No Risk Investment Strategy - Koon Yew Yin

Koon Yew Yin

Publish date: Mon, 02 Jun 2014, 10:40 PM

Koon Yew Yin

During my last 31 years in share investing, I realize that not one single strategy can work all the time because all business operations face different challenges at different time. As a result, their share prices fluctuate and I have to change my strategy quiet frequently to make profit.

How can I find a strategy that I do not have to change so frequently? How can I find a company that can consistently make increasing profit?

As you know, in Malaysia, we do not have companies like Coco Cola, Gillette Razor and MacDonalds which have the competitive market advantage to generate increasing profit consistently. But we have well managed plantation companies like KLK and Batu Kawan which produce palm oil.

Fortunately for us, only Indonesia and Malaysia have the most suitable climactic condition for growing oil palms in the world and our largest buyers India and China cannot grow oil palms. That is why almost all the palm oil is produced in Indonesia and Malaysia.

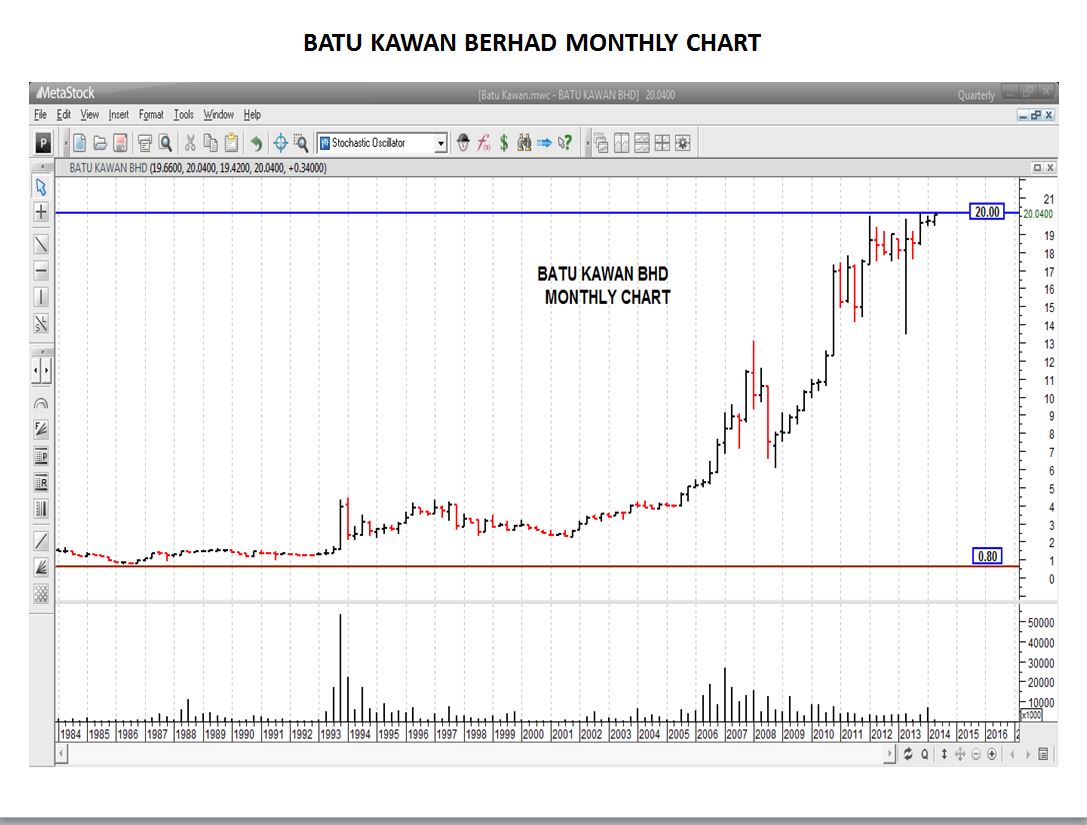

The long term Batu Kawan chart shows that its price was Rm 2,50 in 2001 and currently it is Rm Rm 20.00 , an increase of Rm 17.50 in 13 years, ie 7 times in 13 years.

