Holistic View of Signature with Fundamental Analysis & iVolume Spread Analysis (iVSAChart)

Joe Cool

Publish date: Thu, 09 Jun 2016, 12:32 AM

Is Signature International Berhad an extremely undervalued stock?

Signature International Berhad, an investment holding company, engages in designing, marketing, distributing, retailing, and exporting kitchen systems, wardrobe systems, and built-in kitchen appliances in Malaysia. The company also involves in manufacturing, supplying, fabricating, and installing aluminum, glass, and aluminum related products for the retail and project business. In addition, it markets, distributes, and sells kitchen appliances and white goods, cabinets in kitchen and bedroom, knockdown furniture and furniture parts, appliances and accessories, kitchen systems, and wardrobe systems.

Based on Financial Year (FY) 2015 full year results, Signature achieved RM 273 million turnover, which is considered to be a small size enterprise. Other aspects of the company’s latest financial results are illustrated in the table below.

|

Signature International Berhad |

FY 2015 (RM’000) |

|

Revenue (RM’000) |

273,490 |

|

Net Earnings (RM’000) |

34,664 |

|

Net Profit Margin (%) |

12.67 |

|

Return of Equity (%) |

23.61 |

|

Total Debt to Equity Ratio |

0.163 |

|

Current Ratio |

2.015 |

|

Cash Ratio |

0.266 |

|

Dividend Yield (%) |

4.25 |

|

Earnings Per Share (RM) |

0.28 |

|

PE Ratio |

5.03 |

Since FY2011, Signature’s revenue has been on an uptrend from RM 116.5 million to RM 272.9 million in FY2015, with the exception of FY2012 whereby there is a dip in revenue to RM 96.7 million. This represents a 1.3 times increase in 5 years or an average year to year growth of 23.7%.

In terms of net profit, Signature experience a downtrend from FY2011 till FY2013 from RM6.27 million to RM4.26 million, and then come back very strongly to RM17.83 million and RM 34.66 million in FY2014 and FY2015 respectively. This could be due to 76% of the company’s revenue is from contractual based project, whereby the cost of revenue maybe hard to predict as it varies greatly depending on the project’s client requirements and the profit margin of a project varies depends on the bidding competitiveness.

Net profit Margin wise, Signature still scores well at 12.67%. Return of Equity is great too at 23.61% possibly due to being a service provider which involves relatively less equity for fixed assets in setting up the business.

In terms of company’s debt, Signature has a low total debt to equity ratio of 0.163. The company also manage to achieve a good current ratio of 2.015 but cash ratio of 0.226 is on the low side. Having a low cash ratio may cause cash flow problems to the company during an economy crisis unless the company’s current assets are very liquid. In Signature’s case, their current assets biggest contributors are trade receivables and amount owning by contract customers which are not very liquid, therefore the company is quite susceptible to bad economic conditions.

Dividend wise, Signature started paying dividends since 2013 and has been increasing from 1.5 cents to 6.0 cents per share in FY2015. This translates to a high 4.25% dividend yield and a low dividend payout ratio of 0.2. Growing dividend payout accompanied by low dividend payout ratio is a good sign of company’s growth in net earnings and cash flow.

In conclusion, Signature’s financial performance is good except concerns on relatively low cash ratio. It has consistent revenue growth these few years and earnings has been positive with increasing dividend payout. Moreover, having a PE ratio of 5.03 for a company that is still making profit and with growth potential is considered low. Therefore, most likely the company is truly undervalued, an opportunity not to be missed for both capital gain investors and dividend seekers.

Next quarterly results announcement should be on the month of Aug 2016 for Q4 results.

iVolume Spread Analysis (iVSA) & comments based on iVSAChart software – Signature

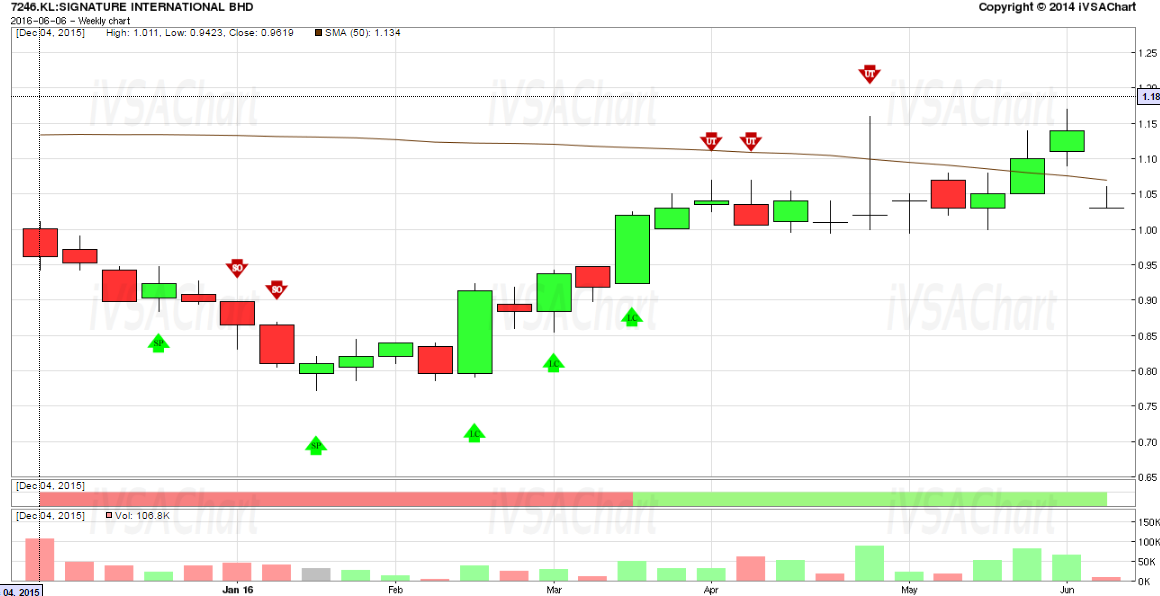

From the classical teaching of iVSA method, Signature has formed a nice stage 1 accumulation.

Despite three Sign of Weaknesses (red arrows) formed seen since April 2016, Signature continued to hold its support around RM1.00 and is at the beginning of Stage 2 Markup (please note that there is a special dividend of RM0.10 which went Ex on 6th June 2016, as reflected in the last weekly price bar).

Based on solid financial performance with potential growth and that iVSAChart is showing it is at the beginning of Markup stage, it is considered a good time to accumulate around current level.

Any questions?

- Website https://www.ivsachart.com

- Email: sales@ivsachart.com

- WhatsApp: +6011 2125 8389/ +6018 286 9809

- Follow & Like us on Facebook: https://www.facebook.com/priceandvolumeinklse/

This article only serves as reference information and does not constitute a buy or sell call. Make your own assessment before deciding to buy or sell any stock.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on iVSA Stock Review

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 15, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Dec 01, 2016

Created by Joe Cool | Nov 14, 2016

Created by Joe Cool | Nov 03, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 24, 2016

Created by Joe Cool | Oct 17, 2016

tklim

haiyaaa...sure or not???..Those numbers are historical numbers maaaa..Give five years forecast lah......NTA only 1.25....how high can go?

2016-06-10 07:54