Holistic View of Focus Lumber with Fundamental Analysis & iVolume Spread Analysis (iVSAChart)

Joe Cool

Publish date: Mon, 12 Oct 2015, 12:32 AM

Focus Lumber, A Company whereby Investors Shall Not Loose Focus On !

Focus Lumber Berhad was incorporated in Malaysia on 30 October 1989 as a private limited liability company and was subsequently listed on the Main Board of Bursa Securities on 28 April 2011. The company’s businesses are manufacturing and sale of plywood, veneer, Laminated Veneer Lumber (“LVL”), and investment holding. Although there are business diversifications, plywood still remains as their core product, generating the bulk of the Group’s revenue.

The company’s plywood manufacturing mill is located at Keningau, Sabah. Having strong emphases on environmentally friendly manufacturing, Focus Lumber became the first Malaysian plywood mill company to be certified as a CARB Certified Manufacturer on 2 October, 2008 by Professional Service Industries, Inc., a CARB authorized third party certifier. The CARB standards regulate formaldehyde emissions from wood products sold in California or used to make finished goods for sale in California. In addition, the company was also awarded with the JAS certification by the Ministry of Agriculture, Forestry and Fisheries of Japan in 2009 as a proven qualified plywood manufacturer. JAS imposes stringent requirements on various aspects of production process. The JAS certification signifies the acknowledgement and endorsement of the high quality of the Group’s product which will enhance customers’ confidence.

In January 2013, the company was accredited as a certified Lacey Compliant Wood Products Manufacturer by Benchmark International, LLC (BMH) under the BMH Lacey Compliance Verification (LCV) Program, affirming the legality of sourced forest products used in the manufacture of FLBHD products. BMH is an independent third party auditors who assist wood products manufacturers and importers in proving that their source of forest products are legal as required by the Lacey Act, which was passed by the US Congress in 1900 and 2008, by adding the protection of plants and plant products. This certification provides their US customers a higher degree of confidence and helps protect them from heavy civil and criminal penalties that can result from violating the Lacey Act.

Although being a small company with only slightly over RM 150 million revenue per year, Focus Lumber has many great aspects in their financial performance. Below are some of the key financial figures as per latest full financial year results in year 2014.

|

Company |

Focus Lumber Berhad |

|

Revenue (RM’000) |

150,419 |

|

Net Earnings (RM’000) |

16,032 |

|

Net Profit Margin (%) |

10.66 |

|

Current Ratio |

14.3 |

|

Cash Ratio |

7.93 |

|

Dividend Yield (%) |

4.103 |

|

Historical PE Ratio |

10.21 |

Revenue of Focus Lumber have achieved a remarkable consistent growth throughout the 4 years of listing. Average year to year growth achieved is at 7.186% from financial year 2011 to 2014. In terms of net profit, although there is a slight dip in financial year 2012, the overall net profit is still in a growing trend with and average year to year growth of 3.99%. Net profit margin wise it is currently at 10.66% which is on par with the average manufacturing industry profit margin.

The main strength of Focus Lumber’s financial figures are its ultra low current and long term liabilities. This results in an extremely high Current Ratio (Current Asset/ Current Liability) of 14.3 due to the low current liability that they incur yearly. In addition, Focus Lumber is also cash rich, which results in the extremely high Cash Ratio (Cash and Cash Equivalent/Current Liability) of 7.93. In fact in the latest financial year, Focus Lumber have recorded a RM56.3 million cash and cash equivalent on hand, which is one third of their yearly turnover.

Not forgetting the third financial highlight, Focus Lumber has a generous dividend payout ratio of 51.5%, which results in the high dividend yield of 4.103%.

FA Comment: In summary, the strengths of this small company is its ultra low debt, cash rich and consistent growth. With its higher than average dividend payout, this company can be considered having the best of both worlds for both capital gain seeking investors and dividend seeking investors. A very little short coming for this company is that the capital expenditure is slightly on the low side (1.3% of its annual revenue whereby growing companies in the manufacturing sectors on average will use 3% to 5% of its annual revenue as expansion funds). Capital gain seekers will be hoping for higher capital expenditure for greater company growth which translates to more annual earnings. Current PE ratio of the company’s share price is at 10.21 percent which is close to the industry average. Investors can consider investing in this company in view that the depreciating Ringgit will generally benefit exporting manufacturers. (8 Oct 2015 share price: RM 1.89)

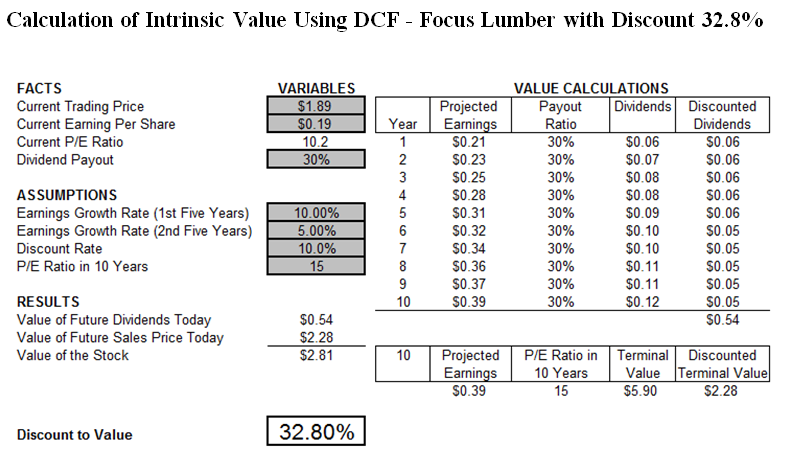

Calculation of Intrinsic Value Using DCF - Focus Lumber with Discount 32.8%

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software toolkit - Focus Lumber

iVSAChart Comment:

Stock on mark up after a nice 3rd break out. The stock is currently on pullback with low volume with unconfirmed upthrust (mid week - 8 Oct 2015). Focus Lumber may test RM1.83-RM1.92 on low vol.

Watch for test and spring here for sign of strength. If successful, stock can still move higher, breaking old high @ RM1.99. Inversely, if volume increase and Upthrust (Sign of weakness) confirmed at the range of RM1.83 till RM1.92, Focus Lumber will see weakness.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on iVSA Stock Review

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Nov 14, 2016

Created by Joe Cool | Nov 03, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 17, 2016

Discussions

Another cash rich company, i.e Eksons Corporation Berhad. Also in timbering industry. Its performance really disappointed. Holding so much of cash without further investment might as well distribute as dividend back to shareholders. Lol

2015-10-12 09:03

It really depend on your risk profile. If you are in growth, Focus Lumber may not be right for you.

At the end, it is your choice but our iVolume Spread Analysis is certainly trending higher and you get a good yield with that.

Discount value with nice market trend. What can one ask for...

2015-10-12 20:48

globalvalueinvestor

You are too optimistic, they are no much plan to grow, really is a concern to me. As you mention, fully cash company with no direction, like jobstreet and others..

2015-10-12 06:26