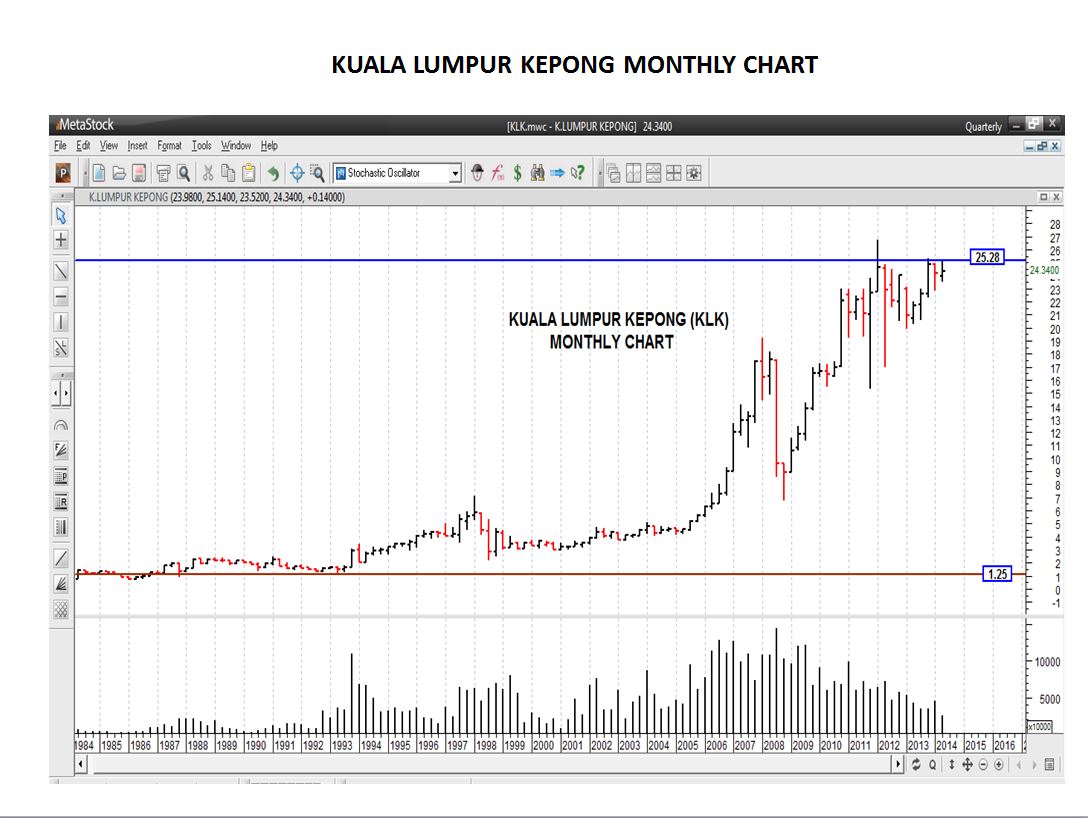

The long term KLK chart shows that its price was Rm 4.00 in 2004 and currently it is Rm 24.00, an increase of Rm Rm 20.00 in 10 years, ie 5 times in 10 years.

Between the 2 companies, Batu Kawan is a better buy. If you buy Batu Kawan you will get about 18% return per year plus about 4.0% as dividend = 22% per year.

If you make use of margin finance costing 4.6% per year, you can easily get another 10% per year at least, totaling 32% per years. You just buy and keep for a long term and you don’t have to do anything.

As you know all shares fluctuate in price. If you sell some when the price is high and buy back when the price is low, you can further improve your profit.

More articles on Koon Yew Yin's Blog

Created by Koon Yew Yin | Dec 26, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Dec 13, 2024

Indonesia remains committed to start implementing a 40% mandatory biodiesel mix with palm oil-based fuel, or B40, on Jan 1 next year, its chief economic minister said. Indonesia, the world's largest..

