(Icon) Hock Seng Lee (1) - 10 Reasons Why You Should Load Up On This Stock

Icon8888

Publish date: Thu, 04 May 2017, 09:17 PM

Reason 1 - Meets Requirement of KYY Golden Rule

HSL is a Sarawak based civil and marine contractor.

In 2016, the group secured RM1.9 billion new contracts (70% of Pan Borneo Highway and Kuching Centralised Wastewater Management Project).

In March 2017, the group secured RM333 mil wastewater treatment project in Miri, Sarawak.

As at todate, the group's outstanding order book is RM2.5 billion.

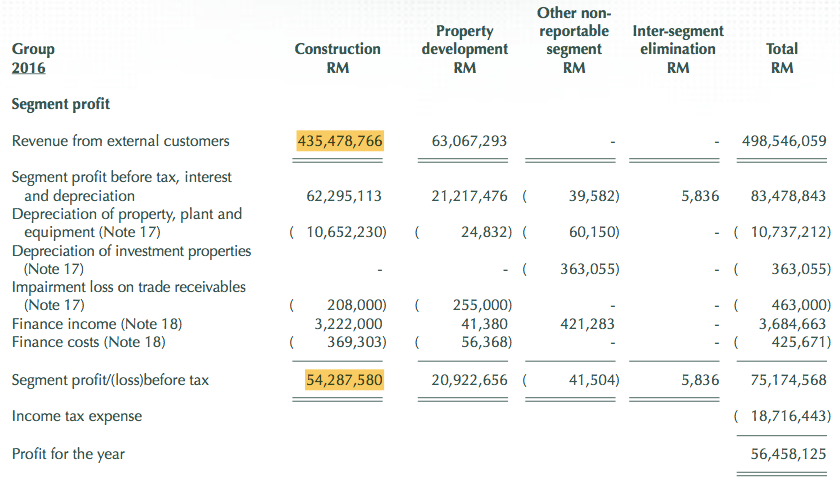

In FY2016, the group's construction revenue was RM435 mil. The existing order book is 5.7 times that figure (analysts expect it to last at least three years once ramped up).

In other words, earning visibility is very good.

Reason 2 - Good Time Is Just Around The Corner

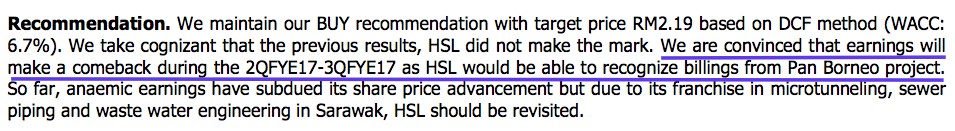

MIDF's analyst visited the company recently (27 April 2017). Based on management guidance, earning from new contracts should start showing up in Q2 / Q3.

https://cdn1.i3investor.com/my/files/dfgs88n/2017/04/27/1505930921-361785338.pdf

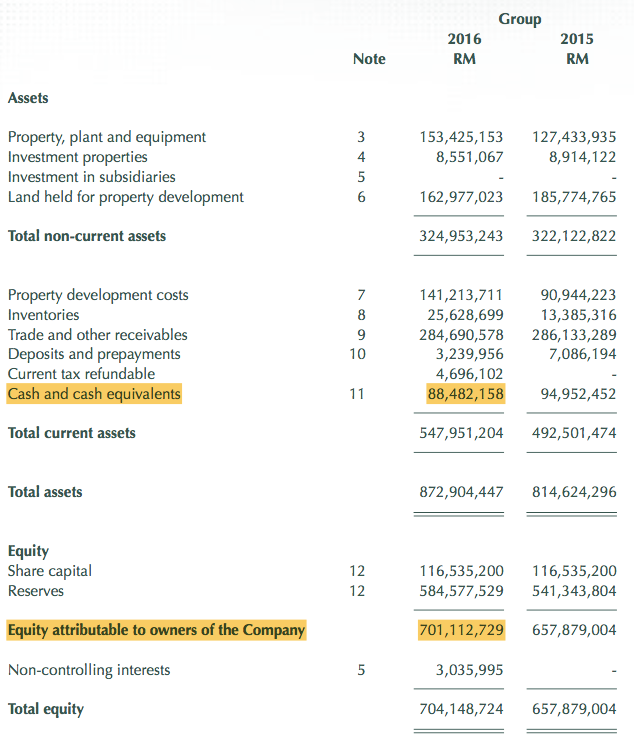

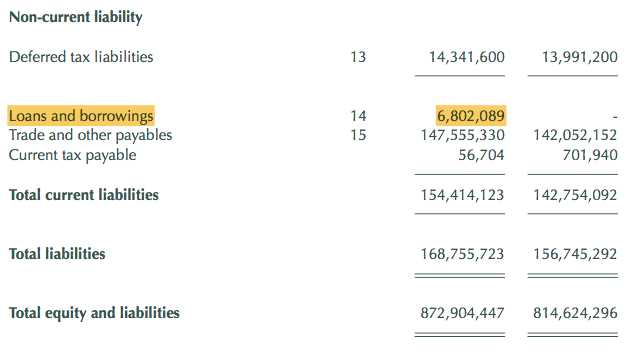

Reason 3 - Strong Balance Sheets

The group is in net cash position. Please refer to information below, which is self explanatory.

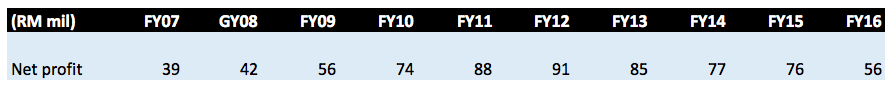

Reason 4 - Impeccable Track Record

Talk no use. Let facts show how well the company has been run in the past.

