(Icon) Tek Seng (1) - Net Profit Up 100%. More To Come

Icon8888

Publish date: Tue, 16 Feb 2016, 02:27 PM

Executive Summary

(a) Yesterday, Tek Seng released its December 2015 quarterly results. Compared to preceding quarter, net profit increased by 100% from RM5 mil to RM10 mil. The substantial jump in earnings was due to higher sales of solar cells and panels by 51% owned subsidiary TS Solartech Sdn Bhd (TSSB).

(b) Going forward, the positive momentum is expected to continue. TSSB targets to complete 200% capacity expansion by Q3 of 2016 to cater for anticipated strong demand.

(c) Based on latest share price of RM1.20 and annualised EPS of 17.2 sen, the stock is currently trading at prospective PER of 7 times. PER will drop further if the group's coming 2016 capex is successfully executed and EPS climbs to new height.

1. Background Information

Tek Seng was originally involved in manufacturing of PVC sheets, car mats and other related products.

(PVC flooring)

(Car mat)

In 2011, the group diversified into solar cells manufacturing by acquiring 60% equity interest in TSSB. In Q4 of FY2012, TSSB commissioned its first production line. Its factory is located in Penang.

In 2012, the group increased its shareholding in TSSB to 86%.

In 2014, TSSB issued the following instruments to Taiwan listed Solartech Energy Corp :-

(a) 3.17 mil new ordinary shares for cash consideration of RM13.2 mil; and

(b) RM87 mil Redeemable Preference Shares (RPS) for 2 units of solar cell turnkey lines.

Pursuant to the issuance of new ordinary shares, Tek Seng and Solartech Energy Corp owned 68% and 21% equity interest in TSSB respectively.

In 2015, Tek Seng and Solartech Energy Corp agreed to amend the terms of the RPS to make them convertible into new ordinary shares in TSSB.

Pursuant to the conversion, Tek Seng's equity interest in TSSB was diluted to the existing 51%.

Based on 240 mil shares and RM1.20, Tek Seng's market cap is RM288 mil.

With net assets of RM175 mil, loans of RM105 mil and cash of RM18 mil, net gearing is approximately 0.5 times.

2. Dramatic Improvement In Earnings

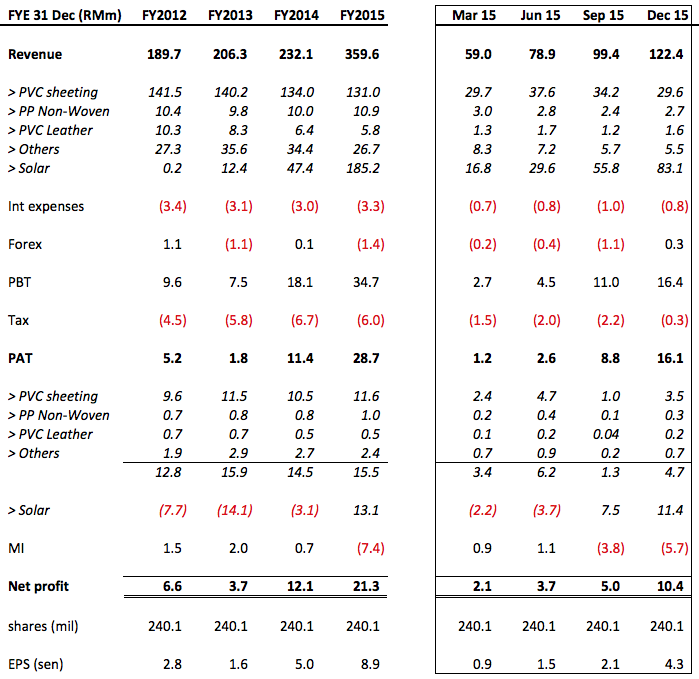

Yesterday, Tek Seng announced a sterling set of results, driven by strong performance of its solar division. Please refer to table below for further details.