Created by Koon Yew Yin | Dec 12, 2024

Indonesia is the world's largest producer of palm oil, producing an estimated 46 million metric tons in the 2022/23 marketing year. Indonesia also exports over 58% of its production, making it the w..

Created by Koon Yew Yin | Dec 03, 2024

Indonesia is the largest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offi..

Created by Koon Yew Yin | Nov 25, 2024

My younger brother who was a dentist had bipolar disorder. Unfortunately, he committed suicide about 12 years ago.

Created by Koon Yew Yin | Nov 22, 2024

All plantation companies are reporting better profit for the quarter ending September when CPO price was about RM 3,800 per ton.

Created by Koon Yew Yin | Nov 21, 2024

Indonesia is the biggest palm oil producer in the world. Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry offici

Created by Koon Yew Yin | Nov 20, 2024

Indonesia plans to implement biodiesel with a mandatory 40% blend of palm oil-based fuel from Jan. 1 next year, a senior energy ministry official said recently, lifting prices of the vegetable oil...

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Created by Koon Yew Yin | Oct 30, 2024

Latest poll on 30th Oct 2024

Discussions

Personally, if you follow Mr.Koon YY's theories blindly, chances of going Holland is higher...

2014-06-03 08:24

Many are chasing after kulim-wc. Wake up, the CPO is sliding and the upside of the wc near term is very limited. Sell the wc before it is too late!

2014-06-03 08:35

Dear Mr Koon, yes I totally agree that Batu Kawan is a better buy as compare to KLK as it generated more return. However, the return rate of 22% was based on past data calculation. If a retail investor does not own any BKWAN now but would like to own some, how can he / she ensure that BKAWAN will continue to give such a return rate to shareholders for another 10years?

2014-06-03 08:56

Unless he/she can be very patient to wait for big correction cycle in every 10 years, and only can buy good companies in low prices

2014-06-03 09:07

kcchongnz is talking about buying Jaya Tiasa at the wrong time. I am talking about buying KLK or Batu Kawan for long term investment. Of course all share including KLK and Batu Kawan fluctuate in price and investors should buy low and sell high to make profit.

In this case I would buy Butu Kawan with my own money and use margin finance to buy more and sell some when the price goes up to make more profit.

2014-06-03 09:11

In equities investing, past performance is no guarantee of future performance. Granted, Batu Kawan and KLK gave excellent returns over the long term if you bought in early 2000's and held them over a decade. I can say the same thing for Public Bank and many other blue chips. Will they give similar returns if you buy them now in 2014? I sincerely doubt it. They are now fully valued, more or less. Instead, I will be out looking for other undervalued and unappreciated stocks to give me double digit returns annually.

2014-06-03 10:00

CPO price is correcting now. Perhaps the best action now is to do nothing, observe the weather condition and wait for a good opportunity to enter. In stock market, Past success does 100% guarantee future success.

2014-06-03 10:27

I am with you both @lohman and @kcchongnz ! Looking at the 2 charts posted by KYY, if you buy now (today's price of 19.96 for BKAWAN and 23.96 for KLK) you are buying at or very near their all time highs (adjusted data) of 20.24 for BKAWAN and 26.76 for KLK ..... always risky to buy at or near the highs unless you are a short term momentum type of trader ! I think this title "No Risk Investment Strategy - Koon Yew Yin" can be a bit misleading - I was drawn to read it !

2014-06-03 10:34

Buy plantation companies only if you are investor. If you are punter, forget it.

2014-06-03 10:37

The problem is not many retailer can keep share 20 years. I keep MKH for 7 year, sell half today, and jump into MNRB.

2014-06-03 10:38

What is a good investor. What might have a good situation for the past 10 years is not necessarily going to be a good one for the next 10 years. An investor who is married to his/her stock and does not know how to realize value is not a good investor.

