IPO - Go Hub Capital Bhd (Part 2)

MQTrader Jesse

Publish date: Tue, 18 Jun 2024, 09:41 AM

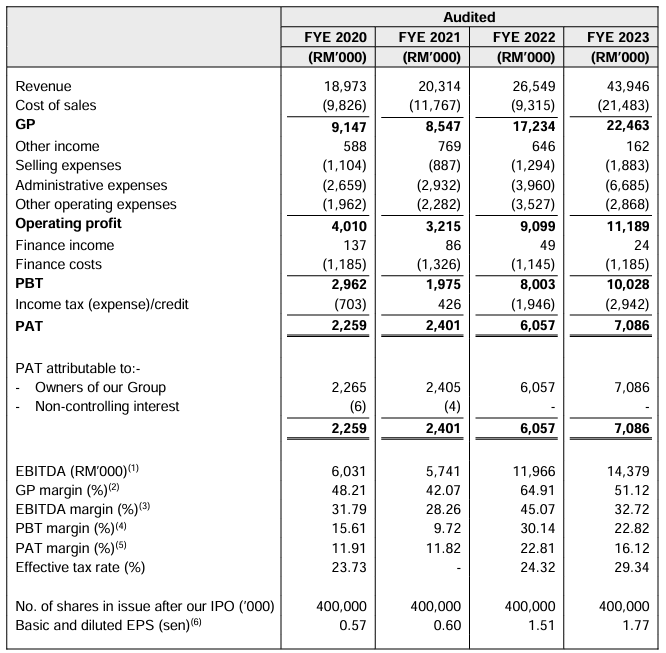

Financial Highlights

The following table sets out a summary of the audited combined statements of comprehensive income for the financial years under review.

- The revenue grew from RM 18 million in FYE 2020 to RM 43 million in FYE 2023. This shows that the company's business still has room to expand in its industry.

- The gross profit margin declined from 48.21% in FYE 2020 to 42.07% in FYE 2021, then grew to its highest level of 64.91% in FYE 2022 before declining again to 51.12% in FYE 2023. The significant drop in the gross profit margin in 2023 was mainly due to the decreased margin in the rail segment, which was related to the final stages of customization and installation of the AFC project, as well as an increase in staff costs for providing system operator services following the increase in Malaysia’s national minimum wage to RM 1,500 per month. (Generally, a GP margin of 20% is considered high/ good).

- The PAT margin was nearly 12% in FYE 2020 and FYE 2021, grew to the highest level of 22.81% in FYE 2022, then declined slightly to 16.12% in FYE 2023.

- The gearing ratio has been decreasing year by year, with the latest ratio at 0.48 times in FYE 2023. This shows that management has been effective in managing debt, reducing the ratio to a healthy range that can help the company avoid liquidity risk in the event of any future financial impacts. (A good gearing ratio should be between 0.25 – 0.5).