Key observations :-

(a) Over the past few years, non solar divisions (PVC related products) generated consistent PAT ranging from RM13 mil to RM16 mil per annum.

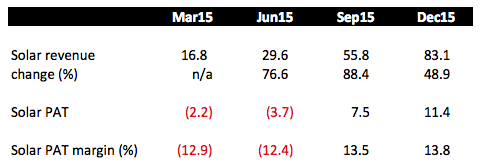

(b) Solar division commenced operation in FY2012. It has been in the red until September 2015 quarter when it decisively turned around and reported PAT of RM7.5 mil.

In December 2015 quarter, PAT further increased to RM11.4 mil, driven by higher sales. PAT margin remained stable at approximately 13.5%.

3. Capacity Expansion

According to an article in The Star dated 15 February 2016, TSSB will increase its capacity by 200% by Q3 of 2016.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

haha stop wasting time talking to them, bjcorp is a holding co, u see how many holding cos are listed in malaysia? most of them just want to con minority shareholders money, all performing like shxt, what they did is geared up like mad, and service the interest, pay high salary and noneed to dividend up back to the holding co, even got, just sufficient to pay debt

tekseng has a lot of potential

2016-02-17 00:49

Tek Seng is a real operating company

One Ringgit debt matched by one Ringgit productive machine, right or not Alpha ?

2016-02-17 00:54

VS at 1.15 is easy money when confident and right, so are Chinwell, Latitude, Kesm last few days. KYY stocks not bad...don't say I didn't tell you. Refer to relevant threads.

Icon8888 > Feb 16, 2016 11:35 PM | Report Abuse

General statements like that everybody also can say, right ?

2016-02-17 00:57

woah Icon promoted BJ a few days ago, via a blog no less and now turn sour on it already.......hahahaha.

2016-02-17 00:59

Hehe. Self conflicting, recommend ppl buy bjcorp, and now telling how bjcorp sucks..... got double character? Shld go see doctor liao this Icon.

2016-02-17 01:04

Icon is a story teller. He is smart enough to tell whatever story he wants.

2016-02-17 01:42

Koon bee u mean? He is low life, he only know vulgar languages. The rest he wont know

2016-02-17 02:10

There are many aspects of bjcorp

High gearing is one aspect

Vietnam lottery is another aspect

I made a buy call bcos Vietnam story will help them to solve gearing problem

No contradiction at all

2016-02-17 07:24

One liner like that doesn't count lah. Need facts, figures and analysis. Otherwise it is all BS

And also, come up with new ideas, don't keep frying other people old rice. People has been buying VS since 2014.

--//--

Desa20201956 VS at 1.15 is easy money when confident and right, so are Chinwell, Latitude, Kesm last few days. KYY stocks not bad...don't say I didn't tell you. Refer to relevant threads.

Icon8888 > Feb 16, 2016 11:35 PM | Report Abuse

General statements like that everybody also can say, right ?

17/02/2016 00:57

2016-02-17 07:31

Alpha jack...

I see you in this thread gives in the shivers.

I saw you at Comintel at 80 sen, Aemulus at 60 ......all holland one.

You kuat kuat bullish.

2016-02-17 10:29

Many ppl believe in avoiding VT counters so think twice, before going to holland.

2016-02-17 10:46

aiyoh.... he is alpha trader, not alpha jack... you lou moong doong like that how to make money in the stock market... ?

Desa20201956 Alpha jack...

I see you in this thread gives in the shivers.

I saw you at Comintel at 80 sen, Aemulus at 60 ......all holland one.

You kuat kuat bullish.

17/02/2016 10:29

2016-02-17 11:22

Anyway this Tek Seng looks tired and over bought.

Surprising Icon promote this over bot counter instead of a half bankrupt counter with no volume one and therefore easier to push.....lol.

2016-02-17 11:23

need a bit of patience... the carrot dangled in front of us is the tripling of capacity by Q3 2016

nobody can guarantee whether they will be successful or not

but for shareholders, it is a sexy concept ... make a bet...