2014-06-03 10:42

I'm doing truly well with oil exchanging. I am utilizing this Traders Superstore system, these fellows are better than average. They have this every day record of their exchanges Youtube. Pretty genuine for me!

2014-06-03 10:46

The market is Big enough to accommodate each one of us here and there is No life span for the market so as Investment is timeliness.

We will do what we can do best that is management on our part.

2014-06-03 10:50

The mission of a great investor today is to find quality companies like Walmart, Nestle, Coke, Gilette, Procter & Gamble etc when they are relatively unknown and young.

2014-06-03 11:27

If we won't mind we can still Buy those companies if we want as valuation is quite relative from time to time and business innovation and expansion is beyond our grasp.

2014-06-03 11:40

One company comes to mind : IRIS

IRIS is one of the most innovative companies in Malaysia. Too bad we Malaysians never give tech companies like IRIS the same valuations like in USA.

2014-06-03 11:42

To be fair to Mr Koon's article, he was only giving a scenario on how to select a long term investment counter. He has highlighted the key point of "competitive market advantage".

And by relating to this point, he highlighted that both Malaysia and Indonesia have the competitive market advantage in term of oil palm industry as both China and India can't produce palm oil due to climate and soil conditions.

He used Batu Kawan and KLK as examples to further strengthen his point. I saw no remarks of Mr Koon suggesting ppl to buy into these counters. In summary, he was just saying that oil palm industry in Malaysia and Indonesia has the competitive market advantage and should be viewed as a long term investment and you could further maximize your profit by leveraging on margin finance and the cyclical cycle of shares market. Not necessary buying into Batu Kawan or KLK but there are other plantation counters out there.

2014-06-03 11:47

Imagine IF it did come years later and what happens is you have been accumulating all these year. Investment is the Best when majority has low confidence and Only you have high confidence.

2014-06-03 11:49

I am glad my article I posted less than 12 hours ago, has generated so many commentaries. I cannot say that all those who do not agree with me are wrong because they have their way of making money from the stock market. As I often say I also like to buy undervalued stocks like TH Plantation, Sarawak Plantation, MFCB, Success Transformers and others.

Yes, I must admit that KLK and Batu Kawan are selling at their record high. You could have made the same remark a few years ago. But both of them kept going higher and higher.

I will soon post another article about Public Bank which has been selling at its record high for decades. Yet EPF and many other big funds are not afraid to buy. The price may fluctuates like all other shares, but over a long period it will keep going up because PBB can continuously make increasing profit every year.

2014-06-03 12:08

Dear Speakup, do you know IRIS well enough and being confident to project its EPS in 5 years or 10 years?

2014-06-03 12:22

I am looking forward to Mr Koon's article on Public Bank which I used to have in my portfolio. I sold it because banking stocks, out of favor after the Asian Financial crisis of 1997/8, hardly moved for years subsequently and Public Bank was around RM2 in early 2000 when I disposed of it. One of my costly not so good moves.

2014-06-03 15:13

Don't think it is misleading. It provides an alternative investment perspective if one do not simply focus on the name of the mentioned companies.

2014-06-03 15:19

Mr. Koon, what is your thoughts on company run by a bunch of crooks? Would these crooks one day become holy, I mean could these people one day reliase their wrong doings, subsequently repent, and get themselves prompted to becoming honest and striving to maximise the returns to shareholders? Based on my past experience in corporate world, once these crooks uncover loopholes, they would never turn back and would seamlessly exploit them to the maximum. The crooks usually own a big chunk of shares in the company so that they have the authority to continuously run the company. Would this happen to Jtiasa?

2014-06-03 15:20

It is neither correct nor fair to the author KYY to say that this article is misleading; rather it is only the title that is a bit misleading.

2014-06-03 15:28

to be fair to everybody reading this blog. everything comes with a price. we should know our risk limit & investment time frame. good luck & happy trading guys

2014-06-03 15:34

High risk comes with high return . Calculated risk and good fundamental and track record is more secure in the long run.

