(Icon) Kobay Technology - Precision Engineering Riding Semiconductor and Aerospace Industry Boom

Icon8888

Publish date: Fri, 08 Jun 2018, 12:43 PM

It is no exaggeration to say that Kobay is a mini SAM Engineering. Both also started as supplier of components to semiconductor industry. By using their expertise in precision engineering, they later diversified into manufacturing of aircraft components.

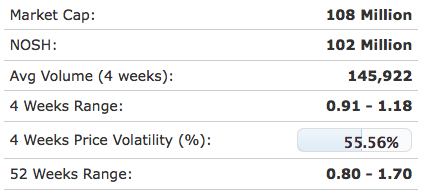

However, Kobay is a much smaller player. While SAM has market cap of RM1 billion, Kobay's market cap is only about RM100 mil.

(Kobay share price)

As shown in chart above, Kobay's share price spiked in February 2018 after reporting a strong set of results for its December 2017 quarter (EPS of 4.45 sen). It touched RM1.70 on 5 March 2018. However, share price slowly retraced to RM1.00 over the subsequent few months. This could be attributed to bearish sentiment caused by Trump trade war threat and GE14 turbulence during that period.

And probably due to insiders selling down ahead of poor results as well.

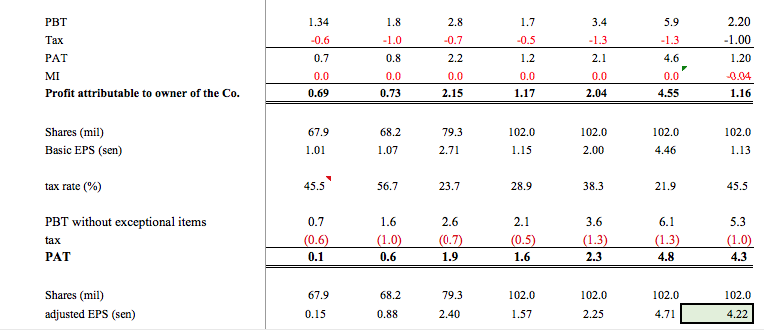

True enough, the company released its March 2018 quarter in May 2018. This round, quarterly EPS was only 1.09 sen (vs. previous quarter 4.45 sen). What a big disappointment.

Did earning really disappoint ?

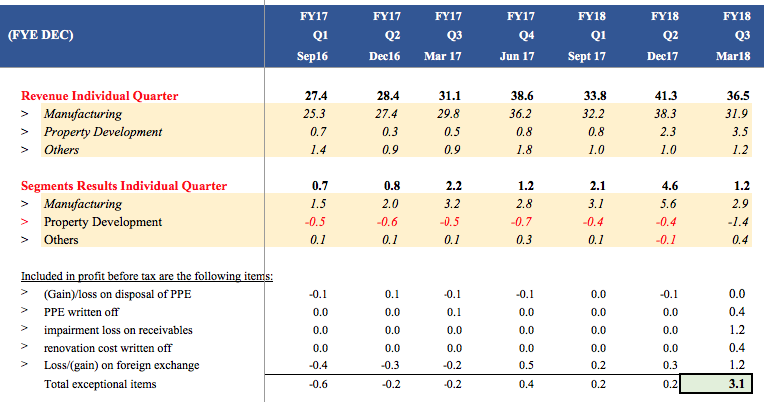

Nope. If you look at the March quarterly result in detail, you will notice that core earning has actually remained more or less the same. The presence of exceptional items dragged down its EPS.

As shown in table above, the group actually reported PBT of RM5.3 mil. It was only after factoring in exceptional items of RM3.1 mil that profit declined substantially.

Excluding the RM3.1 mil exceptional items (which are not recurrent), core EPS was actually 4.22 sen, quite closed to the 4.55 sen reported in December 2017 quarter.

Concluding Remarks

As we all know, I wrote about SAM Engineering recently (it announced a massive 23 sen dividend on 7 June 2018). Kobay is another stock that I like for exposure to precision engineering related industries (semiconductor and aerospace).

The semiconductor industry is currently doing well, with US Semicon index touching new heights. On the other hand, Malaysia is emerging as an increasingly attractive destination for aerospace related FDI. Even UMW recently sets up a new aerospace division.

Strictly speaking, Kobay does not yet qualify as a company with moat (in my opinion, SAM Engineering does have moat). But unlike its peers in general metal stamping and injection moulding, Kobay's expertise in precision engineering lands it in a niche area that faces less competition. With the booming semiconductor and aerospace industry, I believe it stands a good chance of doing well going forward. All eyes on coming quarter results.

Appendix - 2018 NST Article On Malaysia's Aerospace Industry

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Icon8888 Gossips About Stocks

Created by Icon8888 | May 01, 2020

Created by Icon8888 | Mar 10, 2020

Created by Icon8888 | Mar 01, 2020

Created by Icon8888 | Nov 13, 2019

Discussions

the main semicon boom is alrdy finished and done with.

just look at inari and elsoft, they r not reaching new highs this yr while kobay reached a high of 1.70 b4 falling to ard 1.

btw, i have sold off all 3.

lol.............