2016-02-17 11:26

Desa, if need critic Sifu Icon, pls make it interesting and innovative la; bored to see your posting. U may team up with sui makmak to deliver cute message as well. Your popularity getting dull in i3 liaw. Won't let u increase your popularity by juz shoot Ucin8888 the icon in i3. At least make it interesting lar.

2016-02-17 11:29

A few questions...

Net current assets , net current liabilities both at $120 million, how to finance the expansion? Even a 1 for 1 gearing and at 70% equity still needs to find about $ 70 million.

Last year, they did a warrant issue of 120 million convertible at 25 sens.....aiyoh.....future shareholders die la.

They are good businessmen, not so good in financial planning.

2016-02-17 11:34

Patience got....$1 level look like coming if market corrects.

I will get some around that price.

2016-02-17 11:37

Icon.....not easy to reach $2, once factor in only 70%, warrant dilution and further dilution from capital expenditure....and the risks involved.

Some even say got quota one.

2016-02-17 14:18

weird questions

the company is raising money thru private placement to fund the expansion, gearing will be well contain at 0.6x

2016-02-17 16:14

Desa....Icon put effort and added second article liao....u still not support and mention RM1

2016-02-17 16:24

Smart investor.....over bot is over bot......you cannot do any thing about that unless you got unlimited money.

Let me revise my entry range to 1.00 to 1.10.

2016-02-17 17:27

I love Right Issues, Koko888 like Right Issues, that's the interesting part of Equity markat to capitalise $$$,, so simple.

Warrant right even sweeter,,,

................e.g. Eg is an good example........................

Posted by Desa20201956 > Feb 17, 2016 11:48 PM | Report Abuse

Technical weakness because nobody likes rights issue or private placement or uncertainties.

Now you can trade or buy with your eyes open.

2016-02-17 23:58

I know...Fenix is die hard fan.........surprising you are still alive.

2016-02-18 00:19

***************** PROSPECT OF THE JHM GROUP ***********************

[ Crop partialy from 04/02/16 4th EGM circular notice ]

With the expanded business entity primarily involved in designing and manufacturing of electronic printed circuit boards assembly through surface-mount technology and operation capacity expansion undertaken by the Group during the FYE 2015, the Group has secured new customers from both the local and overseas companies and broaden the customer base to reduce its dependency on a major customer. The revenue generated from new overseas companies represents approximately 6% of the Group’s total revenue for the FYE 2015.

The Board is optimistic that the performance of the Group should improve due to the following factors:

(a) the improvement of demand in the E&E industry;

(b) the expansion of the Group’s production capacity with an additional of five (5)

advanced and efficient surface-mount technology production lines to the Group’s

existing two (2) lines. Accordingly, the production capacity has increased from 12 million

mount points per month to100 million mount points per month, representing an increase

of approximately 7 times from the FYE 2014 to the FYE 2015; and

(c) increase in the secured orders in hand during the financial year ended 2015.

(Source: The management of JHM)

2016-02-18 01:08

Desa, in this PP scenario of $1, will not affect the current price so much in short term, if i am new pp owner buying at $1, will not sell below $1.1.

In long term, the 36million will be pumped in to work for better share ROI.

Welcome other input as well.

2016-02-18 07:54

Tekseng no doubt has delivered a very visible biz from both Pvc sheet & its Solar biz. Another very resilient counter . And with huge growing till 2020.

Now , shall my little quite JHM follow throught ? Tppa has put Our Bolehland an expandable base for Green Tech.

Agree not Desa ? Kikiki

2016-02-18 21:02

Best reject both.

08 Anyway, please be reminded that Tek Seng only has 50.7% stake in TSS.

With the 120 million warrants convertible at 25 sen.....sounds like the management is taking everybody for a ride.

2016-02-22 18:48

Icon8888

Sorry annual interest expenses RM400 mil

Not RM200 mil

Gearing not high ? Your MBA must be from USQ (oh ya, it is, I forgot)

2016-02-17 00:44