2014-06-03 15:41

I always love Ben Graham and Seth Klarman's teaching - margin of safety. We are human. We aren't perfect. We always make mistake. Even a wise man like Buffett also makes tonnes of mistakes! Throughout his whole career only 1/3 out of his investments are good calls!

Of course I do agree that there are some risk free counters which are totally neglected by the crowd but like the late J P Morgan said price will fluctuate! It will only be risk free provided that you have the capability to hold it for a certain period. Besides that how sure you are they are not due to your errors? That’s why we need margin of safety. Graham demand for at least 1/3 below the intrinsic value. His calculation for intrinsic value is really harsh to a company or maybe I should say the counters that pass his checklists are insanely cheap. In this case since you said there are risk free, why not you show us your work on intrinsic value for both of them.

In the case of Batu Kawan/KLK, like what you said before they are richly valued! Everyone shall agree that Batu Kawan/KLK are high quality counters. In the 90s my dad's broker will recommend him these two due to their safe and steady characteristic. No doubt they had been perform tremendously good in the past decade but past result doesn't represent future performance. The super bull in commodities already ends. Just look at how much Indonesia had developed! Moreover don't forget that there are plenty of unplanted or forest with low yield trees in Africa! We can't assume the price will stay at the peak for the next few years! Furthermore soybean planting in U.S. is expected to reach another record high this year. Some even assume U.S. ending stocks will reach multi-year peak next year!

It’s true that KLK and Batu Kawan did perform extremely well in the last decade but what about the late 90s to early of 21st century? From 2nd half of 1998 to 1st half of 2005 it hovers around RM 3 – RM 4. They

Like what you said in the past, we need to invest something that can grow in the future but does both of them qualified? Personally I dun think that KLK qualified as high growth counter. With the high price tag and palm oil prices had yet to reach bottom I would rather stay away from them!

2014-06-03 21:28

Don't put all the eggs in one basket.Spread out will mitigate the risk.Put in different sectors with more weightage in the more familiar sector.

2014-06-03 21:36

Plantation stocks are cyclical with great dependence on weather, fertilizer and foreign lab ours unless it is well diversified to mitigate the full impact. Like BK or KLK. So as the demand factors.. In conclusion the stock price fluctuate tremendously in most of the plantation stocks.

2014-06-03 21:48

Luckily Businessman mentality is not affected by share price fluctuation Nor CPO price fluctuation. If they are, they won't be in Plantation Business in the first place, right? If they are, they won't be building a Business Empire as at today.

This is Basic mentality difference between Business Entrepreneur and stock Investment. We always back off But entrepreneur always push forward. It explains why sometimes we miss the Boat.

Do you also really think that CPO price fluctuation will really affect the core value of the company? How about cash on hand or land valuation or increase yield or replanting? Or they might also have downstream Business?

The above just example.I am talking about general mentality. If you think you are right You are always right.

2014-06-03 22:21

I am also like that i like to talk negative so much But if next day share drops I quickly go and buy.

2014-06-03 22:37

Mr. Koon, since you love plantation stocks so much, what is your view on the coming Boustead Plantation IPO?

With your capability, you might be interested to be one of the cornerstone?

2014-06-04 00:14

As far as I know, there is no investment without risk. the closest risk-free investment for us is probably Malaysian Government Securities. Even that i don't know if it is really "risk-free". For example, any chance that the government has no money to pay us? It could be a six-sigma event but is it really impossible? What about the devaluation of Ringgit in a big way? Not possible? I do know that even US government default in its Treasury Bill before during Ronald Reagan's time.

Yes, investment risk can be greatly reduced if you are in for a long haul, for example investment in plantation companies, or any good companies with credible management. That is also provided that you don't buy it too expensive and that you don't borrow and invest with margins, because even a two sigma events are so common now and when they come, you could lose everything as explained in my article here:

http://klse.i3investor.com/blogs/kcchongnz/44344.jsp

Projecting the growth of palm oil output and its growth may not be that difficult as you have the acreage and age profiles, but projecting profit can be very difficult and unreliable. As far as I know, academic research has shown that no one can predict commodity price correctly consistently, including palm oil future prices. Yes, no one.