Major customers and suppliers

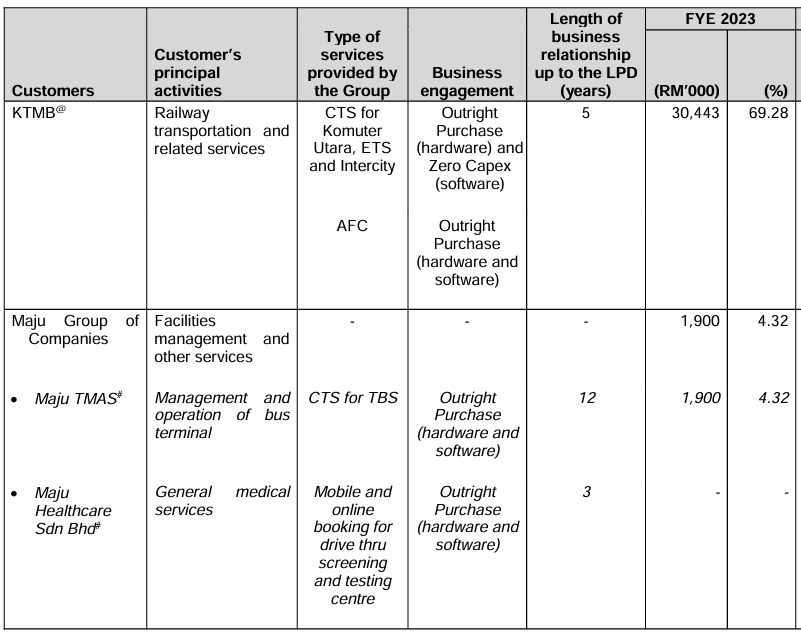

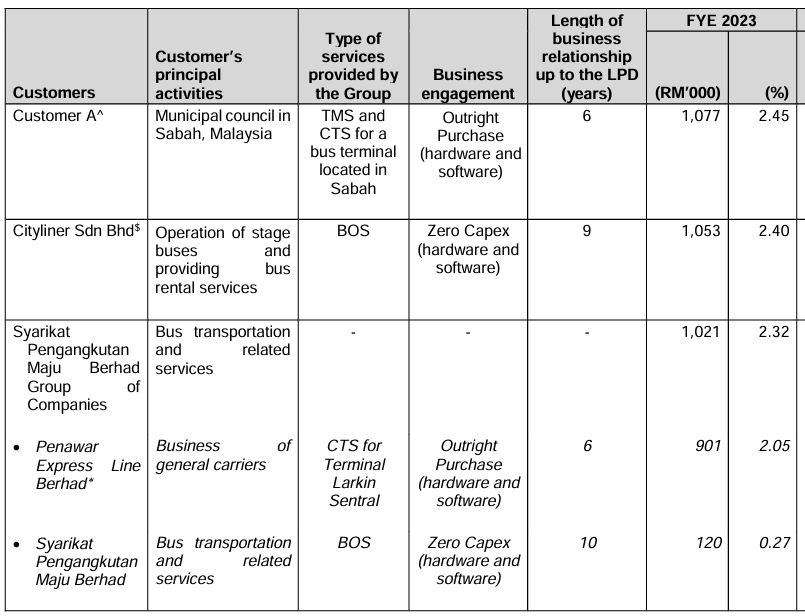

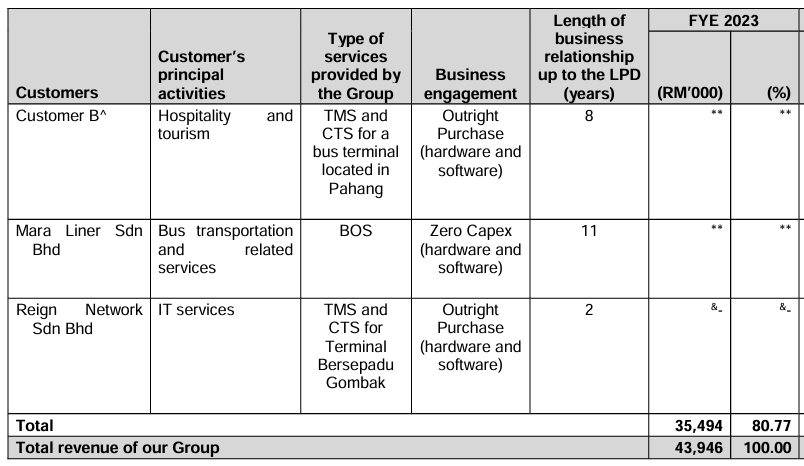

Major Customers

The company primarily serves customers operating in the bus and rail segments. The major customer for FYE 2023 is as follows:

The top major customers contributed 80.77% of the revenue, with the top customer, KTMB, contributing 69.28%, which is more than half of the company's revenue. The company is involved in high-concentration risk. However, management remains confident that KTMB will continue to support local IT service providers that demonstrate their reliability and capacity to deliver consistent and timely support services. This confidence stems from the Group’s effectiveness in delivering prompt CTS maintenance and support services, which is integral to minimizing disruptions and breakdowns of the solutions and for KTMB to run its operations efficiently. Given that the Group has been the primary IT solutions provider for the CTS from the outset, KTMB is likely to continue engaging the Group for upcoming enhancements to the CTS, as well as for the expansion of KTMB’s routes throughout Peninsular Malaysia.