As shown in table above, even during 2007 / 2008 crisis, the group managed to report growing profit.

Reason 5 - No Legacy Issues

The group is squeaky clean. There are no legacy issues that will act as a drag on the group going forward.

There is currently a court case between shareholders. But it is more related to dispute of shareholding instead of over direction of the group. In my opinion, it should not have material impact on the group.

Reason 6 - Still Trading At All Time Low

Market is frothy now. Go defensive. Buy something that has not gone up much.

HSL is now trading at 10 sen above its past two years all time low of RM1.60. Barring a market meltdown, I think there is limited downside.

Reason 7 - Relatively Small Market Cap

Market cap is only RM1 billion. There is plenty of room for growth, especially for a group with such strong earning visibility.

Reason 8 - Potential Additional Contracts

One of the main reasons the stock has not moved much is because analysts have been making conservative forecast of their FY2017 earning.

Even though I frequently complain about analysts' conservative bias to safeguard their reputation, I am not really in a position to dispute their figures.

However, in my opinion, earning is not the only catalyst. The group is very likely to secure further contracts in the next few months. If that happens, we will not be able to get the shares at such bargain price.

It is always good to move one step ahead of others.

Reason 9 - Efficient Management Team

In FY2016, the PBT margin of the group's construction division was 12%. Assuming tax rate of 25%, net margin worked out to be 9%. Based on my experience, normal construction net margin was 5%. As such, HSL's margin is quite impressive.

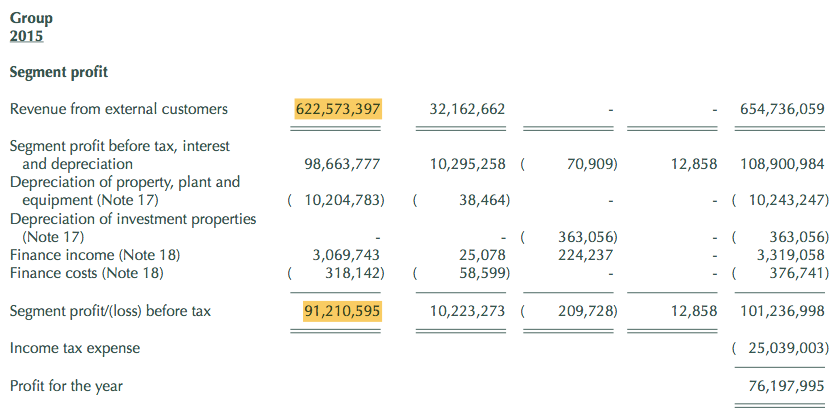

(In FY2015, construction PBT margin was 15%, which worked out to be 11% net margin).

Reason 10 - TA Signal Has Turned Bullish

I am an FA guy, but I do know a little bit of TA. After studying various TA methods in the past one year, I have identified MACD Zero Line Crossing as the most reliable (I am not particularly fond of Signal Line Crossing as it carries too much noise).

In HSL's case, MACD has recently crossed the Zero Line. For me, it is a Buy signal.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

kyy will not buy unless the director cannot sell his stocks,just like the indian boss of sendai

2017-05-04 21:33

limited money. Some times very difficult to decide where to put long term funds.

For really long term funds, I have decided on WCE and Aeon Cr at the moment.

2017-05-04 21:39

I have substantial sums in EPF account that remains untouched. Been thinking about it. I am also very comfortable in current arrangement because not touching it is very comforting and reassuring.

so, we will see. If I am making 40% a year...I don't need anymore injections. But making 40% a year also makes me greedy to inject more. Tough decision.

2017-05-04 22:18

It was previously in my watchlist but too stingy on dividend. Next please!

2017-05-04 22:49

Many more good stocks compared this one. Forget hsl. If they so good and willing to share with minority, It shld have skyrocketed.

Now is steel theme, load up more annjoo and prefer today. Stay focus on steel!

2017-05-04 22:55

Sarawak-based marine engineering and infrastructure specialist Hock Seng Lee Berhad (HSL) has achieved sound progress across its sizeable project order book for the nine months up to 30 September 2016.

the words marine engineering already enough to frighten people off........lol

2017-05-04 23:00

i wait this stock for one year... still cant make money... little dividend...

i will buy again my baby HSL.. dun worry...

2017-05-04 23:38

Profit also not enough to support so many of these directors n senior management.

2017-05-05 01:34

Hmm.... trade & other receivables are mostly half of the yearly revenue, solong credit period.

2017-05-05 08:40

well written icon.. but you missed out one important point..

one of the main reasons why it has not gone up yet:

1) the 2 Mega projects won (Pan Borneo Highway and Kuching Centralised Wastewater Management Project) were at initial/start-up stages so not much revenue had been recognized as of the past few quarters. This has dragged down the 2016 performance. But if you follow FA, u will know that for construction, the revenue recognition is done based on construction progress instead of being linearized every quarter... so you can expect much more revenue and profit recognition in Q2, 3 or 4 this year and even in 2018... as most of us are aware, the unbilled orderbook is so strong that the revenue and profit is already guaranteed for at least 4-5 years

i have mentioned this many times at HSL forum but not many have listened...

when the mega project revenue and profit kick in, we will see who will laugh all the way to the bank...

2017-05-05 14:28

haha

now oldman already changed investment strategy lately

buy lost making company

2017-05-07 09:39

Weird management team always quarrel amongst the brothers and jealous about other peoples success.

2017-05-07 09:56

stockmanmy

very good work, Icon.....

But not sure it will reach KYY because he says he doesn't want to open i3 anymore.

2017-05-04 21:27