There are also a lot of other factors which make one's projection of future profit growth at best a guess, if ever you have a projection.

2014-06-04 07:29

kcchongnz,I realise my mistake. The title should be "Minimum Risk" for the long term.I will post another piece on Public Bank in due course.

2014-06-04 09:51

Batu Kawan is a good pick among the two as it has a 46.57% stake in KLK itself. Now that is one way to try monopolize the market!

2014-06-17 21:40

Public Bank has always been favorite among conservative stock players! Usually they will buy and hold for years! It's much better than mutual funds! The strategy is to buy during bad times and hold for years!

2014-06-17 21:46

Never let napshot stocks....to be excluded just bcos u have a long list portfolio loh.....!!

Of course u can always can take solace to say u can monitor a long list but bet on a very short list loh (This is true & good if U r a trader but raider find no so effective for an investor loh...!!)

AS A FAMOUS INVESTOR GEORGE SOROS SAYS U NEVER BET ......U NEVER KNOW.....U NEED TO GET YOUR FEET WET....TO WIN BIG....!!! This is the psychological aspect of investment mah

Why leh ?

1) Monitoring is stock is like watching pretty girls.....if no take the 1st step.....it remain a dream mah

2) Investing in share is like dating pretty girls....the more u date.....the better u know them better......the more xcited u get.....the more your return mah....!!

3) The more u get to know them.....the better your understanding & more confident u get and better your commitment loh..!!

Then u can handle them better, thus u get better return loh......!!! U can chose different character, aspiration & outlook...!!

4) U may chose to specialize on a few later (marry)......when u get older & more experience loh....but never never when u are still young & dynamic .....like raider and newbies mah.....!!!

Enclosed herewith general stock picking approach:

It is better that those who asked to provide more details of the companies.

At least give some financial data, eg. 5 years revenue, earnings, profit margins, ROE, dividend yield, etc. Give some of your own assessment. At least excite your reader to wish to investigate this company further.

You can use the template below to analyse Kian Joo for us here-FOR GENERAL DISCUSSION.

SOME THOUGHTS ON ANALYSING STOCKS (KISS)

Ideally a stock you plan to purchase should have all of the following charateristics:

• A rising trend of earnings dividends and book value per share.

• A balance sheet with less debt than other companies in its particular industry.

• A P/E ratio no higher than average.

• A dividend yield that suits your particular needs.

• A below-average dividend pay-out ratio.

• A history of earnings and dividends not pockmarked by erratic ups and downs.

• Companies whose ROE is 15 or better.

• A ratio of price to cash flow (P/CF) that is not too high when compared to other stocks in the same industry.

Ben Graham Checklist for Finding Undervalued Stocks

https://docs.google.com/spreadsheet/ccc?key=0AuRRzs61sKqRdFpHTldITEQyZDJuVGdDY3hTS3lvQ0E&hl=en#gid=0

The best undervalue stock an which an intelligent undervalue investor can find are as follows

1) ROE exceeding 15% pa

2) Growth exceeding 10% pa

3) Share Trading at 50 % below NTA

4) PE below 10x

5) Dividend yield exceeding 7% pa

This what Raider call an ideal napshot undervalue fundamental stock......!!!

To remain flexible in your stock selection......Raider allow change of the above combinations & criteria.....but always use as a benchmark loh....!!

A MODIFIED VERSION OF B GRAHAM......!!!

2014-06-19 17:47

LESSON 7........!!!

Raider got this interesting question raise by aspiring newbies !!

Dear Raider,

From your earlier posting it appeared the RCWPROVE$$ SYSTEM is very beneficial to Gamblers & speculators, but i am very eager, how can it benefit we the newbies, who are aspiring to become successful in the stockmarket ?