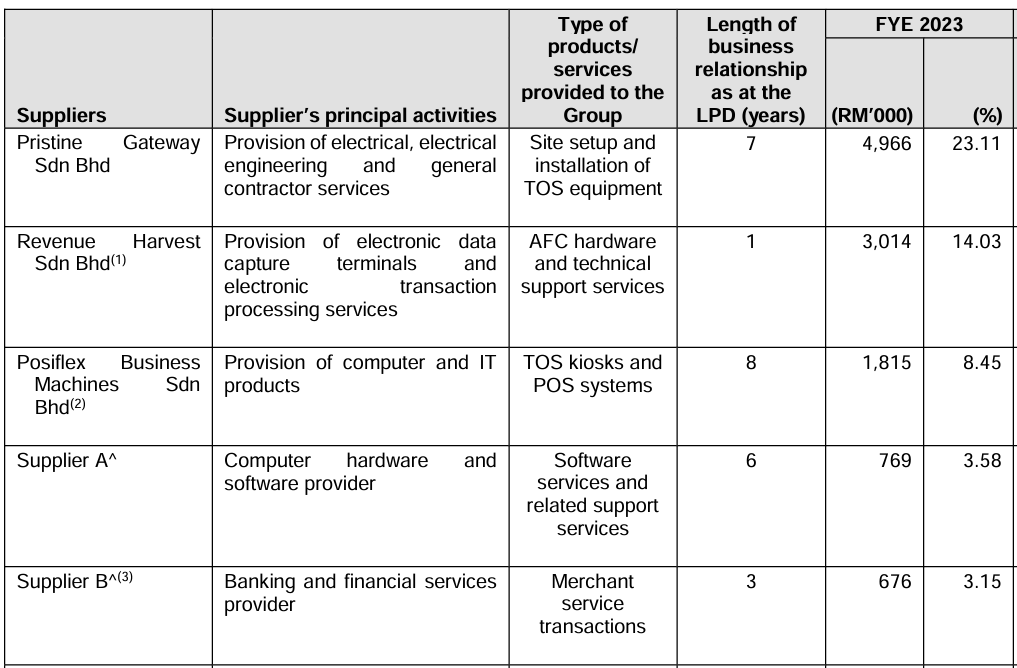

Major Suppliers

The top 5 major suppliers for FYE 2023 as follows:

The top five suppliers account for 52.32% of the purchases. Management mentioned that they maintain good working relationships with their major suppliers and that there have been no material disputes with them or disruptions in supplies to date. However, they are not dependent on any of the major suppliers, as they are able to source from other suppliers who are capable of furnishing comparable hardware, software, or solutions.

Industry Overview

According to Protégé Associates's research, the outlook and prospects of the enterprise IT services industry in Malaysia are expected to be positive during the forecast period. The COVID-19 pandemic and subsequent lockdown measures imposed have accelerated the usage of the Internet and the adoption of digital mediums which together lay a clear path for further potential demand for enterprise IT services offerings. This had led to vast opportunities for the local IT enterprise services to expand its scope of businesses.

Factors priming growth within the enterprise IT services industry include the continuing digital transformation of the economy and the growing demand from cloud computing and IoT technologies. In addition to the manufacturing and services sectors, even sectors that in the past were not perceived as heavy technology users such as the transportation and agriculture sectors have been adopting IT components into their systems. In particular, the transportation sector, an increasing number of transportation terminals have been incorporating IT components such as centralised ticketing systems, self-service ticket vending machines, digital information kiosks as well as security systems. Besides that, the relatively high broadband penetration rate augurs well for the growth in the local enterprise IT services industry. At the same time, while only a handful of terminals have adopted IT components into their systems, the continued relevance of the local transportation sector bodes well for the local enterprise IT services industry as these terminals adopt IT components along with digitisation. On the supply side, the local enterprise IT services industry can expect to continue receiving strong support from the Malaysian Government as well as the availability of skilled IT professionals.

