portfolio.

In marriage, you get to build the deepest relationship of your life. All the little (and big) nice things you do for someone else are added to the ‘love bank’. These little deposits grow over time. You get the interest on your investment through reciprocity; the person you love most in the world doing little (and big) nice things for you.

The draw of marriage is building a deeper, longer bond with one person than you will with anyone else. That is very special.

Society knows marriage is special. That’s why getting divorced is a difficult process. You can’t just tell your spouse ‘we are divorced’ and be done with it. When you give your life-long (and legal) commitment to someone, you can’t just walk out the door with no strings attached.

What if we approached owning our stocks with the same conviction? That’s what long-term investing is about.

“People have a way of looking at me strangely when I tell them that long-term investing isn’t about having a great system, or a superior analytic intellect, or better access to information, or even the best advice money can buy. Long-term investing is about character, about depth of vision and the cultivation of patience, about who you are and who you’ve made yourself to be”

The Single Best Investment

2016-02-01 11:50

Stocktrader,I like your view points on marriage but not so on longterm investment which subjects go all kinds of risks that we must avoid.

2016-02-01 11:56

Jenny,

To help u below is the investment master advise;

Phil Fisher, called the three-year rule. This is what the late Mr. Fisher had to say about this topic:

“While I realized thoroughly that if I were to make the kinds of profits that are made possible by [my] process … it was vital that I have some sort of quantitative check… With this in mind, I established what I called my three-year rule.” Fisher adds, “I have repeated again and again to my clients that when I purchase something for them, not to judge the results in a matter of a month or a year, but allow me a three year period.”

Certainly, there will be situations where an investment thesis is wrong, valuation explodes, or there are superior investment opportunities that will trigger a sale before the three-year minimum expires. Nonetheless, I follow Fisher’s rule in principle in hopes of setting the bar high enough to only let the best ideas into both my client and personal portfolios.

As I have written in the past, there are always reasons of why you should not invest for the long-term and instead sell your position, such as: 1) new competition; 2) cost pressures; 3) slowing growth; 4) management change; 5) valuation; 6) change in industry regulation; 7) slowing economy; 8 ) loss of market share; 9) product obsolescence; 10) etc, etc, etc. You get the idea.

2016-02-01 12:06

Bonercythe(LAN-TAO profile)

Can I recommend you a useful TONIC.....U jz rub on ur mushroom-tortoise head...I think 1 decade will grow hair liao... wanna try??

Now CNY promotion we sell cheap cheap.....is an US organic herb product

2016-02-01 12:15

Posted by i4investor > Feb 1, 2016 10:16 AM | Report Abuse

I see a lot stock god during bull time

I also see a lot stock god turn stock shit when turn to bear

hope ur portfolio continue make money...

TOTALLY AGREE

2016-02-01 12:53

after dropping -12% , reshuffle necessary, I guess??

refer http://klse.i3investor.com/servlets/pfs/54010.jsp for more info.

2016-02-01 12:56

Forget it, icon goreng kaki. He write articles, goreng,dump. Write another again

2016-02-01 22:37

*( Whish icon8888's Blog 红过 Steven Chow, reader's 次次买股如中 Pbb)* 你最好, 妳最红啊, 您更好呀 :)

祝 火候年 行大运

2016-02-05 01:15

***************** PROSPECT OF THE JHM GROUP ***********************

[ Crop partialy from 04/02/16 4th EGM circular notice ]

With the expanded business entity primarily involved in designing and manufacturing of electronic printed circuit boards assembly through surface-mount technology and operation capacity expansion undertaken by the Group during the FYE 2015, the Group has secured new customers from both the local and overseas companies and broaden the customer base to reduce its dependency on a major customer. The revenue generated from new overseas companies represents approximately 6% of the Group’s total revenue for the FYE 2015.

The Board is optimistic that the performance of the Group should improve due to the following factors:

(a) the improvement of demand in the E&E industry;

(b) the expansion of the Group’s production capacity with an additional of five (5)

advanced and efficient surface-mount technology production lines to the Group’s

existing two (2) lines. Accordingly, the production capacity has increased from 12 million

mount points per month to100 million mount points per month, representing an increase

of approximately 7 times from the FYE 2014 to the FYE 2015; and

(c) increase in the secured orders in hand during the financial year ended 2015.

(Source: The management of JHM)

2016-02-18 01:12

Icon8888

you are welcome, chyokh

2016-02-01 09:24