I also noted Raider have 4 categories of product comprises of 34 napshot, 6 nextbluechips, RCWProve$$ and the coming soon Pennystocks ! How can we as newbies who are young with limited resources for investment can do it successfully ?

For your information, i have manage to save up a small sum of RM 38k over a period of 15 yrs since the age of 3.

Today my age is 18, a ripe age to qualify to be a full fledged investor. Can Raider guide me how to invest ?

Which categories of the 4 products, that Raider would recommend me to invest, bearing in mind i am going to invest for the long term .

Please note that i am not letting my Papa and Mama know about my intention to invest.

I want to give them a surprise.

Please keep it as a secret!

LESSON 7 to be continue soon

RAIDER REPLY,

Dear newbies,

Investment is about odds & risk management loh.....!!!

The fastest way to learn about odds & risk management is thru gambling loh.....!!

Since u are only 18 and have Rm 38k.....raider recommend u take Rm 12k out from your funds and go for life speculation and gambling loh...!!

Remember to put your balance Rm 26k into 3 mths fixed deposits.....a reserve for your future use after u have learn the robes of investment.....!!

Raider suggest u use the Rm 12k....to buy the most risky products or investment that u can think of.....!!

U may even consider gambling as well loh.......!!!

But b4 u plunge into any game......raider want u to submit your detail risky investment, speculation or gambling plan in writing to raider for formal approval 1st ..........B4 u do anything stupid loh......!!!

Although u may lose all your Rm 12k monies in the worse scenario.....but raider want u to learn the maximum.....while u are still young loh....!!

More so.....u are still young & still got at least 30 yrs of earnings capacity......this intensive free of charge training.....raider will provide u in a good stead loh in your future loh.......!!!

Just imagine.....the value u can get from raider's intensive training loh....!!

Lets put it this way loh....your parent is willing to spend more than Rm 500k to Rm 1 million....for u to get a not very commercial viable expensive bachelor degree that can allow u to earn a salary of Rm 2.5k a month on a 8 to 6 job......compare the Rm 12k u put into.....good risk investment....is actually a small training cost to groom your future risk taking ability.....to super powerful use loh.....!!

Don forget your trainings free too ( U only come up with your Rm 12k capital only mah).......!!

If things turn up right or better than expected ....u may even triple your monies loh.....!!!

If u had failed....u can take it as a training cost.....of Rm 12k on yourself mah.....it is just a small training cost.....spending on yourself mah..!!

This a good preposition plan for u....Head u win But Tail u also win.....such a wonderful result to start of for U loh....!!!

Please put it...this way....raider....is the biggest monetary loser in this case....as raider is not making anything from u.....despite putting time & effort for your training-free of charge......!!!

Monies aside.....Raider doing this not for monies.....but the" inner satisfaction" seeing greenhorn young newbies becoming skillful investor mah......!!!

Please * think about it ?

If u have any question u may clarify with raider 1st loh....!!

If u want it to be confidential.....u may pm raider loh....!!!

Lesson 7 to be continue......soon......!!!

2014-06-19 18:17

kcchongnz

Plantation companies certainly look good as a long-term investment.

But I didn't know there is such thing as "No risk" investment.

Take for example, a retail investor though that investing in another plantation company, Jaya Tiasa in April 16 2012, that it was a risk-free investment, after reading an article from a very popular finance blog. He borrow 1m with a margin account to buy the share at the adjusted price then at RM3.32 as there is no possibility of losing anything.

Less than one year later on March 18 2013, the share price dropped to RM1.78, or about 45%+. What would have the lender done to his share which were pledged? What would be the well financial well being of this retail investor who thought there was this thing as risk-free investment?

In investing in the stock market, risk generally comes from buying the stocks at high prices. There will be less risk if buying stocks at low prices.

Does anyone think that the stock market is so low that there is little, or even no risk at all?

2014-06-03 07:16