2018-06-09 11:55

Although semiconductor is needed in many electronics other than mobile phones, the recent slowdown in mobile phones demand will give an impact on the semicon biz. Evidenced by

1) https://www.thestar.com.my/business/business-news/2018/04/19/tsmc-trims-full-year-revenue-estimate-on-weaker-smartphone-demand/

2)https://www.thestar.com.my/business/business-news/2018/06/09/apple-to-make-20-percent-fewer-new-model-iphones-this-year/

I would recommend Icon to look into fiber optic biz, more promising on data networking demand.

2018-06-09 22:34

Global Semiconductor Sales Increase 20 Percent Year-to-Year in April; Double-Digit Annual Growth Projected for 2018.

https://www.design-reuse.com/news/44211/april-2018-semiconductor-sales.html

2018-06-10 01:52

Semiconductor Outlook: Further Upside in the Cards

https://www.zacks.com/stock/news/307182/semiconductor-outlook-further-upside-in-the-cards

2018-06-10 01:56

Chip Stocks Saved From IPhone Fate by Data Center Building Boom

http://www.datacenterknowledge.com/business/chip-stocks-saved-iphone-fate-data-center-building-boom

2018-06-10 02:08

AI, Big data, IoT, deep learning, machine learning, data centers, autonomous cars, electric cars, electrification of cars, cryptocurrencies, smart phones

Smart phones are just part of the use of semiconductor.

2018-06-10 07:38

Six reasons why Electric Vehicles on roads will triple in next 2 years

https://www.financialexpress.com/auto/car-news/six-reasons-why-electric-vehicles-on-roads-will-triple-in-next-2-years/1188150/

Autonomous-Driving Chip Stocks That Look Ready to Rally

https://www.thestreet.com/investing/autonomous-driving-chipmakers-look-ready-to-rally-14605769

2018-06-10 07:50

Electric Car Sales Are Surging In China [Infographic]

https://www.forbes.com/sites/niallmccarthy/2018/06/01/electric-car-sales-are-surging-in-china-infographic/#58c24f5ed1f7

2018-06-10 07:52

As Tesla, GM Rally On EV, Self-Driving Hopes These Stocks May Be Next. https://www.investors.com/news/tesla-gm-evs-stocks-texas-instruments-rio-tinto-autoliv-stmicro-lear/

2018-06-10 07:53

Trump Turns Tables on G-7 Allies With Free-Trade ‘Proclamation’

https://www.bloomberg.com/news/articles/2018-06-09/trump-turns-tables-on-g-7-allies-with-free-trade-proclamation

2018-06-10 08:44

US does have robust semicon biz. Unfortunately we Malaysia doesn't have semicon producer, we just have semicon assembly and test services/equipment providers.

I'm afraid the demand for "AI, Big data, IoT, deep learning, machine learning, data centers, autonomous cars, electric cars, electrification of cars, cryptocurrencies" semincon tests is just enough to offset the loss in demand for smartphones semicon test. In the end, no growth in our semicon related companies. After all those too high tech things have not really penetrated Asian markets yet.

I'm looking for tech sector in Malaysia that will have exponential growth right now.

2018-06-10 12:13

Apple announces 5 new products; Xiaomi, HTC and Moto smartphones launched in India;

https://www.gadgetsnow.com/slideshows/apple-announces-5-new-products-xioami-htc-and-moto-smartphones-launched-in-india-microsofts-7-5-billion-acquisition-and-more/xiaomi-launches-redmi-y2-smartphone-at-rs-9999-onwards/photolist/64518585.cms

2018-06-10 16:07

China's mobile phone shipments resume growth in May

http://www.xinhuanet.com/english/2018-06/10/c_137244327.htm

2018-06-10 16:09

Gartner: Worldwide Sales of Smartphones Returned to Growth in First Quarter of 2018

https://www.albawaba.com/business/pr/gartner-worldwide-sales-smartphones-returned-growth-first-quarter-2018-1140444

2018-06-10 16:11

ahh...icon u read the comment of me on SAM, hehe ...tq , can see msniaga u can see big thing with them especially fusionex

2018-06-12 10:31

Dude,

U need to see things from different perspective, too fast jump in conclusion not good lar.

Low profit not neccessary a lousy investment .

2018-08-12 15:17

Jon Choivo

I don't think the Dividend for SAM is massive, considering the yield.

Kobay is interesting. Valuation wise, its a touch high, whether for a prop dev or standard manufacturing arm (precision or not)

The resilience of the earnings of this company is quite doubtful. Future looks bright-ish, with O&G and Aerospace markets expected to expand. But when valuation is taking into account, not nearly cheap enough. For me at least.

2018-06-08 20:37