The enterprise IT services industry was valued at an estimated RM22.36 billion in 2023. Moving forward, the local enterprise IT services industry is projected to reach RM23.48 billion in 2024 and expand at a CAGR of 5.7% to reach RM29.51 billion in 2028.

Source: Protégé Associates

Future plans and strategies for GO HUB CAPITAL BERHAD

The future plans and business strategies are summarised as follows:

- Expanding the geographical footprint in the domestic markets

- Expansion of the market presence in the public land transportation sector

- Explore potential market to capture wider customer base

- Expanding the workforce

- Marketing efforts to showcase the solutions and secure potential customers

- Acquisition of Star Central Office Tower and the set-up of new integrated centre

- D&D

- Acquisitions of IT equipment, tools and software

MQ Trader View

Opportunities

- The company provides a diverse range of services and solutions catering to public transportation. The company specialises in providing enterprise IT services to address the challenges faced by the public transportation sector in terms of terminal operating systems, ticketing systems, fare collection systems and fleet monitoring systems. The approach involves developing and customizing solutions aimed to simplify, enhance and improve the overall efficiency of the operations. The key feature of its solutions included the following:-

- Ticketing interface

- API integration

- Real-time information management

- Passenger Information Display system

- Data analysis and reporting

- Payment gateway

Risk

- The company is dependent on its major customer, KTMB. The company is involved in high-concentration customer risk, as KTMB contributed 69.28% of the revenue in FYE 2023. A decrease in or termination of services to KTMB will directly impact the company's financial results in the future.

- The company is dependent on its ability to secure new projects. Its profitability and financial performance rely on consistently securing and maintaining contracts for the provision of enterprise IT services, particularly from existing and new customers in the public transportation sector. The potential loss of customers, especially major ones, or the risk of facing difficulties in securing new customers or additional projects from existing customers in a timely manner, could adversely impact the business and financial performance.

Click here to refer the IPO - Go Hub Capital Bhd (Part 1)

Eager to explore more trading opportunities?Apply margin account now!

Community Feedback

We encourage traders to try out and evaluate the MQ Trader system and provide us feedback on the features you like to see in the system. We have received many positive feedbacks so far, and we are currently compiling and reviewing them for possible inclusion into the next release of the system.

We would like to develop this system based on community feedback to cater for community needs. Thanks to all those who have provided valuable feedback to us. Keep those feedback coming in!

Disclaimer

This article does not represent a BUY or SELL recommendation on the stock covered. Traders and Investors are encouraged to do their own analysis on stocks instead of blindly following any Trading calls raised by various parties in the Internet. We may or may not hold position in the stock covered, or initiate new position in the stock within the next 7 days.

Join us now!

MQ Trader stock analysis system uses Artificial Intelligence (AI), various technical indicators and quantitative data to generate accurate trading signals without the interference of human's emotions and bias against any particular stock. It comprises trading strategies which are very popular among fund managers for analysing stocks.

MQ Trader stock analysis system is SPONSORED for MQ Trader members. To use this amazing tool, you can sign up via MQ Trader Sign Up!

Contact us

Please do not hesitate to contact us if you have any enquiry:

Facebook: https://www.facebook.com/mqtrader

Instagram:https://www.instagram.com/mqtrader

MQ Chat: https://messenger.i3investor.com/m/chatmq

YouTube: https://www.youtube.com/channel/UCq-26SGjlQTVQfO7DoEihlg

Email: admin@mqtrader.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Initial Public Offering (IPO)